Friday, September 18, 2020

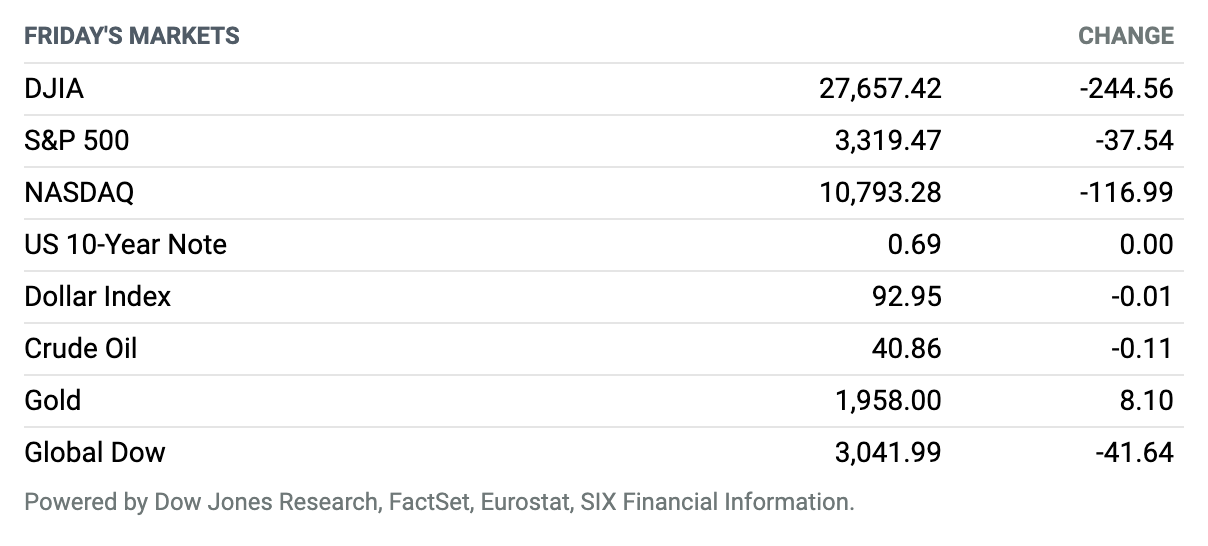

Tech Takes Another Tumble. Stocks ended lower Friday, pulling major benchmarks into negative territory for the third consecutive week as investors again dumped highflying tech shares. The Dow Jones Industrial Average fell around 245 points, or 0.9%, to end near 27,657, according to preliminary figures. The S&P 500 lost around 38 points, or 1.1%, to close near 3319, while the tech-heavy Nasdaq Composite dropped around 117 points, or 1.1%, finishing near 10,793. For the week, the Dow fell less than 0.1%, while the S&P 500 and Nasdaq each gave up 0.6%.

Fed Signals Near-Zero Rates Through 2023 Even if Recovery Quickens

The Federal Reserve on Wednesday said it had decided to keep short-term interest rates unchanged and indicated they could remain near zero through 2023—even with better economic growth than officials had previously expected.

Fed officials also predicted 2020’s slowdown would be less severe than they previously estimated, and they forecast 4% and 3% gross domestic product growth in 2021 and 2022, respectively.

The Fed Has Vowed Not to Take Away the Punch Bowl. That’s a Major Policy Shift.

Sometimes, doing nothing is the most powerful action of all. The Federal Reserve disappointed some observers after its policy meeting this week by refusing to outline new measures to boost the economy. But critics and dismayed investors misunderstand both what the Fed is capable of accomplishing and the significance of what it has announced.

The Fed’s promise to refrain from raising short-term interest rates “until labor market conditions have reached levels consistent with the committee’s assessments of maximum employment and inflation has risen to 2% and is on track to moderately exceed 2% for some time” is a momentous pledge that repudiates the central bank’s prepandemic operating procedure.

U.S. to Ban TikTok, WeChat in U.S. App Stores Starting Sunday

In a move that appears designed to increase the pressure on ByteDance to find a buyer for the U.S. operations of its video platform TikTok, the Department of Commerce on Friday announced a ban on transactions related to both TikTok and Tencent Holdings-owned WeChat in the U.S. over security concerns.

President Donald Trump had issued executive orders on Aug. 6 setting a 45-day deadline to address those issues. That period expires Sunday. Unless something changes, both apps will be barred from U.S. app stores effective Sunday. The order gives TikTok until Nov. 12 to address the White House security issues with the app, which in theory would be addressed by the sale of the business to a U.S. buyer. That also suggests that the app should still work until that date for TikTok users who already have it on their phones.

Jobless Claims Fell to 860,000 in Latest Week

The number of Americans newly seeking unemployment benefits last week fell slightly, but the level remains historically high.

There were 860,000 initial claims filed for the week ending Sept. 12 on a seasonally adjusted basis, lower than both the upwardly revised 893,000 initial claims in the prior week and the 875,000 in new claims economists expected. Continuing claims for the week ending Sept. 5 totaled 12.6 million, marking a sharp drop from 13.5 million in the prior week.

Bank of England Stays Put on Monetary Policy but Warns of Perils Ahead

The Bank of England on Thursday kept its monetary policy unchanged but warned again that “the outlook for the [U.K.] economy remains unusually uncertain,” because of both the coronavirus impact and the prospect of the U.K. failing to strike a trade deal with the European Union.

The Bank’s monetary policy committee kept the key rate at its current record low of 0.1%, and chose not to top up the asset-buying program increased at the beginning of the coronavirus pandemic to a total £750 billion ($970 billion).

Snowflake Gets Really, Really Expensive After Its IPO

Snowflake arrived in the public market Wednesday in breathtaking fashion, instantly becoming one of the stock market’s most expensive stocks, as investors bet heavily on the cloud-based data software company’s ability to maintain what has been astonishing growth.

Snowflake on Tuesday night priced an offering of 28 million shares at $120 each, above the recently increased target range of $100 to $110 a share. Huge demand for the shares made it difficult for the underwriting group to open the shares. Several hours into the trading day, the stock finally opened at $245, which gave the company a starting valuation of about $68 billion. It then traded as high as $319 before settling back to lower levels and closing at $252.99. At the peak, the company was valued at $88 billion. Late in Friday’s session, the stock was changing hands at $242.04. Although that’s below Wednesday’s opening level, it’s still more than double the offering price.

Apple Launches a New Apple Watch, a Fitness Service, and New iPads

Apple on Tuesday announced Apple Watch 6. As expected, the latest version of the watch includes a new sensor that measures blood oxygen levels. The new watches will come in new blue, gold, black, and red cases.

The announcement was part of the company’s “Time Flies” virtual product launch event, held on the company’s Apple Park campus in Cupertino, Calif., but without a live audience. Apple also announced a new fitness service around Apple Watch called Apple Fitness+, offering a catalog of fitness videos. And the company announced two new iPads.

Justice Department Reportedly Probes Short Seller’s Claims About Nikola

The Justice Department is looking into a short seller’s claims that electric-truck company Nikola misled investors, according to The Wall Street Journal.

The Manhattan U.S. attorney’s office is handling the inquiry and is working with the Securities and Exchange Commission, the Journal reported, citing anonymous sources. Last week, short seller Hindenburg Research issued a report alleging that among other things Nikola management overstated the company’s technical prowess to investors.

China’s Economic Recovery Gained Speed in August

China’s economic recovery accelerated last month, with major indicators rising at faster rates as Beijing’s supporting measures kicked in to boost growth amid the coronavirus pandemic.

Retail sales, a major gauge of China’s consumption, returned to growth for the first time in 2020, rising 0.5% in August from a year earlier, according to data released Tuesday by the National Bureau of Statistics. The result was better than the 1.1% drop in July and a 0.1% increase expected by economists polled by The Wall Street Journal.

Lilly and Pfizer Are Testing Treatments for Hospitalized Covid Patients

While vaccines go through clinical trials, people continue to die from Covid-19. Almost a million have died worldwide. So drug companies are working on Covid treatments for those who will get sick before vaccines gain wide use and even after.

This week, Eli Lilly reported its studies of two treatments aimed at getting Covid patients out of the hospital. Its anti-inflammatory drug Olumiant reduced hospital stays when combined with the antiviral drug remdesivir from Gilead Sciences. And a customized Lilly antibody against the Covid coronavirus seemed to help infected patients avoid hospitalization.

Meanwhile, Pfizer says it has begun a Phase 1 study of an antiviral drug that, like Gilead’s remdesivir, inhibits the SARS-CoV-2 virus, aiming for approval in the second half of 2021.