Friday, November 20, 2020

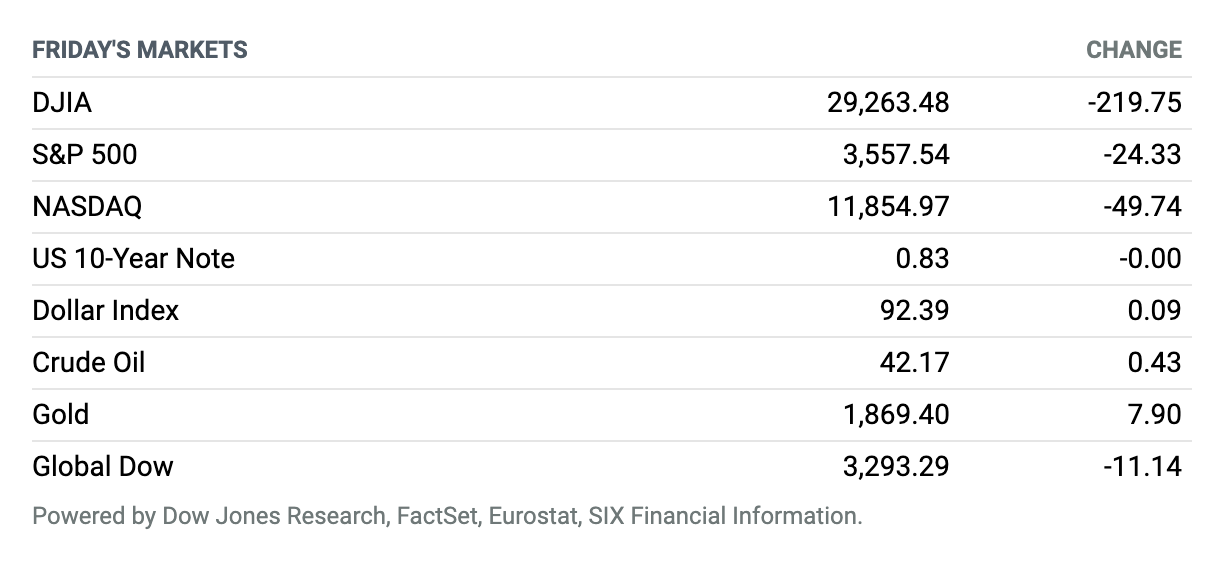

Stocks Slip as Fed, Treasury Clash on Spending. Stocks closed out the week with losses, as Covid-19 cases surge, states shut down, and the threat of expiration of five Federal Reserve credit facilities looms. Technology stocks outperformed, however, ending with a weekly gain. For the session, the Dow Jones Industrial Average fell 219.75 points, or 0.7%, to 29,263.48, while the S&P 500 fell 24.33 points, or 0.7%, to 3577.54. The tech-heavy Nasdaq Composite was down 49.74 points, or 0.4%, to 11,854.97. Yet the Nasdaq closed 0.2% higher for the week, as the prospect of more social distancing policies and restricted movement prompted investors to buy stocks of tech companies whose products are used more during shutdowns. For the week, the S&P 500 saw a 0.8% decline, and the Dow lost 0.7%.

Pfizer and BioNTech Are Filing Today to Distribute Their Covid-19 Vaccine

Two days after reporting that their Covid-19 vaccine was 95% effective, Pfizer and BioNTech said they will submit a request to U.S. regulators on Friday for an emergency use authorization to sell the product. Pending review by the U.S. Food and Drug Administration, the vaccine could reach high-risk populations by mid-December.

Vaccine rival Moderna is close to finishing its own clinical trial, after showing comparable effectiveness in an interim data analysis.

FDA officials have said that review of Covid vaccine submissions could take weeks. The agency’s outside vaccine experts have reportedly been told to reserve Dec. 8 through 10 for hearings on a vaccine. It is possible that they’ll be considering both the Pfizer/BioNTech product and Moderna’s. In Friday’s announcement, Pfizer and BioNTech said they would be ready to ship within hours of authorization.

The Treasury Is Asking the Federal Reserve for Its Money Back

The Federal Reserve will likely be forced to close five pandemic programs on Dec. 31 and return unused funds unless Congress acts.

Treasury Secretary Steven Mnuchin declined to extend the programs in a late Thursday letter to Fed Chairman Jerome Powell, saying that they had done their job and highlighting that much of their capacity remains unused. What’s more, he said, the only programs slated to close are those financed with Treasury funding appropriated by Congress in the Cares Act. Mnuchin asked the Fed to return unused funds and extend the four programs that don’t have that funding.

Jobless Claims Climb as Covid Cases Surge

The number of U.S. workers filing initial claims for unemployment benefits climbed more than expected in the latest week, as surging coronavirus cases pressure the economy.

First-time jobless claims rose by 31,000 in the week ended Nov. 14 to a seasonally adjusted 742,000, the Labor Department said Thursday. The previous week’s level was revised up by 2,000 to 711,000. Economists surveyed by the Wall Street Journal had predicted the latest reading would rise to 710,000.

The four-week moving average, which smooths out volatility, was 742,000—a decrease from 755,750.

AstraZeneca’s Covid-19 Vaccine Produces Strong Immune Response in Older Adults

The experimental Covid-19 vaccine being developed by AstraZeneca and the University of Oxford produces a robust immune response in older adults, data from midstage trials have shown.

The Phase 2 results, published on Thursday in medical journal The Lancet, suggest that the age groups most at risk of death or serious illness from coronavirus may be able to build immunity. The peer-reviewed findings, based on a study of 560 adults, showed that older adults aged 56-69 and over 70 had a similar immune response to younger adults aged 18-55.

U.S. Retail Sales Rise in October, but Pace of Growth Decelerates

Sales at U.S. retailers rose modestly in October with the help of a pandemic-delayed Amazon Prime Day, but the already fading momentum is in danger of softening even further amid a record coronavirus outbreak.

Retail sales rose 0.3% last month, the government said Tuesday, matching the forecast of economists polled by MarketWatch. Although it was the sixth advance in a row, it was the smallest gain since the economy reopened in May.

Walmart Reports Strong Results, but Sales Growth Slows

Walmart reported better-than-expected third-quarter results that show the retail giant is doing well in holding on to pandemic-related gains. Walmart said it earned $1.34 a share on revenue that rose 5.2% year over year to $134.7 billion. Analysts were looking for EPS of $1.18 on revenue of $132.1 billion.

However, there were some items to nitpick in the report. Overall revenue growth, same-store sales growth, and e-commerce growth slowed from second-quarter levels, and the company didn’t provide much in the way of detail about its new Walmart+ subscription service.

The Boeing 737 MAX Jet Is Back. That’s Good News for Lots of Companies.

The Boeing 737 MAX jet is officially back. Wednesday, the FAA rescinded its temporary grounding of the plane, an order that had been in place for 616 days, or almost 20 months, beginning on March 13, 2019.

That’s good news for Boeing, which makes the aircraft. But it’s also a positive development for its suppliers, such as Spirit AeroSystems and General Electric, and for its airline customers, which include Southwest.

GM Doubles Down on Electric Vehicles

Ahead of a presentation at an investor conference on Thursday, General Motors announced some bold electric-vehicle goals stretching out to 2025. The news is sure to get investors talking about GM’s product plan, EV strategy, and the company’s ability to compete effectively with the likes of NIO and Tesla.

General Motors plans to have 30 all-electric vehicles on the market by 2025. Management also said that more than half of all capital spending in coming years will be for electric and autonomous vehicles. That works out to $27 billion.

Apple Halves App Store Fee for Smaller Developers

Apple is halving the commission it charges smaller developers that sell software through its App Store, a partial concession in its battle with critics over how it wields power in its digital ecosystem.

Starting next year, the iPhone maker said Wednesday, it will collect 15% rather than 30% of App Store sales from companies that generate no more than $1 million in revenue through the software platform, including in-app purchases. The fee will remain 30% for developers whose sales through the App Store, excluding commission payments, exceed $1 million—meaning the reduction won’t affect such vocal Apple opponents as videogame company Epic Games.

PNC Will Pay $11.6 Billion for BBVA’s U.S. Unit

NC Financial Services Group has agreed to buy Spanish lender BBVA’s U.S. unit for $11.6 billion in cash, in one of the biggest bank deals since the financial crisis of 2008.

The deal will create the fifth-biggest U.S. retail lender (behind JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup), with around $560 billion in assets, and give Pittsburgh-based PNC a “coast-to-coast franchise” with a presence in 29 of 30 of the biggest U.S. markets.