Friday, October 16, 2020

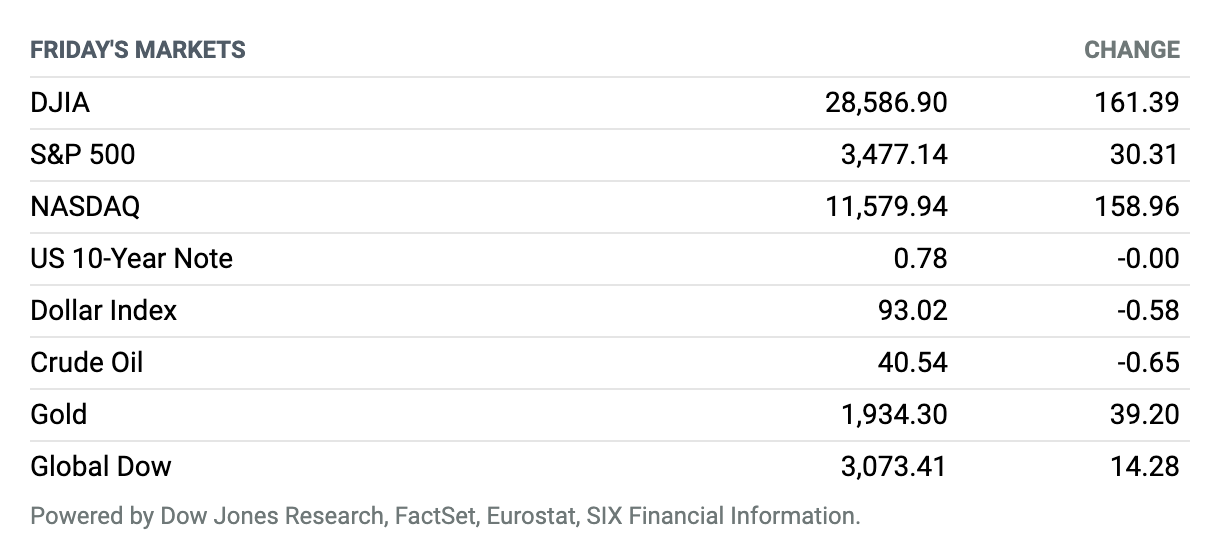

Dow Gains, but Jitters Remain. The Dow Jones Industrial Average closed out the week and the day in positive territory, snapping a three-session skid, but the broader market ended flat to lower as investors grew skittish about buying equities heading into the weekend. The three main equity benchmarks had been trading within shouting distance of all-time record highs, but concerns about the 2020 presidential election, a lack of progress on fresh fiscal relief for American workers and businesses, and the spread of Covid-19 overseas and domestically have given pause to bullish sentiment. On Friday, data showing better-than-expected retail sales in September, along with an improvement in consumer sentiment, relieved some fears about a slow economic recovery, but the fight over a fresh round of stimulus and worries about the trajectory of the deadly disease limited buying sentiment. The Dow Jones Industrial Average closed up 112 points, or 0.4%, at 28,606, and posted a weekly gain of just under 0.1%. The S&P 500 index closed up barely positive at 3484 and booked a weekly gain of 0.2%, while the Nasdaq Composite Index closed the session off 0.4% for the day but booked a weekly gain of 0.8%.

U.S. Retail Sales Were Far Stronger in September Than Economists Expected

Retail sales rose 1.9% in September from August, more than double expectations for a 0.8% increase. Remove autos and fuel, and retail sales rose 1.5%, nearly quadruple forecasts for 0.4%. Sales rose 5.4% from a year ago, a sign that consumer spending, if nothing else, has recovered to pre-Covid-19 levels.

“Overall, a solid report that eases any concerns of a late-third-quarter slowdown in consumption,” writes BMO Capital Markets strategist Ian Lyngen.

Of course, the data are already being played down a bit. They’re backward looking, and don’t capture the pickup in Covid-19 cases in October. They also don’t capture the continued decline in government payouts to unemployed workers.

Initial Jobless Claims Spike as Recovery Loses Some Steam

The number of U.S. workers filing initial claims for unemployment benefits unexpectedly jumped in the latest week, the latest sign of slowing momentum in the recovery from the pandemic.

First-time jobless claims rose by 53,000 in the week ended Oct. 10 to a seasonally adjusted 898,000, the Labor Department said Thursday. The previous week’s level was revised up to 845,000. Economists surveyed by the Wall Street Journal had predicted the latest reading would fall to 830,000.

Goldman Sachs Profits Nearly Doubled. Increased Trading Activity Helped.

Goldman Sachs may be working to diversify itself away from being a pure-play investment bank, but for now, the old way of doing business is working just fine.

Goldman Sachs Group’s third-quarter results blew past analyst expectations as the bank continues to benefit from increased trading activity amid volatile markets. The bank earned $9.68 a share on $10.8 billion in revenue, easily topping expectations from analysts surveyed by FactSet for earnings of $5.60 per share on $9.4 billion. Profits of $3.6 billion were nearly double what they were a year ago.

JPMorgan’s Earnings Were Better Than Expected. Here’s How the Bank Did.

A 30% surge in trading activity lifted third-quarter earnings at JPMorgan Chase. Fixed-income trading climbed 29% from the year-earlier quarter to $4.6 billion, while equities trading jumped by 32% to $2 billion.

The increase in trading activity—the result of markets’ continued volatility in the third quarter—lifted the bank’s revenue above Wall Street estimates. JPMorgan reported revenue of $29.9 billion, which was roughly in line with last year’s figures and just ahead of the $28.2 billion analysts surveyed by FactSet expected. Earnings of $2.92 per share blew past expectations of $2.22 and were 9% higher than last year’s third quarter.

Low Interest Rates Weigh on Bank of America’s Earnings

Profits at Bank of America fell in the third quarter as the bank was weighed down by the continuing effects of operating in a low-interest-rate environment.

Revenue for Bank of America came in weaker than expected as the bank—like others in its cohort—contends with the economic impact of the coronavirus pandemic. The bank earned 51 cents a share on $20.3 billion in revenue. Analysts surveyed by FactSet expected the bank to report earnings of 49 cents a share on revenue of $20.8 billion. Net income totaled $4.9 billion, down 16% from the year-earlier quarter.

What Airline Earnings Say About a Recovery

Airline earnings started trickling in this week, with Delta Air Lines and United Airlines reporting third-quarter results. The reports and commentary from industry executives offer a window seat on the industry’s recovery.

The snapshot so far: Demand trends remain weak, especially with international and business fares, but the carriers made progress on reducing their operating losses, and they have shored up liquidity, removing concerns about solvency. They are also doubling down on safety measures to try to convince consumers to fly again.

Consumer Prices Climbed Last Month, Driven by Used-Car Demand

Consumer prices climbed last month, driven by continued strong demand for cars and trucks as the economy rebounds from the depths of the coronavirus recession.

The consumer-price index rose 0.2% in September on a seasonally adjusted basis, slowing from a 0.4% increase in August, the Labor Department said Tuesday. The reading was in line with the 0.2% economists polled by the Wall Street Journal had expected.

Johnson & Johnson Pauses Covid-19 Vaccine Trial Due to Unexplained Illness

Consumer and pharma conglomerate Johnson & Johnson said Monday that it would pause its Covid-19 vaccine clinical trials due to one participant’s unexplained illness. It added that the case is now being studied by both an independent panel and the company’s own team of physicians.

J&J last month became the fourth company to sign on to the U.S. government’s “Operation Warp Speed,” aiming at producing 300 million doses of safe and effective vaccines, the first to be delivered by January 2021.

Apple Unveiled Its 5G iPhone This Week. Here’s What You Should Know.

In an announcement that investors have been anticipating for many months, Apple on Tuesday finally announced its first iPhone capable of using speedy 5G wireless networks.

As expected, Apple is calling the next generation of phones the iPhone 12. The base model has a 6.1-inch display, comparable to the iPhone 11, but with a thinner, smaller, and lighter form factor.

AMC Scrambling to Raise Cash as Coffers Could Run Dry by 2021

AMC Entertainment is scrambling to raise cash as it fights to survive a steep drop-off in attendance and a lack of blockbuster premieres.

The largest theater-chain operator said Tuesday it was trying to find new ways to raise the money and could run out of its existing cash by the end of the year or early next year.