Insider Guide

October, 2023

Clarity around scheduling your annual review

As the end of the year approaches, we have been calling those of you who have not yet scheduled time with your advisor for your annual financial check-up. During those phone calls, our team received some feedback that we wanted to address with you in case you are feeling the same way.

We would like to clarify a couple of things so that scheduling your annual review is less uncomfortable and so that you know what to expect.

- First, the meeting is included in your service with us (there is no additional fee) and offers a way for us to catch up with one another. We could update you on what is happening with your investments, and we would love to hear how you are doing, hear about your progress on achieving your personal goals, and discuss the implications of any changes (personal situation, goals, etc.).

- Secondly, we heard some of you are concerned that you are wasting our time because you are feeling uncertain of what to talk about or don’t feel you have enough money to warrant a discussion. The truth is, you matter to us, and we value the time we spend conversing with you! We look forward to meeting with each of our clients, and we can guide the discussion if you are not sure what you want to discuss. We can remind you of the goals you shared with us in the past and reevaluate them with you.

- You hired us to provide you with our expertise and knowledge around your financial situation, and therefore, no item is too small to discuss. We care about your entire financial picture as well as your personal life and well-being. We desire to help you grow in all areas of your life.

- If you feel that you are not at a point in your life where you need to have a meeting (for example, you are trying to figure out how to “afford” things vs. build wealth) maybe we can discuss how to help you budget for the things you need or want? We are available to be a part of the process with you.

- If you are too busy with life and feel there really is nothing that needs to be discussed (no specific need that you’re aware of, and you are not looking to change anything), then of course, we would understand! We would appreciate a quick phone call or email to let us know.

The key is that we want to stay in communication with you, and want you to know that we are here for you when you need us.

Upcoming Event

We have chosen to partner with our local Woodstock Arts program by sponsoring this exhibit and we want to share it with you!

- Enjoy art created by local artists

- Live music

- Hors d’oeuvres

- Beer, wine, coffee and non-alcoholic beverages

Drop in on Friday, October 20th from 4-6 pm at the Reeves House

734 Reeves St, Woodstock, GA 30188

We look forward to seeing you there!

Please RSVP by Friday, October 13th – by clicking on the button below.

Blog Update

Our latest blog, “What to do when you receive an inheritance” is a blog to serve as a guide to stewarding your inheritance. It addresses the “Now what?” question you might ask after you have received an inheritance.

While you mourn the loss of your loved one, you may be extremely grateful for this thoughtful gift and receive it as a blessing. However, it can also be a bittersweet experience: it can bring a sense of financial security and opportunity, but it can also leave you feeling overwhelmed and unsure about how to handle the money in a responsible way.

In this blog, we will address some common pain points associated with receiving an inheritance and provide possible solutions to help you make informed decisions and steward your inheritance wisely.

You can also listen to our corresponding podcast in which Joe Beckford and Reid Trego share some of their wisdom on the topic.

Check out one of our newest episodes from The Money PIG Podcast hosted by our very own Reid Trego. This episode features practical wisdom from Nate Mirabella and Tim Goodwin, on the topic “Handling Financial Anxiety.” Click the button below to listen.

Nourish to Flourish

by Tara Bruce

Do you know where you are going and how you’re going to get there?

In today’s hectic life, with daily tasks pulling us in many directions, we have to be very intentional about our time and making sure that the way we spend it aligns with where we want to go and ultimately how we want to grow.

As we focus on growth we need 2 key components –

1. To know exactly where we want to go! It’s important to know where you are going. To have something you are trying to create, build, become. Then, write it down. Better yet, ask yourself your WHY. What is your motivation behind the destination you are aiming for? Is it a person? Is it a legacy you want to leave? Is it a value you want to embody within yourself? Then write it down or create a visual and let it be your compass.

“You’ve got to be very careful if you don’t know where you are going, because you might not get there.” – Yogi Berra

2. Once you know where you want to go, you need directions or a course of action to get you there.

The other day my google maps app was not working. I felt lost. I really had no clue how to get somewhere and I did not have a physical map. I knew where I wanted to go, but trying to figure out how to get there became very difficult because I was in a new city I had never been to before. I needed to ask someone for directions and write them down.

Make a plan or a roadmap to get you where you want to be. If you are uncertain how to get there, then ask someone wiser who has charted that course before you, or who is living out the life and values you want to emulate. The important part is that you begin and that you grow one day at a time. This is when slow and steady really does win the race, because all the learning and growth happens in the process of getting you there.

Some questions to ask yourself:

What areas are you hoping to grow in?

How do you plan to work toward growth in those areas?

Is there someone you can reach out to that can serve as a mentor or source of wisdom?

Is there someone in your life you can thank for embodying the values you hope to live by?

Do you know where you envision yourself in 3-5 years?

Do you know your next best step to help you toward the life, or growth you desire?

“Maybe the question has never really been about whether you see your glass as half full or half empty. After all, every season is at once fraught with scarcity and blessed with abundance. We can work hard, play hard, love hard, and pray for grace, and still the unexpected lands on every doorstep, sweeps in, and changes everything. And in those moments, maybe keeping perspective is about seeing that we have a glass at all… and a choice for how we’ll fill it. That in the midst of owning our reality, we can choose to see opportunity. And in the setbacks or “not yets,” we find new strength to grow.” – Charis Dietz

Real Estate Update

by Sharon Brewer

The Confounding Real Estate Market

Many experts and armchair economists have predicted that the continued rise in mortgage interest rates would force lower home prices. This hasn’t happened yet!

The most recent data (August 2023) shows that the volume of home sales continue to decline across the country (16.6% decrease year-over-year), while the median home price increased across the country! The median home price in the West was up 1% (the smallest increase), 5.8% in the Northeast, 3.2% in the South, and 6.8% in the Midwest.

With home prices and mortgage rates up, buyers appear to be chasing affordability! New construction is faring better than existing homes due to builder incentives that buy the mortgage interest rate down temporarily or permanently.

The “real estate winter” that has would-be buyers frozen in their lower-interest-rate homes keeps the inventory of existing homes limited, which forces home prices up. Continued pressure by the Federal Reserve to increase rates keeps lenders seeking higher compensation for mortgages in anticipation of increased future rates. This combination keeps the experts scratching their heads!

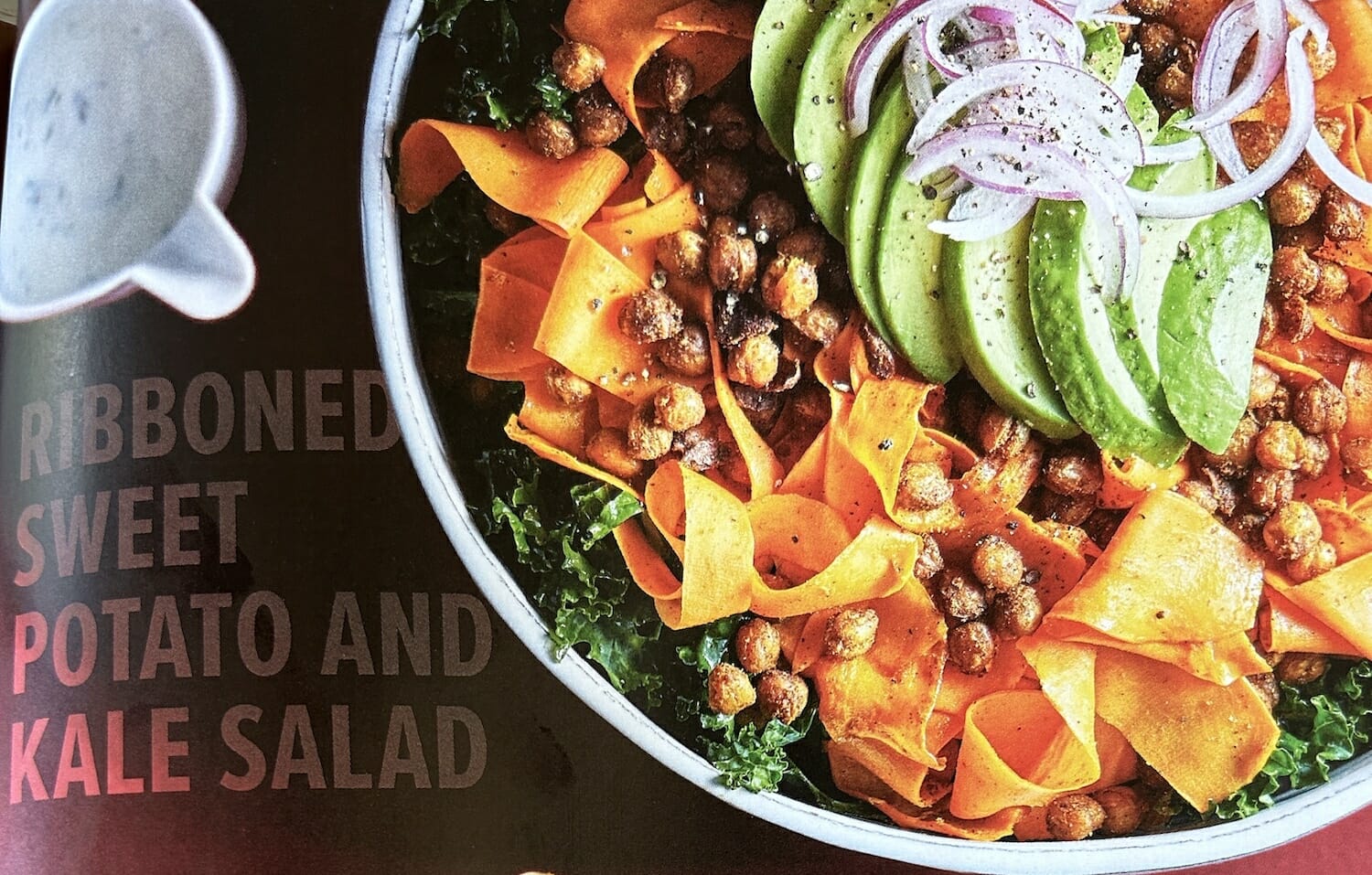

Fall recipe – Ribboned Sweet Potato and Kale Salad

Prep time: 25 min

Roast: 30 min

Cook: 4 min

Makes: 8 servings

Ingredients

1 15oz can chickpeas, rinsed, drained, and patted dry

5 tbsp. olive oil

3 tsp. ras el hanout seasoning (Moroccan spice blend)

8 cups shredded fresh kale, tough stems removed

1/2 tsp. kosher salt

2 8oz. orange and/or white sweet potatoes, peeled

1 avocado sliced

1/2 cup red onion slivers

freshly ground black pepper

+Lemon yogurt dressing (whisk together 1/2 cup plain yogurt, 1Tsp. fresh lemon juice, 2tsp fresh chopped dill, 1/2 tsp. lemon zest, and 1/2 tsp. honey. Whisk in 2-4 Tbsp. milk until desired consistency)

Instructions:

1. Preheat oven to 425°F.

2. Place kale in a large bown. Drizzle with 1 Tbsp. olive oild and sprinkle with 1/4 tsp. salt. Using your hands, rub the kale to help soften it and brighten it’s color. Arrange kale on a serving platter.

3. Using a vegetable peeler, shave sweet potatoes into ribbons and place in a large bowl; add 1 Tbsp. olive oil, the remaining 1 tsp. ras el hanout seasoning, and 1/4 tsp. salt; toss to coat. Heat the remaining 1 Tbsp. olive oil in an extra large skillet over medium-high heat. Add sweet potato ribbons; cook about 4 minutes or just until tender, gently turning ribbons occasionally with tongs.

4. Arrange sweet potato ribbons over kale. Top with chickpeas, avocado and red onion. Season with additional salt and pepper. Drizzle with the lemon yogurt dressing.

Tip – find ras el hanout in well-stocked spice aisles or make your own. (combine 1 tsp. paprika, 1/2 tsp. ground cumin, 1/4 tsp. each of ground cinnamon, ground coriander, ground ginger, ground turmeric, and black pepper; and 1/8 tsp cayenne pepper in a bowl)