April 17, 2023

The Markets

Keep your eye on the big picture.

Last week, there was nothing too surprising in economic and financial news.

Inflation eased, as expected, although it remained above the Federal Reserve (Fed)’s target rate. The Treasury yield curve remained inverted with three-month Treasury bills yielding more than 10-year Treasury notes, as they have been since November 2022. Also, we may be nearing an end to rate hikes around the world. Bloomberg News reported:

“With the first signs of dents in economic growth now visible, and fallout from financial-market tensions lingering, any pause by the Federal Reserve after at least one more increase in May could cement a turn in what has been the most aggressive global tightening cycle in decades.”

Recession predictions for the United States continue to be prominent and varied, ranging from no recession to mild recession to deep recession over the next three to 18 months, reported Rafael Nam and Greg Rosalsky of NPR.

Minutes from the Fed’s March meeting were released last week, and they show that Federal Open Market Committee members think tightening credit conditions could result in a mild recession later this year with recovery following in 2024 and 2025.

While the idea of an economic downturn can be unnerving, recessions are part of every economic cycle. In times of uncertainty, it can help to step back and look at the big picture: the United States is quite remarkable.

“Nearly four-fifths of Americans tell pollsters that their children will be worse off than they are. In fact, America has sustained its decades-long record as the world’s richest, most productive and most innovative big economy. Indeed, it is leaving its peers ever further in the dust…American firms own more than a fifth of patents registered abroad, more than China and Germany put together,” noted Zanny Minton Beddoes of The Economist.

Economic and market uncertainty persists in the United States and elsewhere. We may experience a recession this year. We may not. Either way, it’s important to keep the big picture in mind. Recessions are one part of the economic cycle – expansions are another.

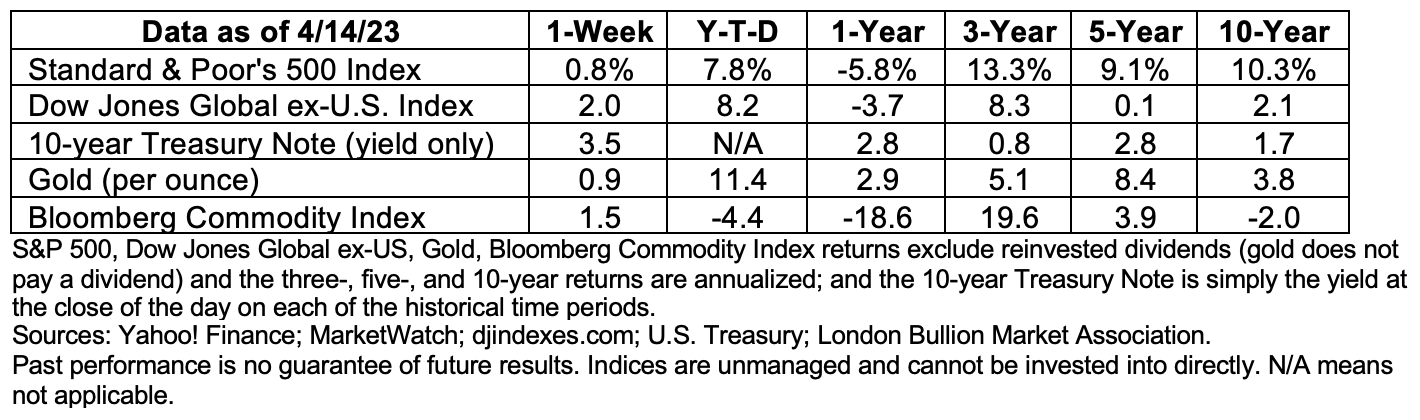

Last week, major U.S. stock indices finished higher, reported Nicholas Jasinski of Barron’s. In the Treasury market, yields on many maturities moved higher over the week.

Weekly Focus – Think About It

“Whenever you do a thing, act as if all the world were watching.”

—Thomas Jefferson, founding father

Required Disclosures:

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.bls.gov/news.release/cpi.nr0.htm

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202304

https://www.bloomberg.com/news/articles/2023-04-09/end-may-be-in-sight-for-global-rate-hike-cycle-as-fed-nears-peak (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/04-17-23_Bloomberg_End%20May%20Be%20In%20Sight%20for%20Global%20Rate-Hike%20Cycle_3.pdf)

https://www.npr.org/2023/01/24/1150319679/recession-slowdown-inflation-interest-rates-jobs-employment-economy

https://www.federalreserve.gov/monetarypolicy/fomcminutes20230322.htm

https://view.e.economist.com/?qs=945bdf0fef48265431723f8e67a3bac4cc6ba8a11ea6c83eae540fb660de54a2e234d27f2f6d212e27090a5bb3dcbf42ddc5d1108092a006a4946b60f29207d5de2d32ef670336e44020ad0567abff5c (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/04-17-23_Economist_The%20Economist%20This%20Week_6.pdf)

https://www.barrons.com/articles/stock-market-needs-solid-bank-earnings-to-keep-rallying-so-far-so-good-47ae4d3e?refsec=the-trader&mod=topics_the-trader (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/04-17-23_Barrons_As%20Bank%20Earnings%20Go%2c%20So%20Does%20Stock%20Market_7.pdf)

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202304

https://www.brainyquote.com/quotes/thomas_jefferson_141477