Friday, June 18, 2021

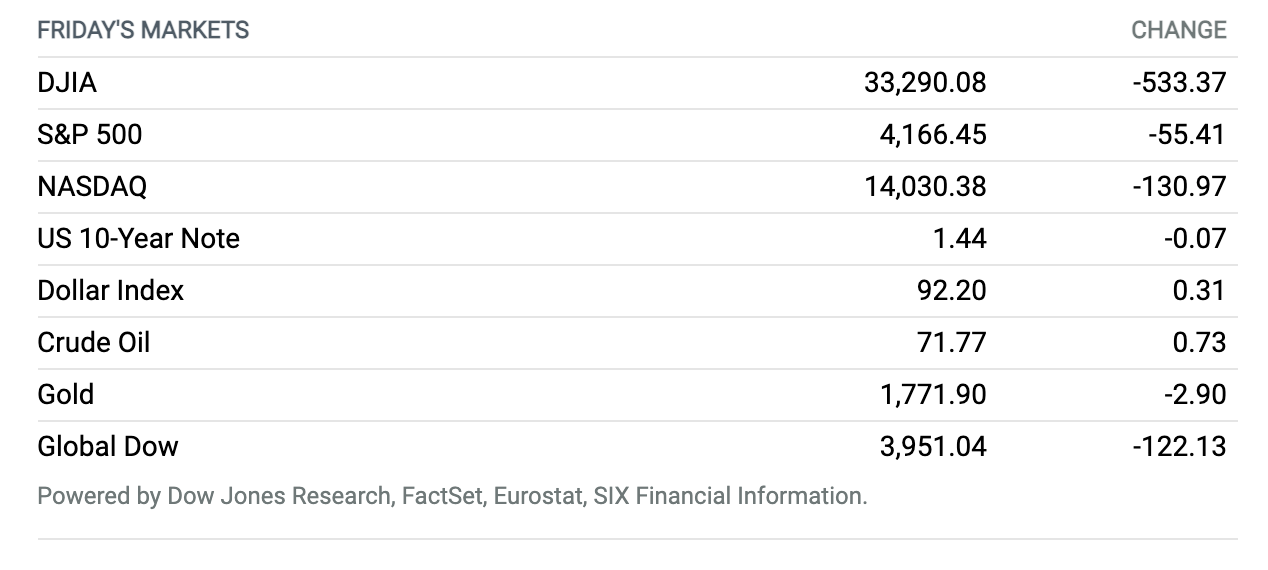

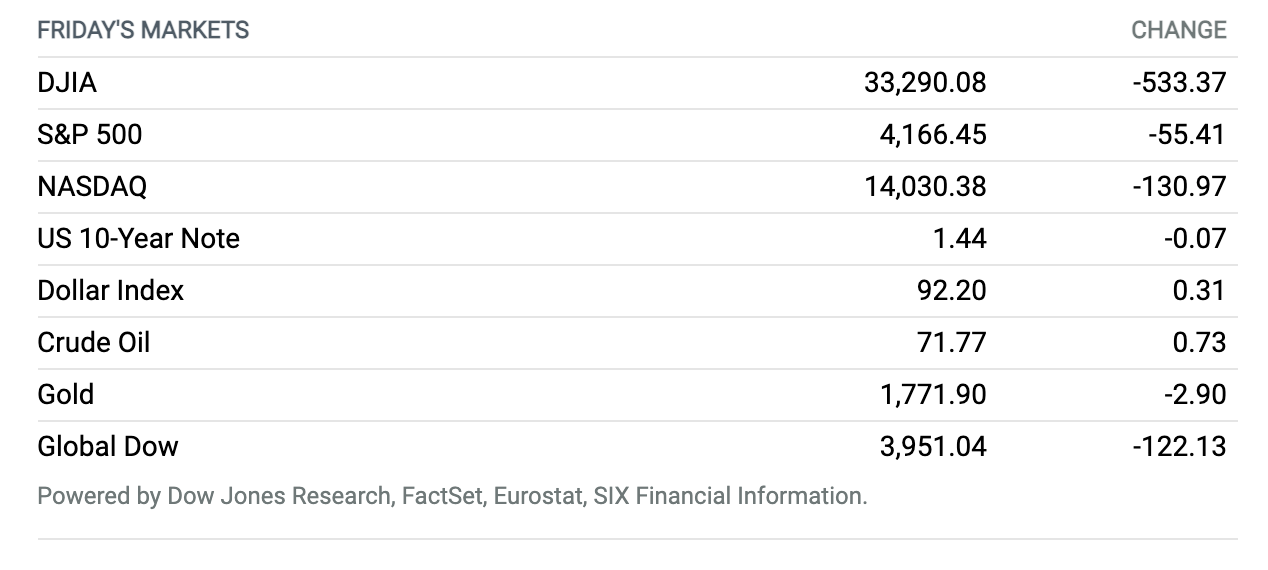

Dow Drops More Than 500 Points on Fed Worries. Stocks fell Friday, with the Dow Jones Industrial Average posting its biggest weekly decline since October on worries the Federal Reserve might begin lifting rates sooner than previously expected. The Dow fell around 533 points, or 1.6%, to close around 33,290, according to preliminary figures. The blue-chip gauge fell 3.5% for the week, its biggest since a drop of more than 6% in the week ending Oct. 30, according to FactSet. The S&P 500 fell around 55 points, or 1.3%, to close near 4166, while the Nasdaq Composite declined around 131 points, or 0.9%, to finish near 14,030. The S&P 500 suffered a weekly fall of 1.9%, while the Nasdaq saw a loss of 0.3%.

The Fed Pulls Back on Its Ultraeasy Stance. Prepare for a Volatile Summer.

It’s summertime, but the living may not be easy, at least for the financial markets.

The summer solstice arrives in the Northern Hemisphere on Sunday at 11:31 p.m. Eastern Time, and the main priority for everybody cooped up by Covid-19 is to get out and go somewhere, anywhere. In ages past, that typically meant that financial markets entered the doldrums, which sailors associate with the season. That’s been less and less the case in recent years, and this summer shapes up to be less than tranquil for the markets.

Credit or blame the Federal Reserve, which this past week signaled an eventual move away from its current ultraeasy monetary stance. While the Federal Open Market Committee made no current policy changes, its so-called dot plot of the members’ guesses about the future federal-funds rate target showed two one-quarter percentage point increases by the end of 2023. In its previous set of dots released at the March meeting, the median dot still had the Fed’s key policy rate at the present rock-bottom range of 0% to 0.25% more than two years hence. To be sure, Eurodollar futures contracts already had been pricing several rate hikes by then, so in essence the dots were getting marked to market.

Continue reading ›

Senate Democrats Are Drafting a Roughly $6 Trillion Reconciliation Package

Senate Democrats are drawing up a $6 trillion reconciliation bill that includes key elements of President Joe Biden’s two major infrastructure packages, as well as other measures targeting climate change and healthcare that Republicans oppose.

Senate Majority Leader Charles E. Schumer (D., N.Y.) is pursuing a compromise through reconciliation, a procedure on budget legislation that could achieve Democrats’ most ambitious spending plans with 51 Senate votes, instead of the 60 votes usually required.

Continue reading ›

Supreme Court Backs Obamacare

The Supreme Court has decided to uphold Obamacare. The justices, in a 7-2 ruling on California v. Texas, rejected a bid by Republicans in Texas and other states to invalidate the law, concluding they didn’t have standing to sue because they hadn’t suffered direct injury.

However, the court didn’t rule on the broader question of whether the Affordable Care Act, as Obamacare is officially known, could survive without a provision that required Americans to obtain health insurance or pay tax penalties. That “individual mandate” was upheld in 2012 by the Supreme Court, but it died in 2017 after Congress eliminated the tax penalties in the Tax Cuts and Jobs Act.

Continue reading ›

Retail Sales Fall. Producer Prices Jump. What’s Going on With the Economy?

American shoppers pulled back in May as businesses across the country raised prices, spending shifted to services from goods, and fiscal stimulus ebbed.

Retail sales for May led a slew of economic data for investors to sift through Tuesday. The data helped push major indexes lower a day before the Federal Reserve reveals updated economic forecasts and Federal Reserve Chairman Jerome Powell answers questions about the economy and monetary policy.

Continue reading ›

Apple’s and Google’s Platforms Are Under New Regulatory Scrutiny

Online platforms underpinning the dominance of Apple and Google will come under scrutiny in the U.K. from a regulator with a record of securing changes from Big Tech.

The Competition and Markets Authority, or CMA, announced on Tuesday that it had opened a study into the “effective duopoly” that Google—owned by Alphabet— as well as Apple have over the major gateways to the internet.

Continue reading ›

GM Hits Accelerator on Spending for Electric and Autonomous Vehicles

General Motors on Wednesday announced more money for the development of electric and autonomous vehicles. It is pouring billions into technology to establish a leadership position in the future of commercial and personal transportation.

GM now plans to spend $35 billion on EV and AV development between 2021 and 2025. That is up $8 billion from a November 2020 announcement, and it is up 75% from the $20 billion the auto maker said it would spend in March 2020.

Continue reading ›

Judge Blocks Biden Oil Lease Suspension

A federal judge has blocked an order from President Biden that suspended new oil and gas leases on federal lands and waters.

The preliminary injunction, released late on Tuesday, theoretically opens up millions of acres to potential new leases. But in practical terms, it may not lead to a rush of new development—and thus the stocks of oil and gas companies did not appear to be moving on the news on Wednesday.

Continue reading ›

U.S. and Europe Call Truce in Feud Over Aid to Airbus and Boeing

The 17-year feud between the U.S. and Europe over airplane subsidies is over—for at least a half-decade.

The two sides have agreed on a five-year truce over subsidies given to rival plane makers Airbus and Boeing, the White House confirmed in a statement from President Joe Biden on Tuesday. The deal, announced as Biden met European Commission President Ursula von der Leyen, is a sign of his desire to improve trans-Atlantic relations after several flare-ups during the Trump administration.

Continue reading ›

Novavax Vaccine Is Real Competition for Pfizer and Moderna

Novavax announced Monday morning that its vaccine against Covid-19 proved 90% effective in preventing the disease in a large study group.

While Novavax’s effectiveness level is slightly below those shown for the authorized vaccines from Moderna or the team of Pfizer and BioNTech, it far exceeds America’s third authorized shot, from Johnson & Johnson.

Continue reading ›

Lordstown’s CEO and CFO Resign

The electric-truck start-up Lordstown Motors surprised investors, announcing the resignation of its CEO and CFO, as well as the results of an internal investigation into allegations made this spring by the short-selling firm Hindenberg Research.

Hindenburg alleged in March that orders that the company had told investors it received were “largely fictitious” and were part of an attempt to gain legitimacy and make it easier to raise capital. It also alleged that Lordstown’s production goals were too aggressive and that its technology wasn’t likely to work.

Continue reading ›

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.