Friday, June 26, 2020

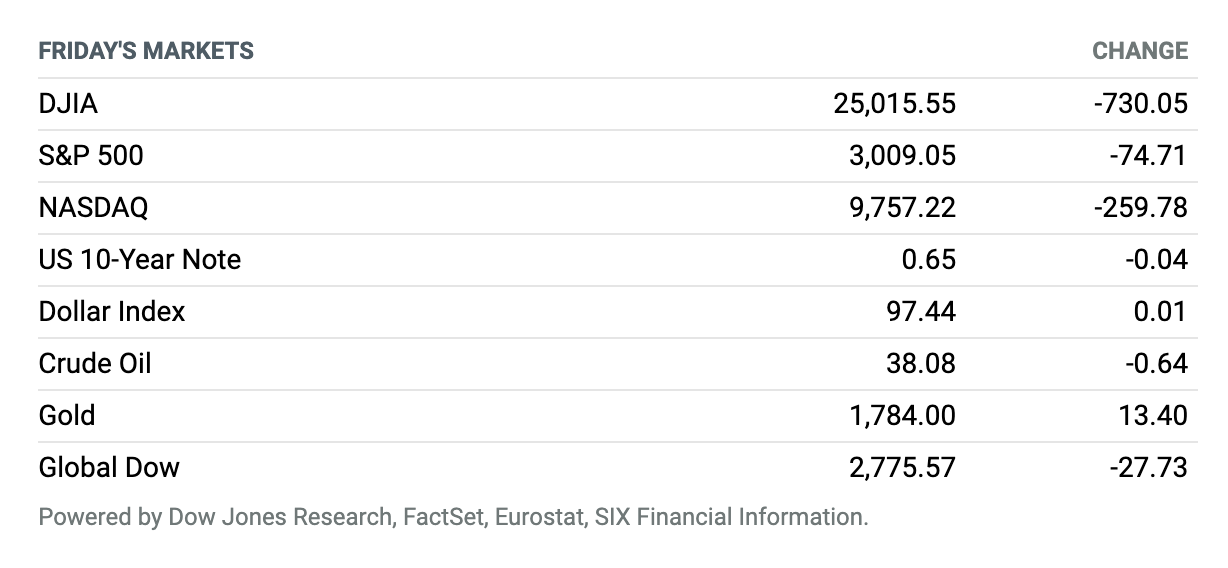

Gloomy Friday. U.S. stocks fell on Friday to end the day and week lower as Texas and Florida were forced to backtrack on reopening plans from Covid-19 lockdowns amid a record number of new cases reported nationwide. The Dow Jones Industrial Average fell 730 points, or 2.8%, to around 25,015, marking the steepest fall for the index since June 11. Meanwhile, the S&P 500 index finished 2.4% lower at 3009, while the Nasdaq Composite Index closed 2.6% lower at 9757. Shares of media giants Facebook and Twitter tumbled more than 7% after Unilever said it would join in halting advertising on the platforms until hate speech concerns were addressed. Meanwhile, bank stocks were hammered, led by a sharp slump in Goldman Sachs after the Federal Reserve’s annual bank stress tests required banks to preserve capital by suspending share repurchases and cap dividend payments in the third quarter based on average net income over the past four quarters. For the week, the Dow closed 3.3% lower, the S&P 500 booked a 2.9% decline, and the Nasdaq lost 1.9%.

Consumer Spending Surged in May. But a Sharp Drop in Income Clouds the Outlook.

Americans shelled out more in May as the economy reopened, but a drop in income could crimp future spending.

Personal spending jumped 8.2% last month after dropping a revised 12.6% in April, the Bureau of Economic Analysis said Friday. The increase was smaller than expected—economists polled by FactSet expected a better rebound of 9.3%—but the bigger concern is in the income side of the BEA’s report. Personal income declined 4.2% last month after rising 10.8% in April, when many Americans received checks from the government meant to help ease the economic blow to households from coronavirus-driven shutdowns.

Fed Caps Bank Dividends and Suspends Buybacks

The Federal Reserve on Thursday took a tougher-than-expected stance on banks’ shareholder payouts in its latest round of stress testing.

While the Fed found that most banks would remain well capitalized if U.S. economic growth rebounds, many would see their capital buffers thinned out by loan losses under the potential worst-case scenarios spurred by the coronavirus pandemic. To help preserve capital, officials on the Board of Governors decided in a 4-to-1 vote to suspend banks’ share buybacks through the third quarter and cap their dividend payouts.

Bank Regulators Ease Up on the Volcker Rule

Bank investors bracing for bad news Thursday got at least a dose of something positive: Regulators eased up restrictions on risk-taking put forth following the financial crisis of 2008-09.

The Federal Deposit Insurance Corporation, the Federal Reserve, the Office of the Comptroller of the Currency, and other regulators finalized an overhaul of the so-called Volcker rule, imposed under the 2010 Dodd-Frank Act. It was meant to prevent banks from engaging in some of the risky behavior that contributed to the crisis, such as proprietary trading and making speculative, hedge fund-like investments.

Covid-19’s Economic Toll Will Be Deeper Than Expected, IMF Says. And the Recovery Slower.

The International Monetary Fund said Wednesday the global economy will shrink even more than it previously predicted and the recovery will be slower as the fallout from the coronavirus pandemic builds.

The downbeat update underpinned investor concerns over the pandemic’s economic toll as Covid-19 cases climb in some parts of the U.S. and elsewhere, such as in Beijing where schools have been closed again as the city braces for a second wave.

Jobless Claims Remain Stubbornly High as Covid-19 Spike Spooks Employers

A downward trend in first-time claims for unemployment insurance stalled in the latest week, showing how long it will take for tens of millions of jobless Americans to return to work as the coronavirus pandemic continues to rock the U.S. economy.

The Labor Department said Thursday that seasonally adjusted jobless claims were 1.5 million in the week ended June 20, little changed from the previous week’s level. Economists polled by FactSet expected a decline to 1.325 million.

Bayer to Pay $10 Billion to Settle Roundup Cancer Claims

German chemical giant Bayer on Wednesday said it has agreed to pay over $10 billion in a mass settlement with American plaintiffs who say their cancers were caused by the Roundup weedkiller made by its Monsanto unit.

“The main feature is the US Roundup resolution that will bring closure to approximately 75 percent of the current Roundup litigation involving approximately 125,000 filed and unfiled claims overall,” Bayer said in a statement.

Unilever Yanks Ads from Facebook Amid Hate-Speech Boycott

Facebook lost another key source of advertising dollars Friday, as the multinational consumer-products maker Unilever said it planned to yank all its U.S. spending on the social media site.

With the addition of Unilever—whose brand Ben & Jerry’s Homemade had already said it would pause Facebook spending—the list of advertisers responding to a campaign from a coalition of civil rights groups to boycott spending on the platform gains a powerful ally. Verizon Communications and others such as Eddie Bauer, Recreational Equipment, Patagonia, and North Face parent VF are on board as well.

Scandal-Hit Wirecard Files for Insolvency

Stricken payments provider Wirecard said Thursday it is filing for insolvency, days after the high-profile German company admitted that 1.9 billion euros ($2.1 billion) were missing from its accounts.

It comes shortly after ex-CEO Markus Braun was detained before being freed on bail. He stands accused of market manipulation and falsifying the company’s accounts, in what is becoming one of Germany’s biggest financial scandals.

Amazon Buys Autonomous Taxi Company Zoox. Look Out, Uber and Lyft.

Amazon.com announced on Friday that it had agreed to acquire Zoox, a privately held company working on autonomous driving technology specifically for ride-hailing services.

Among other things, the deal makes Amazon a serious long-term threat to Uber Technologies and Lyft. “Zoox is working to imagine, invent, and design a world-class autonomous ride-hailing experience,” said Jeff Wilke, Amazon’s CEO, Worldwide Consumer, in announcing the deal.

Macy’s Steps Up Cost-Cutting With Plans to Lay Off 3,900

Macy’s said Thursday that it planned to lay off at least 3,900 workers in an effort to cut costs.

The struggling retailer says the job cuts are part of a restructuring that it expects to save $365 million in costs this year and $630 million of costs annually. The layoffs will be associated with $180 million of pretax cash costs; most of those costs will be recorded in the second quarter.