Insider Guide

May, 2023

The client appreciation was such a wonderful celebration!

Thank you to all those who were able to make it to last Sunday’s event! The weather was perfect, the food was incredible, and who could forget the fantastic venue. Rocky’s Lake Estate provided such a beautiful atmosphere. The cigar roller and s’mores in the gazebo around the fire pit were a big hit. Plus, the swans! We trust all of you that were able to make it felt loved and appreciated, and we missed all of you that were not able to attend. We are so thankful to have Angela Lyle on our team to put these extraordinary events together.

Increase your 401k contributions

Chad Parks, Ubiquity Founder and CEO, shared his advice recently and we wanted to pass it along.

For retirement savers who are saving for a retirement that is 10, 20, or 30 years away, it can make sense to take advantage of the markets when they drop. By taking advantage I mean – increase your retirement contribution percentage, if you’re able, since your money will buy more shares in your retirement investments than before. Definitely do your homework, but he is one to believe what’s going on right now can be thought of as “a sale” that you’ll benefit from years from now. And our advisors at Goodwin Investment Advisory generally agree. You can always talk to your advisor about your specific situation and see what they suggest for you.

real estate update

The “new federal housing rule”

This new rule is changing how upfront mortgage loan fees are calculated and it went into effect on May 1st, 2023.

According to Newsweek, “Starting in May, the current structure of the Loan-Level Price Adjustment (LLPA) matrix will be adjusted by the Federal Housing Finance Agency (FHFA) in the hope of addressing housing affordability challenges in the U.S.” This will be done by decreasing the initial closing fees for some loans (especially for first-time buyers), while increasing the fees for some other loans. (Note: interest rates are not affected by this.)

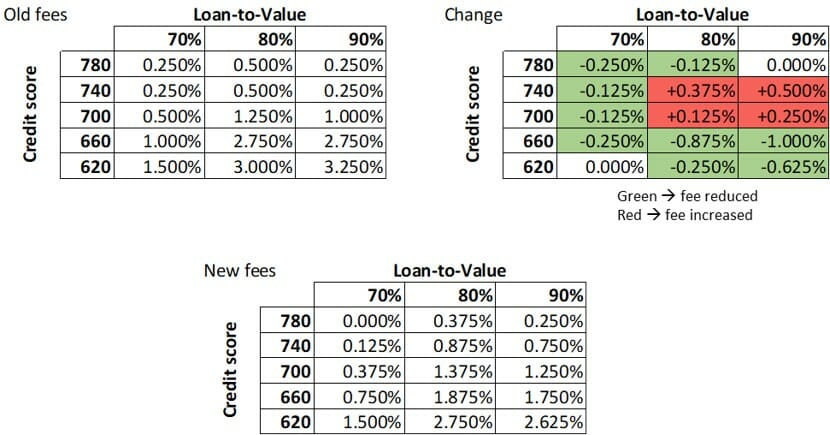

Here is a snapshot of the fee changes for a few cases, derived directly from the tables provided by FannieMae

As can be seen from FannieMae’s tables, the fees are increasing for some lenders, but overall the fees will remain significantly lower for those with good credit – so it is important to keep your credit score as high as possible!

Disclosure

The information shared is based on publicly available sources, and the summary of changes is provided in good faith. Goodwin Investment Advisory is neither a mortgage broker nor a mortgage provider, and does not earn any compensation from the sources listed. Please contact your lender, bank or broker to get specific information relating to your unique situation.

Blog Update

Our newest blog titled, Do fear and greed dictate the market?” talks about how to handle the ups and downs of a fluctuating market as well as the emotions that come with it. The blog shares some helpful tips and advice on how to respond when investors are feeling either fearful or greedy.

Check out the newest episodes from The Money PIG Podcast hosted by our very own Reid Trego. Each episode features practical wisdom from our expert advisors. The newest episodes are linked below covering topics from career transitions, Social Security, and even Pensions. Please subscribe and follow our podcast on Apple Podcasts! You can also find us on Spotify. Maybe one of the episodes would be good to share with family and friends.

In case you were wondering about the name, the Money PIG reminds us that we strive for financial Peace, Independence and Generosity!

Our guides

We have many resources (e.g. several guides and Tim’s book) that might be useful to you, or your friends and family, as different situations arise. We thought it would be helpful to share some of them with you. Some of the guides have printable checklists as well.

nourish to flourish

with Tara Bruce

I am a certified life coach and currently working on my International Coaching Federation Certification Level 2 so that I can focus specifically on Retirement Consulting as it seems to be a way my gifts can truly intersect with a need in the world. I thought I could use this section of the insider moving forward to share something that would be nourishing, or provide a helpful tool you could try that could potentially become a healthy habit. One of my favorite quotes is from a Papua New Guinea proverb that says, “Knowledge is just a rumor until it moves into the muscle.” This means you can know about something and even believe it, but until you practice it and exercise that tool and concept it doesn’t actually become a part of you. I believe the goal is to embody within ourselves the things we want to see in the world. It always starts within.

A simple practice: start small as it is always about progress over perfection. Set an alarm every day at the same time. This is to help you create a healthy habit. Use that time at first to block off 5 minutes with the only goal of asking yourself the question, “What do I need in this moment?” Then spend 5 minutes doing what you need. This could be some deep breaths, a walk outside, a drink of water, a brief meditation, some words of affirmation, to express gratitude to a loved one or friend, processing an emotion you are feeling, or even just stretching your body. There is no wrong choice here as this time is for you alone. You can increase the time or create 2 separate alarms after you have created the habit (it takes about 3 weeks to create a habit and then it can become second nature). Beginning to start listening to what you need, or what your body needs is a powerful practice that you can expand overtime. It allows you to not get so caught up in your everyday activities that you neglect to recognize when you need to nourish yourself. You can’t give away what you don’t have. So give yourself some loving kindness so that you can pass that on to others.

Old fashioned Bourbon punch – A taste from our client appreciation event you can make at home

*This was a huge hit at our event

Ingredients:

Woodford Reserve Bourbon (or any Bourbon of your choice)

Orange juice

Tart cherry juice

Ginger ale

Ice

orange slices

sprig of rosemary or other herb (not necessary but looks more fun)

Directions:

You can premix 2 parts orange juice to one part bourbon. (or take it up a notch and mix equal parts of each)

Pour mixture over ice and fill cup half way

Add a splash of tart cherry juice

top with ginger ale

Add a slice or orange and rosemary if you like

Enjoy!