Friday, December 24, 2020

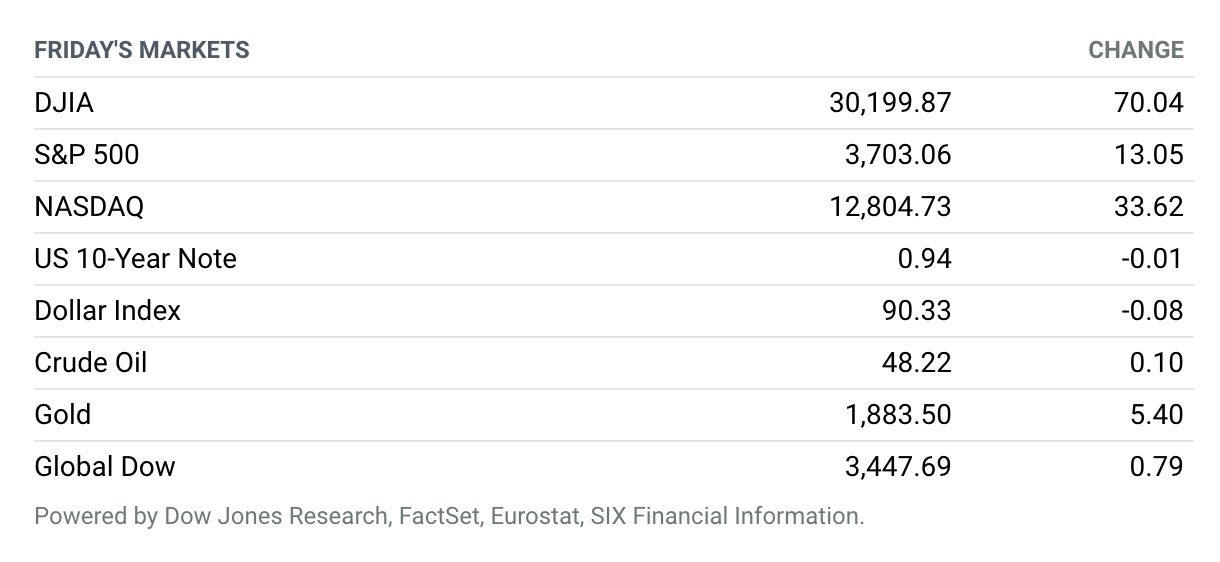

Stocks Gain on Christmas Eve. Stocks closed higher on a low-volume, holiday-shortened Thursday. The status of a $900 billion fiscal stimulus bill that passed in Congress this week remains unclear after President Donald Trump demanded last-minute changes. Still, investors don’t seem concerned—it’s likely a matter of when, not if, the package becomes law. An ongoing vaccine rollout, ultraeasy monetary policy, and the path to an economic and earnings recovery on the horizon are all powerful forces that continue to keep risky assets biased upward. Yet another stimulus delay doesn’t change that prevailing thesis. The Dow Jones Industrial Average closed up 70 points, or 0.2%, at about 30,120 on Christmas Eve, while the S&P 500 rose 13 points, or 0.4%, to 3703, and the Nasdaq Composite advanced about 34 points, or 0.3%, to about 12,805.

Fate of Stimulus Deal Unclear as Democrats Support Trump’s Call for More Aid

President Donald Trump’s rejection of the $900 billion relief package and $1.4 trillion funding bill Congress passed this week scrambled Democrats and Republicans and dredged up the possibility of a government shutdown.

President Trump, who left the capital for Florida, has not said he will veto the package. Whether he does will determine the course of the seemingly reopened negotiations. House Speaker Nancy Pelosi and Senate Minority Leader Chuck Schumer threw their support behind Trump’s proposal for direct payments to be increased to $2,000 per person.

Senate Majority Leader Mitch McConnell hasn’t yet said if he supports larger checks. Trump’s late entrance to the process upends the complicated balance McConnell struck.

A Brexit Trade Deal Has Finally Been Struck

The United Kingdom and the European Union have struck a historic trade deal after nine months of protracted negotiations and just days before the year-end deadline.

The agreement, which still needs to be ratified by Dec. 31, was announced on Thursday afternoon after negotiators reportedly worked through the night to iron out the deal and finally resolve their differences over fishing rights.

The U.S. Is Suing Walmart Over the Opioid Crisis

The U.S. Department of Justice has sued Walmart, alleging the retail giant played a role in America’s opioid crisis.

The DOJ alleges that lack of adequate staff at Walmart pharmacies and manager pressure enabled the fulfillment of suspicious orders on a wide scale. According to the suit, these decisions, which the DOJ says were motivated by profit, led to Walmart dispensing these drugs illegitimately—a violation of the Controlled Substances Act—and thus played a role in the opioid crisis.

China Begins Antimonopoly Probe Into Tech Giant Alibaba

China has launched an antimonopoly investigation into Alibaba, regulators said Thursday, sending the share price of the e-commerce giant tumbling and intensifying the troubles of its billionaire founder Jack Ma.

Regulators will also hold “supervisory and guidance” talks with Alibaba’s gigantic financial services subsidiary Ant Group, state media reported, just weeks after its record-breaking IPO was halted at the last minute by Beijing.

Unemployment Claims Fell Sharply Last Week

The number of people filing for unemployment benefits for the first time fell last week after notching a three-month high in the previous week.

There were 803,000 people filing initial claims for the week ended Dec. 19, data from the Labor Department showed Wednesday. This was down sharply from the upwardly revised figure of 892,000 for the week before. It was also significantly lower than economist projections for 880,000. The four-week moving average for initial claims, which smooths out some of the noise in the data, increased by 4,000, to 818,250.

Hackers Gained Access to Treasury Emails, Dozens of U.S. Companies

The hackers who infiltrated a variety of U.S. government computer systems through SolarWinds software also breached at least two dozen major American technology and accounting companies, The Wall Street Journal found.

The suspected hackers gained access to the email accounts of dozens of high-ranking Treasury Department officials, Sen. Ron Wyden, the ranking Democrat on the Senate Finance Committee, told the Journal.

The Fed Says Banks Can Buy Back Stock Again

Starting next month, the Federal Reserve will permit banks to buy back a certain amount of shares based on their income from the prior year. That constitutes a change from this year: Back in March, eight big banks halted their share buyback programs due to the coronavirus. In June, the Fed required banks to halt buybacks, and capped their dividend payments based on recent income.

A couple of large banks have already responded to the Fed’s decision by announcing buybacks that will start in the first quarter of 2021. In a statement following the Fed’s announcement, JPMorgan Chase said its board has approved a new share repurchase program of $30 billion. Goldman Sachs said it intends to resume its share repurchase program next quarter.

Tesla Stock Is Now Part of the S&P 500—and the Index Will Never Be the Same

Tesla stock became part of the S&P 500 on Monday. The electric-vehicle pioneer went in as the most valuable company as well as the largest weighting ever added to the index. The addition reshapes the S&P 500.

For every $11.11 Tesla stock moves, the S&P 500 moves 1 point, according to S&P Global.

New U.S. Covid-19 Vaccine Deal Gives Pfizer $2 Billion More in Sales

Pfizer and its vaccine partner BioNTech said Wednesday that the U.S. government had arranged to buy another 100 million doses of their vaccine against the Covid-19 virus. Priced the same as the first 100 million-dose purchase, the deal assures Pfizer another $1.95 billion in revenue and will help America reduce the wait to vaccinate its populace.

“With these 100 million additional doses, the United States will be able to protect more individuals and hopefully end this devastating pandemic more quickly,” said Pfizer CEO Albert Bourla, in the announcement.

Royal Dutch Shell to Take Another Write-Down as Covid-19 Hit Tops $22 Billion

Royal Dutch Shell on Monday said it would write down the value of assets by between $3.5 billion and $4.5 billion in the fourth quarter, taking its total charges this year above $22 billion. The fourth-quarter charges are related to its Appomattox asset in the U.S. Gulf of Mexico, the closure of oil refineries, and onerous liquefied natural gas contracts.

The oil major added that adjusted earnings would show a loss in the “current price environment.” Results in its marketing business, which helped the company return to profit in the third quarter, would be “significantly lower” in the fourth quarter, along with oil trading results.