Friday, August 21, 2020

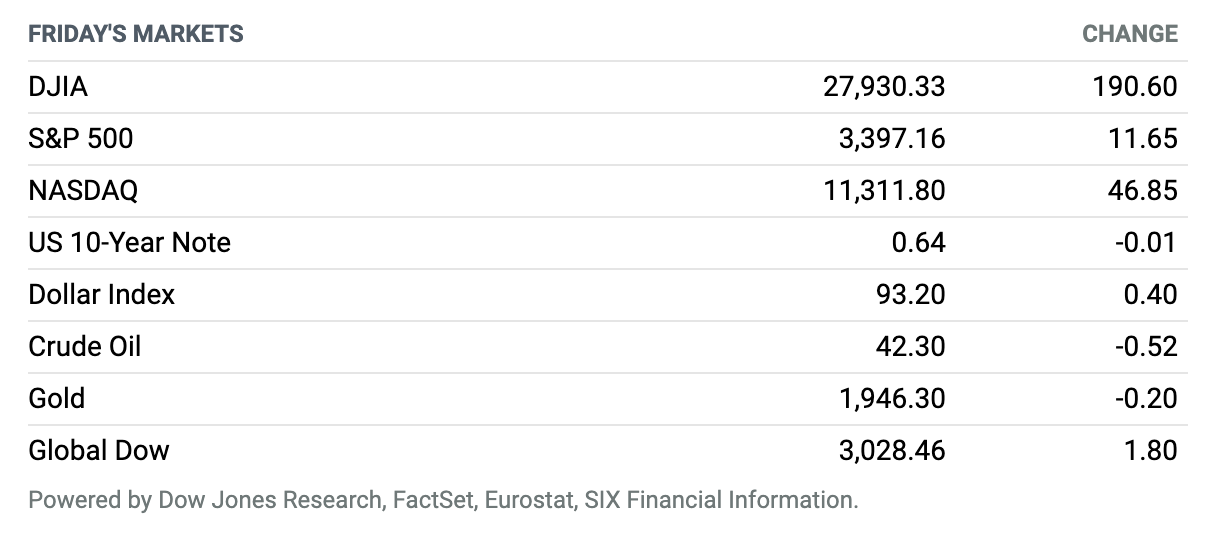

Apple Powers Market Higher. U.S. stocks shook off early weakness on Friday to end the day with gains, with technology-related shares helping to fuel a round of records for the S&P 500 and Nasdaq Composite. Markets took on a decidedly more bullish tone after a report on sales of previously owned homes in the U.S. surged 24.7% between June and July. That home data followed news that IHS Markit’s Composite Purchasing Managers’ Output Index rose to a one-and-a-half year high of 54.7 in August from 50.3 in July, even as similar readings for Europe fell to a two-month low. Apple shares extended a climb after the company’s market capitalization touched $2 trillion, helping to power gains for the Dow and the other main benchmarks. The S&P 500 index closed up 0.4% at 3397, while the Nasdaq Composite Index finished the session up 0.4% at almost 11,312. Both were records. It was the 36th record close for the Nasdaq in 2020 and the S&P 500’s second this week. The Dow Jones Industrial Average closed up 0.7% at 27,930. For the week, the Dow ended virtually unchanged, the Nasdaq booked a 2.7% gain, and the S&P 500 rose 0.7%.

Existing-Home Sales Soar at a Record Pace in July as Americans Make Up for Lost Time

Sales of previously owned homes in the U.S. rose 24.7% between June and July to a seasonally adjusted annual rate of 5.86 million, the National Association of Realtors reported Friday.

It was the second consecutive month in which the monthly increase was the largest on record, according to the trade group. Compared with a year ago, sales were up 8.7% in July.

“The housing market is well past the recovery phase and is now booming with higher home sales compared to the pre-pandemic days,” Lawrence Yun, NAR’s chief economist, said in the report. “With the sizable shift in remote work, current homeowners are looking for larger homes and this will lead to a secondary level of demand even into 2021.”

Housing Starts Surged in July. It’s the Latest Good News on the Housing Market.

Investors got more evidence Tuesday that the housing market remains one of the brightest spots in the U.S. economy as builders break ground at prepandemic levels.

Housing starts surged 22.6% in July from June, to a seasonally adjusted annual rate of 1.496 million. That’s the biggest monthly increase since October 2016, and it was far better than the 3.7% rate of increase to 1.320 million that economists polled by FactSet predicted. Building permits, a forward-looking gauge of residential construction, jumped 18.8% in July from a month earlier to a seasonally adjusted annual rate of 1.495 million—also better than the 2.7% increase to 1.320 million that economists expected.

Renewed Rise in Jobless Claims Suggests Slowing Recovery

Claims for unemployment benefits rose in the latest week, snapping a streak of three consecutive declines, a reminder that the labor market’s recovery from the coronavirus pandemic will continue to be rocky as layoffs continue.

Some 1.11 million Americans filed for first-time unemployment insurance in the week ending Aug. 15, up from the prior week’s revised reading of 971,000. The report is a setback.

The Fed Was Expecting More Fiscal Aid, Its Minutes Suggest. So Far There Is None.

The Federal Reserve believes the economy should be able to return to normal over the next few years—optimism that is contingent on additional measures by the federal government to support incomes and spending.

That’s a big if. Congress and the White House so far haven’t agreed on a coronavirus relief package to follow the Cares Act, which means the economy could end up deteriorating rapidly compared to the central bank’s baseline forecast. That could eventually cause the Fed to respond.

Democrats Nominate Joe Biden. Here’s What Analysts Are Saying.

Joe Biden, who sealed the Democratic presidential nomination on Tuesday night, balances energizing his base while trying to win over undecided independent and conservative voters. His more moderate platform would likely be more friendly to business and finance than runner-up Bernie Sanders, the progressive senator from Vermont.

Thomas McLoughlin, head of Americas fixed income at UBS Global Wealth Management, said in an interview on Tuesday before the start of the Democratic National Convention’s prime-time speeches, that he thinks the fundamental question for investors will be whether a moderate President Biden and Senate Majority Leader Chuck Schumer take the lead and be the predominant voice, compared to the progressive wing of the party, led by Sanders and Senator Elizabeth Warren.

Amazon Consumer Chief Jeff Wilke to Retire

Amazon on Friday announced that Jeffrey Wilke, CEO of the company’s worldwide consumer business, will retire in the first quarter of 2021. He will be succeeded by Dave Clark, who is currently the senior vice president of Amazon’s worldwide operations.

Wilke has been a close advisor to Amazon CEO Jeff Bezos. In a memo to Amazon staff, Wilke said he doesn’t have a new job. “So why leave? It’s just time … Time for me to take time to explore personal interests that have taken a back seat for over two decades.”

Apple Is First U.S. Company to Reach $2 Trillion Market Value

Apple is the first U.S. company to achieve a valuation of $2 trillion.

With 4.276 billion shares outstanding, the target price for reaching that level was $467.72. The stock crossed that level Wednesday morning, trading as high as $468.09, before sliding a hair below the $2 trillion level. On Friday, the stock closed at $497.48. Apple stock is up nearly 70% for the year to date. Apple’s market capitalization hit the $1 trillion level for the first time in August 2018.

U.S.’s Huawei Sanctions Could Have Significant Ramifications

It’s just Trump being Trump. That is Wall Street’s implied reaction to the latest shot in the U.S. government’s war on Chinese telecom powerhouse Huawei.

Taken seriously, a U.S. Commerce Department order issued Aug. 17 marks a significant escalation in the tech cold war. It puts Huawei in roughly the same camp as Iran or Venezuela. No components or software with any U.S. content produced anywhere can be sold to the Shenzhen-based company without a license from Washington.

That could kill Huawei’s ambitions to lead the world into the 5G era, and disrupt order books for microchip suppliers. “There’s never been anything in the history of export controls like this,” says Kevin Wolf, a trade-law partner with legal firm Akin Gump.

Johnson & Johnson Is Buying Momenta Pharmaceuticals

Johnson & Johnson said Wednesday morning it had agreed to buy the biotech firm Momenta Pharmaceuticals in an all-cash $6.5 billion deal, acquiring rights to Momenta’s experimental drug nipocalimab, which has potential uses in a number of autoimmune diseases.

Momenta is the second biotech specializing in immune-mediated diseases snapped up this week. On Monday, Sanofi announced a $3.7 billion deal to acquire Principia Biopharma, with which it had been codeveloping a multiple-sclerosis drug.

Walmart Reports Strong Results but Warns of Flagging Demand

Retail giant Walmart turned in a stronger-than-expected second quarter but warned that demand was waning as stimulus checks ran out.

Walmart said it earned $6.48 billion, or $2.27 per share, up from $1.26 per share a year earlier. Adjusted earnings per share were $1.56, easily ahead of the $1.25 consensus estimate. Revenue of $137.74 billion was also above the $135.57 billion analysts were expecting. Same-store sales in the U.S. jumped 9.3%, fueled by demand for food and general merchandise. E-commerce sales soared 97% in the period.