Friday, December 18, 2020

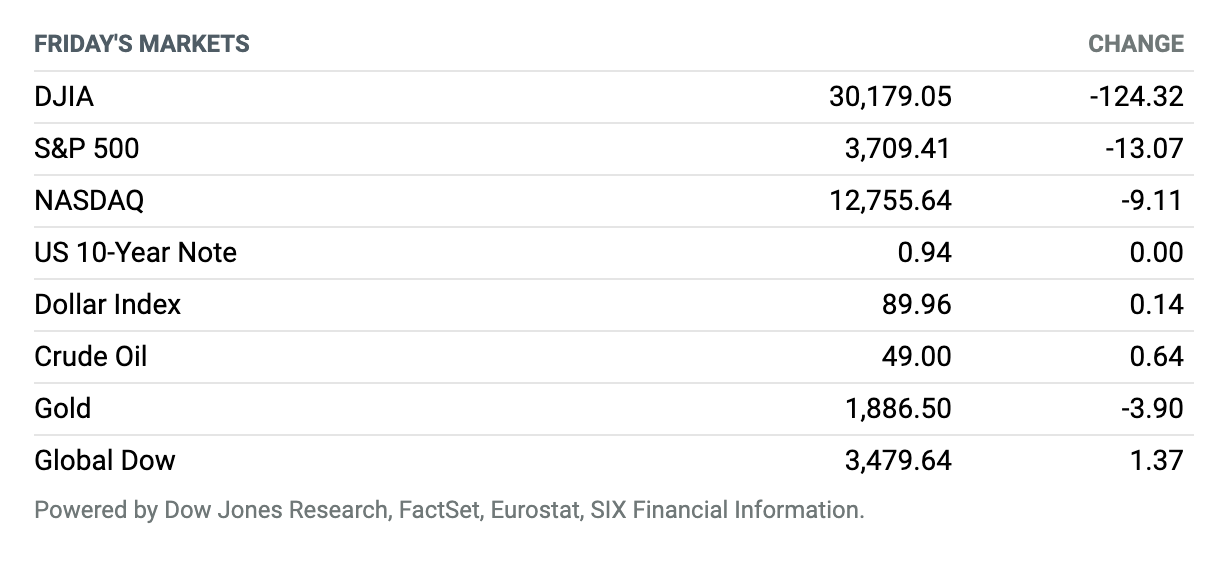

Stocks Slip as Lawmakers Haggle. U.S. stock indexes on Friday pared declines into the close but finished the session lower as investors monitored last-minute negotiations toward cementing a coronavirus aid package amid worsening infections and hospitalizations. The day’s trading action also was colored by quadruple witching and Tesla’s nearing inclusion in the S&P 500 index. Quadruple witching is when stock index options and futures expire simultaneously, an event that can be marked by outsize volatility in equity markets. The Dow Jones Industrial Average finished the day off 0.4% at around 30,179, the S&P 500 index closed 0.4% lower at 3709, and the Nasdaq Composite Index ended the session off less than 0.1% at 12,756. For the week, all three benchmarks finished higher, with the Dow marking a weekly gain of 0.5%, the S&P 500 booking a weekly rise of 1.3%, and the Nasdaq Composite clinching a 3.1% gain. Congressional leaders shifted their sights Friday afternoon to keeping the government open past midnight tonight, as their attempts to find a deal both sides could agree on looked to be stymied. CNBC reported later Friday that Senate Majority Leader Mitch McConnell, R-Ky., was pushing toward passing a funding bill that would keep the government open for another 48 hours as lawmakers attempt to hammer out an agreement to help out-of-work Americans and troubled businesses.

Moderna’s Covid-19 Vaccine Is Backed by FDA Advisory Panel

A second vaccine for Covid-19 got a thumbs-up Thursday from a panel of vaccine experts advising U.S. regulators. After a day of hearings, Moderna’s vaccine was endorsed by an advisory committee to the Food and Drug Administration, with 20 yes votes, zero nos, and one abstention.

Moderna’s shots should be available soon. The agency isn’t bound by the committee’s advice, but FDA scientists told the panel earlier Thursday that the Moderna vaccine merits the agency’s emergency use authorization. That happened for the first vaccine from Pfizer and BioNTech just a day after a Dec. 10 expert panel gave its endorsement.

The vaccines will break the back of the pandemic, declared the University of Michigan epidemiologist who served as chairman of the committee, Arnold Monto.

U.K. and EU in Last Hours of Talks to Avoid Brexit Chaos

The U.K. and the European Union were still desperately trying on Friday to finally strike a deal on a future trade treaty, as EU chief negotiator Michel Barnier told the European Parliament there were “just a few hours left” for both sides to find a compromise on their long-running differences.

While Barnier characterized the current situation as “serious and somber,” U.K. Prime Minister Boris Johnson seemed to echo the pessimistic mood when, speaking later, he called on the EU to “see sense” and make concessions to sign an agreement.

Why Friday Is Big for Tesla Stock, Ahead of Monday’s Epic S&P 500 Inclusion

Tesla will join the S&P 500 on Monday, and its stock price at the end of trading Friday will determine the weighting Tesla will have in the index.

The S&P 500 is weighted by market capitalization, adjusted for the number of shares available for trading, which for Tesla is roughly 80%. The rest is held by insiders, including CEO Elon Musk. Tesla’s current market value is roughly $610 billion. About $490 billion of that is available to trade. And the total market value of the S&P 500 is roughly $32 trillion.

All those numbers work out to about a 1.5% weighting for Tesla in the index. Tesla is already the most valuable company ever added. At a weighting of 1.5%, it might also become the largest weighting ever added. That title is held by Berkshire Hathaway. Its original weighting in the S&P 500 was roughly 1.4%. Berkshire was added in 2010.

Federal Reserve Holds Rates Steady, Raises Economic Outlook

The Federal Reserve said Wednesday it would maintain its current pace of easing until “substantial further progress has been made toward the Committee’s maximum employment and price stability goals.”

The central bank’s latest policy statement says officials decided to keep interest rates steady near zero, and that the Fed would stick to its bond-buying pace of at least $80 billion of Treasuries and $40 billion of mortgage-backed securities each month. Most officials’ updated projections also called for rates to remain near zero through 2023.

Unemployment Claims Rise Again as Coronavirus Surges

The number of Americans newly filing unemployment claims ticked up again last week as rising coronavirus cases and a new wave of restrictions on gatherings continue to plague the economy.

There were 885,000 people who filed initial jobless claims for the week ended Dec. 12, marking a 23,000 person increase from the prior week’s upwardly revised figure of 862,000. The four-week moving average of initial claims also rose, totaling 812,500, an increase of 34,250 from the previous week, the Labor Department said Thursday. Economists expected initial claims in the latest week to total 808,000.

Texas Leads U.S. States Suing Google for Anticompetitive Practices

Several U.S. states led by Texas filed suit against Google Wednesday over alleged anticompetitive practices, branding it an “internet Goliath” that had eliminated competition in online advertising and was harming consumers.

“This Goliath of a company is using its power to manipulate the market,” Texas Attorney General Ken Paxton said in a brief Twitter video announcing the suit. Google rigged ad auctions, taking advantage of its position serving up advertising as well as online search results, Paxton contended.

Tech Giants Face Regulatory Reckoning in Europe, With Fines and Breakups on the Table

The executive branch of the European Union released two sweeping legislative proposals on Tuesday that will have major global consequences for Big Tech—introducing massive new fines and opening the door to breaking up companies.

The European Commission presented proposals for the Digital Services Act and Digital Markets Act on Dec. 15, laying out a regulatory framework that will require new responsibilities for digital platforms and change how they fit into the market.

Robinhood’s ‘Free Trading’ Came With a Catch, SEC Says

The Securities and Exchange Commission on Thursday accused fast-growing online broker Robinhood Financial of misleading customers about how it made money for several years, allowing trades to be executed so poorly that customers came out worse even after taking into account the company’s free commissions.

Privately held parent Robinhood Markets, which is expected to seek to go public next year at a valuation of greater than $10 billion, will pay $65 million to settle the case.

Coinbase Files for IPO Amid Bitcoin Frenzy

Coinbase Global, the largest U.S. cryptocurrency exchange, said Thursday that it had filed confidentially with the Securities and Exchange Commission for an initial public offering.

The announcement comes near the end of a torrid year for the best-known cryptocurrency, Bitcoin. On Wednesday, Bitcoin crossed $20,000 for the first time. On Thursday, it was trading above $22,500, up 241% on the year, making it the best-performing investment of 2020.

AstraZeneca Agreed to a $39 Billion Takeout of Alexion. What You Need to Know.

Saturday’s deal by AstraZeneca to buy Alexion Pharmaceuticals brings a franchise in rare immune disorders to Astra, while also bringing to a close a campaign by discontented Alexion stockholders to get the company sold.

AstraZeneca’s $39 billion payment in cash and stock was valued at $175 per share of Alexion. The deal will just about use up AstraZeneca’s capital available for deal-making.