Nov 10, 2025

The Markets

There were bearish undercurrents in the bullish sea.

While there are many reasons to be optimistic about the long-term prospects for U.S. stocks, investor concerns about artificial intelligence (AI) spending and the possibility of a market correction roiled markets last week.

“All eyes were on the parade of earnings reports from the technology behemoths this past week. But what grabbed the markets’ attention were the implications of their massive capital investments in artificial intelligence on their balance sheets and cash-flow statements,” reported Randall W. Forsyth of Barron’s.

Investors wondered whether and when the enormous amounts of money companies are committing to AI data centers will generate a return, according to John Miley of Kiplinger’s. In addition, there were questions about whether these investments are economically sustainable.

“To meet the expected demand for data centers, it will require $500 billion in annual global capex spending on new data centers…AI companies will have to find $2 trillion in new yearly revenue by 2030 to arrive at an economically sustainable model,” reported Miley.

Investor caution was heightened when the chief financial officer of one large AI research and deployment company suggested the government “backstop the guarantee that allows the financing [for AI data centers] to happen,” reported Bloomberg.

Another sustainability issue is energy usage. AI data centers consume a lot of power. Increasing demand is pushing energy prices higher, and they could go even higher as utilities upgrade power grids to meet new energy demands, reported Pew Research.

“It seems like we have finally reached the point of maximum optimism around artificial intelligence,” commented a source cited by Carmen Reinicke, Alexandra Semenove, and James Crombie of Bloomberg.

While that may prove true, there are many reasons to remain enthusiastic about AI. Advancements in the field have the potential to deliver gains in automation, decision-making, efficiency, and innovation that could reduce costs across diverse industries and generate immense wealth. Already, excitement about AI has “added trillions of dollars to the equity market’s value,” reported Phil Serafino, Carmen Reinicke, and James Crombie of Bloomberg.

AI spending was not the only issue that gave investors pause last week. Other concerns included consumer sentiment hitting a three-year low and the government shutdown having a negative effect on the U.S. economy, reported Jeff Cox of CNBC.

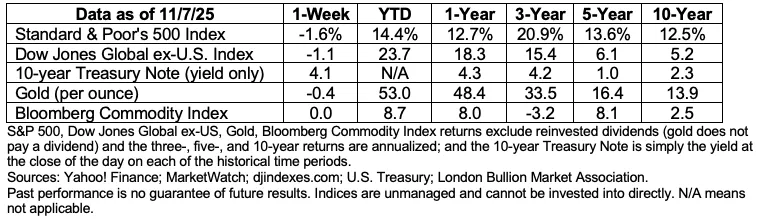

Major U.S. stock indexes gained a bit on Friday but finished the week lower. In addition, yields on most maturities of U.S. Treasuries moved lower over the week.

IS AI TAKING AMERICANS’ JOBS? Americans won’t be receiving any employment data from the government until the shutdown ends. However, some private sector companies stepped in to share the employment information they gathered in October. Overall, the picture was not rosy. Layoffs were abundant – but AI didn’t appear to be the primary culprit.

Employers in the United States eliminated more than 150,000 jobs in October – the highest number for the month since 2003, according to data compiled by a large outplacement firm. Year-to-date, more than one million jobs have been eliminated by employers. That’s a significant rise from the same period during the previous year.

For 2025, through October, the top three reasons cited for company layoffs were Department of Government Efficiency (DOGE) actions, market and economic conditions, and corporate restructuring. In October, the top three reasons were cost-cutting, AI, and market and economic conditions.

| October 2025 | 2025 (through October) | |

|---|---|---|

| DOGE actions | – | 293,753 |

| Cost-cutting | 50,437 | 77,285 |

| Artificial intelligence (AI) | 31,039 | 48,414 |

| Market/economic conditions | 21,104 | 229,331 |

| Business closed | 16,739 | 161,391 |

| Federal government layoffs/shutdown | 8,983 | 8,983 |

| Restructuring | 7,588 | 108,038 |

“Some industries are correcting after the hiring boom of the pandemic, but this comes as AI adoption, softening consumer and corporate spending, and rising costs drive belt-tightening and hiring freezes. Those laid off now are finding it harder to quickly secure new roles, which could further loosen the labor market,” reported the Chief Revenue Officer of the outplacement firm.

While the number of layoffs was quite large in October, that’s just one part of the employment picture. A large payroll firm’s National Employment Report found that private-sector employers added 42,000 jobs last month. In other words, enough new jobs were created to offset October layoffs. The new positions were primarily in the areas of education and health services, and trade, transportation and utilities.

WEEKLY FOCUS – THINK ABOUT IT

“It is a capital mistake to theorize before one has data. Insensibly one begins to twist facts to suit theories, instead of theories to suit facts.”

– Sir Arthur Conan Doyle, author of the canon of Sherlock Holmes