Thursday, July 2, 2020

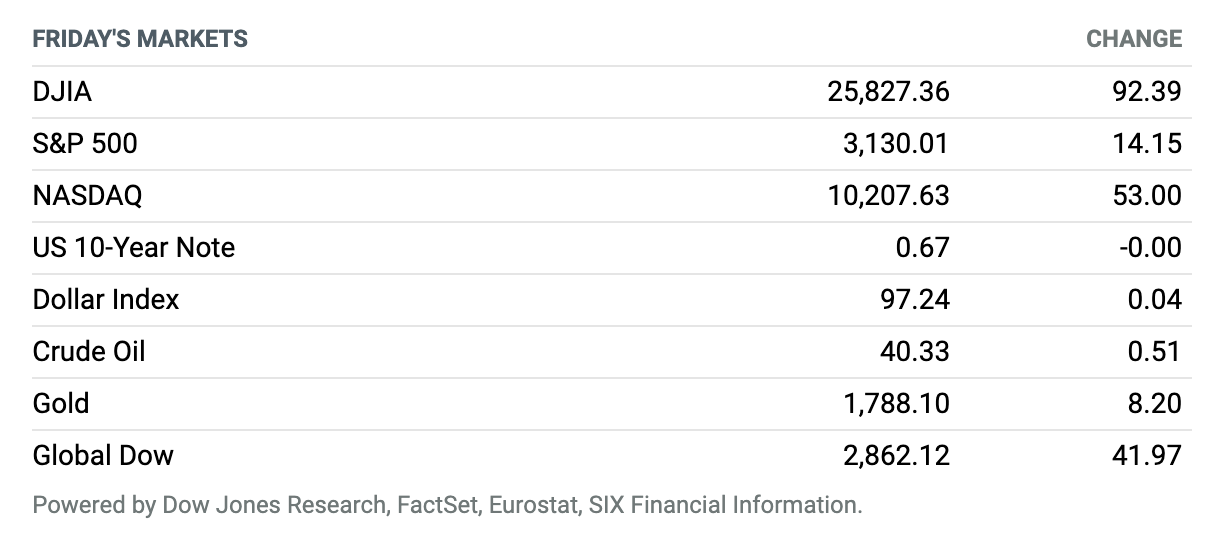

June’s Jobs Jump. U.S. stocks clung to their gains at the end of Thursday after a stronger-than-expected employment report confirmed the labor market’s rapid recovery at the end of the second-quarter. The S&P 500 gained 0.5% to 3130. The Dow Jones Industrial Average advanced 92 points, or 0.4%, to end around 25,827, based on preliminary numbers. The Nasdaq Composite added 0.5% to 10,208, booking an all-time closing high for a second straight day. The U.S. added 4.8 million jobs in June compared with expectations for a rise of 3.7 million, and the unemployment rate fell for the second straight month to 11.1%. Still, analysts worry the resurgence of new coronavirus cases across the U.S. could hold back further improvements in the broader U.S. economy.

(Editor’s note: We are publishing the weekly Market Brief on Thursday instead of Friday this week, because the stock market will be closed Friday in honor of Independence Day.)

U.S. Added 4.8 Million Jobs in June as Reopened Businesses Rehired

U.S. businesses added 4.8 million workers in June, evidence that rehiring continued as the economy reopened and businesses brought back staff. A normal labor market, though, is still a long way off.

The Labor Department said Thursday that the unemployment rate fell to 11.1% last month from 13.3% in May. The rise in payrolls and decline in the unemployment rate were much better than expected; economists surveyed by FactSet anticipated an increase of 3.1 million in nonfarm payrolls and an unemployment rate of 12.5%.

Oil Major Royal Dutch Shell Warns of $22 Billion Hit

Anglo-Dutch oil supermajor Royal Dutch Shell said on Tuesday it expects to take a hit of up to $22 billion in the second quarter as coronavirus has a lasting effect on demand for oil and gas.

In a trading update on Tuesday, Shell said it would book charges between $15 billion and $22 billion in the second quarter as it lowered its mid- and long-term oil and gas price outlook, citing the pandemic and its shift to lower carbon emissions.

Pfizer Offers Hope, and Details, on Potential Coronavirus Vaccine

Promising and detailed new data from the drug giant Pfizer and its German biotech partner BioNTech on an experimental Covid-19 vaccine lifted Pfizer shares on Wednesday and Thursday.

The companies said that all 24 patients who received lower doses of the vaccine developed levels of neutralizing antibodies after 28 days that were roughly two times higher than those found in patients who have recovered from Covid-19 infections.

Gilead Discloses Pricing Plans for Covid-19 Treatment Remdesivir

Biotech firm Gilead Sciences announced the price of its Covid-19 antiviral drug remdesivir Monday morning. The figure was lower than some estimates.

In an open letter Monday morning, Gilead CEO Daniel O’Day said that a five-day course of remdesivir will cost private health insurers in the U.S. $3,120, and will cost governments of developed nations, including the U.S., $2,340. The company said it believes that remdesivir’s ability to shorten recovery times for Covid-19 patients will result in hospital savings of $12,000 per patient in the U.S. It said it chose to set its price for remdesivir lower “to ensure broad and equitable access at a time of urgent global need.”

Tesla Has Hit a New Milestone

Tesla is now the most valuable car company on earth.

Tesla stock rose almost 4% in Wednesday trading, giving the electric vehicle pioneer a market value of about $208 billion. That eclipsed the Toyota Motor market value of roughly $202 billion. Toyota shares were down nearly 1% in overseas trading. Year to date, Toyota stock is down about 12%. Tesla, on the other hand, has soared more than 168%. And over the past month, Tesla shares have climbed more than 20%.

Tesla’s Second-Quarter Vehicle Deliveries Smash Estimates

Electric vehicle pioneer Tesla delivered more than 90,000 vehicles in the second quarter, an increase from the first quarter. It’s an incredible feat amid plant shutdowns and the global pandemic.

Tesla vehicle deliveries came in at 90,650 for the period from April ending in June. Wall Street estimates were all over the place, changing daily because of the Covid-19 pandemic, but the consensus number, according to FactSet, was about 72,000 vehicles.

PG&E Stock Climbs on Utility’s First Day Out of Bankruptcy

Pacific Gas and Electric shares traded higher Friday on the California utility’s first day of trading after emerging from bankruptcy.

PG&E filed for Chapter 11 reorganization in January 2019 after its equipment was found to have caused some of the most destructive wildfires in the state’s history. Because its restructuring plan was approved by the bankruptcy court last month, the company will be able to take part in a state wildfire fund, half financed by California rate payers, created to cover costs of future catastrophic wildfires. It contributed $5 billion to the fund as part of its emergence, the company said.

Government Report Says Boeing Played Down Key Change to 737 MAX

The commercial aerospace and defense giant Boeing didn’t submit certain documentation to regulators regarding changes to the flight-control software that has been blamed for crashes of the 737 MAX jet, according to a government report.

The Transportation Department report also says minutes from a 2013 meeting indicate that the company presented the software as an update to an existing system, rather than something new, to minimize regulatory scrutiny.

BP to Sell Petrochemicals Arm to Ineos

British oil major BP on Monday announced the sale of its petrochemical arm to Ineos for $5 billion.

Ineos, the chemicals giant founded and owned by British billionaire Sir Jim Ratcliffe, will pay BP $400 million up front and $3.6 billion when the sale is completed, with a further $1 billion due in 2021. The deal completes a broader $15 billion asset disposal plan one year ahead of schedule and will give the company room to breathe after cutting its outlook earlier this month and revealing it would take up to $17.5 billion of charges in the second quarter.

Chesapeake Energy Files for Bankruptcy

Chesapeake Energy said in a Sunday statement that it had filed for bankruptcy protection. “Chesapeake intends to use the proceedings to strengthen its balance sheet and restructure its legacy contractual obligations to achieve a more sustainable capital structure,” the company said, adding that it will continue to operate as normal while it goes through the chapter 11 process.

Chesapeake was a pioneer in hydraulic fracturing, commonly known as fracking, the technology that led to a massive increase in American oil and gas production and at one point had drilling rights to an area of American land as large as the state of West Virginia, The Wall Street Journal noted.