Friday, October 2, 2020

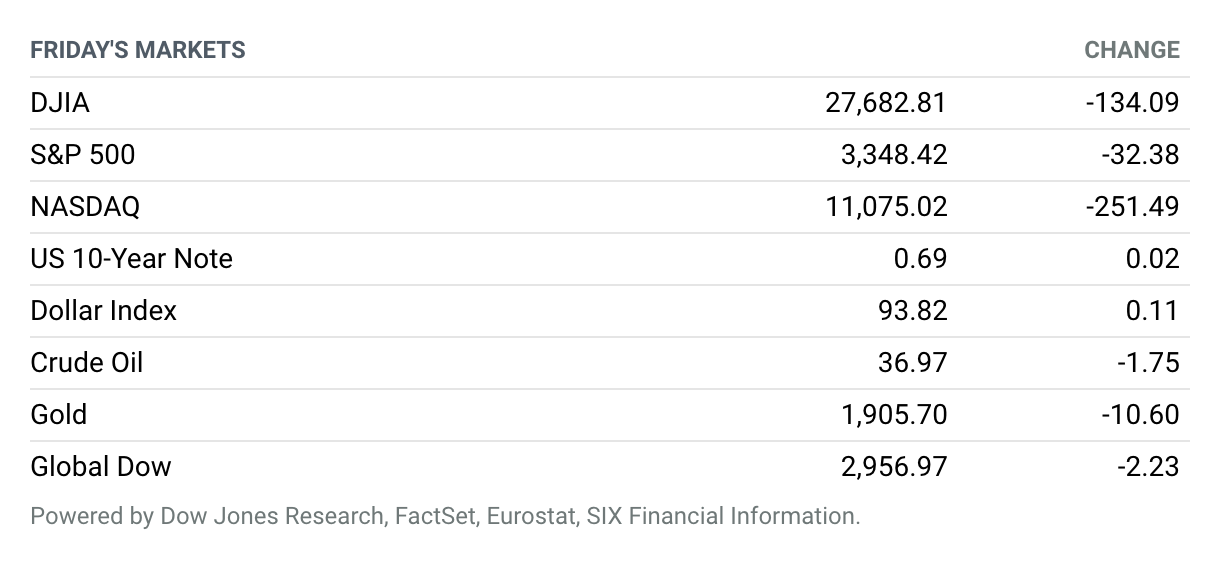

Trump Tests Positive. Major U.S. stock indexes declined on Friday—though the Dow industrials outperformed—as investors weighed U.S. President Donald Trump’s positive coronavirus test and a weaker-than-expected employment report against hopes for additional stimulus from Washington. U.S. stock futures had fallen as much as 1.5% heading into the open of trading Friday, but by midday, performance was mixed and varied widely by sector. Declines in technology shares dragged the S&P 500 and Nasdaq Composite lower, while industrials, materials, and energy shares advanced. The Dow Jones Industrial Average slipped 134.09 points, or 0.5%, to 27,682.81. The S&P 500 dropped 32.38 points, or 1%, to 3348.42, while the tech-heavy Nasdaq sank 251.49 points, or 2.2%, to 11,075.02. Even with Friday’s declines, the three indexes closed with weekly gains of 1.9%, 1.5% and 1.5%, respectively. The Dow industrials and S&P 500 both broke four-week losing streaks, while the Nasdaq closed out a second consecutive week of gains.

U.S. Hiring Slows as Recovery Moderates

Hiring slowed in September, rising for the fifth consecutive month but at a pace that fell short of economists’ expectations as the recovery from the coronavirus recession continues to moderate.

U.S. businesses added a seasonally adjusted 661,000 jobs in September, the Labor Department said Friday, less than half the 1.4 million added in August and well below economists’ expectations for 800,000 hires.

The unemployment rate declined to 7.9% last month, from 8.4% in August and 10.2% in July. Economists had anticipated a slightly smaller September decline, to 8.2%. The labor-force participation rate decreased by 0.3 percentage point to 61.4%, meaning the decline in unemployment was due in part to people leaving the labor force.

Federal Reserve Extends Restrictions on Bank Buybacks and Dividends

The Federal Reserve announced Wednesday afternoon that it was extending restrictions on share repurchases and dividends for the largest banks—those with more than $100 billion in assets—for at least one more quarter.

The Fed put the capital restrictions in place back in June after it released the results of its annual stress tests. Many banks had already elected to halt share repurchases in March amid the economic uncertainty spurred by the coronavirus pandemic. Buybacks historically accounted for roughly 70% of the banks’ capital return to shareholders. But the restrictions on dividends—capped at the lesser of second-quarter levels or trailing 12-month earnings—gave investors yet another reason to be nervous about investing in the sector.

The Pandemic Has Pushed Retail Bankruptcies to a Record

Skeptics have been predicting the demise of traditional retail in the face of e-commerce since 2015 and, since then, once-storied names including Toys ‘R’ Us and Sears have been wiped out by the changing landscape. Each year seemingly brings more failures than the last.

Covid-19 appears to be the sector’s next grim reaper. The first half of 2020 saw a record round of bankruptcies, liquidations, and store closings, according to accounting firm BDO USA. Eighteen retailers filed for Chapter 11 bankruptcy in the first six months of the year, according to the firm. Eleven more joined the list in July and August. There have been more bankruptcies year to date than in all of 2019.

Boeing Makes It Official, Moves 787 Production From Seattle to South Carolina

Boeing said Thursday it will shut down the original assembly line for its two-aisle 787 jetliner near Seattle and consolidate the plane’s production in South Carolina as the airline industry tries to weather the global pandemic.

The move will begin in mid-2021. The company intends to keep assembling other jetliners—the 737, 747, 767, and 777—in the Seattle area.

“Consolidating to a single 787 production location in South Carolina will make us more competitive and efficient, better positioning Boeing to weather these challenging times and win new business,” Stan Deal, CEO of Boeing’s commercial aircraft business, told workers in an email.

Disney Lays Off 28,000 Workers as the Pandemic’s Economic Toll Continues

Closures and attendance caps at Walt Disney theme parks across the globe have led the company to begin laying off 28,000 employees, including thousands that had previously been furloughed.

The layoffs are in its parks, experiences, and consumer products division, the company said, and 67% of those affected were part-time workers. The company pointed the finger at California in particular for its inability to retain workers at its two parks there, calling out “the state’s unwillingness to lift restrictions that would allow Disneyland to reopen.”

Walmart’s Asda Sale Signals Continuing Shift to Higher-Growth Strategy

Walmart just made it crystal clear, for anyone who hasn’t been paying attention, that it wants to target higher-growth businesses and expand its digital presence, disclosing a deal to unload a majority stake in Asda, the U.K. grocery business.

Walmart on Friday said it had reached a deal with the billionaire Issa brothers and TDR Capital that values Asda at $8.8 billion, less than the retailer paid for the business more than two decades ago. The agreement will allow Walmart to retain an unspecified stake in the company.

Palantir Ends Week Lower After Opening for Trading at $10 a Share on Wednesday

Palantir Technologies opened for trading Wednesday at $10 a share, about in line with recent expectations, giving the big-data analytics company an initial valuation of about $22 billion. The stock ended its first day at $9.73, down slightly from the first trade, on huge trading volume of 335.5 million shares. Shares ended the week down even more, closing Friday’s session at $9.20.

Founded 17 years ago by a group of former PayPal execs, including current CEO Alex Karp and the venture investor Peter Thiel, Palantir provides software tools to help companies, nonprofits and government agencies analyze data sets. (The name is a reference to magical stones in J.R.R. Tolkien’s Lord of the Rings books.)

Caesars Agrees to $3.7 Billion Deal to Buy William Hill

Caesars Entertainment has agreed to a £2.9 billion ($3.7 billion) deal to buy British gambling company William Hill.

The London-listed company said its board intends to recommend “unanimously and unconditionally” that shareholders vote in favor of Caesars’ takeover bid. The U.S. hotel and casino operator’s offer, which would solidify its position in the burgeoning U.S. sports betting market, has seemingly won out over an offer from buyout group Apollo Management.

Uber Wins Appeal to Continue Operating in London

Uber, the popular ride-hailing company, won an appeal allowing it to continue to operate in London, its biggest European market.

“Uber does not have a perfect record but it has been an improving picture,” Deputy Chief Magistrate Tanweer Ikram said in a written verdict on Monday. “Despite their historical failings, I find them, now, to be a fit and proper person to hold a London private hire vehicle (PHV) operator’s license,” he concluded.

The city transport regulator Transport for London (TfL) had decided not to renew Uber’s PHV operating license in November 2019, over concerns about its safety practices. Uber has since introduced a range of new safety measures in its app.

Cleveland-Cliffs’ Purchase of ArcelorMittal USA Reshapes Industry

Iron ore miner Cleveland-Cliffs has agreed to purchase ArcelorMittal USA from steel giant ArcelorMittal in a deal that will make Cleveland-Cliffs the second-largest steel producer in North America, behind Nucor.

Under terms of the agreement, Cliffs is giving up about $1.4 billion in cash and stock, and getting North American assets that shipped 12.5 million tons of steel in 2019. Mittal is keeping its assets in Canada and Mexico.