Friday, February 26, 2021

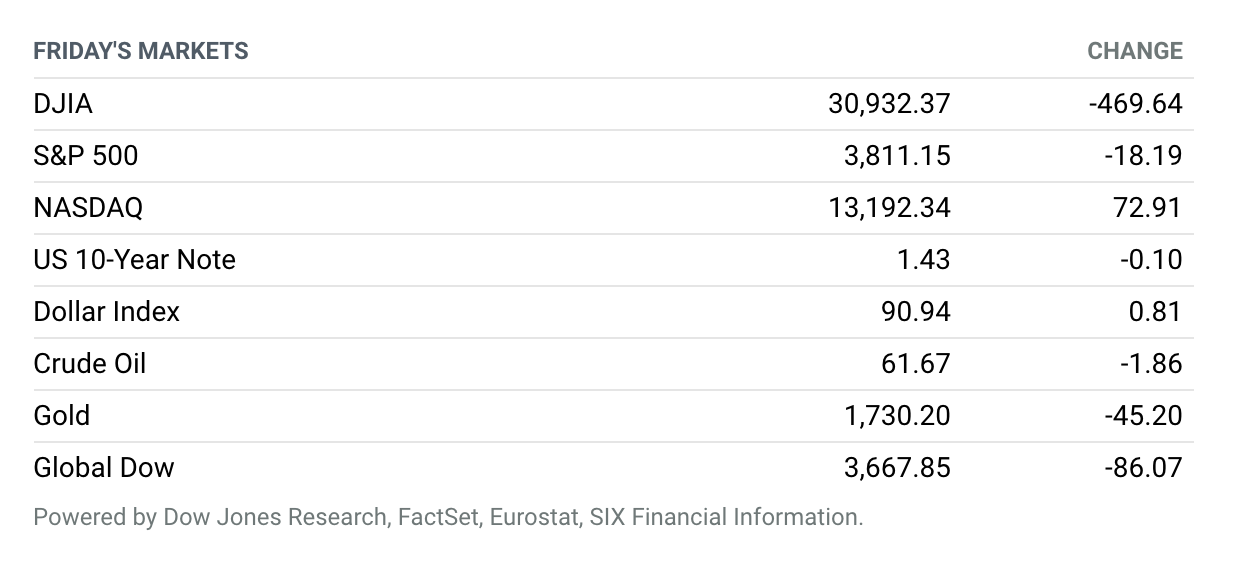

Stocks End Tough Week Mostly Lower. Stocks ended mostly lower Friday, dipping toward session lows in the final minutes of trading. Tech-related shares bounced after a rout sparked by a sharp rise in Treasury yields, but still suffered weekly losses. The Dow Jones Industrial Average ended with a loss of around 470 points, or 1.5%, near 30,932. The blue-chip gauge ended the week down 1.8%, its fall cushioned by a rotation into shares of companies more sensitive to the economic cycle. The S&P 500 gave up a modest gain ahead of the closing bell, finishing with a loss of around 18 points, or 0.5%, near 3811 and leaving it with a weekly decline of 2.5%. The tech-heavy Nasdaq Composite clung to a gain of around 73 points, or 0.6%, to close Friday near 13,192, after suffering its largest one-day percentage fall since October in the previous session. The Nasdaq suffered a 4.9% weekly fall.

Fed Is Committed to Easy Money Until Recovery Is Much Further Along, Powell Says

Federal Reserve Chairman Jerome Powell reiterated the central bank’s promise to keep interest rates near zero and maintain its bond-buying program until the U.S. economy improves.

In the Fed’s semiannual monetary policy report to Congress, Powell said that “the economy is a long way from our employment and inflation goals, and it is likely to take some time for substantial further progress to be achieved.” He pointed to hefty unemployment rates among lower-income workers as a particular concern.

Most of the views in his speech echo prior comments from Powell at panels and in news conferences.

Bond Markets Saw Ugly Trading This Week. What It Means.

Declines in Treasury yields gave traders a respite on Friday, after a tumultuous week in financial markets.

The 10-year yield was down 6 basis points, or hundredths of a percentage point, at 1.46% Friday afternoon. But it is still up 12 basis points for the week, after a turbulent session Thursday when it briefly went as high as 1.6%.

Thursday’s jump in yields may have been a sign of a market shift: Rising yields could soon become a “tantrum” that could end up hurting markets. Strategists across Wall Street have started to speculate about whether U.S. officials will respond to the ongoing rise in Treasury yields with changes in tone, however small, about policy.

Jobless Claims Fall More Than Expected

The number of U.S. workers filing initial claims for unemployment benefits fell last week more than expected, amid potential disruptions to reporting claims in storm-stricken Texas.

First-time jobless claims fell by 111,000 in the week ended Feb. 20 to a seasonally adjusted 730,000, the Labor Department said Thursday. The previous week’s level was revised lower by 20,000 to 841,000. Economists surveyed by The Wall Street Journal had forecast a reading of 845,000 initial claims. The four-week moving average, which smooths out volatility, was 807,750, a decrease from a downwardly revised 828,250 the week before.

An FDA Committee Meets Today to Discuss Johnson & Johnson’s Vaccine

Just over a year after Johnson & Johnson announced its plans to develop a vaccine to prevent the then-unnamed coronavirus that spread through China’s Hubei province, that vaccine has reached the last step of its development process in the U.S.

On Friday, the U.S. Food and Drug Administration’s vaccine advisory committee planned to meet to discuss whether the evidence available indicates that the benefits of widespread administration of the vaccine outweigh the risks.

Eli Lilly Signs $210 Million Deal With U.S. for Covid-19 Antibody Therapy

Eli Lilly said Friday that the U.S. government had agreed to pay $210 million for 100,000 doses of a newly authorized combination therapy for Covid-19 patients.

The company has agreed to deliver the doses, which are made up of two monoclonal antibodies called bamlanivimab and etesevimab, by the end of March. The government has an option to increase the order by another 1.1 million doses, which would be available by late November.

Airbnb’s First Earnings Report Was a Mixed Bag. A Travel Recovery Remains Uncertain.

Airbnb posted better-than-expected revenue in its first earnings report since going public in December, but the results showed the ongoing impact of Covid-19 on its business.

For the December quarter, Airbnb reported revenue of $859 million, which was down 22% from a year ago, but above Wall Street’s consensus forecast of $748 million. Revenue for the full year was $3.4 billion, down 30%.

AT&T Is Spinning Off DirecTV. It Gets $8 Billion to Pay Down Debt.

AT&T is spinning off its satellite and cable TV operations into a separate company and bringing on private-equity firm TPG Capital as a minority investor, it announced on Thursday.

The transaction will provide the telecom and media conglomerate with close to $8 billion in cash, which it says it will use to pay down debt. It values the combination of its DirecTV, AT&T TV, and U-verse pay-TV services at $16.25 billion, including debt. Customers shouldn’t see any change as a result of the transaction.

Novavax Takes a Step Toward Approval for Covid-19 Vaccine

The biotech Novavax said it had completed enrollment of the large Covid-19 vaccine trial it is running in the U.S. and Mexico, a key step toward submitting the vaccine to the U.S. Food and Drug Administration for emergency-use authorization.

Novavax has already presented positive results from one Phase 3 trial, which it ran in the U.K. But while the company has begun a “rolling review” of that data with the FDA, at least one analyst has cautioned that it will need results from its U.S.-based Phase 3 trial before it can receive authorization.

Sanofi and GlaxoSmithKline Start Phase 2 Trial of Delayed Covid-19 Vaccine

In December, Sanofi and GlaxoSmithKline said that interim results of their Phase 1/2 study of the vaccine showed an insufficient response in older adults, so the companies took the vaccine back to the drawing board.

Now, they’re taking a second crack at it. On Monday, the companies said they had begun a Phase 2 study in 720 adult volunteers of an updated version of the vaccine to determine the best dosage for a Phase 3 study, expected to begin in the second quarter of the year.

M&T Bank Plans to Buy People’s United

M&T Bank announced Monday that it plans to buy People’s United Financial in an all-stock transaction that values the Bridgeport, Conn.-based bank at roughly $7.6 billion.

The deal comes amid heightened expectations for bank merger activity this year. Last year was expected to be a big one for mergers before the coronavirus interrupted activity as banks had to focus on securing their own business rather than thinking about acquiring others. But while the pandemic paused activity, it only increased the rationale for regional tie-ups as banks found that they need to boost their scale and digital offerings amid a period when interest rates are expected to stay low for some time, squeezing potential profits.