Friday, July 17, 2020

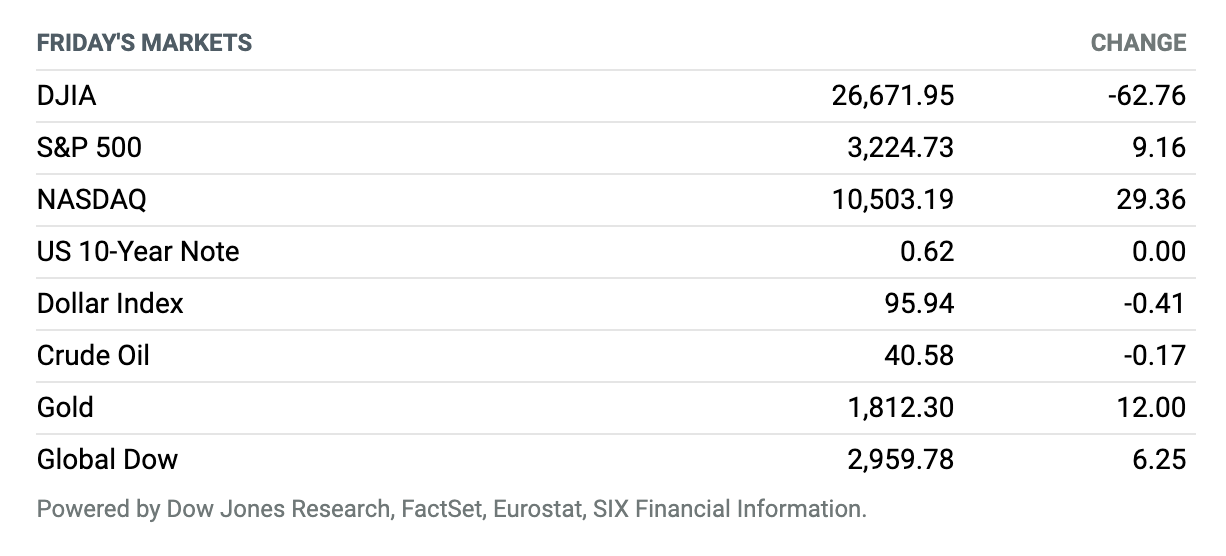

Mostly Higher. Stocks finished Friday’s session mostly higher, though the Dow Jones Industrial Average lost ground for a second consecutive day, in a lightly traded session. Investors monitored a continued rise in Covid-19 cases and the prospect for additional fiscal stimulus in Europe and the U.S. The Dow fell around 63 points, or 0.2%, to end near 26,672, according to preliminary figures, while the S&P 500 finished around 9 points higher, up 0.3%, near 3225. The Nasdaq Composite gained around 29 points, or 0.3%, to close near 10,503. Shares of video-streaming giant Netflix slumped 6.5% after the company reported strong subscriber growth and earnings that topped estimates but raised investor worries over the second-half outlook. Tech shares, which have been a pocket of strength for equities this year, saw a setback this week, with the Nasdaq Composite seeing a 1.1% weekly decline while the S&P 500 advanced 1.3%, and the Dow gained 2.3%.

Facebook, Other Tech Companies Could Face Pressure After EU Court Ruling

In what could turn out to be a major blow to the technology sector, the European Court of Justice on Thursday struck down Privacy Shield, a cross-border legal agreement that governs data transfers from the European Union to the U.S. The court found that Privacy Shield fails to adequately protect Europeans from weak U.S. consumer-data-privacy laws.

The ruling could cause considerable issues for tech companies like Facebook, Alphabet, and Amazon.com that routinely store and process data generated by European customers on U.S. servers, where they could be subject to surveillance by U.S. government authorities. More than 5,000 companies rely on the Privacy Shield agreement for cross-border data transfers.

Twitter Suffers High-Profile Hack

Twitter said late Wednesday in a series of tweets that hackers used some form of deception to gain access to its systems and tools normally reserved for employees—and used them to send messages asking for bitcoin from dozens of verified accounts, including those of celebrities, politicians, business tycoons, and some tech giants’ corporate accounts.

As of early Thursday afternoon, Twitter hadn’t disclosed details on how the attackers breached its security and exactly what the breach—known as a social-engineering attack— looked like, though it has said it is continuing to investigate the matter. U.S. lawmakers have also raised questions about the attack and asked Twitter to disclose what occurred in detail.

Here Are the Long-Awaited Data on Moderna’s Vaccine Trial. So Far, So Good.

Moderna’s announcement of positive data on a Phase 1 trial of its Covid-19 vaccine in May was met with skepticism from some experts, who noted that the company had not included much detail on the trial’s outcome in its press release. Now, two months later, that detail is here.

The vaccine “induced anti–SARS-CoV-2 immune responses in all participants, and no trial-limiting safety concerns were identified,” says a New England Journal of Medicine paper published on Tuesday evening. “These findings support further development of this vaccine.”

Pfizer, BioNTech Vaccines Receive FDA Fast Track Status

Shares of Pfizer and American depositary receipts of German biotech BioNTech jumped on Monday after the companies announced that the Food and Drug Administration had granted Fast Track designation to two Covid-19 vaccines that the companies are developing jointly.

The FDA grants Fast Track designation to speed review and approval of experimental drugs that could fill unmet medical needs. The Pfizer and BioNTech vaccines aren’t the first to receive the nod: In May, Moderna said that the FDA had given its experimental Covid-19 vaccine a Fast Track designation.

Retail Sales Spiked in June. Since Then, Coronavirus Cases Have Spiked, Too.

Retail sales increased at a better-than-expected clip in June from May. And even better, sales were also up from a year earlier. The same cloud, however, hangs over this report as has hung over others this month: The data were collected before coronavirus cases began to spike anew.

U.S. retail and food-services sales jumped a seasonally adjusted 7.5% in June, the Census Bureau said Thursday, better than the 5.4% increase economists polled by FactSet predicted. Investors have gotten used to sizable increases in economic gauges from depressed levels in April and May, when the economy was virtually shut down and slowly reopening. But the fact that retail sales rose 1.1% in June from 2019’s level suggests some real strength beyond just favorable month-over-month comparisons.

Apple and Ireland Win Appeal in EU Dispute

The European General Court ruled on Wednesday that the European Commission was wrong in 2016 to order Ireland to claw back some €13.1 billion ($15 billion) from Apple as undue tax advantages deemed illegal state aid.

Even though Apple and the Irish government, which had appealed the decision, rejoiced at the ruling, this may not be quite the end of the legal story. The Commission has the right to appeal to the Court of Justice of the European Union—the EU’s highest court—and it may take another few years before a final ruling is issued.

Analog Devices Agrees to Buy Maxim for $20B

In a deal reverberating through the semiconductor industry, Analog Devices on Monday announced an agreement to buy rival Maxim Integrated Products in an all-stock combination valued at about $20.5 billion.

The terms call for Maxim holders to receive 0.63 Analog Devices shares for each Maxim share. After the transaction closes, current Analog holders will have 69% of the combined company, with Maxim holders owning 31%. The deal is structured to be tax-free for U.S. income-tax purposes. Wells Fargo analyst Gary Mobley noted that this would be the largest chip-sector deal in four years—since Intel’s acquisition of MobileEye and Analog Devices’ acquisition of Linear Technology—and should buoy other chip shares.

JPMorgan’s Earnings Were Surprisingly Strong

Megabank JPMorgan Chase crushed expectations for its second-quarter earnings. The shares traded higher on Tuesday, following the earnings announcement, even though it wasn’t all good news: Profits fell by about 50% year over year.

JPMorgan earned $1.38 a share from $33.8 billion in revenue. In last year’s second quarter, the bank earned $2.82 a share from $29.5 billion in revenue. Interest income at JPMorgan was down in the second quarter—interest rates are lower. But corporate and investment banking revenue exploded, soaring 33% to $19 billion.

Morgan Stanley Reports Strong Results

A surge in trading activity allowed Morgan Stanley to be the rare bank to see a year-over-year gain in profits as lenders struggle with the pandemic.

The investment bank reported profits of $3.2 billion, or $1.96 per share, in the second quarter, beating profits of $2.2 billion in the year-earlier period. Revenue popped to $13.4 billion—a $3.2 billion jump from last year.

Netflix’s Coronavirus Subscriber Boom Comes to an End

It turns out, there are limits even for Netflix. The streaming video giant’s shares traded lower Friday amid signs that the company’s Covid-19 driven growth spurt is coming to an end.

In the June quarter reported late Thursday, Netflix added 10.1 million net new subscribers, above the company’s forecast of 7.5 million, but falling short of Wall Street estimates that had reached 12 million or higher. Netflix is forecasting just 2.5 million net adds in the September quarter, well shy of analyst expectations.