Oct 7, 2025

The Markets

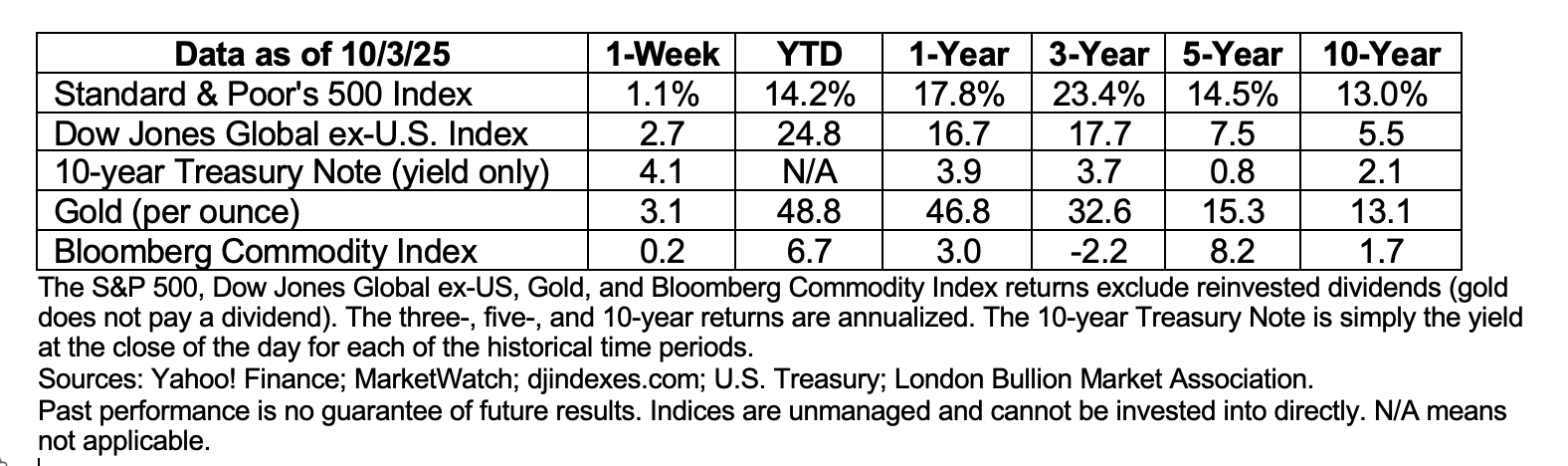

It was a stellar quarter for investors.

The last three months have delivered stock market gains amid signs the economy might not be doing as well as previously thought. Here’s what we saw:

Stock markets advanced

Solid corporate earnings growth, enthusiasm for artificial intelligence (AI), and expectations for a Federal Reserve (Fed) rate cut helped drive stock markets in the United States higher during the third quarter of 2025.

“The broad U.S. equity indices were higher across the board in both September and Q3. For the S&P [Standard & Poor’s] 500 and Nasdaq-100, September marked their 5th and 6th consecutive monthly gains, respectively. And for the S&P 500, this was its 2nd best September…in 27 years,” reported the Nasdaq Market Intelligence Desk Team.

Stock valuations moved higher

The downside of recent stock market performance is that valuations have reached lofty levels. As a result, investors are paying “the most for future earnings in more than two decades, adding a new element of risk to the market’s rally,” reported Martin Baccardax of Barron’s. The risk is that earnings may not meet investors’ expectations, which could lead to lower stock prices.

Questions rose about the strength of the economy

Economic data is usually revised several times before the final numbers arrive. In September, the employment report revision showed 911,000 fewer jobs may have been created over the past twelve months than previously thought. The change raised questions about the strength of the economy – and the quality and collection of data for the report, reported Jeff Cox of CNBC.

“The revisions were more than 50 [percent] higher than last year’s adjustment and the largest on record going back to 2002. On a monthly basis, they suggest average job growth of 76,000 less than initially reported.”

The Fed lowered the federal funds rate

Investors have been anticipating a Fed rate cut for some time. In September, the Fed’s concerns about inflation were offset by data suggesting the U.S. labor market is softening rapidly, and the Fed lowered the federal funds rate by one-quarter percentage point.

While investors expect more rate cuts this year, it’s unclear whether that will happen. “At the center of the tension are rising prices. While inflation has slowed from its pandemic highs, it remains above the Fed’s 2 [percent] target. Several regional Fed presidents cautioned on Monday that policymakers shouldn’t move too quickly to ease policy, even as investors and Wall Street analysts bet on more cuts,” reported Nicole Goodkind of Barron’s.

Consumer sentiment moved lower, too

While investors had a lot to celebrate in the third quarter, consumers’ optimism faded in August and September. The University of Michigan’s Consumer Sentiment Index showed that sentiment was down about five percent month over month in September, and more than 21 percent year over year.

“Although September’s decline was relatively modest, it was still seen across a broad swath of the population, across groups by age, income, and education, and all five index components. A key exception: sentiment for consumers with larger stock holdings held steady in September, while for those with smaller or no holdings, sentiment decreased,” reported Surveys of Consumers Director Joanne Hsu.

The fourth quarter began with a government shutdown. The closure had little effect on market optimism, and major U.S. stock indexes moved higher last week. Yields on U.S. Treasuries generally dipped lower or remained steady over the week.

WHAT DOES A GOVERNMENT SHUTDOWN MEAN FOR INVESTORS? Last week, the U.S. government closed after Congress failed to pass a temporary funding measure to keep it open. The sticking point appeared to be whether the government should continue to provide tax credits to offset the cost of healthcare premiums under the Affordable Care Act, reported Anita Hamilton of Barron’s. The credits are scheduled to expire at the end of 2025.

Historically, government shutdowns have had little impact on financial markets. However, some analysts believe this shutdown may create additional financial market volatility. The good news is, when markets are negatively affected, they tend to recover quickly, reported Callum Keown of Barron’s. In any case, investors should be aware of shorter-term risks, including:

- Delayed Initial Public Offerings (IPOs). When a private company raises capital by selling shares to the public for the first time, it is called an IPO. “With the Securities and Exchange Commission running only essential functions on a skeleton staff, the agency will stop processing IPO paperwork, leaving companies primed for Wall Street debuts…in limbo,” reported Manya Saini and Niket Nishant of Reuters.

- Delayed drug approvals. The U.S. Food and Drug Administration (FDA) will continue to review current product applications during the shutdown; however, it has stopped accepting new applications, reported Kristin Jensen of Biopharma Dive. The FDA is funded through user fees, which it cannot collect when the government is closed, reported Josh Nathan-Kazis of Barron’s. That could create issues if the shutdown lasts for a significant period.

- Challenges for federal contractors. The shutdown affects U.S. government employees – and everyone employed by a government contractor. “While some federal contracts will stop work in the event of a shutdown, others will continue on, particularly if they’re funded by appropriations from past fiscal years…however, problems emerge when contractors need an action by or information from a federal employee who is furloughed,” reported Sean Michael Newhouse of Government Executive. If the administration decides to layoff government employees, the issue could become more complicated.

- Lack of economic data. The Bureau of Labor Statistics, Bureau of Economic Analysis and Census Bureau stop collecting and distributing data when the government shuts down. As a result, the shutdown “will shut off the flow of key economic data at a moment of uncertainty among policymakers and investors about the health of the U.S. job market, the trajectory of inflation and the strength of consumer spending and business investment,” reported Reuters.

The overall effect of the shutdown will depend on how long it lasts.

WEEKLY FOCUS – THINK ABOUT IT

“I don’t think that you can be an extraordinary leader unless you love your people sincerely. Now history shows us that you can win battles, you can accomplish missions, you can build buildings, and you can win games without loving your people, because a lot of people have done it that way. But I am convinced that you and your organization, your unit, your group will never be extraordinary in the long run without…genuine concern for your people.”

– Colonel Arthur J. Athens, United States Marine Corps Reserve (Retired)