Friday, April 1, 2021

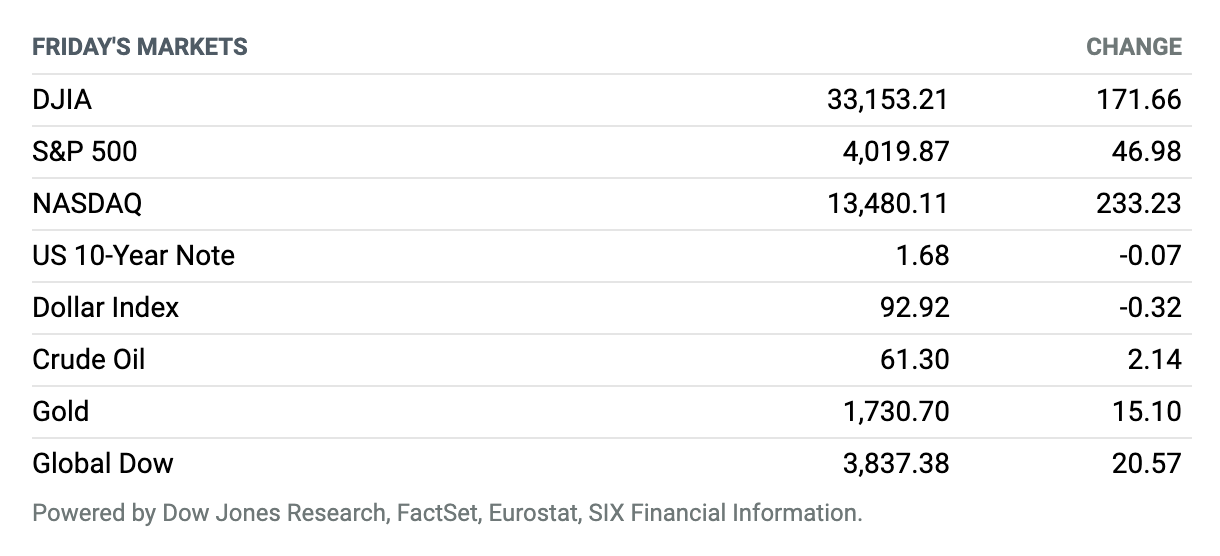

S&P Breaches 4000. The S&P 500 rose above the 4000 level for the first time on Thursday as investors took heart from President Joe Biden‘s infrastructure spending proposal, even though it faces obstacles. The Dow Jones Industrial Average rose 172 points, or 0.5%. The S&P 500 rose 1.2% to a new high. The Nasdaq Composite gained 1.8%. The gains came despite news of an increase in claims for unemployment benefits. The Labor Department said Thursday that 719,000 people filed initial claims for benefits in the latest week, up from a revised 658,000 in the prior week, signaling that although the economy is improving, the path may not follow a straight line.

Corrections & amplifications: The Labor Department said Thursday that initial claims for the prior week were a revised 658,000. An earlier version of this newsletter stated that the prior week’s claims were 684,000, which was the department’s original, unrevised figure.

(Editor’s note: We are publishing the weekly Market Brief today, because U.S. stock markets will be closed tomorrow in observance of Good Friday.)

Weekly Initial Jobless Claims Climb, but Overall Trend Is Improving

Initial claims for unemployment insurance rose in the latest week as joblessness remains high, though the report offered some slightly brighter details.

The Labor Department said seasonally adjusted claims increased 61,000 to 719,000 in the week ended March 27. Economists had expected a smaller increase; those surveyed by FactSet predicted a reading of 690,000.

Now for the good news, albeit modest: The four-week moving average came in at 719,000, a decrease of 10,500 from the previous week and the lowest level since March 14, 2020–when it was 225,500 as shutdowns started. Meanwhile, continuing claims for the most recent week (March 20 for that series of data) improved to 3.79 million from 3.84 million, and both initial and continuing claims for Pandemic Unemployment Assistance dipped.

The Treasury Market Just Had Its Worst Quarter Since 1980

The Treasury market just posted its worst quarterly performance in more than 40 years, with investors betting on a strong U.S. economic recovery from Covid-19.

For the quarter ended March 31, the Treasury market lost 4.6%, according to ICE Indices. That is the worst performance since its 6.8% loss in the third quarter of 1980.

Biden’s Infrastructure Plan Faces Tough Road

President Joe Biden’s $2.3 trillion proposal to upgrade the nation’s infrastructure faces challenges both from some moderate Democrats, who want the president to reinstate the state and local tax deduction, and Republicans, who oppose paying for the bill with tax increases.

Calling his plan a “once-in-a-generation investment in America” when he unveiled it on Wednesday in Pittsburgh, Biden said it would improve both traditional infrastructure like roads and bridges as well as build 500,000 electric-vehicle charging stations and expand home care for the elderly and disabled.

Pfizer and BioNTech Say Their Covid-19 Vaccine Is 100% Effective in Adolescents

Pfizer and BioNTech said early Wednesday that their Covid-19 vaccine had completely prevented Covid-19 in a Phase 3 trial of children ages 12-15.

The vaccine demonstrated 100% efficacy in the 2,260-person trial, with 18 cases of Covid-19 in the placebo group and none in the vaccinated group.

Megaship Is Refloated, and Suez Canal Reopens to Traffic

The MV Ever Given was refloated and the Suez Canal reopened to traffic Monday, sparking relief almost a week after the huge container ship got stuck and blocked a major artery for global trade.

Tugboat crews sounded their foghorns in celebration after the Japanese-owned megaship the length of four football fields was fully dislodged from the sandy banks of the Suez.

Amazon-Backed Deliveroo Slumped After London Debut

Shares of food delivery company Deliveroo tumbled 30% in the first hours of their first day of trading in London, in the largest-ever technology initial public offering on the London Stock Exchange, even though the company had been priced at the low end of its range.

The steep fall of the stock on Wednesday underlined investors’ worries about the profitability of gig-economy companies in general, and their concerns about the future evolution of labor laws that could affect the way Deliveroo’s self-employed drivers and cyclists are compensated.

Home Price Growth Hit a Nearly 15-Year High in January

Home prices continued their pattern of strong annual growth in January, with the national S&P CoreLogic Case-Shiller Index registering the highest annual gain since February 2006, according to a Tuesday release.

Home prices nationally saw an annual gain of 11.2%. That’s faster than December’s 10.4% annual growth, and one month shy of a 15-year high, according to the release.

Banks May Take a $10 Billion Hit on Archegos, J.P. Morgan Says

Heightened trading activity was a savior for banks last year, but the recent fallout from Archegos Capital Management’s margin call last week will muddy the picture when the largest banks report first-quarter results in April.

Analysts at J.P. Morgan Securities said in a note Tuesday that they expected that banks collectively would face trading losses in the range of $5 billion to $10 billion, as result of Archegos being “highly leveraged” at an estimated five to eight times holdings.

PayPal Users Will Be Able to Use Cryptocurrencies for Purchases

PayPal users soon will be able to use cryptocurrency to pay for merchandise at millions of retailers, a move that could further push digital currencies into the mainstream.

The announcement comes a day after Visa said it would process crypto payments. Tesla recently began accepting payments in crypto for their merchandise, while Mastercard said last month it would facilitate crypto transactions beginning this year.

Southwest Orders 100 More 737 MAX Jets

Southwest Airlines placed an order for 100 more Boeing 737 MAX jets and added 155 options, meaning it now has about 350 MAX planes on order and options for another 270.

The moves extend Southwest’s order book through 2031 “while accelerating 737-700 retirements and investing over $10 billion in new and existing firm aircraft orders to further improve fuel efficiency and reduce carbon emissions,” the airline said.