Friday, March 13, 2020

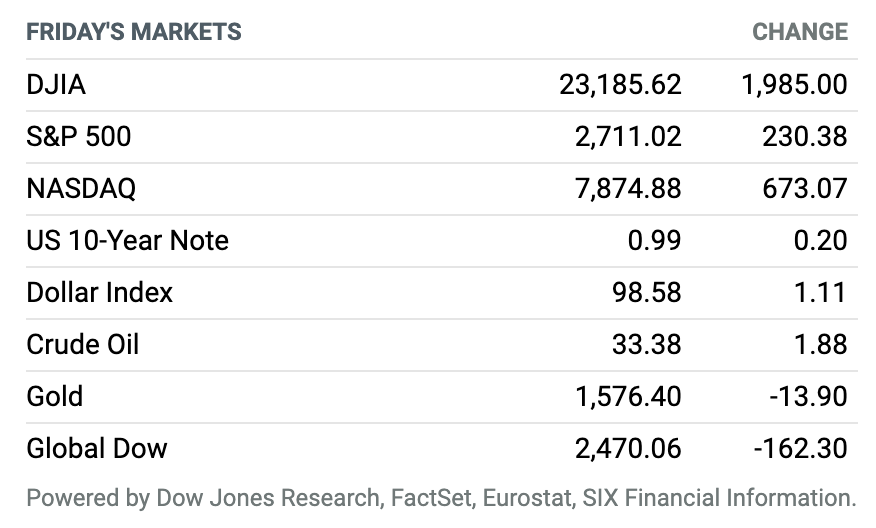

TGIF. After suffering sharp coronavirus-related losses earlier in the week, U.S. stocks soared on Friday and got an extra lift late in the session from President Trump’s declaration of a national emergency. On Thursday, U.S. stock indexes suffered their biggest one-day drop since 1987’s Black Monday crash, and closed deep in bear market territory. Friday’s big gains couldn’t reverse all the damage from previous sessions. For the week, the S&P 500 was down 8.8%, the Nasdaq Composite was 8.2% lower, and the Dow Jones Industrial Average fell 10.4%.

What President Trump’s National Emergency Declaration Means

President Donald Trump has declared a national emergency under the Stafford Act, a move that will free up greater federal resources for states and cities battling the coronavirus.

The president can make a Stafford Act emergency declaration for any occasion when federal help is needed to support state and local efforts to provide emergency services, “such as the protection of lives, property, public health, and safety, or to lessen or avert the threat of a catastrophe in any part of the United States,” according to the Federal Emergency Management Agency.

Continue reading ›

Roche Gets Emergency Approval for First Fast Covid-19 Test

The first high-speed coronavirus test was approved by the U.S. Food and Drug Administration, said Roche Holding today. The Swiss medical giant’s new test works in its high-volume cobas 6800/8800 systems—widely used diagnostic machines that will be able to process up to 4,000 of the Covid-19 tests per day. That’s 10 times faster than currently used tests.

There are more than 800 of the automated Roche systems around the world, the company has said, including about 110 in the U.S. More have been placed in recent weeks. Millions of units of the Roche test will be available for the hospital and commercial labs that use its system, the company said.

Continue reading ›

New York Fed Increases Liquidity Amid Financial Market Turmoil

The Federal Reserve Bank of New York is aggressively expanding its interventions to provide liquidity during this week’s market turmoil. But the news only briefly helped arrest the market’s decline on Thursday.

The New York Fed plans to offer banks at least $1 trillion of additional short-term cash loans each week, in its largest effort yet to smooth operations in Treasury and money markets. And it will expand the scope of the $60 billion in bond purchases it is tasked with making each month through April.

Continue reading ›

Why President Donald Trump’s Wednesday Speech Spooked the Stock Market

The Dow Jones Industrial Average sank into a bear market Wednesday, but only just. And with President Donald Trump addressing the nation Wednesday night, there was still a chance that it would be a short-lived one. In fact, the market was betting on it: Dow futures were up around 300 points before the president’s address began. And then the president started talking—and futures started falling. By the time Trump was finished, Dow futures were down more than 1,000 points, and any chance of a quick reversal of the bear market had faded.

So what did Trump say, or not say, that spooked the market? In a nutshell, it appears that he acknowledged the seriousness of coronavirus by banning flights to and from Europe and encouraging Americans to be vigilant in combating the illness—necessary but economically damaging, nonetheless—without providing a plan to compensate for the economic hit.

Continue reading ›

The ECB Has a Liquidity Plan but Didn’t Cut Interest Rates. Investors Aren’t Happy.

The European Central Bank surprised investors Thursday when it didn’t cut interest rates. Instead, the central bank announced a variety of asset purchases and liquidity injections in an attempt to offset the economic blow from the coronavirus outbreak, and called upon European lawmakers to step in.

The decision by the ECB to leave its key rate unchanged came after the Federal Reserve’s emergency half-point cut earlier this month and after the Bank of England cut rates to a record low 0.25% this week.

Continue reading ›

Is Coronavirus a Pandemic? Yes, Here’s What That Means.

The World Health Organization on Wednesday declared the Covid-19 coronavirus outbreak a pandemic. The virus had infected more than 120,000 people and spread to more than 100 countries at the time of the announcement.

A pandemic is worse, in theory, than an epidemic. An epidemic affects a region or community. A pandemic on the other hand, affects the entire world. There isn’t a firm definition based on cases or mortality, according to the WHO. To call coronavirus a pandemic required “uncontrolled spread.” With about 70 countries reporting initial cases over the past two weeks, apparently, the tipping point was reached.

Continue reading ›

Bank of England Takes Steps to Deal With Coronavirus Fallout

The Bank of England on Wednesday gave both the U.S. Federal Reserve and the European Central Bank a lesson in central banking, with a surprise rate cut coupled with a string of measures geared toward helping businesses cope with the “sharp and large shock” of coronavirus consequences.

The Bank’s Monetary Policy Committee cut the key interest rate to 0.25% from the previous 0.75%. But the BoE fired on all cylinders and acted in all its roles. Even if it is the most spectacular, and the markets’ main focus, the surprise cut may not be the most important decision. Rate cuts are a blunt instrument, not designed to deal with a short-term supply shock such as the one triggered by the coronavirus outbreak.

Continue reading ›

Oil Fell Nearly 25% on Monday, for its Biggest 1-Day Loss Since 1991

Oil futures plunged to a four-year low Monday and recorded their biggest one-day drop since 1991 as OPEC and Russia appear headed for an all-out price war—shaking a market already reeling from the demand shock created by global spread of Covid-19.

West Texas Intermediate crude for April delivery on the New York Mercantile Exchange fell $10.15, or 24.6%, to end at $31.13, after briefly trading below $29 in early trade. May Brent crude, the global benchmark, dropped $10.91, or 24.1%, to settle at $34.36 a barrel on ICE Europe. The percentage declines for both grades were the largest since January 1991, during the Gulf War.

Continue reading ›

Xerox Pauses Activity Tied to HP Bid to Focus on Virus-Related Issues

Xerox Holdings basically declared a timeout in its push to acquire HP Inc.

In a statement, Xerox says it was pulling back on all activities related to the offer to focus on issues around the spread of the coronavirus crisis.

Xerox has a tender offer on the table for all HP shares, at a stated price of $24 a share, including $18.40 in cash and 0.149 Xerox shares for each HP share. (Given the drop in the Xerox share price in the recent market slide, the proposal’s value is now just slightly over $22.) Xerox also has proposed a full slate of directors for the HP board. HP has repeatedly rejected the Xerox bid as too low.

Continue reading ›

Carnival Stock Tumbles After Halt in Princess Cruise Operations

Carnival stock continued its free fall Thursday as the cruise operator’s Princess Cruises line, which has had two ships quarantined due to the coronavirus outbreak, said it would voluntarily cease its operations for 60 days. The stock was down about 23% late in Thursday’s session.

Princess is one of Carnival’s signature brands, catering to the middle market of cruise customers, according to Harry Curtis, an analyst at Instinet. The cessation of operations will run from March 12 through May 10.

Continue reading ›