Friday, February 5, 2021

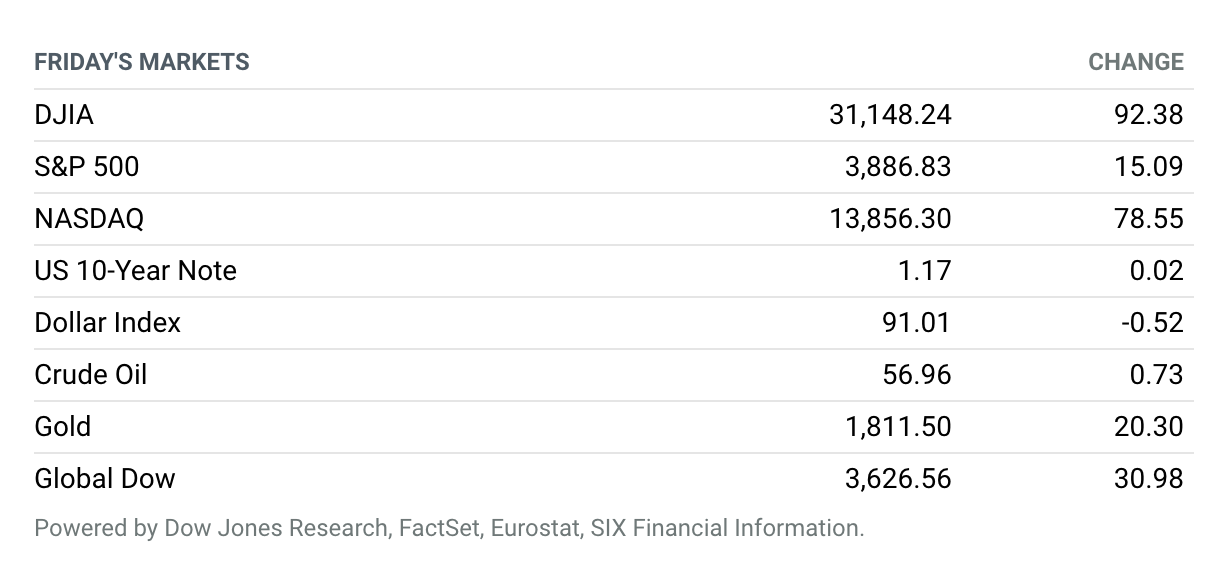

Stocks Log Best Week Since November. The three big U.S. stock benchmarks finished at or near records on Friday, notching the best rally in about three months. Fretting about the potential detrimental impact of trading in stocks popular with individual investors, like GameStop and AMC Entertainment, gave way to a focus on progress toward a fresh round of coronavirus aid led by the Biden administration. The Dow Jones Industrial Average finished up 0.3% at 31,148, just missing a closing record at 31,188.38. The S&P 500 index closed at a record at around 3887, up 0.4%, while the Nasdaq Composite Index booked another all-time closing peak at 13,856, up 0.6% for the day. For the week, the Dow closed with a 3.9% gain, marking its longest winning streak, five straight days, since August and its best weekly gain since Nov. 13. The S&P 500 notched a weekly advance of 4.7%, and the Nasdaq Composite logged a five-session advance of 6%, marking their best weekly gains since Nov. 6. The big data point of the week was a reading of monthly employment. The Labor Department showed that 49,000 jobs were added in January, while the unemployment rate fell to 6.3% from 6.7%. The results affirm the view that the recovery in the jobs market is stalling out amid the Covid-19 pandemic that has slammed the U.S. economy. Some 10 million jobs that vanished in the early stages of the pandemic still haven’t returned. That said, the Senate early Friday approved a budget resolution, 51-to-50, that would allow for a fast tracking of the $1.9 trillion coronavirus relief plan.

Hiring Rebounded in January, but Signs of Weakness Abound

U.S. businesses last month rebounded from a December decline in hiring, delivering a slightly lower-than-expected gain that reflects continued fallout from the pandemic and mitigation efforts.

Nonfarm employment rose by 49,000 in January, following the prior month’s downwardly revised loss of 227,000 jobs, the Labor Department said Friday. The unemployment rate, which is taken from a separate survey of households, fell 0.4 percentage point to 6.3%, leaving 10.1 million unemployed workers.

Economists polled by The Wall Street Journal had expected an increase of 50,000 jobs and a steady unemployment rate. In addition to the December jobs revision, November’s gain was revised down by 72,000, to 264,000. Together, employment in November and December was 159,000 lower than previously reported.

Amazon Names AWS Chief to Succeed Jeff Bezos as CEO

Amazon.com made the surprise announcement Tuesday that founder CEO Jeff Bezos will transition to the role of executive chairman in the third quarter, with Amazon Web Services chief Andy Jassy to succeed him as chief executive.

The company also announced spectacular results for the December quarter, with strong growth in its flagship e-commerce segment, although some investors may be a little disappointed with the growth in the AWS unit.

Johnson & Johnson Seeks Emergency Authorization for Covid Vaccine

Johnson & Johnson said Thursday it submitted its vaccine to the U.S. Food and Drug Administration for an emergency use authorization.

The company said it plans to distribute the vaccine to the U.S. government following authorization. It expects to supply 100 million doses to the U.S. in the first half of the year. Paul Stoffels, the company’s chief scientist, said in a news release that the company is prepared to begin shipping upon authorization.

AstraZeneca Vaccine Slows Virus Spread and Protection Lasts Through Dosage Gap: Study

A single dose of the AstraZeneca Covid-19 vaccine offers 76% protection for up to three months after the first injection and appears to reduce transmission, according to new research by the University of Oxford.

Preliminary results of the study, published in medical journal The Lancet on Wednesday but not yet peer-reviewed, seemingly support the U.K. government’s policy to delay second doses of vaccines to inoculate as many people as quickly as possible.

Merck Announces New CEO

Drug company Merck announced Thursday that its CEO, Kenneth Frazier, would retire at the end of June after a decade leading the company. Merck’s current executive vice president, Robert Davis, will succeed him.

Frazier’s departure is long-awaited, and the company has been previewing its succession planning for years. Davis seems an obvious successor: He served as Merck’s chief financial officer after joining the drug company in 2014, until his responsibilities were expanded in 2016.

Brazil’s Vale to Pay $7 Billion in Damages for Deadly 2019 Dam Collapse

Brazilian mining giant Vale said Thursday it has agreed to pay more than $7 billion in damages over the 2019 collapse of a dam at its Brumadinho mine, which killed 270 people.

It is the largest damages agreement ever in Latin America, according to the government of Minas Gerais, the southeastern state where the disaster sent millions of tons of toxic waste gushing into the surrounding area.

UnitedHealth CEO David Wichmann Is Leaving

Health-care giant UnitedHealth Group said that David Wichmann, its current CEO, will retire after serving in the role since September 2017. He will be succeeded by Andrew Witty, who has been CEO of UnitedHealth subsidiary Optum since March 2018, and president of UnitedHealth since November 2019.

Witty took a leave from the company through much of 2020 to work on the World Health Organization’s Covid-19 response.

Jazz Pharmaceuticals to Acquire GW Pharma for $7.2 Billion

Jazz Pharmaceuticals said Wednesday it has agreed to acquire GW Pharmaceuticals in a cash-and-stock deal valued at $7.2 billion.

GW is a leader in therapies based on its proprietary cannabinoid product platform to treat a number of diseases. The company was the first to receive FDA approval for a CBD-based treatment for severe forms of childhood epilepsy in its Epidiolex lead product. Jazz makes sleep medications and has a growing oncology business.

Daimler to Split into Two Companies and List Truck Unit

German automobile maker Daimler said it was splitting its industrial businesses into two independent pure-play companies, with Daimler Truck set to be listed in Frankfurt by the end of 2021.

The company said Daimler Truck would “accelerate its path towards zero emissions” as the world’s largest truck-and-bus producer, and continue to focus on electric vehicles and self-driving technologies.

Daimler will eventually be renamed Mercedes-Benz and the luxury car business will focus on leading a drive toward electric vehicles, it added.

Tesla Recalls Roughly 135,000 Vehicles Over Touch-Screen Failures

Tesla is recalling roughly 135,000 Model S luxury sedans and Model X sport-utility vehicles over touch-screen failures, one of the electric-car maker’s largest-ever safety actions.

The move comes after the National Highway Traffic Safety Administration requested a recall last month, saying the touch screen in some models can fail when a memory chip runs out of storage capacity, affecting functions such as defrosting, turn-signal functionality and driver assistance. The agency said the problem affected roughly 158,000 vehicles, including Model S sedans built between 2012 and early 2018 and Model X vehicles made from 2016 through early 2018.