Friday, September 24, 2021

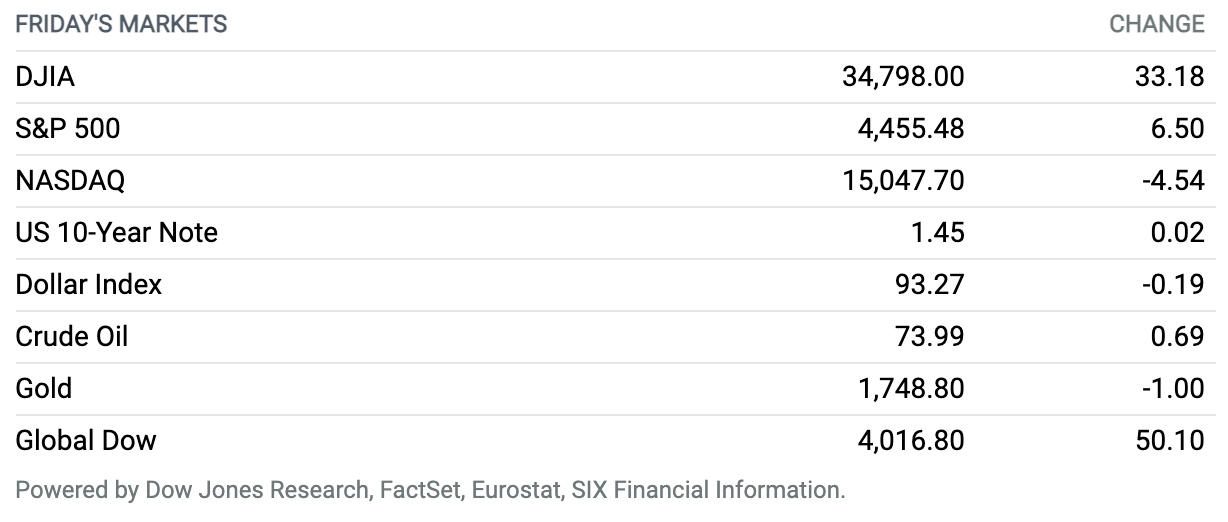

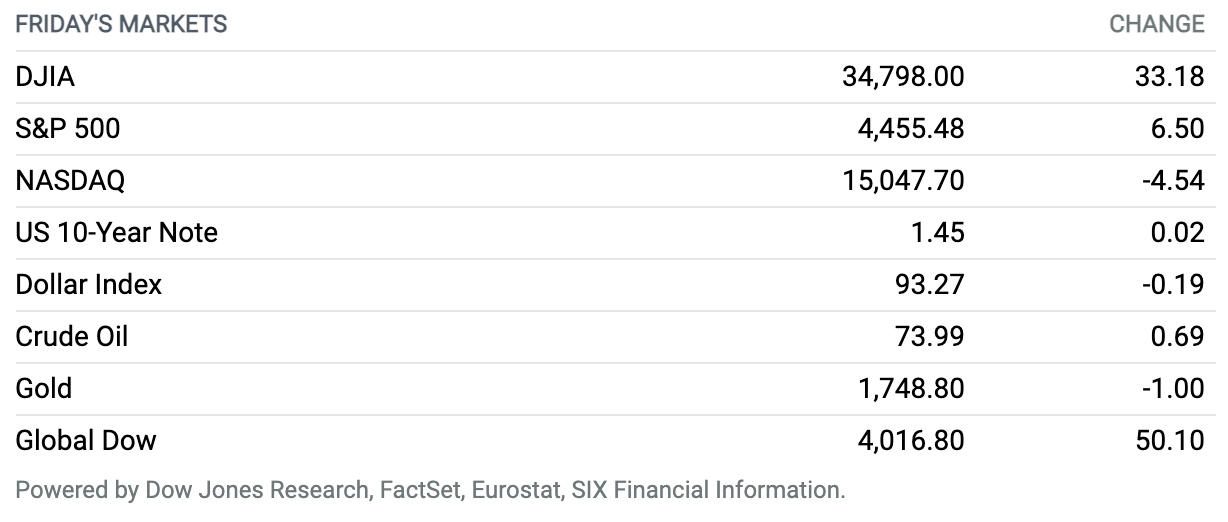

Stocks Shake Off Evergrande-Inspired Shocks, Fed Tapering Talk. The Dow Jones Industrial Average and the S&P 500 ended higher Friday and the broader market notched weekly gains, capping a wild stretch for equity markets that was initially marked by a bout of uncertainty over the potential collapse of Chinese property developer Evergrande. The outlook for the developer, with some $300 billion in debt, remains uncertain. Still, the Dow closed up 0.1% at 34,798, the S&P 500 index finished 0.2% higher at 4455, logging weekly gains of 0.6% and 0.5%, respectively, FactSet data show. The Nasdaq Composite Index finished the day lower, off less than 0.1%, as the benchmark 10-year Treasury yield rose to around 1.45%, contributing to a 9 basis point jump for the benchmark bond and marking the largest weekly rate rise since March 19, Dow Jones Market Data show. The yield-sensitive Nasdaq Composite still managed to end the week in positive territory.

Evergrande Missed Payment Deadline on Global Bonds, According to Reports.

Troubled Chinese property giant Evergrande missed a deadline Thursday on interest payments of $83.5 million to offshore bondholders, according to unnamed sources quoted in The Wall Street Journal.

The group is now entering a 30-day grace period during which it can still make good with its creditors, but fears have increased about the company’s capacity to manage its $305 billion total debt load.

If the payment doesn’t come it could be the largest-ever dollar-bond default seen in Asia by a company.

Continue reading ›

Fed Officials Say Tapering ‘May Soon Be Warranted’ and Pencil In an Earlier Rate Hike

Federal Reserve officials on Wednesday sent a strong signal that they are almost ready to taper their bond buying and said they expect to raise interest rates by late 2022, sooner than they had expected in June.

With inflation “elevated” and the labor market showing improvement, the Fed said that “if progress continues broadly as expected, the committee judges that a moderation in the pace of asset purchases may soon be warranted.”

Continue reading ›

Crypto Crumbles. What China’s Ban Means for Digital Currencies.

Bitcoin, Ethereum, and smaller coins tumbled Friday after the People’s Bank of China and other regulators said all crypto-related transactions were illegal and must be banned. The statement, signed Sept. 15 by several government agencies, lays down a tough new regime, reinforcing a ban on mining, warning of stiff penalties for trading and financial transactions in crypto, and promising to “severely crack down on criminal activities involving virtual currencies.”

The ban applies to all digital tokens, which China said are not legal and cannot be used as a currency in the market. Online crypto services to Chinese residents provided by overseas virtual currency exchanges are also considered illegal financial activity. The ban applies to crypto derivatives trading, too.

Continue reading ›

U.S. Justice Department Reaches Deal With Huawei CFO Held in Canada

The U.S. Justice Department has reached a deal that will allow Huawei Technologies Co. finance chief Meng Wanzhou to return to her home in China nearly three years after she was detained in Canada on behalf of the U.S., people familiar with the matter said Friday.

The agreement, which is expected to be entered in a New York court later Friday, will require Ms. Meng to admit to some wrongdoing in exchange for prosecutors deferring and later dropping wire and bank fraud charges, the people said. She is scheduled to appear in federal court in Brooklyn Friday afternoon remotely from Canada.

Continue reading ›

Pfizer Vaccine Boosters Officially Approved. What to Know.

The director of the Centers for Disease Control and Prevention approved Pfizer’s Covid-19 booster shot for older Americans, people with underlying medical conditions, and anyone working at a job where the risk of infection is high. The booster shots could be administered as early as Friday.

To be eligible, individuals need to have received their first two doses of Pfizer’s vaccine at least six months earlier.

Continue reading ›

New-Home Sales Climb Amid Shortage of Existing Homes

New-home sales increased in August even as sales of existing homes fell. It could be a sign that buyers are turning to newly constructed houses as shortages limit their options.

Sales of new single-family houses in August reached a seasonally adjusted annual rate of 740,000, a 24% decrease from last year but an increase from July’s revised rate of 729,000, the Census Bureau and Department of Housing and Urban Development said Friday. Consensus called for a rate of 710,000.

Continue reading ›

The American Airlines and JetBlue Alliance Is Under Threat. Why It Matters.

The alliance between American Airlines and JetBlue Airways in the Northeast is under threat from the U.S. Justice Department months after getting off the ground.

The Justice Department, six states, and the District of Columbia filed a lawsuit Tuesday attempting to block the partnership, alleging it “eliminates competition in New York and Boston” and would ultimately result in higher fares for travelers. Specifically, they said it would significantly diminish JetBlue’s incentive to compete with American, further consolidating an industry where “just four airlines control more than 80% of domestic air travel.” The four are American, Delta Air Lines, United Airlines, and Southwest Airlines.

Continue reading ›

Facebook’s CTO Departure Signals a New Era for the Company

The resignation of Facebook’s chief technology officer Mike Schroepfer, which he announced Wednesday, has broad implications that shouldn’t be overlooked.

Schroepfer will be replaced by Andrew Bosworth, head of the company’s Reality Labs unit. In that role, Bosworth has been charged with growing the company’s virtual reality and augmented reality business.

His elevation to CTO is the clearest sign yet that Zuckerberg is serious about Facebook’s role in growing the metaverse, a nascent digital meeting grounds that Zuckerberg has described as “the ultimate expression of social technology.”

Continue reading ›

Political Risks Are Mounting in Washington. Here’s What to Watch.

The scramble over the debt ceiling, government funding, and President Biden’s spending plans has been overlooked, as the market has been focused on tapering and tightening clues from the Federal Reserve. The situation in Washington, meanwhile, has gotten messier and warrants attention.

Political risks have been increasing in recent weeks and may ratchet up further in the coming days, says Brian Gardner, chief Washington policy strategist at Stifel, in a note to clients Wednesday. “The prospects of a default or the collapse of the infrastructure bills remain low probabilities, but these outcomes can no longer be easily dismissed or discounted,” he says.

Continue reading ›

Biden to Tap Wall Street and Crypto Critic to Lead Bank Regulator: Report

The Biden administration intends to nominate vocal Wall Street and cryptocurrency critic Saule Omarova as the top official overseeing banking regulations, Bloomberg reported.

President Joe Biden is expected to choose Omarova to run the Office of the Comptroller of the Currency, which supervises about 1,200 banks and federal savings associations, as soon as this week, sources told the news agency.

Continue reading ›

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.