Friday, August 28, 2020

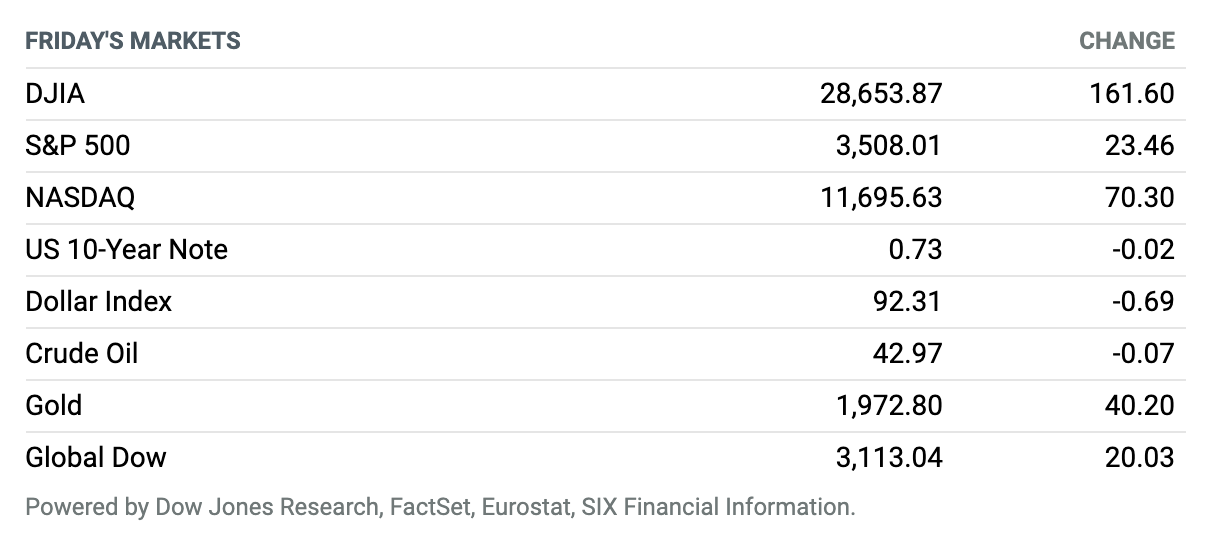

Dow Erases Losses for Year. U.S. stocks on Friday wrapped up the week and day higher. They’re one session away from the end of August, a month that has seen a powerful rally that leaves the main benchmarks at or near records, powered by gains in technology and e-commerce stocks as well as financials, amid growing optimism around coronavirus cures and treatments. The moves for the week were also framed largely by a speech from Federal Reserve Chairman Jerome Powell that likely ushered in an era of looser monetary policy after the central bank dropped its longstanding practice of pre-emptively lifting rates to head off higher inflation. The Dow Jones Industrial Average rose 0.6% to about 28,654, the S&P 500 index closed up 0.7% at 3508, while the Nasdaq Composite Index rose 0.6% to end at 11,696 (all closing levels are on a preliminary basis). Both the S&P 500 and the Nasdaq wrapped up the session at records. The Dow closed up positive for the year, erasing its coronavirus-induced losses. The blue-chip benchmark is about 3% shy of its Feb. 12 record closing high. For the week, the Dow rose 2.6%, the S&P 500 surged 3.3%, and the Nasdaq Composite notched a gain of 3.4%.

Fed Shifts View on Employment, Sees One Less Reason to Tap Economic Brakes

Federal Reserve Chair Jerome Powell announced Thursday that the Fed will target average inflation levels over time. That change wasn’t surprising news, as strategists and investors have been eyeing the potential policy shift for more than a year. Still, it confirms Wall Street’s belief that the Fed is more likely to keep interest rates low for the foreseeable future. The central bank will likely allow inflation to rise above its 2% target, to make up for recent months’ sharp contraction in economic activity, which led consumer prices to fall.

One other point in Powell’s speech was more surprising, however. The central bank has started to distance itself from the idea that the U.S. economy has a peak sustainable level of employment above which inflation will become harmful. That idea is known as the non-accelerating inflation rate of unemployment.

Americans Slowed Spending in July as Relief Aid Came to an End.

Americans’ pace of spending slowed in July as coronavirus infections spiked and enhanced unemployment benefits came to an end, the latest reminder that the economic recovery is tenuous and dependent on the pandemic’s trajectory.

Personal consumption expenditures increased 1.9% last month from June, the Bureau of Economic Analysis said Friday, better than the 1.5% rate economists polled by FactSet predicted but much cooler than in previous months. As the economy bounced back from closures during April, spending rose 8.6% and 6.2% month-over-month in May and June, respectively.

Consumer Confidence Tumbles to New Pandemic Low After Summer Viral Outbreak

Consumer confidence fell in August to a new pandemic low after a fresh rash of coronavirus cases during the summer caused Americans to turn more pessimistic about an economic recovery, according to a closely followed survey.

The index of consumer confidence sank to a six-year nadir at 84.8 this month from a revised 91.7 in July, the Conference Board said Tuesday. Economists polled by MarketWatch had forecast the index to rise to 93.0.

Jobless Claims Remain Above 1 Million. 2Q GDP Was Slightly Less Bad Than First Thought

Applications for unemployment insurance fell slightly in the latest week but held above 1 million, reflecting a job market that remains stressed as the coronavirus pandemic rolls on. Seasonally adjusted initial claims came in at 1.01 million for the week ended Aug. 22, down from a revised 1.11 million a week earlier. The number was largely in line with what economists polled by FactSet expected.

Separately on Thursday, second-quarter gross domestic product was revised slightly higher. The Bureau of Economic Analysis said the U.S. economy shrank 31.7% in the second quarter, a bit better than the initial estimate of negative 32.9% but still the worst decline on record. A tiny improvement is better than nothing, but, as Pantheon Macroeconomics chief economist Ian Shepherdson says, “this is all ancient history now.”

Walmart Is Partnering With Microsoft on a TikTok Bid

The ticking on TikTok is getting louder.

Walmart on Thursday confirmed that it has teamed up with Microsoft on an offer to acquire the red-hot video-sharing app. Microsoft previously acknowledged holding talks with ByteDance, TikTok’s parent, and had said it might include other investors. The software giant is widely considered the most likely buyer for TikTok.

TikTok Confirms It Is Suing Over Ban Ordered by Trump

Video app TikTok on Monday said it had filed a lawsuit challenging the U.S. government’s crackdown on the popular Chinese-owned platform, which Washington accuses of being a national security threat

As tensions soar between the world’s two biggest economies, President Donald Trump signed an executive order on Aug. 6 giving Americans 45 days to stop doing business with TikTok’s Chinese parent company ByteDance—effectively setting a deadline for a sale of the app to a U.S. company.

Facebook Says Apple’s New iPhone Update Will Disrupt Online Advertising

Facebook says privacy changes that Apple has made to its newest operating system will cripple the social-media giant’s ability to serve targeted ads to iPhone users while they use outside apps.

The announcement sharpens the clash between the two tech giants, with Apple standing for user privacy while Facebook defends the free flow of data that has long underpinned digital marketing.

New Home Sales Soar to 14-Year High

The housing market is booming thanks to low mortgage rates and urban flight. Low inventory suggests investors can expect continuing strength in builder stocks.

New home sales surged 13.9% in July from June, to a seasonally adjusted annual rate of 901,000, the Census Bureau said Tuesday. That’s a 14-year high, up 27.4% from a year earlier. The latest rise in new home sales was a surprise; economists surveyed by FactSet expected a decline to an annual rate of 782,000 from 791,000 in June.

Judge Says Apple Can’t Prevent ‘Fortnite’ Maker From Using Its Developer Tools

A federal judge in California late Monday said that Apple could not block Epic Games from accessing its developer tools, but she declined to force Apple to put Epic’s popular “Fortnite” game back in the App Store.

The decision from Judge Yvonne Gonzalez Rogers is one of the first big moves in Epic’s legal battle with Apple, which is likely to last years. The game developer sued Apple earlier in August, alleging that the smartphone giant has engaged in “monopolistic” behavior with its App Store practices, which allow Apple to collect up to 30% of revenue from digital purchases made through apps that are downloaded through its App Store.

Hotel and Casino Group MGM Resorts Lays Off 18,000

Hotel and casino giant MGM Resorts on Friday said 18,000 furloughed employees in the United States would be permanently laid off as the hospitality industry struggles amid the coronavirus pandemic.

“Federal law requires companies to provide a date of separation for furloughed employees who are not recalled within six months,” CEO Bill Hornbuckle said in a letter seen by AFP. “Regrettably, August 31, marks the date of separation for thousands of MGM Resorts employees whom we have not yet been able to bring back.”