Friday, July 10, 2020

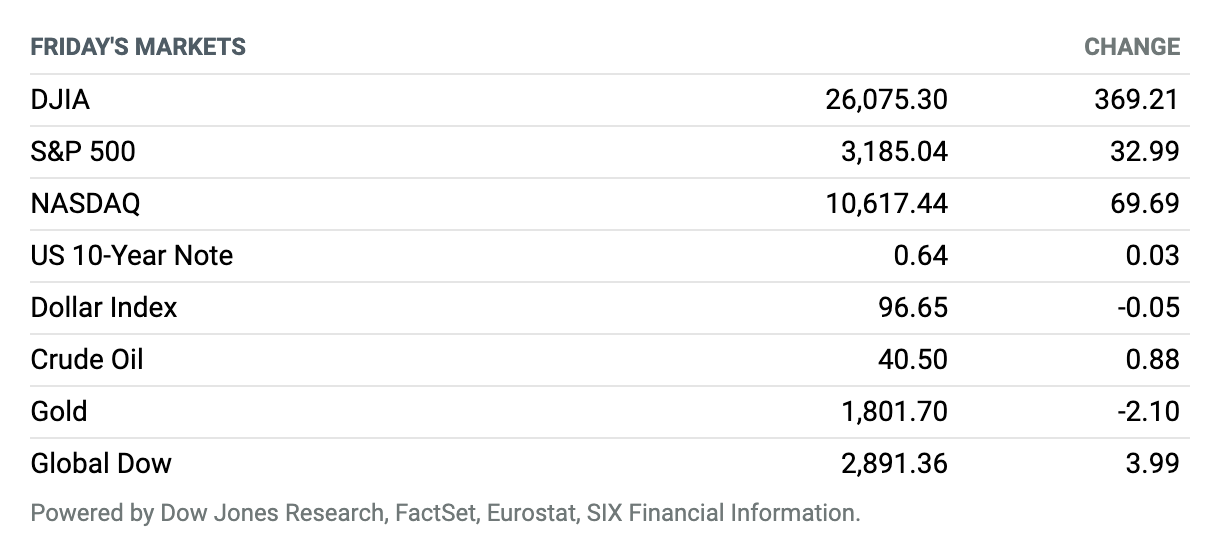

Good News on Virus Treatment. Stocks ended higher in thin trade Friday, getting a lift from positive news on a coronavirus treatment. The Dow Jones Industrial Average rose around 369 points, or 1.4%, to end near 26,075, according to preliminary figures, while the S&P 500 advanced around 33 points, or 1%, to end near 3185. The tech-heavy Nasdaq Composite rose nearly 70 points, or 0.7%, to end near 10,617, marking its third consecutive record close. Stocks shed premarket weakness after drugmaker Gilead Sciences released potentially promising data about remdesivir that indicates the experimental Covid-19 drug may reduce deaths. For the week, the Dow finished 1% higher, the S&P 500 booked a gain of 1.8%, and the Nasdaq advanced 4%.

Gilead Says New Analysis Suggests Remdesivir Reduces Covid-19 Deaths

Gilead Sciences said Friday that a new analysis suggests that its antiviral remdesivir was associated with a 62% reduction in deaths in patients with severe Covid-19. The company also cautioned that the finding needed to be confirmed in clinical trials.

The analysis compares outcomes from a trial that included no control group, and similar patients who did not participate in a trial but were sick at the same time and received standard of care treatments.

Buffett Makes $10B Natural Gas Purchase

Warren Buffett’s Berkshire Hathaway is buying Dominion Energy’s natural gas storage and transmission assets in a deal worth a total of $9.7 billion, the company said in a release Sunday.

Once the deal closes in the fourth quarter of 2020, Berkshire Hathaway’s energy subsidiary will gain ownership of 7,700 miles of natural gas pipelines, vast storage facilities, and a 25% stake in a liquefied natural gas export, import, and storage site in Maryland. Buffett is usually a bargain hunter during significant market downturns, placing big bets on Goldman Sachs and General Electric during the financial crisis. But until Dominion, Buffett hadn’t made similarly large acquisitions during the coronavirus pandemic.

Uber to Buy Postmates for $2.65 Billion

Uber Technologies announced on Monday a deal to acquire venture-backed Postmates for $2.65 billion in stock. The combination follows Uber’s recent failed attempt to buy Grubhub, which instead accepted a takeover bid from Just Eat Takeaway, an Amsterdam-based food delivery company.

An Uber/Postmates merger would reduce the number of primary players in the U.S. market to three from four, along with Grubhub and DoorDash. The deal will also likely increase speculation on the potential timing of an initial public offering for DoorDash, which recently raised a new round of funding at a valuation of nearly $16 billion.

New Jobless Claims Come In Above 1 Million for the 16th Consecutive Week

First-time claims for unemployment insurance remain stubbornly high, demonstrating how tough it will be for the labor market to recover from the coronavirus pandemic despite better-than-expected hiring in recent months.

The Labor Department said Thursday that some 1.31 million Americans filed initial jobless claims in the latest week. That’s down from 1.41 million a week earlier and below the 1.38 million economists surveyed by FactSet predicted, but it marks the 16th straight week where initial claims exceeded 1 million. What’s more, continuing claims for unemployment benefits remain above 18 million, while continuing claims for Pandemic Unemployment Assistance—representing gig workers and others not normally eligible—rose 1.5 million to 14.4 million in the latest week.

Activity Surges in Services Sector. Employment, However, Continues to Contract.

The Institute for Supply Management said activity across the services sector, everything from hotels and restaurants to finance, grew in June after two consecutive months of decline. The ISM’s non-manufacturing index, based on a survey of service-sector businesses across the country, jumped to 57.1 from 45.4 in May—its biggest month-over-month increase since the series launched in 1997. The result was far better than the reading of 50 economists polled by FactSet predicted.

On one hand, the services-sector reading is the latest sign that the worst of the economic pain caused by the coronavirus pandemic is over, with activity springing back as businesses reopen and rehire. On the other hand, it’s a reminder of how long a road it will be to fully recover—especially as a renewed rise in infections slows or reverses reopening plans in some states. Moreover, the report shows ongoing weakness in services-sector employment.

Novavax Gets a $1.6 Billion U.S. Infusion for a Covid-19 Vaccine

The biotech company Novavax took a leap forward in the Covid-19 vaccine race Tuesday morning, announcing that the U.S. government had awarded it $1.6 billion to test and manufacture its Covid-19 vaccine.

The company will deliver 100 million doses of the vaccine to the federal government, which it said could be ready “as early as late 2020.”

The U.S. Is Buying $450M of Regeneron’s Experimental Covid-19 Antibody

A day after announcing the start of late-stage trials of an antibody cocktail designed to treat and prevent Covid-19, Regeneron Pharmaceuticals said it had signed a $450 million contract with the U.S. government to procure up to 1.3 million doses of the drug. The company said the first doses could be ready as early as the end of the summer.

Regeneron stock jumped 2% on Tuesday morning. The stock rose 0.8% on Monday on both positive and negative Covid-19 updates from the company: disappointing results in a trial of its arthritis drug Kevzara in serious Covid-19 patients, and promising results in a small safety trial of the antibody cocktail.

United Airlines Warns of Mass Layoffs. It’s an Industry Headwind.

A wave of layoffs seems to be coming in the airline industry, with United Airlines warning employees that it may have to furlough nearly half of its U.S. workforce this fall.

United told 36,000 employees on Wednesday that mass furloughs might be necessary, because of continuing losses caused by the coronavirus pandemic and collapse in air travel. The warnings came during town hall meetings with employees. A senior executive told The Wall Street Journal that mass furloughs would be a “last resort.”

American Airlines Might Cancel Some 737 MAX Orders

The Wall Street Journal reported Friday that American Airlines is considering canceling some orders for the Boeing 737 MAX jet. That would be a fresh blow for the commercial aerospace giant and for the troubled jet.

The 737 MAX is Boeing’s newest model single-aisle jet and has been grounded world-wide since mid-March 2019, following two deadly crashes over a five-month span. American has ordered 100 MAX jets and has received 24. About 300 MAX orders have been canceled so far in 2020, most by foreign airlines. That makes the possible American Airlines cancellation sting a little more.

Brooks Brothers Files for Bankruptcy as It Seeks a Sale

Brooks Brothers is looking for a new owner, and on Wednesday filed for Chapter 11 bankruptcy to facilitate its search.

The privately held chain is the latest retailer to file for bankruptcy protection in response to the coronavirus pandemic. Sales at many major retailers slid earlier this year as state and local governments asked nonessential businesses to close to prevent further spread of the virus.

Carnival Cancels More Cruises Due to Virus, and Delays or Adjusts Other Sailing Itineraries

Carnival has canceled more sailings, pushed back others, and redeployed some of its ships—the latest signs of the continuing damage wrought by the coronavirus pandemic on the cruise industry.

The company said in a release on Monday that itineraries of the ship Mardi Gras out of Port Canaveral, Fla., from Nov. 14 through Jan. 30, 2021, have been canceled. Instead, that ship, which can hold more than 5,000 passengers, is scheduled to enter into service in early February of next year.