Friday, May 22, 2020

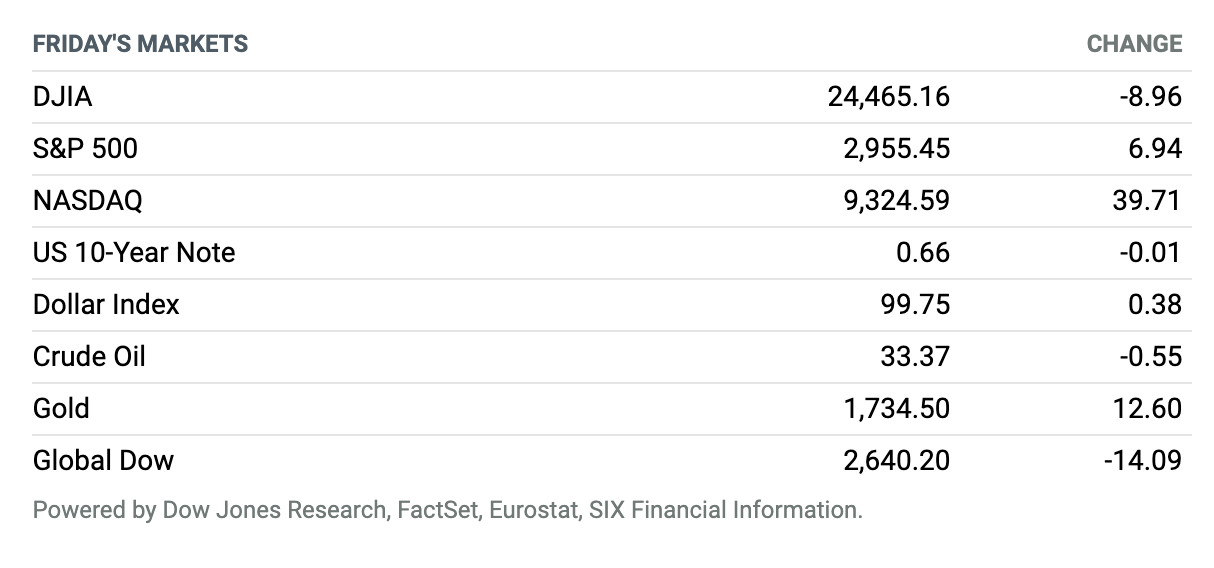

Strong Week. Stocks booked small gains Friday as investors prepared for the three-day Memorial Day weekend, capping a strong week for equities as investor optimism over the lifting of lockdowns and prospects for a Covid-19 vaccine provided a lift. Investor cheer was dampened somewhat by signs of renewed tensions between the U.S. and China over Hong Kong, and Beijing’s handling of the pandemic earlier this year. The Dow Jones Industrial Average fell around 9 points, or less than 0.1%, Friday to finish near 24,465, according to preliminary figures, leaving the blue-chip gauge with a weekly rise of 3.3%. The S&P 500 rose around 7 points, or 0.2%, ending near 2955, while the Nasdaq Composite added around 40 points, or 0.4%, closing near 9325. The S&P 500 saw a weekly rise of 3.2%, while the Nasdaq advanced 3.4%.

Coronavirus Job Toll Hits 38 Million as 2.4 Million Americans File Unemployment Claims

An additional 2.4 million Americans filed for unemployment insurance in the most recent week, the lowest weekly number of jobless claims since lockdowns began but still reflecting massive and ongoing job losses due to the coronavirus.

The latest figure, in line with what economists had anticipated, brings the tally of jobs claimed by the pandemic to over 38 million. The Labor Department said Thursday that the 2.4 million seasonally adjusted initial claims for the week ending May 16 followed a revised 2.7 million in the previous week.

Walmart Trounced Earnings Expectations. What’s Behind Its Big Beat.

Walmart reported better-than-expected fiscal first-quarter earnings Tuesday, saying it earned $1.18 a share on revenue of $134.62 billion. Analysts were expecting earnings per share of $1.09 on revenue of $130.91 billion.

Comparable sales in the U.S. rose 10%, led by food, consumables, and health and wellness—not surprising, given the pandemic. E-commerce sales soared 74%. However, given the uncertainty related to Covid-19, Walmart withdrew its financial guidance for the full fiscal year.

Target Earnings Beat Expectations. Walmart Wasn’t a Tough Act to Follow After All.

Target stock traded lower Wednesday even though the big-box retailer reported fiscal first-quarter earnings that exceeded expectations. Target said it earned 59 cents a share on revenue of $19.37 billion. Analysts were expecting earnings per share of 40 cents on revenue of $19.04 billion.

Comparable sales climbed 10.8% in the quarter, and, as we’ve seen with other retailers, average basket size jumped 12.5%, as shoppers chose to make less frequent, bigger trips. Digital comparable sales soared 141%, making up nearly 10 percentage points of the quarter’s comparable sales growth. Same-day delivery was up 278%.

Lowe’s Reports an Earnings Beat Because It Did What Home Depot Couldn’t

Home-improvement retailer Lowe’s said it earned $1.77 a share on revenue of $19.68 billion in its fiscal first quarter. Analysts were expecting earnings per share of $1.32 on revenue of $18.33 billion.

Overall comparable sales climbed 11.2% during the quarter, while comparable sales in its U.S. home-improvement category climbed 12.3%. The company said website orders surged 80%. Rival Home Depot reported earnings on Tuesday, and although its same-store sales surged, it missed earnings estimates largely because of Covid-19-related expenses.

Macy’s Stores Reopen to More Shoppers Than Expected

Macy’s shares were jumping Thursday after the department store said customer demand at its reopened stores has been “moderately higher than…anticipated.”

The upbeat news about reopenings eclipsed estimates for the company’s first-quarter results, which fell slightly short of what Wall Street is expecting. Macy’s warned that its first-quarter operating loss could exceed $1 billion. It also said it expects to report sales of around $3 billion, down from $5.5 billion a year earlier. Wall Street analysts surveyed by FactSet have been expecting a $348 million operating loss on $3.6 billion of sales.

SoftBank Group to Sell $3 Billion Stake in Japanese Wireless Company

In another step toward fulfilling its promise to raise $41 billion to pay down debt and buy back stock, SoftBank Group Thursday morning announced that it plans to sell 7.5% of its stake in SoftBank Corp., a separately listed Japanese wireless company.

Over the past few days, the specifics of SoftBank Group’s plan to strengthen its balance sheet have become clearer. In announcing earnings, the company disclosed that it has raised $11.5 billion via the forward sale of a small portion of its stake in Alibaba Group. The company also is reportedly planning to steps to sell a substantial portion of its stake in T-Mobile US, with Deutsche Telekom buying some shares and the company reportedly considering a public sale of additional shares.

Deere Crushes Earnings Estimates, but Its New Guidance Is Weak

Iconic American manufacturer Deere crushed Wall Street estimates for its fiscal second quarter ended May 3. Covid-19 impacted results, but the farming business held up pretty well, all things considered. The pandemic, however, is weighing on future earnings guidance, and the new outlook Deere offered Friday isn’t pretty.

Deere earned $2.11 a share from $8.2 billion in equipment sales. Wall Street was looking for $1.72 in per-share earnings from $7.9 billion in sales. The problem is the company’s outlook. Deere’s initial guidance—offered in November 2019, long before the pandemic was declared—called for about $2.9 billion in net income for fiscal year 2020. Guidance was withdrawn in March as world-wide Covid-19 infections grew. Deere’s new guidance, offered Friday, calls for about $1.8 billion of net income, down almost 40% from the original estimate and down almost 45% from the $3.2 billion earned in fiscal year 2019.

Housing Starts Fell 30% in April—but It’s Not as Bad as It Looks

The latest housing numbers are very bad: Builders reported a steep decline in the ground they broke, and filings for permits to do so in the future also dropped sharply. There are, however, reasons for investors to remain optimistic about the state of the housing market.

The drop in activity last month was inevitable given the coronavirus lockdowns, and some economists say the latest numbers will mark the floor. Ian Shepherdson of Pantheon Macroeconomics notes that mortgage applications have recovered more than half the drop triggered by the lockdowns, and Google searches for “new homes” are now trending above the pre-pandemic peak.

Questions Arise Around the Data Shared About Moderna’s Covid-19 Vaccine

Investors in Moderna, the preclinical biotechnology company developing one of the front-running Covid-19 vaccine candidates in the U.S., may be facing a volatile ride through the clinical trial process.

Shares of Moderna closed at a record high of $80.00 on Monday after the company released a slice of positive interim clinical data from the first phase of its Covid-19 vaccine trial. That night it announced it would sell $1.34 billion in stock to help fund manufacturing costs associated with the experimental vaccine. The stock took a nose dive on Tuesday, closing at $71.67, likely due in some degree to a Stat News story that questioned a lack of clinical clarity in the data Moderna provided to investors.

Tesla and California Are Making Nice. The Next Factories Will Be Somewhere Else.

Relations between Tesla CEO Elon Musk and Alameda County, Calif., appear to be on the mend. Tesla is no longer suing the county. That isn’t the end of the story though.

Investors now must think about whether Tesla will stay in California and what any geographic changes could mean for the stock. More diversification, geographically speaking, is probably inevitable and, in the long run, that should help shares.