Friday, March 26, 2021

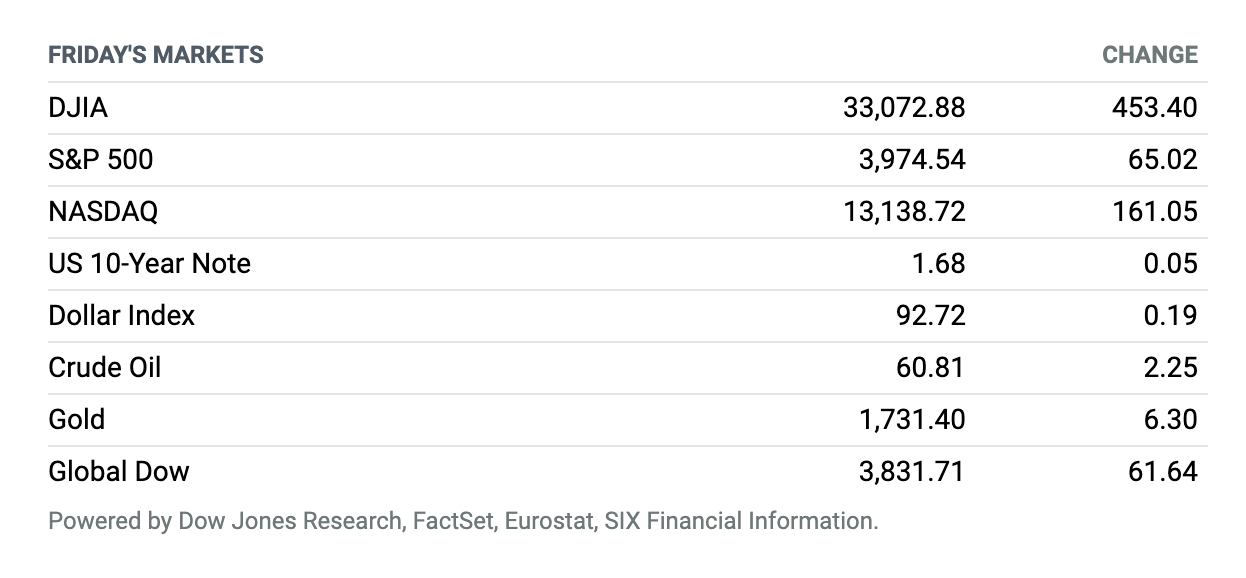

Dow and S&P 500 Close at Records as Oil Prices Rise. Stocks climbed Friday as interest rates moved decisively higher, while oil prices have climbed in response to the continuing blockage of the Suez Canal. By the close, the Dow Jones Industrial Average was up 453 points, or 1.4%, while the S&P 500 had gained 1.7%. Both ended higher on the week and notched new record closes on Friday. The Nasdaq Composite ended up 1.2%, though it fell for the week, as the yield on 10-year Treasury debt jumped to 1.68% from 1.62%. The rise in yields is a signal that investors are confident that inflation and economic demand will firm. That sentiment was lifting many stocks Friday, but higher long-dated interest rates are a marked negative for the valuations of growth companies—many of which are in the tech space and traded on the Nasdaq—because higher rates reduce the present value of future earnings. The bulk of growth companies’ earnings are expected years from now. For the week, the Dow notched a 1.4% increase, the S&P 500 added 1.6%, and the Nasdaq declined 0.6%.

WeWork Is Going Public via a SPAC Merger

WeWork, the office-sharing start-up founded by Adam Neumann, is becoming a publicly traded company via a merger with the special-purpose acquisition company BowX Acquisition.

Barron’s reviewed the merger presentation, which offers an update on WeWork’s financials since the company’s failed 2019 initial public offering.

Sales at WeWork held up during the pandemic. Revenue, disclosed in the company’s previous initial public offering filing, hit about $1.8 billion in 2018. Sales in 2019 jumped to $3.2 billion. In 2020 they stayed at $3.2 billion, but it wasn’t a normal year because of the pandemic. For context, sales at IWG, owner of the office-sharing business Regus, fell in 2020 compared with 2019.

Jobless Claims Fall Below 700,000, Lowest Level Since Pandemic Shutdowns Began

The number of Americans filing for first-time unemployment insurance fell to the lowest level since the pandemic began, the latest sign the U.S. economy continues to recover a year after it was locked down.

Seasonally adjusted initial claims dropped 97,000 in the latest week, to 684,000. That was a much steeper drop than the 730,000 decline economists expected.

AstraZeneca Now Says Covid-19 Vaccine Is 76% Effective in Updated Trial Data

AstraZeneca on Wednesday announced updated Phase 3 trial data of its Covid-19 vaccine, saying it is 76% effective at preventing symptomatic coronavirus disease, as it moved to address concerns from a U.S. federal health agency that it had published outdated interim data earlier this week.

The U.K.-Swedish drug company also reiterated that its vaccine, which was developed in collaboration with the University of Oxford, was 100% effective against severe disease and hospitalizations, and that for patients older than 65, it had 85% efficacy against the virus that causes Covid-19.

The Suez Canal Remains Blocked by a Large Cargo Ship

Global supply chains are again in focus, for an odd reason. A ship is stuck in the Suez Canal.

The situation won’t likely have a lasting impact, but it demonstrates the vulnerability of companies’ global supply chains, an issue they have been grappling with since the onset of the pandemic. Supply-chain management is getting harder, creating new risks, and even greater opportunities, for industrial companies.

Fed Says Dividend and Buyback Curbs Will End for Most Banks by July

The Federal Reserve says temporary restrictions on bank dividends and share repurchases will end for most banks on June 30—subject to how the banks fare during the annual stress tests. Last summer, with the economy reeling from the effects of the coronavirus pandemic, the Fed blocked buybacks and capped dividends to recent profits to force the banks to conserve capital.

Despite the dire economic scenario, banks proved resilient during the crisis, and actually have been a “source of strength,” Fed Vice Chair Randal Quarles said in a statement Thursday.

Powell and Yellen Diverge on Timeline for Full Employment. Here’s Why It Matters.

If there is one takeaway from the joint testimony by Treasury Secretary Janet Yellen and Federal Reserve Chairman Jerome Powell on Tuesday, it’s this: Yellen sees full employment possible next year, a forecast that is in conflict with the Fed’s guidance and underpins investors’ inflation concerns.

Yellen and Powell made their first joint appearance before the House Financial Services Committee on Tuesday afternoon, testifying on pandemic relief efforts that began a year ago. Much of the prepared remarks and responses to representatives’ questions reiterated what investors have grown accustomed to hearing—the U.S. economic recovery is far from complete, monetary and fiscal authorities plan to continue providing support, and trillions of stimulus spending is unlikely to stoke price increases that are large and persistent.

Intel’s New CEO Is Spending $20 Billion to Double Down on Chip Manufacturing

Amid a global shortage of semiconductors that has hit the output of consumer goods ranging from autos to videogame consoles, Intel CEO Pat Gelsinger committed the chip maker to spending billions to expand its manufacturing footprint.

Despite recent issues with perfecting techniques for fabricating the most advanced chips, Gelsinger said Tuesday that Intel planned to spend $20 billion to build two manufacturing plants in Arizona, committing the largest U.S. chip maker by sales to improving and growing its manufacturing capabilities for years to come. The decision to do so comes only weeks into Gelsinger’s tenure as CEO, and amid increased U.S. government interest in securing domestic semiconductor manufacturing supply.

Amazon Names Salesforce Executive Adam Selipsky to Run AWS

Amazon on Tuesday named Adam Selipsky to succeed Andy Jassy as the CEO of Amazon Web Services. The appointment makes Selipsky one of the most powerful people in the software business.

Selipsky, who ran sales, marketing, and support for AWS from 2005 until 2016, had left Amazon to become CEO of Tableau, a business intelligence software company that was acquired by Salesforce in 2019 for $15.7 billion.

Big Tech CEOs Are Pounded Over Misinformation, Extremism

The chief executives of Google parent Alphabet, Facebook, and Twitter alternately were filleted, grilled, and otherwise pummeled before the House Committee on Energy & Commerce on Thursday.

“It is now painfully clear that neither the market nor public pressure will force these social-media companies to take the aggressive action they need to take to eliminate disinformation and extremism from their platforms,” committee chairman Frank Pallone Jr. (D., N.J.) said in opening remarks during the hearing. “And, therefore, it is time for Congress and this Committee to legislate and realign these companies’ incentives to effectively deal with disinformation and extremism.”

Pfizer Will Test a Pill to Kill the Covid-19 Virus

Pfizer has started a Phase 1 trial of a pill that could foil the Covid-19 virus, the company said Tuesday.

The experimental drug inhibits enzymes essential to the replication of the SARS-CoV-2 virus; many successful antiviral drugs against HIV and hepatitis C work the same way. If clinical trials prove the Pfizer antiviral safe and effective, the pill could be given at the first sign of infection, said the company’s chief scientific officer, Mikael Dolsten, in the announcement.