Friday, March 20, 2020

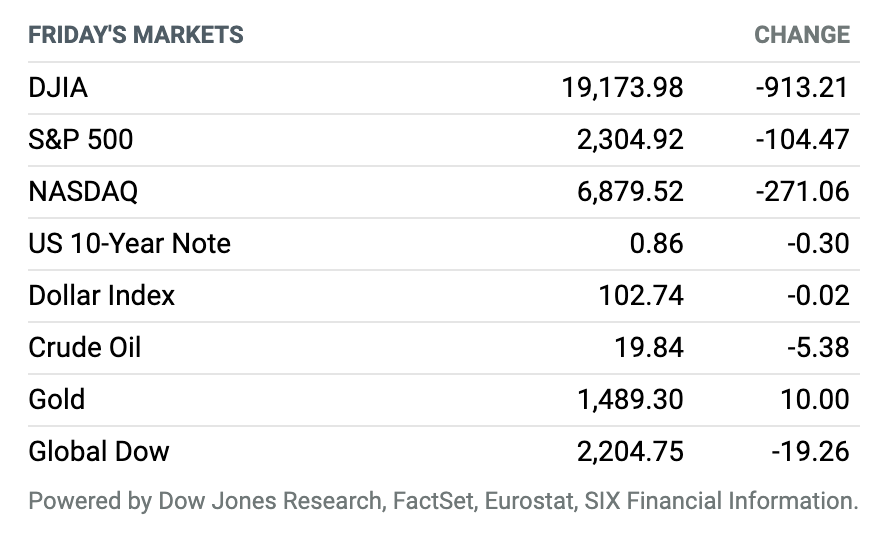

Rough Week. U.S. stock indexes dropped in response to a renewed fall in the price of oil and after New York Gov. Andrew Cuomo ordered all nonessential businesses in the state to close. Friday’s losses capped off the worst week for the Dow Jones Industrial Average and S&P 500 since the 2008 financial crisis. On Friday, the Dow Jones Industrial Average fell 913 points, or 4.4%, to 19,173. The S&P 500 was down 4.3%, and the Nasdaq Composite, which has outperformed the other major indexes in recent days, was off 3.8%. For the week, the Dow dropped more than 17%, while the S&P 500 fell 15% and the Nasdaq dropped more than 12%.

U.S. Oil Prices Post Weekly Loss of 29%, Biggest Since 1991

Oil settled sharply lower on Friday, with U.S. prices down 29% for the week—the largest weekly loss since 1991—as economic stimulus plans from government and central banks fail to offset expectations for steep fall in demand due to coronavirus pandemic, and as Saudi Arabia and Russia oversupply the market.

Prices for U.S. benchmark West Texas Intermediate crude just a day earlier had posted their largest one-day percentage rise on record, partly due to comments from the Trump administration, which indicated that it was considering intervention in the oil-price war between Saudi Arabia and Russia.

Continue reading ›

Mnuchin Says White House Wants $1,000 Checks for Adults to Help During Coronavirus

The Trump administration wants to send $1,000 checks to most adults and $500 for each child to help families endure economic hardship in the next few weeks as the U.S. seeks to contain the coronavirus epidemic.

Treasury Secretary Steven Mnuchin, in an interview with Fox Business, urged Congress to pass a massive financial aid package that includes direct payments to families as quickly as possible. Under the White House proposal, the IRS would deliver checks to most adults and children within weeks of Congress passing a $1 trillion-plus rescue package. If the crisis continues, another round of checks would be sent out several weeks after the first batch of payments.

Continue reading ›

Fed Cuts Rates to Zero as Financial-Crisis Tools Make a Comeback

The Federal Reserve has cut interest rates back to zero and reintroduced the bond-buying program it used to fight the financial crisis a decade ago. It also reduced the cost of its overnight lending facility for U.S. banks and will expand its facilities to lend dollars to other global central banks.

In a statement late Sunday, the Federal Open Market Committee decided to cut interest rates back to the financial crisis-era range of 0% to 0.25%. It also has decided to buy $500 billion of Treasuries and $200 billion of mortgage-backed securities “over coming months.”

Continue reading ›

ECB Launches Mammoth, Open-Ended Bond-Buying Package

The European Central Bank announced on Wednesday night an extraordinary 750 billion euro asset-buying program to help the eurozone fight the consequences of the coronavirus outbreak and support “all citizens of the euro area through this extremely challenging time.”

After a late-night videoconference call, the ECB’s governing council made it clear that its new “pandemic emergency purchase programme” wouldn’t be constrained by the self-imposed limits of its previous and current quantitative easing policies.

Continue reading ›

The Fed Is Now Buying Munis, More or Less

The Federal Reserve is expanding its program to bolster money-market funds by extending its support to municipal debt, as well.

The Fed’s original money-market lending program, introduced late Wednesday, was created to finance banks’ purchases of short-term corporate securities known as commercial paper (specifically from money-market funds). After this latest expansion, the Fed will also finance similar bank purchases of municipal debt maturing in less than one year.

Continue reading ›

Higher Treasury Yields Send a Hopeful Signal to Markets

Treasury yields rose this past week while stocks slid. That’s the opposite of the usual pattern when risky assets, such as equities, come under pressure. Normally, investors flock to the haven of government securities, pushing their prices higher and their yields lower. But this time, that relationship unraveled, with longer-term Treasuries failing to appreciate and to provide a cushion against falling stocks.

Jim Paulsen, the Leuthold Group’s chief investment officer, sees the upturn in longer-term Treasury yields as a glass-half-full story. The history of market crashes since 1987 shows that the 10-year note’s yield turns upward as a bear market is close to running its course, he writes in a client note.

Continue reading ›

What the U.S. Can Learn From China’s Response to the Coronavirus Pandemic

As the U.S rushes to slow the spread of the deadly novel coronavirus, it has unleashed a kitchen-sink array of measures to stave off severe economic damage from the pandemic. Investors grasping for a road map—and perhaps a bit of optimism—as to what comes next have settled on China, whose economy is restarting while the rest of the world is shutting down. But economists and fund managers warn the U.S. could be in for an even longer and bumpier path to recovery.

First, the good news: The number of new confirmed cases of the coronavirus in China has slowed considerably, and that suggests the risk from the virus isn’t indefinite. “It’s the uncertainty for what the virus is engendering that’s creating market chaos, but the important thing is that it’s a fading virus,” Alan Greenspan, former Federal Reserve Chairman and advisory board member at RockCreek, a $14 billion investment firm, said in a video to the company’s clients. “The book will close on this, but not right away.”

Continue reading ›

Amazon Is Adding 100,000 New Jobs Because of Coronavirus Demand

Amazon.com on Monday announced plans to add 100,000 new full-time and part-time workers around the world to meet a surge in demand as a result of the widespread impact of the coronavirus, which is shutting down normal retail commerce in many countries around the world.

Amazon says the new hiring in its fulfillment centers and delivery network is intended “to meet the surge in demand from people relying on Amazon’s service during this stressful time, particularly those most vulnerable to being out in public.” The company says it is seeing “a significant increase in demand, which means our labor needs are unprecedented for this time of year.”

Continue reading ›

Regeneron’s CEO Says We Could Have a Covid-19 Treatment ‘Quickly’

Regeneron Pharmaceuticals on Tuesday morning announced a breakthrough in the search for a Covid-19 treatment. It has identified hundreds of virus-neutralizing antibodies that could potentially be used in a cocktail drug.

“Similar to the approach the company pursued for Mers and Ebola virus, we believe Regeneron’s Covid-19 antibody cocktail may offer efficacy in preventing and treating the virus,” SVB Leerink analyst Geoffrey Porges wrote in a note to investors.

Continue reading ›

Ford Suspends Its Dividend, Shuts North American Factories

Ford Motor has suspended its dividend and is temporarily halting car production in the U.S., Canada, and Mexico as it and other companies reel from the spreading coronavirus epidemic.

Ford said the move was necessary to preserve cash and provide additional financial flexibility.

Continue reading ›