Insider Guide

December, 2023

The Santa event was a huge success, with over 25 client families present, a hot chocolate bar, lots of cookies and desserts, craft tables, and, of course, photos with Santa! This will be an annual event, so if you missed it this year, we hope to see you next year.

Joe Beckford’s story on why he became an advisor

Joe shares the importance of building your legacy while you are alive.

Joe Beckford shares how he personally understands the importance of building a legacy while you are alive and why he loves helping his clients live their lives to the fullest. From experiencing his parent’s divorce to seeing his mom’s retirement cut short, Joe Beckford has experience with and understands that while creating a plan for retirement is important, none of us are promised tomorrow. Joe can help you create a plan to live your dream retirement and help you possibly retire sooner than you think while truly enjoying your life to the fullest!

Blog Update

Our latest blog was on the topic of goal-setting titled “Goals For The Year.” As we move toward the new year, we want to encourage you to complete any goals you still can, evaluate your 2023 goals, and create new goals for 2024. Below are some links to some goal-setting resources.

Give the gift of peace of mind

We are offering a new promotion and service – a free second opinion on your retirement plan. You might have conversations with family and friends over the holidays, and this could be an easy way to share some peace with them regarding their retirement plan.

What they will receive

First, they will complete the 10-question assessment with Tara Bruce, and then they will have a follow-up conversation with one of our advisors to discuss their answers. After, they will receive a follow-up email with the top three things they can focus on to help them improve their retirement plan.

If you know someone who could benefit from a free second opinion on their retirement plan, please forward the attached pdf, and they can scan the QR code to get started.

reminders

Extra giving – Consider being a little extra generous since the standard deduction is now so high. Consider bunching your giving; for example, you could donate three years’ worth of giving in year one into your Donor Advised Fund (DAF). With this strategy, you could itemize on year one, and then take the standard deduction on years two and three. All while your DAF continues to give monthly to your charities through years one, two, and three. Don’t forget we can help you to open a DAF.

Failure to pay your estimated income tax comes with an 8% penalty this year – Failing to keep up with tax payments now could lead to an expensive surprise next spring. As of Oct. 1, the Internal Revenue Service charges 8% interest on estimated tax underpayments, up from 3% two years ago. The increase is one of the many effects of rising interest rates. To learn more, read the article titled “The Surprise Bill Coming to Those Who Do Underpay Their Taxes.” If you live in Georgia, the State’s estimated underpayment penalty is 5% for 2023.

You can now take up to $1000 in an emergency withdrawal from your IRA – A provision in the Secure 2.0 Act allows special emergency distributions of up to $1,000 per year beginning in 2024. You can withdraw the money penalty-free and repay it over three years. Within those three years, no other emergency distributions can be taken out of the account unless the amount has been repaid. The new rule would waive the 10% early-withdrawal tax penalty for savers who pull up to $1,000 from a 401(k) or individual retirement account for a financial hardship. This rule also lets savers self-certify that they need the funds.

No Wash Sale with Cryptocurrency – If you have a crypto account and unrealized losses… you could save on taxes this year.

There’s an extra benefit that cryptocurrency has over stocks and other conventional assets when selling at a loss. The IRS states that for tax purposes, virtual currency should be treated as property rather than as a capital asset, like a stock.

This is important because capital assets are subject to wash sale rules while property is not. (This is true as of Dec. 2023, but might be changing in the future)

Wash sale rules bar investors from artificially harvesting tax benefits by selling capital assets for a loss and then immediately repurchasing the same or a broadly similar asset within thirty days of the sale. Since crypto isn’t considered a capital asset, it’s not subject to the rule.

So, if you’ve got unrealized losses but want to hold your crypto long-term, you could sell your crypto positions, immediately repurchase them, and still be allowed to realize the loss on your taxes.

Remember, capital losses can offset capital gains and up to $3,000 of your income.

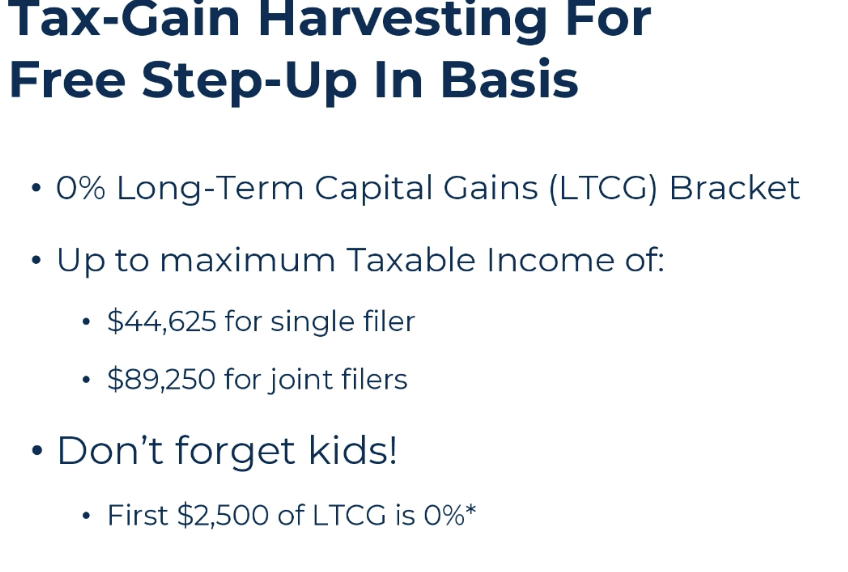

Tax gain harvesting for free – For 2023, individuals with taxable income below $44,625 ($89,250 for married couples) pay 0% tax for long-term capital gains (LTCG). In years when you’re under the threshold—say, if you’re in between jobs or receive a smaller bonus—you could effectively lock in tax-free long-term gains. If you have a UTMA or UGMA (brokerage accounts for kids), the first $2500 of long-term capital gains is taxed for free. To learn more, check out this article titled “How to leverage 0% capital gains with this lesser-known tax strategy.”

End-of-year checklist – Click below to download our end-of-year planning guide with an updated checklist from our advisors, a CPA, and an Estate Planner. If you want to know what end-of-the-year items to consider that may impact your financial, tax, and estate planning goals, check out this list created by our advisors!

Check out one of our newest episodes from The Money PIG Podcast hosted by Reid Trego. This episode features practical wisdom on our end-of-year guide from Wealth Advisor, Justin Pitcock. Click the button below to listen.

Nourish to Flourish

by Tara Bruce

Be Kind To Yourself

give yourself what you need

We can get so caught up in the exhale, the pouring out, especially around the holidays, that we forget that we need to inhale and receive. Sometimes, we need to receive from ourselves. We can’t look for others to give us ALL that we need. To do this, you can ask yourself, “What do I need in this moment?” Then, please give it to yourself. It could be space, solitude, walking in nature, engaging with your playful side, laughing, finding a friend to talk to, or trying something new. This is a way of honoring yourself, as others can’t read your mind and know what you need at any given moment. Don’t forget to let those you love know what you need and ask them for help.

give yourself grace

As the end of the year approaches, remember to give yourself grace for the things you were unable to accomplish this year. Instead, give yourself the kindness you would give to your friend or your child. Talk to yourself the same way you would speak to someone you love. It’s ok if you didn’t accomplish all the goals or items on your list. And don’t forget to spend time celebrating what you did accomplish in 2023. But, more importantly, life is always about the process and not the destination; spend some time thanking the person you have become — the ways you have grown, changed, and evolved!

forgiveness

Great opportunities are often brilliantly disguised as impossible situations. There is always a way to choose to grow and evolve as long as we love ourselves enough to let go of the harshness and the pressure we place upon ourselves. We can’t dwell on trying to make up for past mistakes through constant striving and heaps of shame. Instead, we have to choose to love ourselves enough to move forward and evolve with forgiveness and grace. If you learn to receive forgiveness, only then can you forgive others. Some might even say that learning to receive forgiveness from God, ourselves, or others is the key to a life filled with a fundamental understanding of love.

facing life’s challenges

In 2023, you might have faced some significant life transitions or challenges. I am deeply sorry if you have gone through a hardship this year. Take a deep breath. You made it here! Take a moment to be proud of yourself and reflect on all the goodness you have in your life. Maybe the holidays are more challenging this year, especially if you have lost someone you love. If they were here, I bet they would tell you to be kinder to yourself!

A POEM — by Sophie Diener

Be Kind to Yourself

I hope today you remember that

the sky is not humiliated by its vastness,

and the mountains remain unashamed of their height.

Mother Earth and her oceans are not afraid of their size,

and the sun is not concerned if someone has to squint their eyes–

it will shine,

and it will not apologize

for its light.

And like the trees teach us

that it’s okay to lose our leaves

as seasons change

and then come back to life,

I hope that nature teaches us to look at ourselves

and be kind.

I hope that we don’t

dim or shrink or fold

into spaces far too tight.

Yes, today I hope you look at yourself

and you are kind.

Apple cider braised pork

INGREDIENTS AND SUBSTITUTIONS

- Pork Shoulder. Also referred to as Pork butt or Boston butt. Opt for high-quality pork. Boneless or bone-in, it’s up to you!

- 2 cups Apple cider. Fresh apple cider is seasonal, fresh pressed, unfiltered, and unpasteurized. It’s bright and fresh and pairs perfectly with the pork. Look for it in the refrigerated produce section.

- 2-3 Apples. Pick firm, and slightly tart apples so that the dish doesn’t get too sweet. Honey crisp and pink lady are my favorites! Slice these – You can use an apple slicer here.

- 1 Onion. I love red onion here, but you could swap in any onion.

- 2 cups Chicken stock. Chicken stock helps cut some of the sweetness of the apple cider. Homemade is always best, but store bought is fine too.

- 2 Tbsp Dijon mustard. Dijon is the absolute best with pork and really bolsters the braising liquid with flavor.

- 1 head Garlic. You’re going to use a whole head here and just cut off the top of the garlic opposite the root. You’ll end up with rich roasted garlic flavor that we’ll squeeze into the liquid.

- Spices. I love a little dehydrated onion here to really drive the savory flavor home.

- Herbs. Rosemary and thyme give all the fall flavors here.

THE PROCESS

- Cube your pork. You want the pieces to be at least 4 inch pieces. If you’re going bone-in pork, cut the pork into 2 large pieces, working around the bone.

- Season everything. Pat your pork really dry (helps with browning). These are thick pieces of pork so season all sides really well with salt and pepper.

- Sear the pork. This is a crucial step! Sear the pork really well on all sides until deeply golden brown.

- Add the cider and stock. Whisk together the apple cider, chicken stock, dijon, and dehydrated onion until smooth. Pour the liquid over the pork. Add the herbs tied in a bundle into the pot. Cover and place in the oven.

- Oven time! Braise for about 3 hours, flipping the pork halfway through, until the pork is almost fork-tender. Remove from the oven and add the apples and onion slices, arranging them around the pork. Return the pot to the oven for 45 min – 1 hour, until the pork is tender. Let the pork rest in the juices for 30 minutes before serving

What to Serve with Apple Cider Braised Pork Shoulder

If you’re throwing a dinner party or just want a nice dinner to enjoy, here are some dishes to serve with the Apple Cider Braised Pork Shoulder.

Leafy salad – I love starting a meal with a big leafy salad! This recipe for KALE CAESAR SALAD is a favorite salad and pairs well with any braised meat. You’re going to love the homemade Caesar dressing!

Mashed potatoes – Who doesn’t love piling tender pork and juices on a bed of mashed potatoes? If you want a classic version, try CREME FRAICHE MASHED POTATOES. If you want to try something new, try these CARAMELIZED ONION AND BACON MASHED POTATOES.

Dinner Rolls – I don’t know about you, but I’m a sucker for warm dinner rolls! I love sopping up any extra juices with a warm piece of bread. Try these FLUFFY DINNER ROLLS!