Friday, March 12, 2021

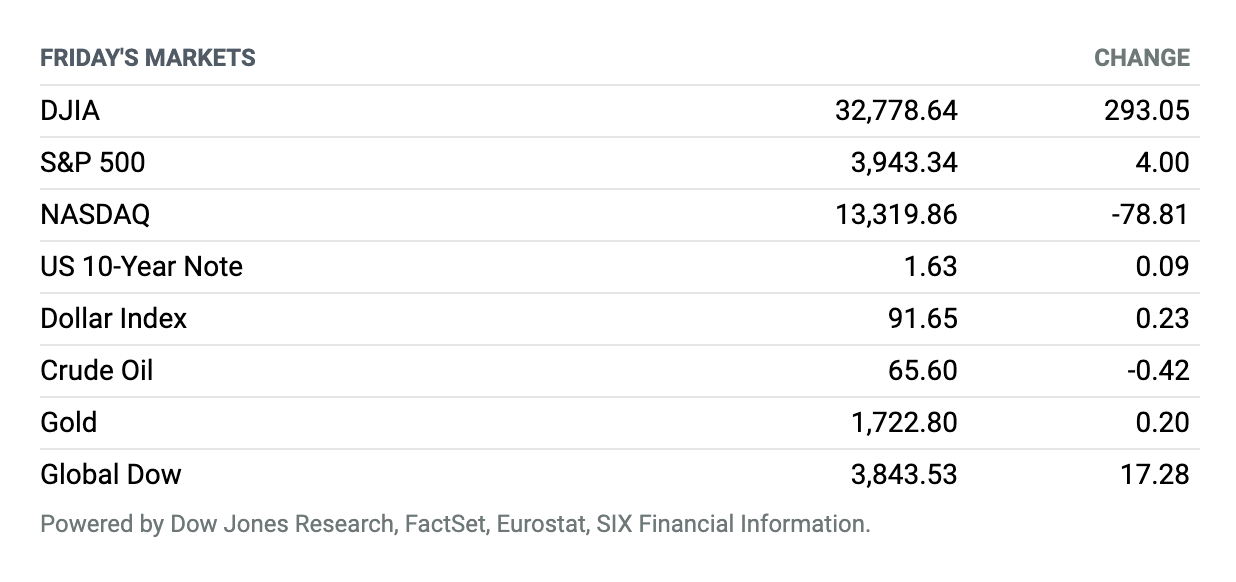

More Records for S&P 500, Dow. The S&P 500 and the Dow Jones Industrial Average booked record closes for a second day in a row, while the Nasdaq Composite saw some selling as a rise in yields for government debt continued to push investors out of highflying growth stocks and into those that are expected to perform better during a vaccine-induced rebound from the Covid-19 pandemic. The Dow closed up about 293 points, or 0.9%, at a record around 32,779, while the S&P 500 index closed at about 3943, up 0.1%. The Nasdaq Composite Index finished down 0.6% at about 13,320. The moves for the equity benchmarks came as the yield on the 10-year Treasury note moved up nearly 10 basis points to around 1.62%. For the week, the Dow closed up 4.1%, the S&P 500 gained 2.6%, and the Nasdaq Composite ended up 3.1%, despite its decline on Friday.

Producer Prices Log Largest Year-Over-Year Increase Since October 2018

A measure of the prices businesses receive for their goods and services climbed last month, pushing the producer-price index to its largest year-over-year increase since October 2018.

The index, which measures wholesale inflation, rose a seasonally adjusted 0.5% in February, a slowdown from 1.3% surge in January, the Labor Department said Friday. The increase was in line the expectations of economists polled by the Wall Street Journal.

Most of last month’s increase was driven by a 1.4% increase in goods, itself driven by a 6% jump in the energy index. The so-called core index, which subtracts food, energy, and trade services, rose 0.2% in February.

Jobless Claims Fall, but Pandemic’s Toll Is Still Evident

The number of U.S. workers filing initial claims for unemployment benefits last week fell more than expected, the latest sign of improving labor trends as the economy grapples with still-elevated levels of joblessness one year into the pandemic.

First-time jobless claims fell by 42,000 in the week ended March 6 to a seasonally adjusted 712,000, the Labor Department said Thursday. The previous week’s level was revised up by 9,000 to 754,000. Economists surveyed by the Wall Street Journal had forecast a reading of 725,000 initial claims.

ECB to Accelerate Its Asset-Buying Program

Faced with a recent rise in bond yields that threatened to undermine its monetary policy, the European Central Bank on Thursday decided to accelerate the asset-buying program it launched a year ago to counter the effects of the Covid-19 pandemic.

The size of the program was kept unchanged at €1.85 trillion ($2.2 trillion), but the ECB said in a release that purchases under the so-called pandemic emergency purchase program will “be conducted at a significantly higher pace” in the next three months than during the first quarter of the year.

Biden Signs Third Stimulus Into Law, Checks Will Start Arriving This Weekend

President Joe Biden signed the $1.9 trillion Covid-19 relief package into law at the White House Thursday afternoon, marking his first major legislative victory. After the signing, the White House said the direct payments to most Americans included in the bill could start arriving this weekend. “People can expect to start seeing direct deposits hit their bank accounts as early as this weekend,” White House press secretary Jen Psaki said at a press briefing.

“This historic legislation is about rebuilding the backbone of this country,” Biden said before the signing. “And giving people in this nation, working people, middle class folks, the people who built this country, a fighting chance.”

China’s Regulators Punished Tech Giants. What Could Come Next.

Chinese regulators said Friday they had fined a dozen companies, including Tencent Holdings, amid Beijing’s ongoing antimonopoly crackdown on internet companies. Meanwhile, the chief executive of embattled Ant Group resigned, and reports surfaced that Alibaba Group Holding could face a hefty fine though softer regulatory measures than those targeting fintech affiliate Ant.

Broadly, policy watchers see the spate of measures as a warning shot but one that didn’t jeopardize the long-term viability of the companies. “The Alibaba move suggests that Beijing will pursue only a light touch regulatory response around tech platform business practices, sending a message to be careful and clean up some of the bad business practices, but they won’t take heavier measures given the importance of Alibaba and Ant to short-term financial stability and longer-term economic growth,” said Eurasia Group’s Paul Triolo via email.

Hayward, Joann, Longboard Pharmaceuticals and Prometheus Biosciences Begin Trading

Four companies—Hayward Holdings, Joann, Longboard Pharmaceuticals and Prometheus Biosciences—made their public equities market debut. Prometheus rose as much as 31.5%.

The IPOs came at the end of a strong week for the IPO market. The much anticipated offering from Roblox, the gaming platform, soared in its first day of trade on Wednesday, while Coupang, the Korean e-commerce giant, rose 41% a day later. But not all offerings did well this week. First High-School Education Group dropped below its $10 IPO price.

GE Cuts Debt With Sale of Jet-Leasing Unit to AerCap

General Electric and AerCap struck the anticipated deal for GE‘s aircraft-leasing business, disclosing an agreement that provides GE with billions needed to pay down debt, simplify its business, and continue remaking the industrial conglomerate.

On Sunday evening, The Wall Street Journal reported the two sides were talking. General Electric declined to comment on the deal’s status at the time, but negotiations wrapped up quickly. In the end, the deal will provide GE with about $24 billion in cash as well as $1 billion in debt-like instruments issued by AerCap. GE will also receive 112 million newly issued AerCap shares, worth about $6 billion based on recent AerCap stock prices.

GE Proposes Reverse Stock Split

General Electric is proposing a reverse stock split in which it will give investors one share for every eight they now hold. That will take its share price to about $112, based on recent levels, reducing the shares outstanding to about 1.1 billion from a little less than 9 billion.

The question is why? Most companies split their stock, creating a lower share price and more shares outstanding, as stock prices rise over time. Companies appear to like to have a stock price at a certain level, following the Goldilocks principle of not too high and not too low.

Zoom Founder Eric Yuan Transfers $6 Billion of Stock to Unspecified Beneficiaries

Zoom Video Communications founder Eric Yuan transferred $6 billion worth of his shares to unspecified beneficiaries last week, according to a regulatory filing.

The videoconferencing platform’s chief executive transferred roughly 40% of his ownership in the company, in two tranches of close to 9 million shares shown as gifts. A Zoom spokesperson said the transfers were consistent with the Yuan’s “estate planning practices.”

Apollo to Acquire All of Athene in $11B Deal

Alternative asset manager Apollo Global Management has struck an $11 billion deal to acquire all of Athene Holding.

Apollo, which formed Athene more than a decade ago and owns a 35% stake in the offshore insurer, agreed to a stock-for-stock deal that offers Athene holders a roughly 16% premium above Athene’s share price Friday.