Friday, July 16, 2021

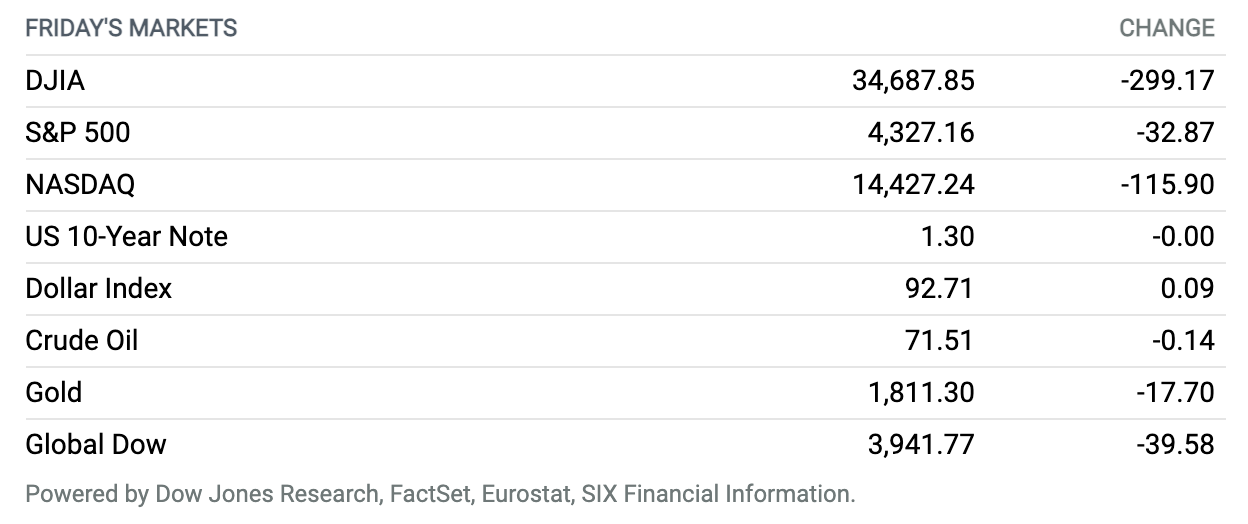

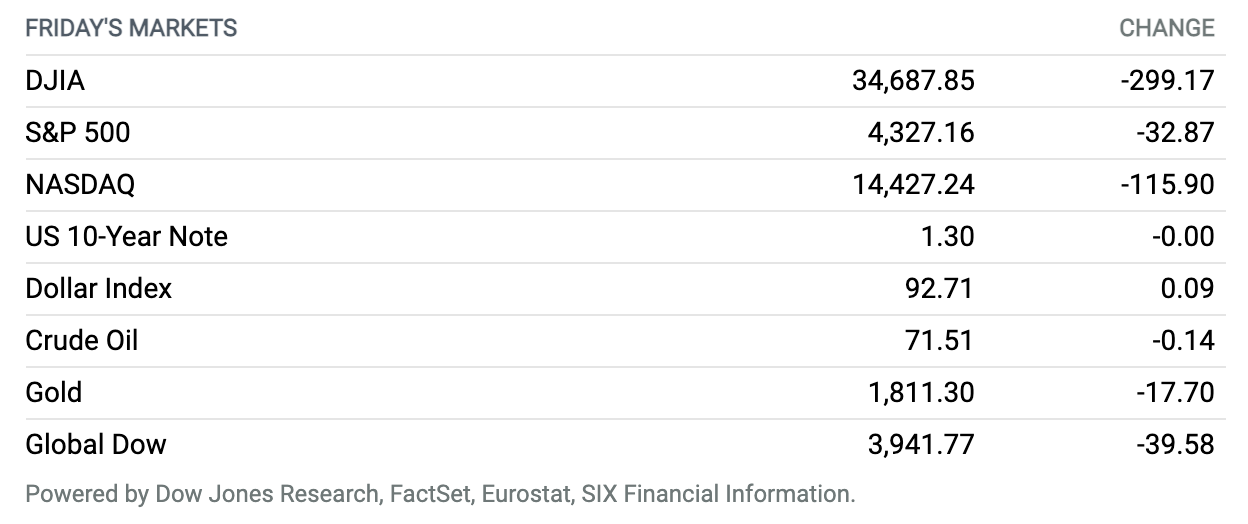

Stocks Snap 3-Week Winning Streak. Stocks ended lower Friday, giving up initial gains after a consumer survey showed inflation fears were on the rise. The Dow Jones Industrial Average ended the day down more than 299 points, or 0.9%, to finish near 34,688, while the S&P 500 shed around 33 points, or 0.8%, to close near 4327. The Nasdaq Composite gave up around 116 points, or 0.8%, ending near 14,427. All three major benchmarks posted weekly declines—Dow, down 0.5%; S&P 500, down 1%; Nasdaq Composite, down 1.9%—ending a three-week run of gains.

Retail Sales Unexpectedly Rose in June, but Consumer Inflation Expectations Jump

Retail sales rose unexpectedly in June, alleviating some immediate concerns about a spending slowdown. But a drop in consumer sentiment and jump in inflation expectations this month may portend cooler consumption in coming months.

The Commerce Department said Friday that total retail sales rose 0.6% last month from May. Economists polled by FactSet had predicted a decline of 0.5%. Excluding autos, retail sales increased by 1.3%, while sales also excluding gasoline, building materials, and food services considered volatile rose 1.1%. Economists anticipated 0.4% rates of increase for both the ex-autos figure and the so-called control group number.

A separate report Friday from the University of Michigan showed a surprise drop in sentiment, to the lowest level since February. The report’s headline sentiment index dropped to 80.8 from 85.5 in June; economists anticipated a rise to 86.5. For context, the index hovered around 100 in the months before the pandemic.

Continue reading ›

Chinese Regulators Raid Didi on Cybersecurity Concerns

Officials from seven government agencies raided the offices of Didi Global for a cybersecurity review of the ride-hailing app, the Cyberspace Administration of China said Friday.

The operation, which involved state security and police officials, marks a new step in Beijing’s regulatory crackdown on China’s big technology companies, who have amassed troves of confidential data considered sensitive by authorities.

Continue reading ›

Intel in Talks to Buy GlobalFoundries for $30 Billion: Report

Semiconductor heavyweight Intel is in talks to buy contract chip maker GlobalFoundries for $30 billion, The Wall Street Journal reported late Thursday.

Intel declined to comment. GlobalFoundries, which was once owned by Intel rival Advanced Micro Devices, declined a request for comment from Barron’s, but a spokeswoman told the Journal the company isn’t currently in discussions with Intel.

Continue reading ›

Another Setback for Biogen’s Controversial Alzheimer’s Drug

Two major hospitals said they won’t administer Biogen’s drug to treat Alzheimer’s disease, yet another blow to the pharmaceutical maker amid a debate about the drug’s effectiveness and whether regulators lowered their standards in approving it.

Cleveland Clinic said it reviewed the evidence on the drug, aducanumab, and decided not to carry it, though individual doctors can prescribe it to be administered intravenously elsewhere. Mount Sinai in New York also decided not to administer it, according to the New York Times, which was first to report the moves.

Continue reading ›

Unemployment Claims Drop to Pandemic Low, but Businesses Still Struggle to Find Workers

New applications for unemployment benefits fell last week to a new pandemic low, as companies sought to hire more workers and avoid layoffs amid a robust U.S. economic recovery.

Initial jobless claims fell by 26,000 to 360,000 in the seven days ended July 10, matching the forecast of economists polled by The Wall Street Journal. These are traditional benefits paid by the states.

Continue reading ›

China’s Economic Growth Slows to Still-Robust 7.9% in Second Quarter

China’s economic growth slowed to a still-strong 7.9% over a year earlier in the three months ending in June as a rebound from the coronavirus leveled off.

Growth reported Thursday was down from the previous quarter’s explosive 18.3%, which was magnified by comparison with early 2020, when the world’s second-largest economy closed factories, stores and offices to fight the coronavirus.

Continue reading ›

Fed’s Powell Repeats View of Transitory Inflation but Sharpens Focus on Expectations

Federal Reserve Chairman Jerome Powell reiterated that recent inflation strength reflects temporary pressures in testimony to Congress on Wednesday, while also highlighting the role inflation expectations play as an input to central bank policy.

In his prepared comments to the House Financial Services Committee, Powell said that central bank officials will continue to discuss their timeline to reduce the pace of its bond purchases at coming meetings. Earlier this year officials said they wanted to see “substantial further progress” toward the Fed’s goals of maximum employment and price stability before stepping back from accommodation.

Continue reading ›

Delta Air Lines Is Profitable Again. American Airlines Is Turning a Corner.

Airlines are getting back to profitability for the first time since the pandemic struck.

Delta Air Lines, the first carrier to report second-quarter results, said it turned a profit, excluding special items, earning $1.02 per share in the quarter as domestic leisure travel rebounded to prepandemic levels. The results handily beat consensus estimates, which called for Delta to lose $1.33 a share.

American Airlines Group also issued a positive update on Wednesday, including forecasts for a “slight” second-quarter pretax profit. American said it expects revenue in the quarter to be 2.5 percentage points higher than its prior forecast and predicted lower operating costs. The airline also said it was profitable in June for the first time since December 2019, excluding special items.

Continue reading ›

Inflation Climbs at Fastest Clip Since 2008, Defying Expectations

Consumer prices continued to surge in June, rising at the fastest pace since August 2008 and raising fresh questions over whether price inflation will be transitory.

Hot inflation readings in recent months have largely been attributed to the so-called base effect, where depressed pandemic levels from a year ago translate to artificially higher year-over-year rates. But that explanation is less sufficient for June. While the base effect hasn’t entirely faded, it is diminishing. Starting in June 2020, monthly inflation numbers bounced from negative levels that accompanied shutdowns, meaning Tuesday’s CPI reading is the first since inflation started surging that can’t so easily be written off.

Continue reading ›

Elon Musk Testifies He Did Not Influence Tesla’s 2016 SolarCity Deal

Tesla CEO Elon Musk defended the electric car company’s 2016 acquisition of SolarCity against a lawsuit filed by shareholders, telling a Delaware court on Monday that he did not act improperly during the negotiation, The Wall Street Journal reports.

Plaintiffs, including several pension funds that owned Tesla shares, say the deal was designed to benefit Musk and bail out a failing company. They are seeking to recoup the $2.6 billion Tesla paid for the solar panel maker, where Musk was chairman at the time. But Musk testified that the deal was not a bailout of SolarCity, which was founded by his cousins in 2006.

Continue reading ›

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.