Friday, October 9, 2020

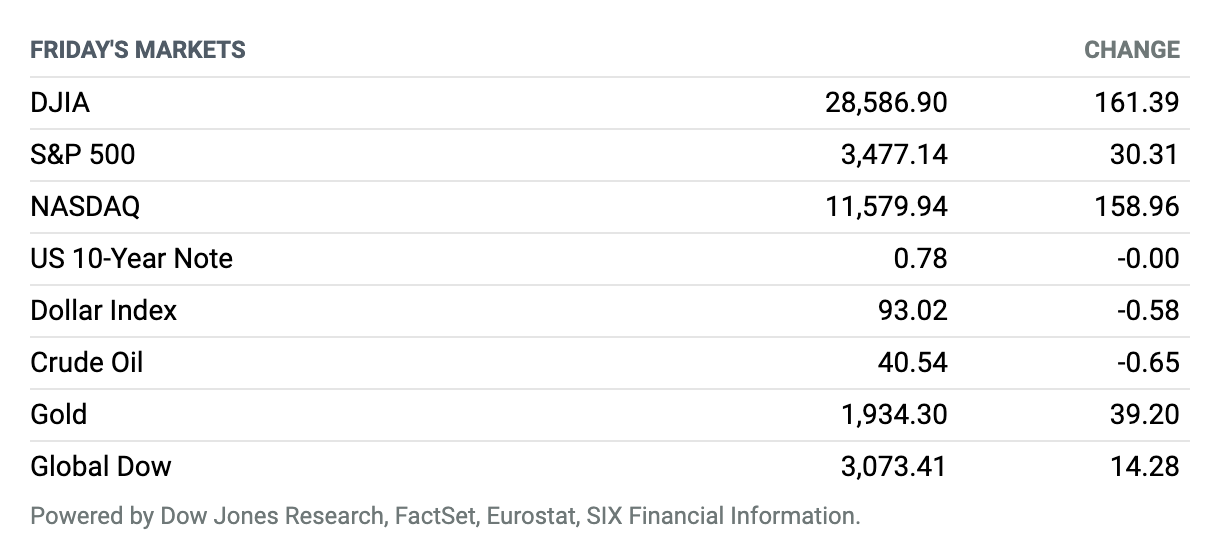

Stimulus Hopes Drive Rally. Signs of progress toward a sizable U.S. stimulus package helped drive gains for stocks on Friday, as the S&P 500 index capped off its best week since early July. The Dow Jones Industrial Average closed up about 161.39 points, or 0.6%, at 28,587 on Friday. The S&P 500 and the Nasdaq Composite added 0.9% and 1.4%, respectively. Stocks had endured a string of weekly losses but have bounced back in the past two weeks. The S&P 500 index rose 3.8% on the week, while the Nasdaq Composite and Dow Jones Industrial Average gained 4.6% and 3.3%, respectively. Late Friday morning, President Donald Trump said on Twitter, “Covid Relief Negotiations are moving along. Go Big!” The Wall Street Journal reported the White House is planning a $1.8 trillion stimulus proposal, up from its previous $1.6 trillion offer.

Stimulus Negotiations Appear to Gain Steam

The carousel of on-again, off-again fiscal stimulus talks in Washington sped up Friday, as major figures hinted progress was being made on a big deal previously considered dead.

House Speaker Nancy Pelosi (D., Calif.) said she and U.S. Treasury Secretary Steven Mnuchin were set to talk again Friday, while President Donald Trump continued his cheerleading for a big deal from the Twitter sideline.

Amid reports the administration was willing to go to $1.8 trillion from its previous level of $1.6 trillion in its offer, Larry Kudlow, director of the White House’s National Economic Council, on Friday said Trump had signed off on a revised offer. “The President has approved a revised package. He has approved a revised package, he would like to do a deal,” Kudlow said on Fox Business News.

U.S. Jobless Claims—aka Layoffs—Fall Slightly in Early October but Are Still Very High

The number of Americans who applied for jobless benefits fell slightly in early October to a fresh pandemic low, but they are declining more slowly in a sign the labor market could be experiencing a setback amid another wave of corporate layoffs.

Initial jobless claims filed through state programs slid to 840,000 in the week ended Oct. 3 from a revised 849,000 in the prior week, the Labor Department said Thursday. Economists polled by MarketWatch had forecast new claims to fall to 820,000.

AMD Reportedly in Talks to Buy Xilinx

Xilinx shares spiked Friday after The Wall Street Journal reported that the company was in advanced talks to be acquired by Advanced Micro Devices in a deal that could be worth $30 billion or more.

Citing “people familiar with the matter,” the Journal said that a deal between AMD and Xilinx could come together as soon as next week. Some analysts, however, are lukewarm on the deal, pointing to the disappointing returns on the 2015 acquisition by Intel, AMD’s rival, of Altera, a Xilinx competitor.

Regeneron Wants FDA Approval for Trump’s Covid-19 Treatment

Regeneron Pharmaceuticals asked federal regulators Wednesday for emergency authorization to distribute the antibody cocktail that President Donald Trump received when he was treated for Covid-19 last weekend. Without waiting for the U.S. Food and Drug Administration to weigh in, Trump tweeted a video in which he called the treatment “a cure” and said “I’ve authorized it.”

Although the president has no official role in such scientific decisions, Trump’s treatment with the antibodies surely won’t hurt prospects for the experimental product of Regeneron, or for a similar antibody treatment that Eli Lilly submitted for emergency use authorization earlier this week. Until recently, many investors thought the opportunity for such Covid treatments would be truncated by the arrival of vaccines. Now analysts forecast billions of dollars in sales.

IBM Is Sharpening Its Focus on the Cloud With Infrastructure Spinoff

IBM plans to spin off its $19 billion managed-infrastructure services business, while zeroing in the rest of the company on hybrid cloud software and services.

The tech giant said it expects to complete the transaction via a tax-free spinoff to shareholders by the end of 2021. IBM said the combined companies will pay dividends no less than its current rate. The business to be spun off—the new company will be named later—accounts for about a quarter of IBM’s total revenues. IBM did not name a leadership team or board members for the new company.

Six Chicken-Industry Officials Indicted for Price Fixing

Six current and former chicken-industry executives have been indicted on price-fixing charges, according to court documents, expanding the U.S. government’s antitrust prosecutions in the $65 billion poultry industry.

The charges target executives from six different chicken companies, including Pilgrim’s Pride Corp., and provide new details about the alleged conspiracy. Prosecutors alleged the price-fixing took place from 2012 into early 2019, a longer period than the Justice Department previously had alleged.

Bristol Myers Squibb to Acquire Heart-Drug Maker MyoKardia

Bristol Myers Squibb said Monday it would acquire biotechnology company MyoKardia in a deal valued at $13.1 billion in cash. The deal values MyoKardia shares at $225 each, which is 61.2% above their closing price last Friday of $139.60.

MyoKardia’s lead pipeline drug mavacamten treats symptomatic obstructive hypertrophic cardiomyopathy. The deal is expected to “minimally” dilute Bristol Myers’ adjusted earnings in 2021 and 2022 and start adding to earnings in 2023.

GE Received a ‘Wells Notice.’ Here’s What That Means.

General Electric said it has received a “Wells Notice” from the Securities and Exchange Commission in connection with accounting practices tied to insurance and GE Power operations.

A Wells Notice is a letter from the SEC telling a recipient that the agency is planning to bring enforcement actions. It is sent at the end of an investigation into potential securities-law violations.

The SEC has been investigating accounting reserves tied to long-term-care insurance policies written long ago. Legacy long-term-care insurance has nettled GE investors before. The company has taken charges against earnings and has added billions in cash to pay insurance policies that performed worse than the company expected.

Boeing Sees Difficult Decade Ahead for Commercial Aviation

Boeing predicted tough times for commercial aviation in its updated market outlook on Tuesday, but the commercial aerospace and defense giant still sees plenty of opportunity for growth over the coming decade.

First, the bad news. Boeing predicts the world will require 11% fewer planes over the next 10 years, mainly because of Covid-19. That reduces expected demand through the end of 2029 to 18,350 planes, down from about 20,600 new planes predicted in 2019. The difference is more than 200 planes a year, and removes roughly $350 billion from Boeing’s forecast over the decade.

Cineworld Temporarily Shuts Cinemas Because of Virus Impact

British cinema chain Cineworld announced Monday that is temporarily shutting cinemas in Britain and the United States, as the coronavirus pandemic delays major new films like the latest James Bond spy blockbuster.

The company said in a statement that it would suspend its 127 Cineworld and Picturehouse theatres in Britain starting Thursday, and 536 Regal theatres in the U.S. The news confirmed weekend media speculation over the temporary closures at the group, which employs around 45,000 staff in its two main markets.