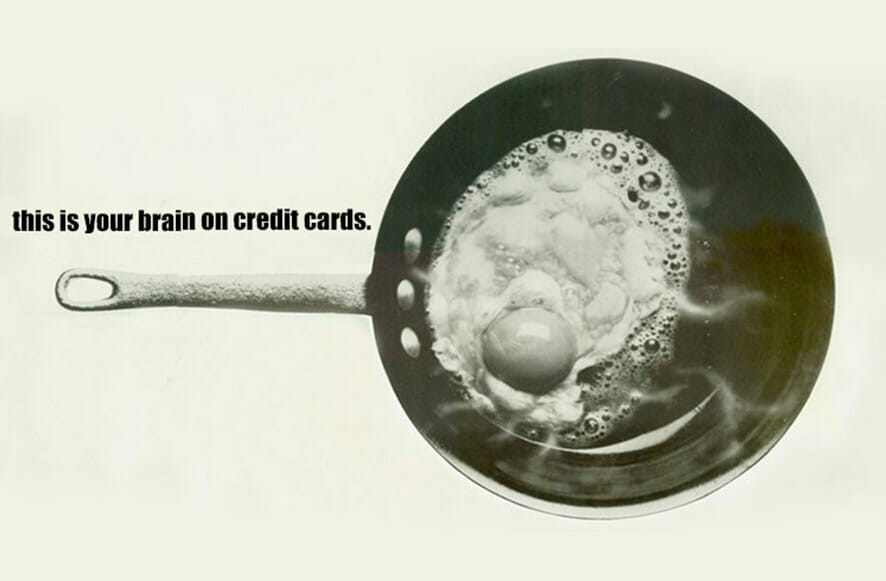

Derek Thompson, wrote an article titled, This is Your Brain on Credit Cards. He is a staff writer at The Atlantic, where he writes about economics, technology, and the media. He is the author of Hit Makers and the host of the podcast Crazy/Genius. The title of this article makes me immediately think of the old drug infomercials that stated – “This is your brain” and “This is your brain on drugs,” while zooming in on an egg frying in a pan. Well, this article will show you how credit cards and their use can actually scramble/fry your brain just like an egg and cause you to make unwise purchases.

In Derek’s article he mentions a new study conducted by Massachusetts Institute of Technology (MIT) in which they asked participants to bid on NBA tickets with either cash or credit and the results concluded that those using a credit card as their payment option, bid twice as high as the cash bidders. Derek then poses the question, “Why are we as consumers willing to spend double when we pay with plastic than cash?”

Jonah Lehrer who studied neuroscience at Columbia University and was a Rhodes Scholar, explains how shopping decisions cause a competing effect between the two parts of our brain. He explains, “the nucleus accumbens (NAcc) goads us with sweet dopamine while the insula pushes back by secreting bitter feelings of aversion.” It’s a battle between your left and right side of your brain, or your conscious brain and your subconscious brain. You can read more about his findings in his book, How We Decide, where he discusses: How does the human mind make decisions? And, how can we make those decisions better?

Here’s the problem with credit cards: the brain, specifically the Cortex insularis that deals with disgust, pain, and loss doesn’t seem to understand how they work. When we pay with plastic, the transaction is abstract and arbitrary. We don’t physically see money transferring hands – it happens electronically. So in our brains, we didn’t have to give anything up in return for the good, or service. In another article titled, Lottery Tickets and Credit Cards: The Dangers of an Irrational Brain, Lehrer interviews George Loewenstein, who is a neuro-economist at Carnegie Mellon University and an expert on the brain activity triggered by retail shopping. Lowenstein said, “The nature of credit cards ensures that your brain is anesthetized against the pain of payment.” So, because spending money doesn’t feel bad, we spend more money, even when we can’t afford it.

Another study in 1999 by Dilip Soman, a professor of marketing at the University of Toronto, suggests that that people are significantly more likely to make purchases with credit cards then with cash. In 2001, they completed another study that showed how people are less likely to recall, and more likely to underestimate, how much they spent on a recent transaction when they paid by credit card than with cash. It’s like our brain’s really are on drugs, or can’t comprehend or process the payment as a real transaction, so we in turn think it is “free money” and don’t feel the consequences. At least, not at first.

To back this up even further, in an article done by the Cleveland Clinic called, Why Your Brain Falls for the Credit Trap, they interviewed a clinical psychologist, Scott Bea, PsyD. He explains that by nature our brains don’t know how to fully grasp the concept of credit. He says the exchanges we make with credit cards are taxing for our brains to interpret stating, “Somewhere, our brain knows we have to pay for it, but it gets harder to actually pay for something without a physical exchange, and especially after we’ve consumed it.” This stems from a term called sense processing which is the human brain’s ability to make sense of things by using our five senses. He also connects credit card use to gambling, mentioning, “It’s very similar to what happens in a casino when people are handed chips instead of real money. The more they become separated from the actual tangible money, the easier it is to get into trouble.” So, we need to be extra careful and become aware of our brain’s lack of understanding when it comes to invisible transactions.

At Goodwin Investment Advisory, we don’t want your interest to go both ways, or for your brain to become immune to the effects of credit cards. We encourage you to follow Dave Ramsey’s 7-baby steps, beginning at step Zero, which is to decide to stop using credit cards altogether. Create an emergency fund and once that is in place, close your credit cards. You can even close your cards when they have a remaining balance. You will have to keep paying off the remaining amount, but you won’t be able to continue to add charges. Credit cards are not your friend and you don’t need them. We advise you NOT to use credit cards, because unless you’re spending cash/debit, it’s costing you money to spend your money. Now, that should resonate with your logical brain.

You might be arguing, “What about all the reward points I would lose?” Well our rebuttal is – what you would have gained in credit card reward points you would have lost in overspending on your credit card. So, you don’t have to worry about missing out on those credit card reward points. So in looking out for you, we urge you this Christmas season to be aware and use cash instead. Don’t let your brain be tricked into racking up tons of credit card debt that you will end up taking into the new year. Decide to plan ahead, save, and spend only the budgeted amount this Holiday Season, because in the end if you use cash, or debit you will spend less money and will have more money to invest, which will grow over time, creating your own rewards.

Nathan W. Morrisen said it best, “Every time you borrow money you’re robbing your future self.”