Friday, September 25, 2020

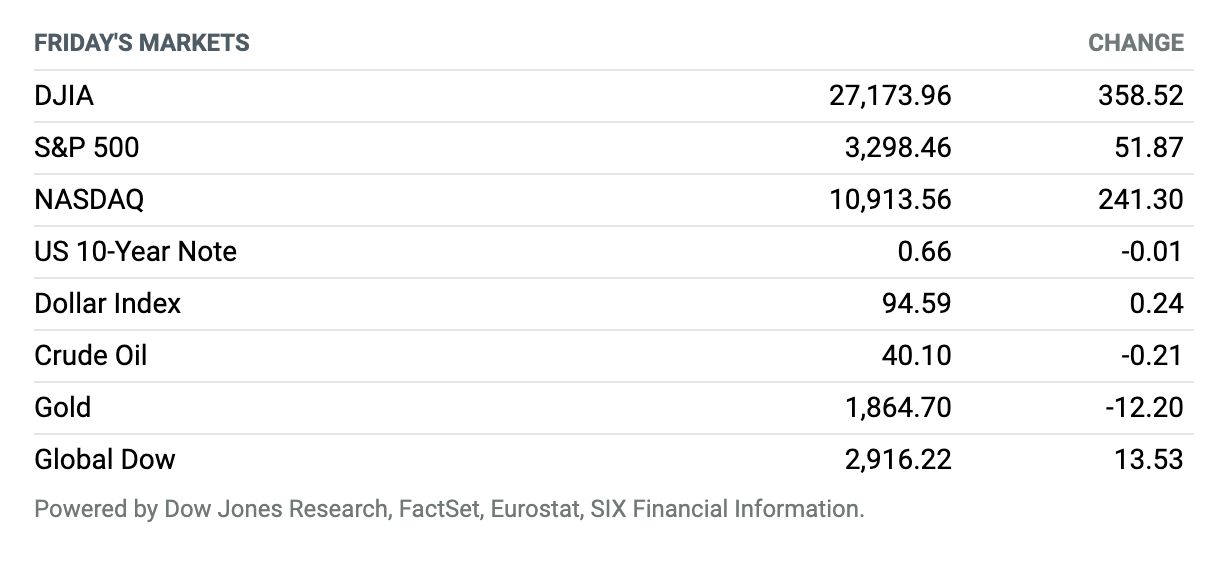

Dow, S&P 500 Suffer Fourth Straight Down Week. U.S. stock indexes closed higher after a choppy session Friday, but the Dow Jones Industrial Average and S&P 500 logged their fourth straight weekly losses as worries grow over the economic outlook in the absence of renewed aid from Washington, the November presidential election, and rising Covid-19 infections in the U.S. and Europe. The Dow Jones Industrial Average rose 358.52 points, or 1.3%, to close at 27,173.96, while the S&P 500 advanced 51.87 points, or 1.6%, to 3298.46, well above the 3222.76 level that would indicate a correction, which is commonly defined as a drop of at least 10% from a recent peak. The Nasdaq Composite Index closed up 241.3 points, or 2.3%, at 10,913.56. For the week, the Dow was down 1.8%, and the S&P 500 lost 0.6%. It was the fourth straight weekly decline for the two indexes, matching the longest losing streak since August 2019. The Nasdaq gained 1.1% for the week, ending a three-week stretch of declines.

Durable-Goods Orders Climbed 0.4% in August, Much Slower Than in Recent Months

Solid demand for machinery drove orders for durable goods higher last month, but the rebound from pandemic lows moderated.

New orders for durable goods, or items meant to last at least three years, rose 0.4% in August, the Commerce Department said Friday. August’s reading was weaker than the 1.8% increase expected by economists polled by the Wall Street Journal. August’s gain follows an 11.7% increase in July, and a 7.7% increase in June. Excluding the volatile transportation category, orders rose 0.4% in August. Excluding defense, orders rose 0.7%.

Initial Jobless Claims Edge Up, but Continuing Claims Appear to Be Easing

The number of U.S. workers filing initial claims for unemployment benefits edged up in the latest week, delivering a higher-than-expected reading that comes amid some signs that the worst of the pandemic’s toll has passed.

First-time jobless claims rose by 4,000 in the week ended Sept. 19 to a seasonally adjusted 870,000, the Labor Department said Thursday. The previous week’s level was revised up to 866,000. Economists surveyed by FactSet had predicted 850,000 new jobless claims in the latest week.

Continuing claims for the week ended Sept. 12 fell by 167,000 to 12.6 million on a seasonally adjusted basis, compared with an upwardly revised 12.75 million in the week ended Sept. 5.

Pace of New Home Sales Tops 1 Million for First Time in 14 Years

The housing market continued to boom in August, as low mortgage rates and pandemic-driven demand pushed the rate of new home sales above 1 million for the first time in 14 years.

Sales of new single-family homes rose 4.8% in August from July to a seasonally adjusted annual rate of 1.01 million, the Commerce Department said Thursday. Economists polled by The Wall Street Journal had expected a 0.3% decline to 898,000. August sales were 43% above the year-earlier level.

Powell and Mnuchin Tell Congress: Send More Fiscal Stimulus to Stabilize Recovery

Federal Reserve Chairman Jerome Powell and Treasury Secretary Steven Mnuchin told Congress that more fiscal stimulus is needed to stabilize the nascent U.S. economic recovery amid the coronavirus pandemic.

In testimony Tuesday to the House Financial Services Committee, the two officials touted the effectiveness of the U.S. government’s initial response to the pandemic. They also called for additional stimulus, with Mnuchin calling for a “targeted package” focused on “kids and jobs and areas of the economy that are still hard hit.”

Democrats Begin Drafting a New Coronavirus Relief Bill

House Democrats are looking to kickstart a new round of negotiations over another round of coronavirus stimulus spending by drafting a new, roughly $2.4 trillion package, according to multiple reports.

Talks among the White House, Senate Republicans and Democrats have been dead for weeks, but Speaker Nancy Pelosi (D., Calif.) appears to be betting that a smaller package than the more than $3 trillion measure House Democrats passed in May will bring Republicans to the negotiating table.

Palantir Is Seen Opening for Trading Next Week at About $10 a Share

Palantir Technologies shares are expected to open for trading next Tuesday at around $10 a share, giving the company a valuation of around $22 billion, The Wall Street Journal reports.

The 17-year-old data analytics firm is expected to open for trading on Tuesday via a direct listing on the New York Stock Exchange, under the symbol PLTR. The offering will be closely scrutinized. While there has been considerable discussion about direct listings in recent months, there have been only two direct listings of venture-backed technology companies in recent years: Slack Technologies in June 2019 and Spotify Technology in April 2018. Neither has been a screaming success.

J&J Launches Trial of Single-Dose Covid Vaccine. Results Could Come Quickly.

Johnson & Johnson started inoculating volunteers Wednesday in the biggest planned trial yet for a Covid-19 vaccine.

Although the health-care giant started its trial two months after those of Moderna and the team of Pfizer and BioNTech, J&J may have results from its trial within a month or so of the expected November readouts of the others.

Beijing Has ‘No Reason’ to Approve U.S. TikTok Deal: Chinese Media

An agreement on the ownership of TikTok’s U.S. operations approved by Washington last weekend is a “dirty and underhanded trick” based on “bullying and extortion,” state-owned English language newspaper China Daily wrote in an editorial on Wednesday.

The White House last weekend approved a deal that quickly showed the three signatory companies at odds over its interpretation. TikTok’s Chinese owner, ByteDance, said it would own 80% of a new TikTok Global entity, while Oracle and Walmart, its U.S. future partners, insisted instead that they would control the company.

Peltz’s Trian Partners Takes Stake in Comcast

Late Monday, it was reported that Nelson Peltz’s Trian Partners had a 0.4% stake in Comcast. The activist investor, known for recent campaigns at Procter & Gamble and General Electric, said shares are “undervalued” but didn’t elaborate on what the company can do to improve.

There is skepticism about what the hedge fund can accomplish. Its nearly $900 million stake pales in comparison to Comcast’s market capitalization, which exceeds $200 billion. Making matters more complicated, roughly a third of Comcast’s voting rights are held by the Roberts family. Brian Roberts, son of founder Ralph Roberts, currently serves as Comcast’s chair and chief executive.

Nikola Founder Trevor Milton Resigns Amid Fraud Allegations

Electric-truck maker Nikola said on Sunday that founder Trevor Milton had voluntarily resigned as executive chairman and as a board member.

The shock resignation came after allegations from short seller Hindenburg Research, which launched an attack on Nikola earlier this month, claiming the company had misled investors. Stephen Girsky, former vice chairman of General Motors, has been appointed chairman, Nikola said.