Friday, September 11, 2020

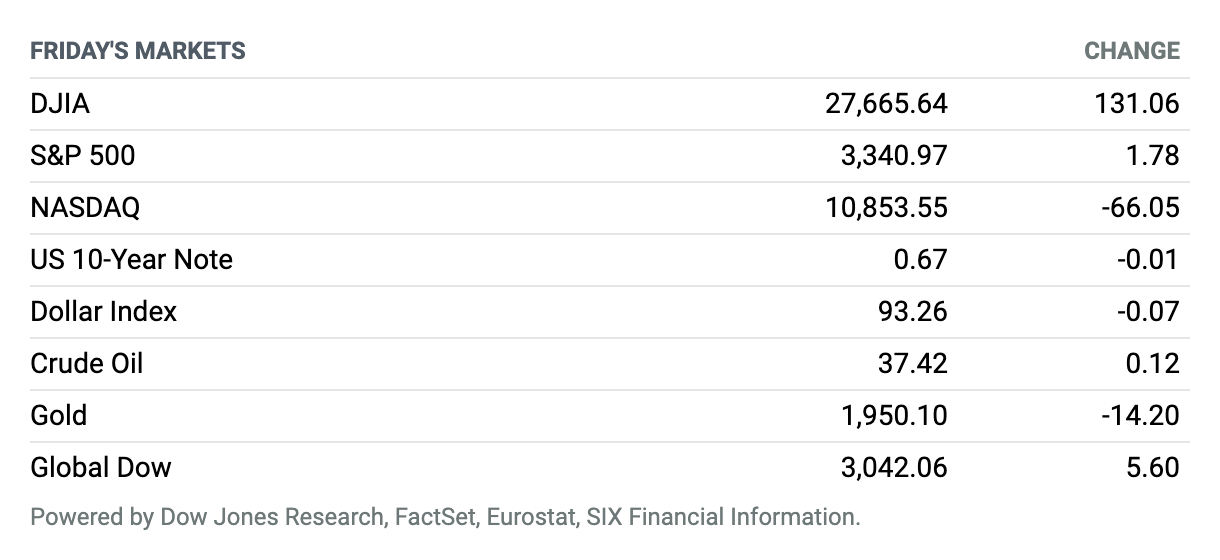

Nasdaq Suffers a Rough Week. U.S. stocks on Friday finished a volatile week and trading session mixed, with once-highflying technology-related stocks suffering the heaviest losses since the coronavirus pandemic took hold in March. Investors attributed the recent volatility to concerns about the presidential election, which is looming, and to elevated valuations for e-commerce and mega-cap companies that have thus far led the market’s rally from the depths of the public-health crisis. The Dow Jones Industrial Average closed up 131 points, or 0.5%, at 27,666, while the S&P 500 index notched a gain of less than 0.1% to finish around 3341, and the Nasdaq Composite Index declined 0.6% to end at about 10,854. All three benchmarks were down for the week. The Nasdaq Composite notched its worst weekly skid, sliding more than 4%, since its tumble of more than 12% in the week ended March 20, according to FactSet data. The weekly decline for the S&P 500 index, off 2.5%, was its worst since June. The Dow lost 1.7% for the week.

Citigroup Names Jane Fraser Its New CEO. She’s the First Woman to Head a Major Bank.

A big change is brewing on Wall Street.

Citigroup announced Thursday that chief executive Michael Corbat will retire in February after eight years at the helm. He will be replaced by Jane Fraser, current president of the bank and CEO of its global consumer banking division. Once the change takes place, Fraser, a 16-year veteran at Citigroup, will be the first woman to lead a major Wall Street bank.

To some, Fraser, 53, is seen as a natural successor to Corbat. She was named one of Barron’s 100 Most Influential Women in U.S. Finance earlier this year. A Scotland native, she joined Citigroup’s corporate and investment banking division in 2004, following stints at Goldman Sachs and McKinsey & Co. She also holds two graduate degrees: an MBA from Harvard Business School and a master’s in economics from the University of Cambridge.

U.S. Inflation Climbed in August as Demand Continues to Rebound

The prices consumers pay on everything from shelter to recreation rose in August a bit more than expected, albeit at a slightly slower pace than the prior month, as demand continues to rebound six months into the pandemic.

The consumer price index climbed 0.4% on a seasonally adjusted basis last month, following a 0.6% increase in July, the Labor Department said Friday. Compared to a year ago, prices were up 1.3% before seasonal adjustments. Economists had expected a monthly gain of 0.3% and a year-over-year increase of 1.2%.

Jobless Claims Hold Steady at 884,000

Initial filings for unemployment benefits were flat in the latest week, a sign that the recovery is leveling off about six months into the pandemic.

The Labor Department said Thursday that 884,000 Americans filed first-time claims for jobless benefits in the week ended Sept. 5—matching the upwardly revised figure for the prior week. Economists were expecting last week’s claims would total 850,000.

Why the U.S. May Still Extend Deadline for TikTok Sale

On Friday, the White House reiterated that there would not be an extension to the Sept. 20 deadline for TikTok’s parent, ByteDance, to sell the popular short-video app.

That’s a problem, because there are multiple bidders for TikTok, none of which have been able to pin down a deal. In addition, ByteDance is based in Beijing, and on Thursday Bloomberg reported that China is pressuring the company to give it time to review any proposals.

Of course, the most logical solution, and one that analysts expect, is that the deadline will be extended. That would benefit whichever U.S. bidders reach an agreement with ByteDance, as well as the U.S. itself.

LVMH Files Counter-Suit Against Tiffany

LVMH Moët Hennessy Louis Vuitton said Thursday that it plans to countersue U.S. jeweler Tiffany & Co. in Delaware “as a result of its crisis mismanagement.”

The news came a day after the luxury-goods giant said it was backing out of its $16.2 billion takeover deal for the company. The French company said it was surprised by Tiffany’s lawsuit on Wednesday, which it claimed is “totally unfounded.” LVMH added that its board examined Tiffany’s current economic situation and found its first-half results and outlook for this year to be “very disappointing and significantly inferior to those of comparable brands of the LVMH group.”

Off-Price Retailer Century 21 to Shut Down Due to Covid-19

Century 21, the off-price retailer with 13 stores in New York, New Jersey, Pennsylvania and Florida, will shut down operations due to the impact of Covid-19.

The company, which has been in business for 60 years, says its insurers have failed to pay on policies that protect against business interruption. The payments total about $175 million.

AstraZeneca Pauses Covid Vaccine Trial After Test Subject Gets Ill

AstraZeneca said Tuesday afternoon it was pausing its 30,000-patient trial of an experimental Covid vaccine, after one recipient came down with a kind of spinal cord inflammation that rarely occurs with some viral infections, but also some vaccines.

Whether the problem stemmed from the vaccine could take some days to determine, but AstraZeneca is taking the cautions that a vaccine trial merits. Unlike most medicines, vaccines are given to millions of healthy people and the treatment shouldn’t make them sick.

United Airlines Cuts Flight Capacity. It’s a Bad Sign for Fall Air Travel.

Demand for air travel is going from bad to slightly worse, according to United Airlines Holdings, which warned investors on Wednesday that its near-term outlook had deteriorated.

United said in a filing that its scheduled flight capacity in the third quarter would be down 70% year over year, compared with the 65% decrease that it previously forecast. The airline expects passenger revenue to be down 85%, compared with previous guidance of an 83% decline. United reiterated that it would burn through $25 million a day in cash in the third quarter.

Nikola Inks Partnership With General Motors

Nikola shocked the Street Tuesday by announcing a partnership with General Motors. Nikola is an alternative fuel heavy-duty trucking pioneer.

Under the terms of the agreement, General Motors will engineer and build Nikola’s light-duty truck named Badger. GM will take an 11% stake in Nikola and have the right to nominate one person to the board of directors. The 11%, or roughly $2 billion, equity stake will be due from “in-kind” contributions. In-kind isn’t cash. The Badger is expected to enter production by year-end 2022.

BP Enters Offshore Wind Market With $1.1 Billion Equinor Deal

Oil major BP has entered the offshore wind market in a $1.1 billion deal with Norwegian energy giant Equinor.

The FTSE 100-listed company has agreed to buy 50% stakes in two of Equinor’s wind farm developments on the U.S. East Coast—the Empire Wind project in New York and the Beacon Wind farm in Massachusetts. The two companies have also formed a strategic partnership to pursue further opportunities for offshore wind in the U.S.