Friday, September 4, 2020

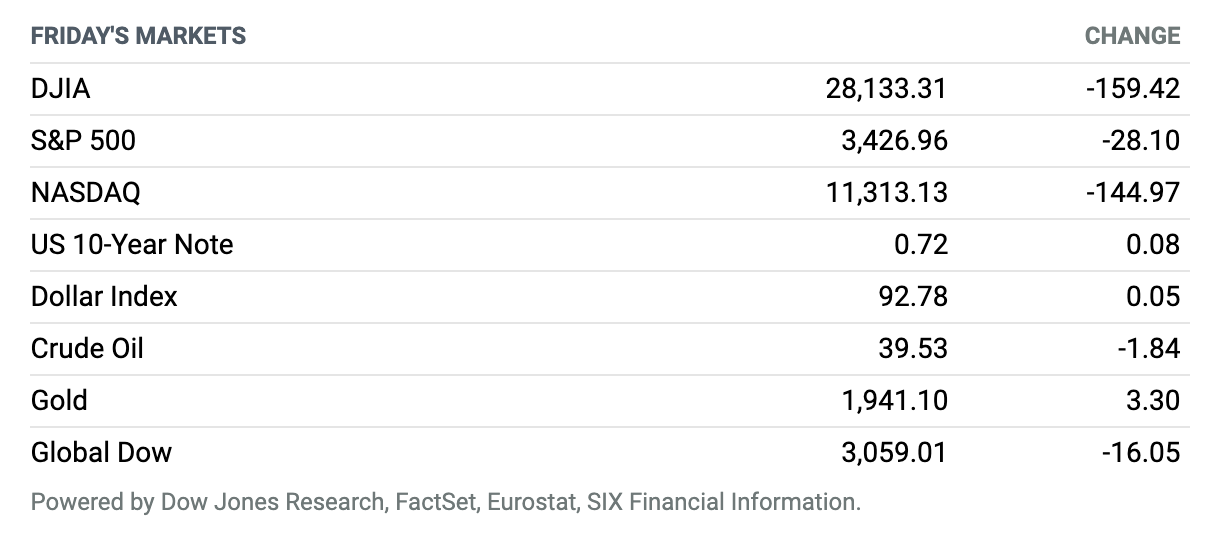

Stocks Pare Back Big Losses. U.S. equities ended lower on Friday after rebounding sharply off session lows, capping a week that saw benchmark equity indexes hit new records and the tech-heavy Nasdaq log its biggest one-day selloff since June. The S&P 500 fell 0.8% Friday to end around 3427. The Dow Jones Industrial Average shed 159 points, or 0.6%, to end near 28,133, based on preliminary numbers. The Nasdaq Composite slipped 1.3% to finish around 11,313. For the week, the S&P was down 2.3%, the Nasdaq fell 3.3%, and the Dow lost 1.8%. Throughout Friday’s ferocious selloff, unloved sectors like financials gained ground at the expense of tech stocks, which have showed the most impressive gains since the March lows. Investors also eyed data from the Labor Department showing the economy had regained 1.4 million jobs in August and the unemployment rate fell to 8.4% from 10.2%. U.S. markets will be closed next Monday in observance of the Labor Day holiday.

Unemployment Rate Falls to 8.4%, First Reading Under 10% Since the Crisis

Hiring rose for the fourth straight month, though at the slowest pace since the U.S. economy began to spring back from April shutdowns.

Nonfarm payrolls increased 1.4 million in August, the Labor Department said Friday, matching economists’ expectations and following gains of 2.7 million, 4.8 million, and 1.8 million in May, June, and July, respectively. The temporary hiring of 238,000 Census 2020 workers helped boost payrolls.

The U-3 unemployment rate, meanwhile, dropped to 8.4% in August from 10.2% in July. The decline was much bigger than anticipated—economists polled by FactSet expected a 9.8% rate—and it marks the first sub-10% print since the coronavirus crisis began. An increase in the labor-force participation rate, by 0.3 percentage points to 61.7%, makes the decline in unemployment even better.

SoftBank’s Bets on Hot Tech Stocks May Have Fueled Tech’s Big Rally

Investors have been wondering what fueled the huge gains in tech stocks during the month of August. They may have an answer.

On Friday, the Financial Times reported that SoftBank was responsible for large bets on hot tech stocks using call options, which give investors the right to purchase stocks at a preset price in the future. The FT reported, citing sources familiar with the situation, that “SoftBank is the ‘Nasdaq whale’ that has bought billions of dollars’ worth of US equity derivatives in a move that stoked the fevered rally in big tech stocks before a sharp pullback on Thursday.”

The Jobless Claims Headline Isn’t as Good as It Looks

New applications for unemployment insurance appeared to fall in the latest week, but a change in methodology means the headline isn’t as good as it looks.

The Labor Department said Thursday that seasonally adjusted initial claims fell 130,000 in the latest week, to 881,000, from an upwardly revised 1 million a week earlier. On its face, that marks the lowest reading for the series since the coronavirus crisis began. Economists polled by FactSet expected 965,000 initial claims.

But investors should be wary. The Labor Department said last week that beginning with this week’s report, it would change the way it seasonally adjusts jobless claims data. The idea is that it had been using a multiplicative model, which economists say is generally preferred in times of economic stability. The department switched to an additive model, which works better when there is a big shift in a time series—such as during a pandemic.

Justice Department Could Launch Antitrust Suit Against Google as Early as This Month

After months of rumors about the timing of a potential antitrust action against Google, it appears that the Justice Department is planning to initiate litigation as soon as the end of September or early October, according to reports. Google and the Justice Department didn’t respond to requests for comment.

The Justice Department has been building its case against Alphabet’s Google for months, ramping up the probe into the powerful company’s business practices around advertising, which has been a major focus of the investigation. The company’s search engine dominance has also come under scrutiny. According to reports, some Justice Department attorneys working on the case have been at odds with what they call an aggressive timeline set out by Attorney General William Barr, arguing that the government hasn’t adequately prepared a winning case and needs more time to pore over the millions of pages of documents it has obtained.

Facebook’s Campaign-Ad Restrictions Won’t Hurt Its Revenue

In an effort to combat disinformation campaigns, social-media giant Facebook said Thursday that it planned to block all new political advertising on its platform the week before the U.S. general election in November.

The changes, while potentially beneficial to the integrity of U.S. elections, pose little to no risk to Facebook’s revenue. Under the new set of rules, political campaigns are allowed to continue to run issue and campaign ads they had previously, so it’s likely spending will continue—or even ramp up—as usual. Campaigns will also be allowed to further adjust the ads’ targeting, which has long been considered one of the strengths of advertising on the platform.

Berkshire Buys Passive Stakes in 5 Japanese Trading Houses

Berkshire Hathaway has taken passive stakes of slightly more than 5% in five Japanese trading companies: Itochu, Marubeni, Mitsubishi, Mitsui, and Sumitomo.

Berkshire disclosed the investments late Sunday and said they were made by its wholly owned insurance unit National Indemnity. The total value of the five stakes appears to be around $6.25 billion based on their current market values as listed on Bloomberg.

McDonald’s Faces Discrimination Suit From Black Franchisees

A lawsuit filed late Monday in federal court in Illinois alleges that McDonald’s has discriminated against Black franchisees, putting them in neighborhoods where they are destined to earn less than their white counterparts.

The suit was filed by 52 former McDonald’s franchise owners. The number of Black franchisees has declined from 377 to 186 since peaking in 1998, even as the number of McDonald’s restaurants globally has more than doubled, the lawyer for the plaintiffs said in a news release with the suit. The suit also alleges that the company, which maintains substantial control over franchised restaurants, steered Black entrepreneurs to restaurants that were likely to underperform.

United Airlines and Other Airlines Eliminate Change Fees

The days of paying $200 to change a $150 domestic flight may soon be over—at least on the major carriers.

United Airlines said Sunday that would it eliminate domestic change fees “forever,” according to CEO Scott Kirby. American Airlines Group and Delta Air Lines followed on Monday, saying they would also ditch change fees. The moves level the playing field with Southwest Airlines, which has never charged a change fee, and it leaves low-cost carriers such as Spirit Airlines and JetBlue Airways alone in charging change fees (though all have suspended the fees due to Covid).

United Airlines Plans Layoffs if There’s No More Aid From Washington

United Airlines said Wednesday it plans to lay off up to 16,000 workers amid a prolonged industry downturn due to the coronavirus and the continuing stalemate in Washington over further federal support for the industry.

The big U.S. carrier, which had previously said as many as 36,000 workers could be terminated, said early retirement and other programs had lessened the need for even deeper job cuts, but the “devastating” impact of Covid-19 on airline travel still required layoffs.

Walmart Is Finally Ready to Launch an Amazon Prime Competitor

Walmart on Tuesday said its new subscription service, Walmart+, will make its debut in two weeks, with a yearly subscription priced below Amazon Prime. The move is the retail giant’s latest pushback against Amazon.com and shows the value of its store base as it confronts its rival.

Walmart said Walmart+ will combine its e-commerce business with more than 4,700 stores, 2,700 of which have same-day delivery capabilities. A subscription, which costs $98 a year or $12.95 a month, will give members unlimited free delivery from stores, fuel discounts, and the ability to use the ‘Scan & Go’ feature in the Walmart app to pay while they shop in stores.