Friday, January 22, 2021

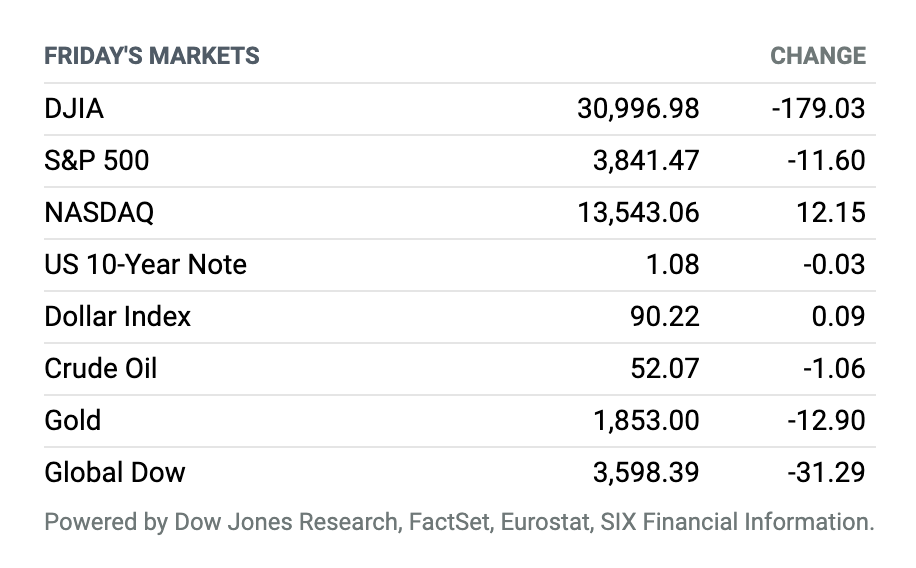

Stocks Log Weekly Gains. Stocks ended mixed on Friday, but managed to hold on to weekly gains as investors eyed the economic impact of Covid-19 restrictions in Europe. The S&P 500 fell 0.3% to 3841. The Dow Jones Industrial Average shed 179 points, or 0.6%, to 30,997, based on preliminary numbers. The Nasdaq Composite was up 0.1% to 13,543, setting a new closing record on Friday. For the week, the S&P 500 rose 1.9%, the Dow gained 0.6%, and the Nasdaq climbed 4.2%. Economic data from Europe reflected the continuing toll from the pandemic, raising concerns the eurozone could enter into another recession. Shares of Schlumberger rose after the oil services company topped profit forecasts, and beat revenue expectations for the first time in four quarters.

New Covid-19 Strains May Make Vaccines Less Effective, Fauci Warns

In his first White House press briefing of the Biden administration, Dr. Anthony Fauci warned that new strains of the virus that causes Covid-19 now in circulation could make the currently available vaccines and antibody therapies less effective.

“We’re paying very, very careful attention to this, and we take it very seriously,” Fauci said.

Johnson & Johnson Aims for 100 Million Vaccine Doses by Spring

A Johnson & Johnson board member said the company is aiming to have enough doses of its Covid-19 vaccine available by “April or so” to inoculate 100 million Americans, assuming the clinical trials are successful.

Speaking on CNBC Thursday, Dr. Mark McClellan, a former commissioner of the Food and Drug Administration who sits on the board of Johnson & Johnson, said the company is working to maximize production of the vaccine.

Eli Lilly Says Its Antibody Prevented Covid-19 in Nursing Home Residents

A Covid-19 antibody produced by Eli Lilly kept nursing home residents and staff from coming down with symptomatic infections in a Phase 3 trial, the company said Thursday.

The company said that an analysis of one trial subgroup showed that nursing home residents who received the drug, called bamlanivimab, had 80% lower odds of getting Covid-19 than people in the same facility who received a placebo.

Jobless Claims Dropped, but They’re Still Way Too High

The number of people filing for unemployment benefits for the first time fell last week as the economy continues to navigate through the effects of the coronavirus pandemic.

U.S. jobless claims fell to 900,000 for the week ended Jan. 16, marking a 26,000 drop from the prior week’s downwardly revised tally of 926,000, the Labor Department said Thursday. The four-week moving average of initial claims, which smooths out spikes in weekly data, climbed by 23,500 to 848,000.

Netflix’s Subscriber Growth Beats Estimates

Netflix late Tuesday posted better-than-expected fourth-quarter subscriber growth and disclosed that it now expects to be cash flow break-even or better moving forward. The company also said it has begun considering stock buybacks.

Fourth-quarter subscriber growth was well above guidance: Netflix added 8.51 million net new subscribers, well ahead of the company’s forecast of 6 million adds. Netflix now has 203.7 million subscribers. For the full year, the company added 37 million new members, up 31% from the 28 million added a year ago. In 2020, 83% of net adds came outside the U.S. and Canada.

Intel Reports Stronger-Than-Expected Earnings as PC Sales Continue to Impress

Strong sales from its personal computer chips and its autonomous driving unit Mobileye helped Intel end a difficult 2020 on a positive note.

The Silicon Valley chip maker said fourth-quarter sales declined to $19.98 from $20.21 billion in the year-ago period. Personal computer sales, however, rose 9% to $10.9 billion, and the company said it sold a record number of notebook chips. Analysts had forecast PC sales of $9.57 billion.

Adjusted for restructuring and acquisition costs, earnings were $1.52 a share. The results handily beat Intel’s own sales forecasts for the fourth quarter, and topped consensus estimates, allowing outgoing CEO Bob Swan to leave the company on something of a high note.

IBM Profits Top Estimates, but Revenue Misses

IBM late Thursday posted mixed results for the fourth quarter, with profits ahead of Street estimates but revenue coming in light amid continued pressures from a soft global economy.

For the quarter, IBM reported revenue of $20.4 billion, down 6% (or 8% adjusted for currency and divested businesses) and below the Wall Street analyst consensus forecast of $20.6 billion. Non-GAAP profits were $2.07 a share, nicely ahead of the Street consensus view at $1.79 a share. On a GAAP basis, the company earned $1.41 a share, reflecting more than $2 billion in restructuring costs.

P&G Notches Another Strong Quarter

Procter & Gamble reported strong fiscal second-quarter earnings and offered an upbeat outlook—evidence that shoppers are still flocking to its premium brands amid the Covid-19 pandemic.

Procter & Gamble said it earned $3.85 billion, or $1.47 a share. Adjusted earnings per share, which exclude the impact of currency, were $1.64 on revenue that rose 8% to $19.75 billion. Analysts were looking for earnings per share of $1.51 on revenue of $19.27 billion.

UnitedHealth Results Beat Wall Street’s Estimates

The health insurance giant UnitedHealth Group reported fourth-quarter financial results on Wednesday morning, beating Wall Street’s expectations as it clocked fourth-quarter adjusted net earnings per share of $2.52.

That’s 12 cents above the FactSet consensus estimate of $2.41 per share, a cheering nugget in an otherwise unsurprising, but largely positive, earnings report. The company reported full-year revenues of $257.1 billion, slightly above the FactSet consensus estimate of $256.4 billion.

Goldman Sachs’s Profit Shows It’s a Great Time to Be an Investment Bank

Investment bank Goldman Sachs’ fourth-quarter results blew past analysts’ expectations.

The bank posted earnings of $12.08 per share on revenue of $11.7 billion. Analysts surveyed by FactSet expected Goldman Sachs to post earnings of $7.39 per share from $10 billion in revenue. The per-share profit was far above the $4.69 a share recorded in the same quarter a year earlier.

While other banks had to spend much of 2020 building up reserves against potential loan losses, Goldman Sachs, less dependent on lending, was able to benefit from increased trading and deal making activity amid the pandemic.

Bank of America Earns More Than Expected

Bank of America’s fourth-quarter earnings topped analysts’ expectations but came in well below the year-earlier figure, and revenue fell short of Wall Street estimates.

The quarterly profit for the bank totaled $5.5 billion, down from $7 billion in the year-ago quarter. Earnings per share were 59 cents a share, beating Wall Street’s expectations of 55 cents. Bank of America’s revenue came in at $20.1 billion, short of the $20.6 billion forecast by analysts surveyed by FactSet, and 10% below the last three months of 2019.