Friday, September 3, 2021

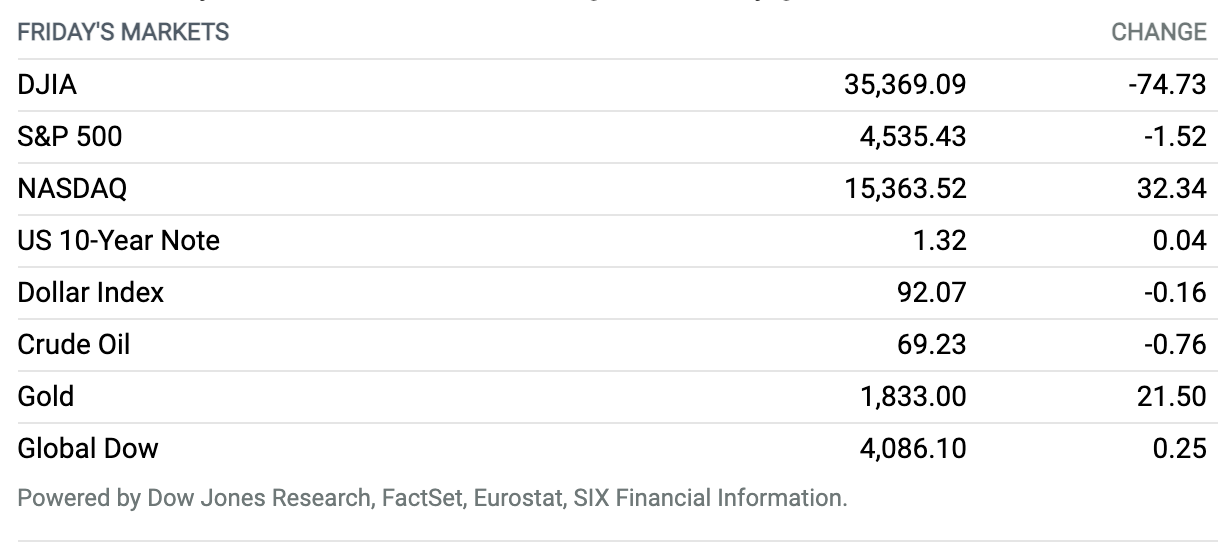

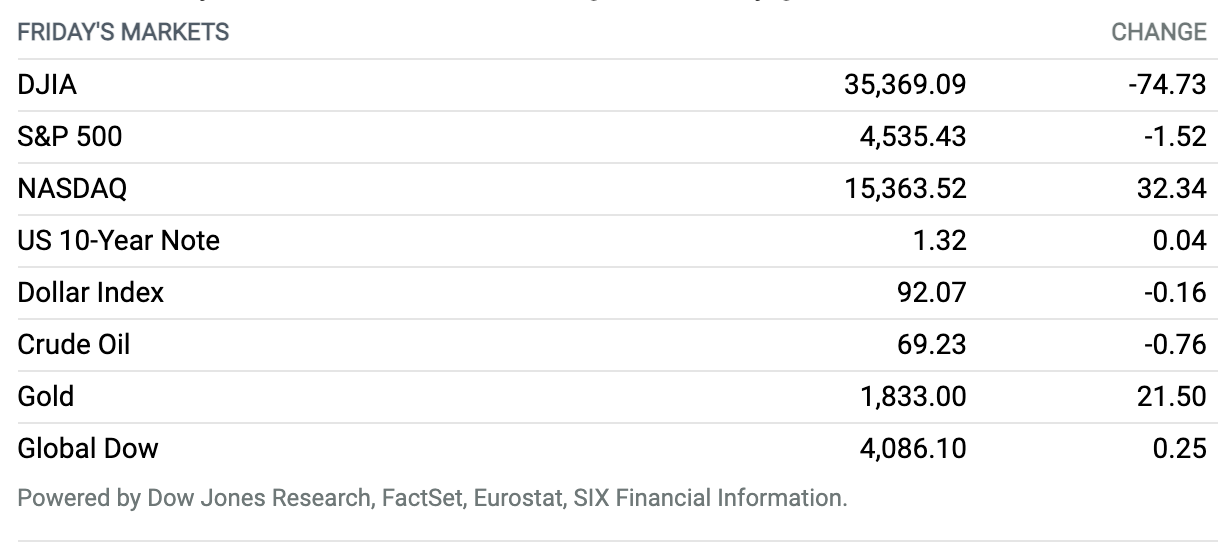

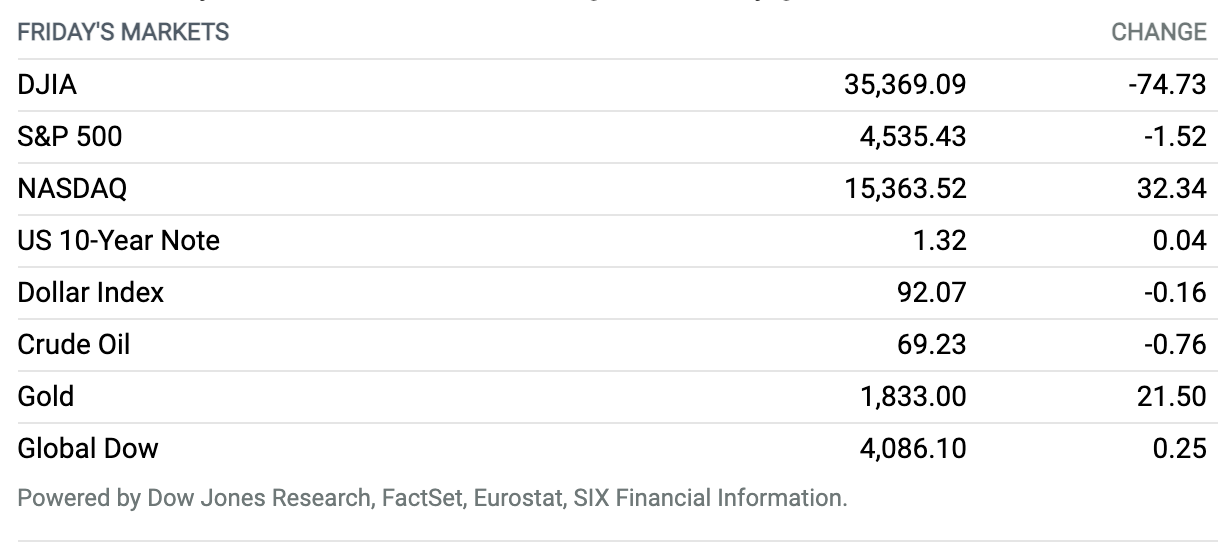

Nasdaq Hits Another Record as S&P 500, Dow Sag After Weak Jobs Report. U.S. stock indexes ended mixed Friday, with the Nasdaq booking its 35th record close of 2021, but the other two main benchmarks closing lower after a report on monthly employment from the Labor Department came in weaker than expected. The Dow Jones Industrial Average closed down 0.2% on Friday to end the session at 35,369, and booked a weekly decline of 0.24%. The S&P 500 index finished 0.03% lower on Friday to close at 4535, but marked a 0.6% gain for the week, while the Nasdaq Composite notched a 0.2% gain for the day, enough for a record closing high—its 35th of the year—of 15,363, contributing to a weekly gain of 1.6%

Jobs Growth Falls Way Short. Tapering Likely Delayed, but Recovery Worry Mounts.

Employers added 235,000 jobs in August, far short of the 750,000 economists anticipated and reflective of an ongoing labor shortage and the Covid-19 Delta variant’s impact on the labor market recovery.

The disappointing increase in nonfarm payrolls last month is the smallest since January, and will likely delay any tapering of the central bank’s bond-buying program. The massive miss undermines growing expectations that reductions in the $120 billion in monthly Treasury and mortgage-backed securities purchases will begin this year.

“This will certainly help keep the Fed on hold on their tapering plans, likely for the rest of the year, and keep interest rates low, which will likely cushion any impact on the markets,” says Brad McMillan, chief investment officer for Commonwealth Financial Network.

Continue reading ›

SEC’s Gary Gensler Has a Big, New Vision for the Stock Market

Gary Gensler, the new chairman of the Securities and Exchange Commission, seems intent on overhauling market structure in ways that he thinks will make it fairer for new retail traders and everyone else.

The infrastructure that allows investors to tap on a phone and instantly buy stocks and options has been revolutionary. Yet the trading system is extremely complex underneath, and it could be in for a remake. Gensler is particularly concerned that the market for executing stock trades has become segmented, with nearly as much order flow going to “dark pools” and other less-transparent venues as goes to exchanges.

Continue reading ›

Apple Will Ease Payment Rules for Some Media Apps Like Netflix and Spotify

Apple will ease payment rules for certain apps like Netflix and Spotify, a concession that will allow some media platforms to bypass fees the tech giant collects on in-app purchases.

The move was prompted by a ruling from Japan’s Fair Trade Commission, but will apply globally, the company announced this week. Starting in early 2022, some media apps will be able to share a single link to their website to allow users to set up and manage their account.

Continue reading ›

Gas Prices May Keep Rising After Labor Day. Blame Hurricane Ida.

Labor Day weekend traditionally signals the conclusion of the U.S. summer driving season, but it may not mark the end of the peak period for gasoline prices, which stand near their highest since 2014.

Atlantic storm Ida, which hit the U.S. Gulf Coast as a Category 4 hurricane on Aug. 29, led to the shutdown of some key Gulf Coast refinery operations, and it’s still not clear when those may fully resume.

Continue reading ›

What to Know About Mu, a New Covid Variant Detected in 39 Countries

A new strain of the virus that causes Covid-19 that is now responsible for a growing proportion of cases in Colombia, and which has been detected in 39 countries around the world, is now a “variant of interest,” according to the World Health Organization.

Designating the variant with the Greek letter Mu, the agency said that early data indicate that the immunity provided by vaccines or through prior infection “may not be as strong against this variant,” though more studies are needed.

Continue reading ›

Robinhood Says It Likely Would Challenge a Ban on Payment for Order Flow

Robinhood Markets fired back at the Securities and Exchange Commission after the agency said it’s considering eliminating a revenue stream that subsidizes the brokerage’s zero-commission business model. The firm told Barron’s it likely would challenge a ban in court.

“The idea of banning payment for order flow is pretty draconian,” Robinhood’s legal chief Dan Gallagher, himself a former SEC commissioner, said this week. “This is the revenue that provided us the ability to offer commission-free trading with no minimum balance.”

Continue reading ›

Elizabeth Warren Urges Justice Department to Investigate Google-Facebook Ad Deal

Four members of Congress have asked the Justice Department to launch a criminal investigation into whether an advertising agreement between Facebook and Alphabet violated federal antitrust laws.

The letter, signed by Sens. Elizabeth Warren (D., Mass) and Richard Blumenthal (D., Conn.), and Reps. Pramila Jayapal (D., Wash.) and Mondaire Jones (D., N.Y.), was sent to Attorney General Merrick Garland and Acting U.S. Attorney Nicholas Ganjei.

Continue reading ›

Elon Musk Hosted a Tesla ‘All Hands’ Meeting. Here’s What Happened.

Things are getting more complicated for electric vehicle leader Tesla.

The company is balancing the addition of new models, new capacity, and new employees, all during a pandemic and a semiconductor shortage that is constraining global auto production. The rising complexity might be why CEO Elon Musk wanted to chat with employees.

Continue reading ›

Disney May Have a China Problem

Shang-Chi and the Legend of the Ten Rings made its debut in the U.S. on Friday, just in time for Labor Day weekend. The summer movie season gets longer every year, it seems. Not so in China, the world’s second-largest movie market, where Shang-Chi may not be shown at all.

Starring Simu Liu and Awkwafina, the martial-arts epic is the 25th film release in Walt Disney’s never-ending Marvel Cinematic Universe. It’s the first picture in the MCU with a lead actor, director, and majority of the cast coming from Asian backgrounds.

Continue reading ›

Reddit May Be Moving Toward an IPO

Social-media company Reddit, which operates online communities and chat rooms, is seeking to hire bankers and lawyers to quarterback an initial public offering in New York, according to a report.

The company, founded in San Francisco in 2005, reportedly targets a valuation of more than $15 billion, after being valued at $10 billion in a private fundraising round last month. The IPO could happen early next year.

Continue reading ›

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.