Thursday, April 9, 2020

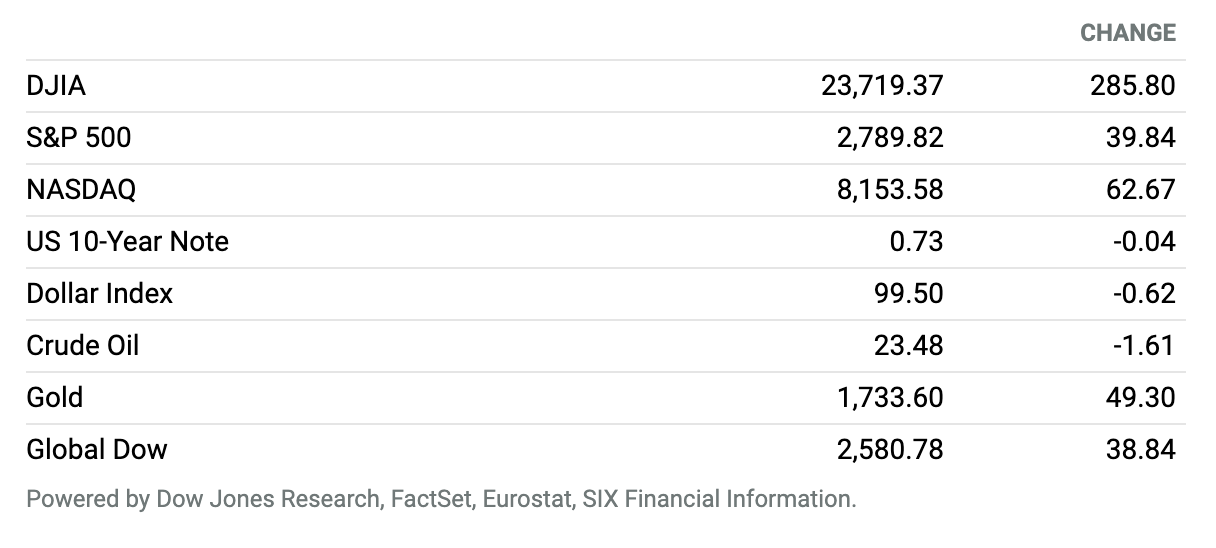

An Up Week. U.S. stocks capped significant weekly gains on Thursday after the Federal Reserve made a surprise announcement that it would deploy $2.3 trillion of funds through its lending programs to support the broader economy. The S&P 500 was up 1.4% to end at 2790. The Dow Jones Industrial Average advanced 286 points, or 1.2%, to finish around 23,719, based on preliminary numbers. The Nasdaq Composite climbed 0.8% to finish around 8,154. For the week, the S&P is up 12.1%, the Dow is up 12.7%, and the Nasdaq is up 10.6%. Data showed another 6.6 million Americans claimed unemployment benefits in the latest week. But the disappointing news on the labor-market was offset by the Fed’s lending announcements, with the central bank’s unrolling of its $600 billion Main Street Lending program for small and medium sized businesses capturing the attention of investors.

Market Brief won’t be published tomorrow as equity markets will be closed for the Good Friday holiday.

The Fed Is Pouring $2.3 Trillion Into Coronavirus Fight

Corporate and municipal borrowers are getting more backup from the Federal Reserve in a series of initiatives the central bank says could make available as much as $2.3 trillion in new loans.

In addition to an expansion of its corporate-lending facilities, the Fed’s latest moves include several new programs that extend central-bank support to corners of markets where it hadn’t been active, such as municipal bonds and high-yield exchange-traded funds. It will also provide extra support to banks that make small-business loans or participate in the Treasury’s Paycheck Protection Program, or PPP, programs that have so far struggled to get loans to businesses.

The Fed for the First Time Can Buy Junk Bonds. That Should Help ‘Fallen Angels.’

The Federal Reserve is making its first-ever foray into the junk-rated corporate bond market, saying it will consider buying noninvestment-grade corporate bonds and exchange-traded funds.

As part of an effort to make available $2.3 trillion in new loans amid the coronavirus crisis, the central bank said Thursday that it would buy the bonds of “fallen angel” companies, or companies that get downgraded from investment grade to junk. Companies will qualify if they had an investment-grade rating on March 22 and have since been downgraded to one of the top three tiers of the high-yield bond market (BB+, BB or BB-).

Saudis, Russians Reach Agreement in Principle to Cut Oil Production

Saudi Arabia and Russia have reached an agreement in principle to cut oil production, The Wall Street Journal reported Thursday.

The Organization of the Petroleum Exporting Countries is holding a virtual meeting with its allies, which include Russia, with a goal to help balance the oil market that has suffered from a drop in demand tied to efforts to stop the spread of Covid-19 and a price war between Moscow and Riyadh that has flooded the world with crude. Under the agreement in principle, Saudi Arabia would remove 4 million barrels a day from its April production levels, while non-OPEC member Russia would cut 2 million barrels a day.

6.6 Million File for Unemployment Benefits

Claims for unemployment benefits continued to surge last week, with more than 16 million Americans losing their jobs since mid-March as the coronavirus keeps nonessential businesses shut.

The Labor Department said Thursday that for the week ended April 4, 6.6 million people filed for unemployment insurance. That follows an upwardly revised, and record high, 6.9 million in the previous week.

GE Withdraws Its 2020 Guidance. First-Quarter Earnings Will Miss Expectations.

General Electric is withdrawing earnings guidance for 2020. What’s more, the industrial conglomerate expects first-quarter numbers to come in below Wall Street expectations.

Analysts expected 10 cents in earnings per share. The number will be “materially below” that level. For the year, General Electric had expected to earn about 55 cents a share and generate about $3 billion in free cash flow from its industrial operations.

Morgan Stanley CEO James Gorman Recovers From Covid-19

Morgan Stanley Chief Executive James Gorman has recovered from the coronavirus.

Gorman contracted the disease roughly three weeks ago but largely worked throughout his illness, a Morgan Stanley spokesman told Barron’s. The bank’s staff was informed of Gorman’s health status on Thursday after he sent a 10-minute video to employees in which he provided an overview of the bank’s business amid the pandemic as well as his own health status. He received medical clearance from doctors more than a week ago.

Starbucks Withdraws 2020 Outlook as Coronavirus Pandemic Drags on Sales

Starbucks withdrew its fiscal 2020 outlook on Wednesday, adding it expects second-quarter adjusted earnings to come in at 32 cents a share.

Wall Street’s consensus estimate for fiscal second-quarter earnings was recently 39 cents a share, according to FactSet. Analysts had been calling for 59 cents a share as recently as Feb. 28, according to FactSet.

A Shockingly High Number of Realtors Say Demand for Housing Has Dropped

As the U.S. adjusts to growing unemployment and life under lockdown, 90% of the members of the National Association of Realtors have seen interest in homes drop, according to the results of a new survey.

The association, known as NAR, polled its members to learn how coronavirus is affecting business. Of the more than 5,000 respondents, 90% say they have seen interest decline among homebuyers in their markets—up from 48% in mid-March, the last time the survey was conducted.

Covid-19 Mortality Is More Than 10% in France, Italy, and the U.K. In the U.S., it’s 3.4%.

Covid-19 cases are approaching 1.5 million. Deaths are approaching 90,000 as the world continues to battle the coronavirus.

Mortality in France, Italy, and the U.K. is more than 10%. Those are the countries hit hardest by deaths. South Korea, Germany, and Canada each have mortality rates below 3%. In the U.S., mortality is about 3.4%. The American figure is elevated because of the high rate of deaths in the New York region.

Trump Blasts Amazon for the U.S. Postal Service’s Losses

President Donald Trump blamed Amazon.com for the U.S. Postal Service’s losses on Tuesday. He might want to redirect his ire toward Congress.

“The Postal Service has lost billions of dollars a year for many years,” Trump said during Tuesday’s coronavirus task force media briefing. “I’ll tell you who’s the demise of the Postal Service…Amazon or these other internet companies.”