Friday, March 5, 2021

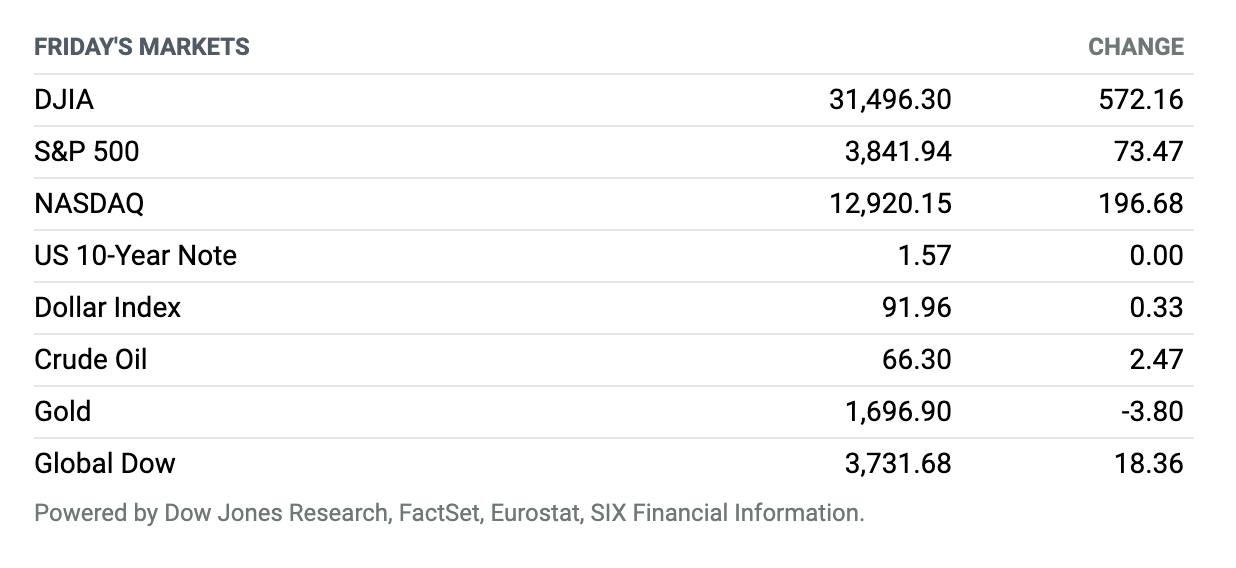

Stocks Jump Following Jobs Report. U.S. stocks finished Friday sharply higher after the U.S. government reported stronger-than-expected jobs growth in February. The Dow Jones Industrial Average posted a 572-point gain, up 1.9%, to around 31,496, while the S&P 500 index closed 2% higher at 3842. The tech-heavy Nasdaq Composite finished 1.6% higher on Friday after notching an intraday low of 12,397.05, managing one of its biggest intraday comebacks in a year. Friday’s session was turbulent, highlighting a choppy week in which rising bond yields prompted investors to unload technology stocks. For the week, the Dow closed up 1.8% thanks to Friday’s rally, the S&P 500 gained 0.8%, and the Nasdaq notched a 2.1% drop, despite its Friday rebound.

U.S., EU Reach Truce in Boeing-Airbus Feud

Washington and Brussels hailed an opportunity to restore frayed ties Friday as U.S. President Joe Biden and EU leader Ursula von der Leyen suspended tit-for-tat trade tariffs.

A 16-year-old transatlantic dispute over subsidies for rival plane makers Boeing and Airbus had loomed over hopes that Donald Trump’s departure would herald warmer relations.

But Biden and von der Leyen’s phone call on Friday led to a four-month suspension in billions of dollars of tariffs, and what the White House said was an opportunity “to repair and revitalize the U.S.-EU partnership.”

Treasury Yields Jump After Fed Chairman Powell Speaks

The benchmark 10-year Treasury yield climbed back above 1.5% on Thursday—and was at about 1.56% Friday afternoon—after Federal Reserve Chairman Jerome Powell reiterated that there is a “long way” to go before the central bank meets its goals but didn’t signal any imminent plans to address the recent rise in yields.

Investors have been keeping a close eye on Fed officials’ comments, after a weekslong rise in Treasury yields that last week devolved into messy trading after a “brutal” seven-year Treasury auction. Wall Street strategists have highlighted the possibility that the central bank could decide to extend the maturity of its Treasury purchases, as long-term yields climb and short-term yields sink closer to zero.

Treasuries Just Had Their Third-Worst Start to a Year Since 1830

Treasury yields just keep climbing, and that has given the 10-year note one of its worst starts to a year in two centuries.

The benchmark note posted historically bad performance for January and February, according to data from Deutsche Bank’s Jim Reid, the bank’s global head of thematic research. The 10-year index has lost 4.7% in that time, according to ICE BofA Indices.

Since 1830 there have been only two years when it has gotten off to a worse start: 1980, and 2009, according to Reid. The iShares 20+ Year Bond exchange-traded fund is down about 12% this year.

U.S. Reports Robust Jobs Growth in February

U.S. businesses added a more-than-expected 379,000 jobs in February, led by the leisure and hospitality industries, as states began easing some pandemic restrictions and Covid vaccinations reached more of the adult population.

The unemployment rate was down 0.1 percentage point at 6.2%, leaving 10 million unemployed Americans, according to the Labor Department’s nonfarm payrolls report released Friday. Economists polled by The Wall Street Journal had expected an increase of 210,000 jobs and an unemployment rate of 6.3%.

Jobless Claims Are Better Than Expected

U.S. jobless claims came in lower than economists forecast.

The number of Americans filing for first-time jobless claims in the week ended Feb. 27 rose 15,000 to 745,000, the Labor Department said Thursday, better than forecasts for 750,000. The previous week’s number was revised up by 6,000 to 730,000. The four-week moving average fell to 790,750, down 16,750 from the previous week. Continuing claims fell to 4.295 million, from 4.419 million.

Google Is Making a Change to its Ad Business. What it Could Mean.

Alphabet has said for some time that it will eliminate one of the ways it tracks people browsing the web—third-party cookies. But Wednesday, Alphabet’s Google unit said that after it finishes phasing out those cookies over the next year, it won’t invest in new technologies that would take their place.

The news means that Google is backing away from watching what third-party sites people visit, though it will continue to track them on its own apps, including its search function.

Merck Will Help Make J&J’s Covid-19 Vaccine

The White House announced Tuesday that Merck will chip in to help competitor Johnson & Johnson manufacture doses of its Covid-19 vaccine.

While it is one of the world’s largest pharmaceutical companies, Johnson & Johnson has not been a major vaccine manufacturer. Merck, on the other hand, is one of the biggest vaccine makers in the world, and has a well-established vaccine-manufacturing apparatus. Yet the company’s experimental Covid-19 vaccine programs failed in late January, leaving it with no Covid-19 vaccine of its own to manufacture.

Las Vegas Sands Shifts Focus to Asia, Ditching Its Namesake City in $6 Billion Sale

Las Vegas Sands, the casino operator run for many years by the late Sheldon Adelson, may have to change its name.

The company announced Wednesday before the market opened that it will sell its Las Vegas “real property and operations,” including the Venetian Resort Las Vegas and the Sands Expo and Convention Center, for about $6.25 billion, to VICI Properties and funds affiliated with Apollo Global Management.

Greensill Capital Planning to File for Insolvency in U.K. This Week

Embattled financial start-up Greensill Capital plans to file for insolvency in the U.K. this week, as it simultaneously moved toward a deal to sell its operating business to Apollo Global Management, according to people familiar with the matter.

The deal with Apollo, which could be struck by the end of the week, would be part of a Greensill insolvency, similar to the U.S. bankruptcy process, the people said.

Target Reports Another Banner Quarter

Big-box retailer Target reported fiscal fourth-quarter earnings and revenue that handily beat Wall Street’s estimates.

As an essential retailer, Target benefited by staying open in the early days of the pandemic and has only built on that advantage: The company estimates that it gained about $9 billion in sales from competitors over the past year, a period in which the biggest retailers have gobbled up market share.