We do not recommend Whole life insurance.

Listen to Justin Pitcock share why we don’t recommend Whole life insurance on The Money PIG podcast.

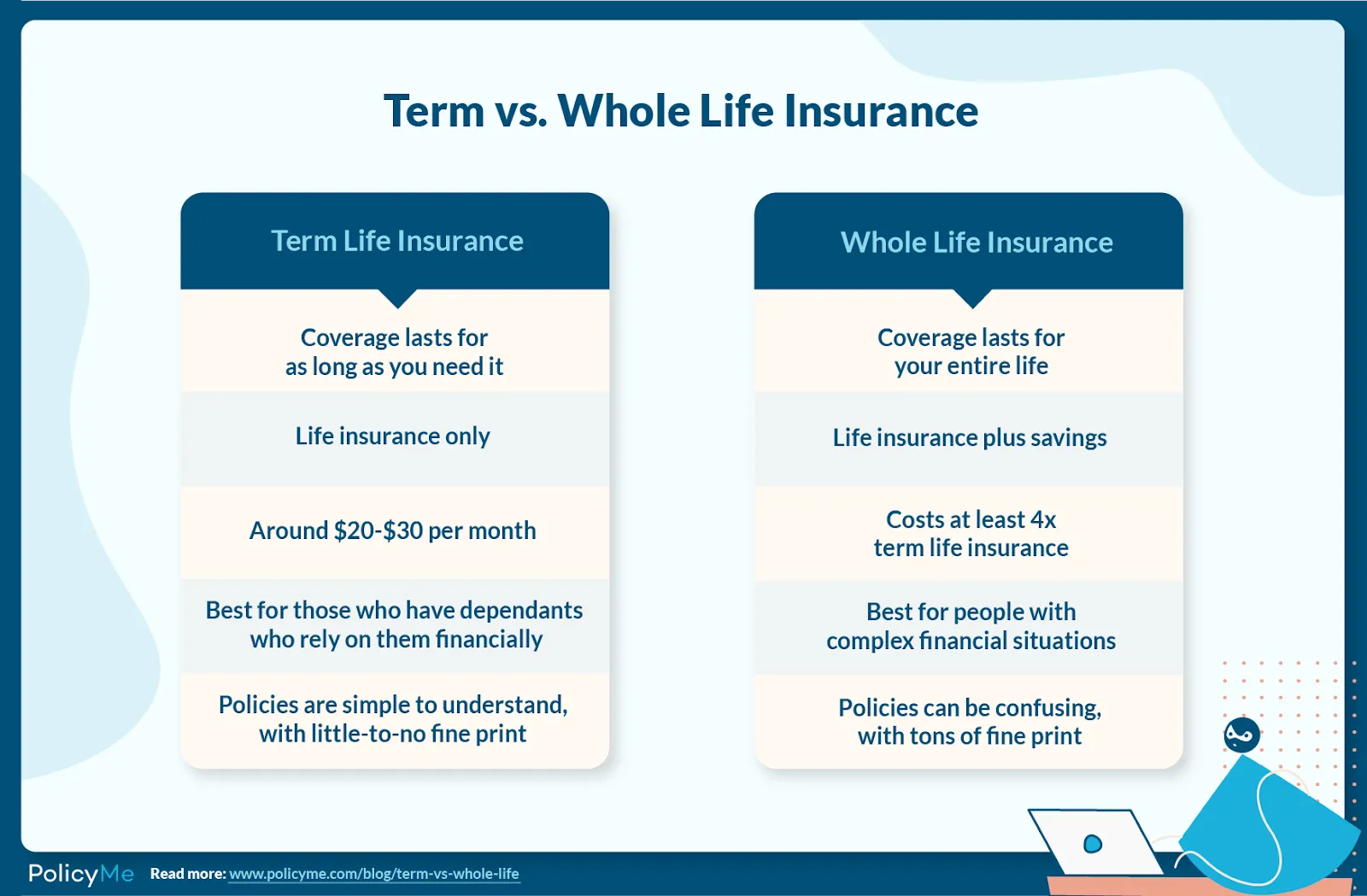

There are two types of insurance: Term life Insurance and Whole life Insurance. The chart below provides a brief comparison.

- Term life insurance offers simple and affordable coverage for a specific predetermined amount of time, typically 10–30 years. If you die within the set term, your loved ones or beneficiaries receive the policy’s payout. It’s pretty straightforward.

- Whole life insurance has higher premiums because it combines insurance and investing—which means that your money is paying for lifetime insurance coverage and has cash value options. One complication of Whole life insurance is that if you pass away with a whole life policy, your loved ones receive the policy’s original payout amount. But the insurance company keeps it if you don’t take out your cash value savings before you die. (Nobody knows when they are going to die, so it makes this tricky with a significant risk of losing your cash value)

Whole life insurance may not be the most suitable option for everyone. Here are some reasons our Financial Advisors caution against purchasing it for specific individuals.

- Monthly cost: Whole life insurance is typically more expensive than term life insurance, and any dividends or profits earned are taxed as ordinary income if cashed out early.

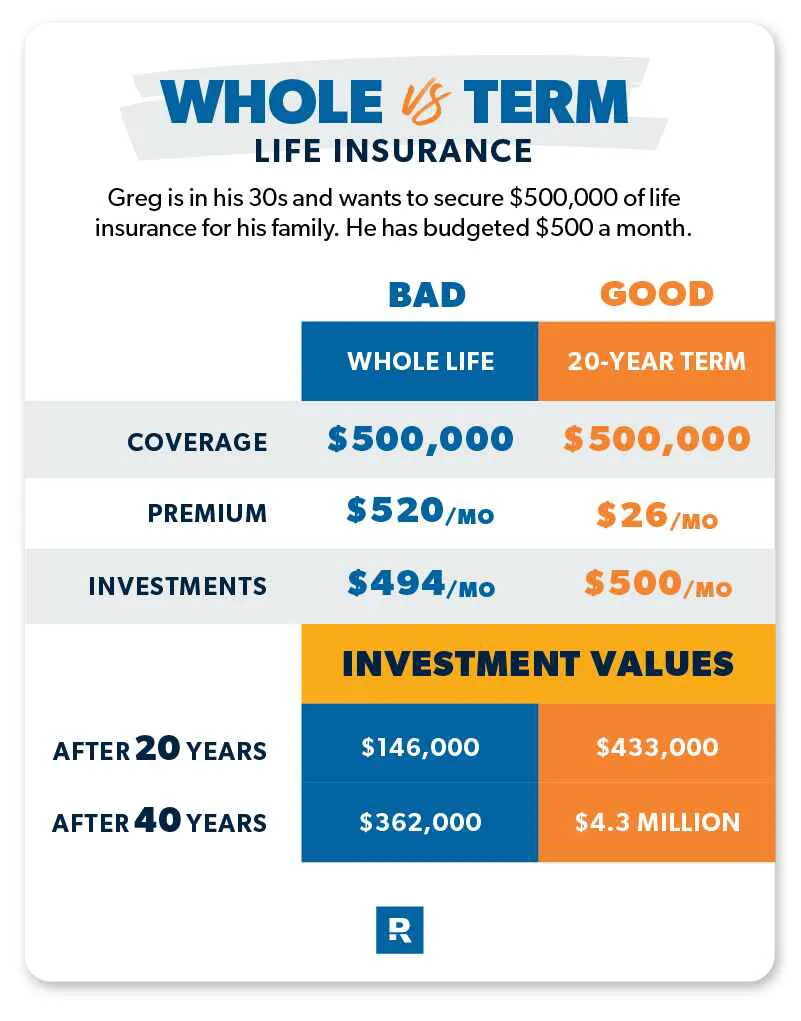

- Opportunity cost: The growth you could potentially miss out on by paying for this type of insurance coverage instead of investing the money elsewhere.

- Most consumer advocates do not recommend whole life insurance (another red flag)

- Try asking the person wanting to sell you whole life insurance, “How much money do you make by selling me this insurance?” Then, see if you are still comfortable moving forward.

- Bringing insurance and investing together is typically not beneficial for the buyer.

The above graph is from Ramsey Solutions’s Term Life vs Whole Life Insurance article.

Ramsey Solutions shares its opinion on the topic, stating, “Bottom line: Don’t mix insurance with investing by purchasing a whole life policy. You’ve got way better ways to invest than what you’ll find in an insurance plan.”

This article from BFM Asset Management provides a more detailed comparison. “Whole life vs term life insurance: the “Buy Term Invest the Difference.”

Our advisors recommend term life insurance to our clients for the above reasons.

Before purchasing any life insurance policy, individuals should carefully assess their financial goals, needs, and budget. Consulting with a fiduciary can help determine the most suitable life insurance strategy based on individual circumstances.