Thursday, April 17, 2020

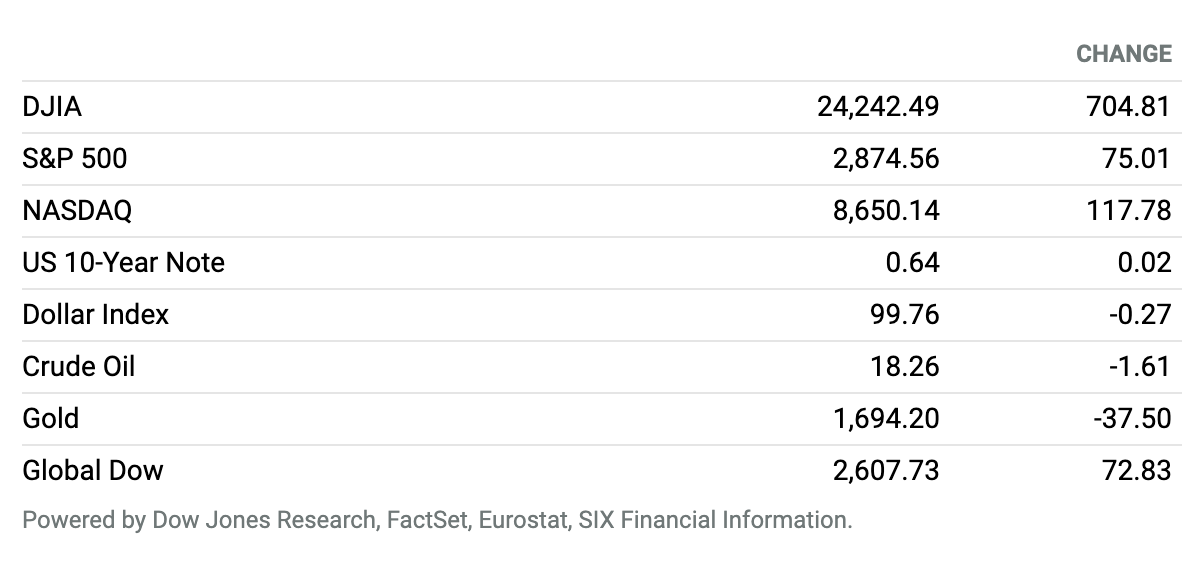

Positive Week. Stocks ended with strong gains Friday, cementing a positive week, as investors appeared to take comfort in a report that a Covid-19 treatment showed promise and the White House outlined a plan to begin reopening parts of the economy. The Dow Jones Industrial Average ended around 705 points higher, up 3%, near 24,242, according to preliminary figures, while the S&P 500 advanced around 75 points, or 2.7%, to close near 2875. The Nasdaq Composite gained 118 points, or 1.4%, finishing near 8650. The gains left the Dow up 2.2% for the week, while the S&P 500 rose 3% and the Nasdaq advanced more than 6%. Boeing Co. helped lift the Dow, with shares rising 14.7% after the company said it would slowly resume production. The bounce turned shares positive for the week, leaving them with a 1.4% gain. Boeing shares have fallen nearly 53% in the year to date.

Gilead Says It’s Too Soon to Draw Conclusions on Its Coronavirus Drug

Investors may be too enthusiastic about a scoop from the health-care news website STAT on a trial of Gilead Sciences ’ antiviral drug remdesivir in patients with severe Covid-19, analysts say.

Gilead shares were up 10.6% shortly after the open on Friday, and had risen much further in trading after the close on Thursday. STAT reported Thursday evening that nearly all of the patients at one Chicago hospital participating in a Gilead-sponsored trial of remdesivir were discharged in less than a week.

In a statement, Gilead said conclusions could not be drawn from a subset of the trial data. “Anecdotal reports, while encouraging, do not provide the statistical power necessary to determine the safety and efficacy profile of remdesivir as a treatment for Covid-19,” a spokesman said.

Moderna Is Getting $483M From the U.S. Government to Develop Its Covid-19 Vaccine

Shares of the biotech Moderna blasted off after the company said Thursday night it would receive nearly half a billion dollars from an arm of the federal government to fund development of its experimental Covid-19 vaccine.

“The grant …is going to be a big accelerator to the development of mRNA-1273,” Moderna’s experimental Covid-19 vaccine, the company’s CEO, Stéphane Bancel, said in an investor call on Friday morning.

China Is Reopening Its Economy. It’s Still Waiting for the Rebound.

As the U.S. begins to think about reopening the economy, the latest figures from China show that lifting restrictions doesn’t mean a quick recovery.

Gross domestic product fell 6.8% in the first quarter—the first decline since record-keeping began in 1992 and likely the first since the Cultural Revolution—grim news that was nevertheless in line with economists’ expectations. More surprising was that domestic retail sales fell 16% in March, a figure that was better than the previous two months, but worse than economists anticipated.

P&G Beats Earnings Forecasts

Procter & Gamble reported solid earnings—given the Covid-19-induced economic turmoil—Friday morning. Sales growth, however, is slowing, but not because of the virus.

The company earned $1.17 a share from $17.2 billion in sales in its fiscal third quarter. (The March quarter is P&G’s fiscal third quarter.) Wall Street expected $1.13 from $17.3 billion in sales. Management reduced full-year guidance for sales growth but not because of slower demand as consumers shelter in place. Instead, a strong U.S. dollar will reduce the value of overseas sales.

Schlumberger Slashes Its Dividend

Schlumberger, the world’s largest oil-services firm, lowered its dividend by 75% as Covid-19 damages operations already under pressure from a yearslong decline in drilling budgets.

Schlumberger reported 25 cents of earnings per share on Friday, a penny more than Wall Street had anticipated. Its revenue of $7.46 billion narrowly missed expectations for a result of $7.52 billion.

Las Vegas Sands Suspends Dividend

In a news release, casino operator Las Vegas Sands said it would suspend its dividend due to the impact of Covid-19, though it will continue its capital-spending programs in Macao and Singapore.

The company’s properties include the Venetian in Las Vegas, where it is based. Its Las Vegas properties have been closed due to the pandemic.

The Dollar Is Still Strong. It’s a Warning Sign for the Stock Market Rally.

The stock market’s rally gives the impression that investors think the worst of the coronavirus slowdown is over. But the persistent strength of the dollar should be a warning sign for the bulls.

The U.S. dollar spiked at the end of last month, as companies and investors scrambled to secure enough cash to withstand an indefinite period of coronavirus lockdowns.

Boeing Stock Is Soaring on Hopes for the U.S. Economy and Production Resuming

Commercial aerospace giant Boeing is resuming production at its Seattle area manufacturing facilities and pushing for more government aid for its industry. Boeing stock is rallying Friday, but that has more to do with broader hopes for the U.S. economy.

Boeing halted production in late March. It employs about 27,000 people in the Puget Sound area. These days, any news of people going back to work can hearten investors. More than 20 million people, after all, have filed jobless claims in recent weeks as Covid-19 rips through the American economy.

Tesla Stock Is Up for the 10th Straight Day. Stocks Don’t Move Like This.

Stock in electric vehicle pioneer Tesla is up for a 10th straight day, continuing its incredible run. Stocks simply don’t move like this

Ten-day runs are unusual to say the least. Tesla shares had a nine-day winning streak back in October 2019, after third-quarter earnings beat Wall Street expectations. Looking farther back, Barron’s couldn’t find another streak as long for Tesla.

Waiting for Your Government Stimulus Payment? Here’s How to Check Its Status.

Millions of Americans are waiting for checks from the federal government to help them through economic fallout from the coronavirus outbreak. The IRS has set up a website to help people track the so-called economic impact payments, as well as determine payment eligibility.

All U.S. citizens and legal resident aliens with social security numbers can qualify for payments. Filing a 2019 tax return isn’t required to receive money either. The IRS will base payments on 2018 tax returns if last year’s numbers aren’t yet filed.