Friday, February 12, 2021

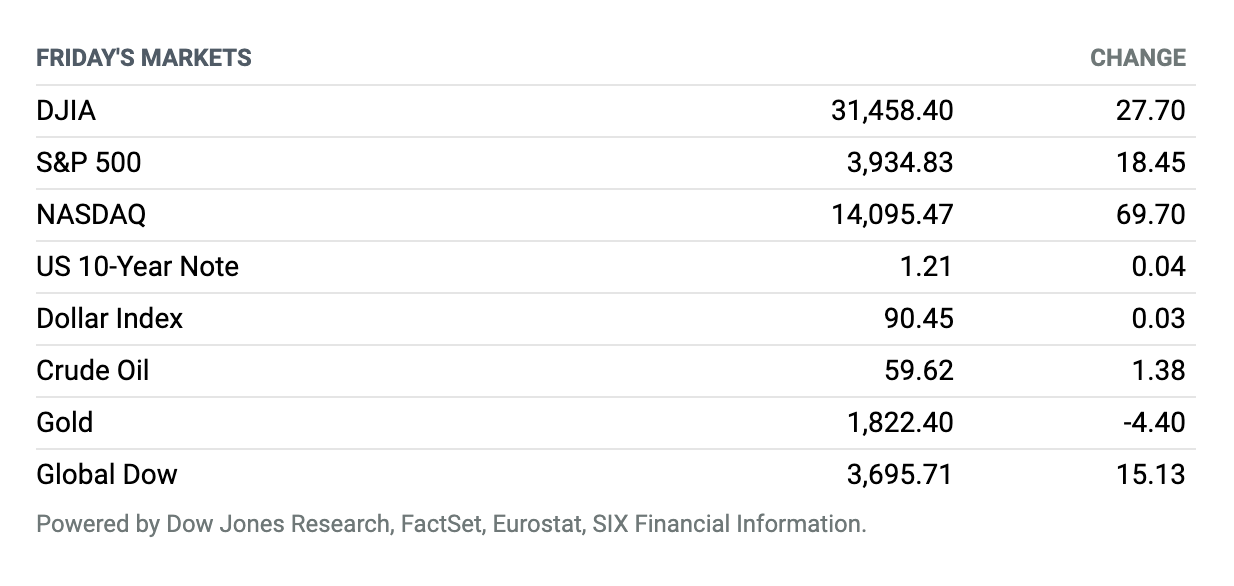

Stocks End Week on Optimistic Note. Major U.S. stock indexes notched record closing highs Friday on optimism about a fresh round of Covid spending, strong corporate earnings, and progress in rollouts of vaccines to combat the viral pandemic. The Dow Jones Industrial Average closed up less than 0.1% to end at around 31,458, enough for a closing record for the blue-chip index, aided by gains in Goldman Sachs and Amgen. The S&P 500 index closed up 0.5% to reach about 3935, also a record, while the Nasdaq Composite Index ended the day up 0.5% at an all-time closing high at roughly 14,095. For the week, the Dow finished up 1%, the S&P 500 gained 1.2%, and the Nasdaq Composite booked a 1.7% advance. U.S. markets will be closed on Monday in observance of Presidents Day.

The U.S. Will Be Swimming in Covid-19 Vaccines by Midsummer

It is looking more likely that the U.S. will be swimming in Covid-19 vaccine doses by the summer.

Two months into the U.S. Covid-19 vaccination campaign, 68.3 million vaccine doses have been delivered to states and territories by the Centers for Disease Control and Prevention, and 34.7 million people have received at least one vaccine jab.

Fed’s Powell Says He Doesn’t Expect a ‘Large or Sustained’ Inflation Outbreak

Downplaying the risk of a runaway inflation, Federal Reserve Chairman Jerome Powell on Wednesday said he and his colleagues are focused on getting Americans back to work in the wake of a devastating pandemic.

In a speech to the Economic Club of New York, Powell said he doesn’t expect “a large nor sustained” increase in inflation right now. Price rises from the “burst of spending” as the economy reopens are not likely to be sustained, Powell said.

Consumer Prices Rose a ‘Very Tame’ 0.3% in January, but Many See Inflation Pickup Ahead

The consumer price index inched up 0.3% in January, driven largely by a 7.4% increase in gasoline prices, but many observers believe inflation is on the way.

Although prices for electricity and natural gas decreased, gasoline prices kept the energy index up 3.5% for January, the Labor Department reported on Wednesday. Consumer prices overall were up 1.4% over the past 12 months.

Jobless Claims Show Uneven Recovery

The number of people seeking unemployment benefits in the latest week shows that the economic recovery will be an uneven one.

There were 793,000 workers filing initial jobless claims for the week ended Feb. 6, a drop of 19,000 from the prior week’s upwardly revised tally of 812,000, the Labor Department said Thursday. The latest week’s figure exceeded economists’ expectations for 760,000 initial claims. The four-week moving average for initial claims was 823,000, a 33,500 decrease from the prior week’s upwardly revised figure of 856,500.

Disney Earnings Show a Recovery. And It’s Not Just Disney+.

The bull thesis on Walt Disney stock is centered around the long-term promise of its fast-growing but still-unprofitable streaming business, along with a coming postpandemic recovery at its theme parks and movie studio segments. The media and entertainment giant’s latest quarterly results on Thursday evening showed that the recovery in the legacy businesses is unfolding ahead of schedule, while growth at Disney+ continues to accelerate.

In its fiscal first-quarter results, which correspond to the calendar fourth quarter, Disney managed to turn a profit of 2 cents per share, while the average Wall Street analyst forecasts had been for a loss of 71 cents a share. That compares with a loss of 39 cents per share in Disney’s previous fiscal quarter, and a $1.53 profit in the year-earlier period.

II-VI Makes Buyout Bid for Coherent, Topping Existing Bids

II-VI made a $260-a-share cash-and-stock buyout bid for laser technology company Coherent.

With 24.45 million shares outstanding as of Feb. 8, the bid values Coherent at about $6.36 billion. That bid tops the unsolicited one made by MKS Instruments earlier this week that would value Coherent at about $5.8 billion, and the buyout agreement Coherent has already entered into with Lumentum Holdings, which valued the company at the time at $5.7 billion.

Bumble Opens for Trading With Shares Rising as Much as 85%

Dating-app operator Bumble made its much-anticipated public-market debut with shares soaring as much as 85% on Thursday, its first day of trading.

CEO Whitney Wolfe Herd founded Bumble in 2014. The start-up calls itself a “women-first” dating app because it allows women to make the first move. Women, once they match with someone, have 24 hours to start a conversation with their “target.”

GM Reports Strong Quarter but Offers Disappointing Outlook

General Motors reported fourth-quarter adjusted earnings of $1.93 a share from $37.5 billion in sales, while Wall Street was projecting $1.57 in per-share earnings and $35.9 billion in sales. What’s more, fourth-quarter free cash flow came in at $3.4 billion, easily above the $3.1 billion analysts had anticipated.

GM’s financial forecasts qualify as only OK, however. In 2021, the company expects to earn about $4.90 a share and generate $1.5 billion in free cash flow. Analysts had been projecting about $5.90 in per-share earnings and $4 billion in free cash flow. Investment spending on electric and autonomous vehicles is rising. That’s the most likely reason for the lower cash-flow figure, while the earnings number might be conservative.

Coca-Cola Earnings Benefit From Cost-Cutting

Cost-cutting helped Coca-Cola beat fourth-quarter expectations, and the beverage giant gave an earnings outlook for the first time since the pandemic started.

Coke said Wednesday that fourth-quarter net income fell 28% from the same quarter a year ago, to $1.46 billion, or 34 cents a share. But adjusted earnings per share rose to 47 cents and beat the consensus estimate by a nickel.

Lilly CFO Josh Smiley Resigns Following Allegations of Inappropriate Relationship

Eli Lilly & Co. said its chief financial officer, Joshua Smiley, has resigned after the company was made aware of allegations of an inappropriate personal relationship between Smiley and an employee.

Lilly on Tuesday said an independent investigation with an external counsel found what it deemed consensual but inappropriate communications between Smiley and certain employees and “behavior that Lilly leadership concluded exhibited poor judgment.”