Friday, December 4, 2020

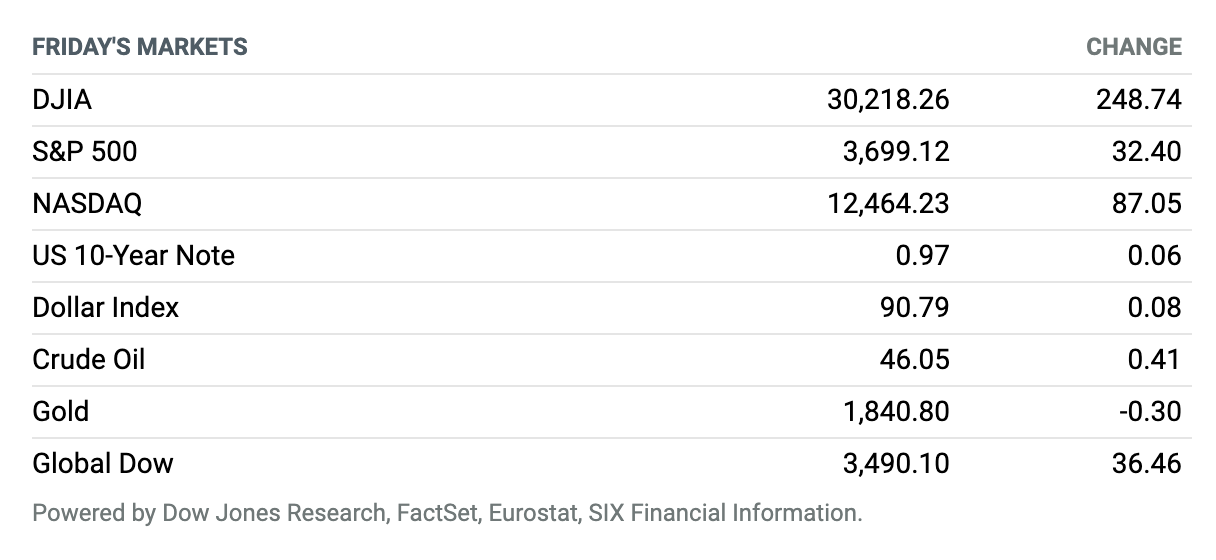

Record Finish. Major stock benchmarks scored a round of records Friday to cap another week of gains for equities as investors looked past a weaker-than-expected jobs report. The Dow Jones Industrial Average, S&P 500, Nasdaq Composite, and Russell each ended at an all-time high, the first simultaneous record finish for the quartet since Jan. 22, 2018. The Dow rose around 249 points, or 0.8%, to close near 30,218, according to preliminary figures, while the S&P 500 advanced around 32 points, or 0.9%, to finish near 3699, and the Nasdaq Composite gained around 87 points, or 0.7%, to end at 12,464. For the week, the S&P 500 gained 1.7%, the Nasdaq was up 2.1%, and the Dow rose 1%.

Hiring Slowed Last Month as Covid Spiked

U.S. businesses added 245,000 jobs in November, a lower-than-expected reading that comes as coronavirus cases spiked across the country.

The unemployment rate fell to 6.7%, down from 6.9% in October, the Labor Department said Friday. That was in line with estimates of economists polled by The Wall Street Journal. The unemployment rate is now down 8 percentage points from its April high, during the heights of the first wave of the pandemic, but is still more than 3 percentage points above prepandemic levels.

The slowdown in hiring, however, was steeper than economists had expected. After businesses added 610,000 jobs in October, economists polled by the Journal had forecast a slowdown to 440,000 new jobs in November. The latest gains were driven by transportation and warehousing, professional and business services, and health care. Employment declined in government and retail, the report said.

U.K. Becomes First Country to Approve Pfizer-BioNTech Covid-19 Vaccine

The U.K. has become the first country to approve the Covid-19 vaccine developed by U.S. drugmaker Pfizer and its German partner, BioNTech, with preparations under way to begin a mass rollout next week.

The two-shot vaccine was authorized by the U.K. medicines regulator ahead of the U.S. and Europe, and will become available starting next week, the government said on Wednesday. Care home residents, health and care staff, elderly people, and those clinically vulnerable are in line to receive the jabs first.

Salesforce Agrees to Buy Slack for $27.7 Billion in Cash and Stock

Cloud-computing pioneer Salesforce.com has agreed to acquire the collaborative communications company Slack Technologies for about $27.7 billion, in a deal that was widely expected.

Each Slack share will be exchanged for $26.79 in cash plus 0.0776 Salesforce shares. Slack CEO “Stewart [Butterfield] and his team have built one of the most beloved platforms in enterprise software history, with an incredible ecosystem around it,” Salesforce CEO Marc Benioff said in a statement.

Glencore CEO Ivan Glasenberg to Retire After 18 Years at the Helm

Ivan Glasenberg, the longtime chief executive of Glencore PLC, is handing over the reins of the global mining and trading giant he built, saying Friday he would retire in the first half of next year.

The Switzerland-based, London-listed company said it had tapped Gary Nagle, a senior deputy who currently runs the company’s coal industrial assets, for the top job.

Nasdaq Proposes New Listing Rules Requiring More Diverse Corporate Boards

In yet another sign that corporate board diversity and disclosure is increasingly important to investors, the Nasdaq exchange plans to require most Nasdaq-listed companies to have at least two diverse directors, including one who self-identifies as female, and another who self-identifies as either an underrepresented minority or LGBTQ+.

In addition, Nasdaq will require companies to publicly disclose consistent, transparent diversity statistics regarding their boards of directors.

Boeing Gets First Big 737 MAX Order in a Year and a Half

Boeing has made a big sale of 737 MAX jets, its first substantial one since June 2019.

Ryanair said Thursday that it will buy 75 MAX jets in addition to the 135 firm orders the European budget airline already has on Boeing’s books. What’s more, Ryanair said it would take delivery of planes at a faster rate than it had planned.

Chevron Will Shrink Spending Even as Oil Prices Rebound

Chevron said on Thursday it would spend even less than it had previously projected to explore and produce oil and gas from wells around the world, making it clear that U.S. companies are committed to tightening their belts even as prices have started to rebound.

Oil prices have rebounded to the mid-$40s from the high $30s in the past month, the kind of rise that historically would have resulted in companies racing to boost production. But the pandemic and sour investor sentiment has convinced most oil companies to hold the line.

GM, Nikola Scale Back Their Agreement

General Motors and Nikola announced on Monday that they now have a memorandum of understanding for fuel-cell supply that replaces the blockbuster agreement they had announced on Sept. 8.

The previous agreement gave General Motors an 11% stake in Nikola in exchange for fuel-cell supply, battery supply, and manufacturing support for Nikola’s pickup truck called the Badger. There is nothing about an equity stake or battery supply in the updated release, and the Badger appears to be dead.

The U.S. Manufacturing Recovery Continues

The industrial economy is recovering at a higher pace than in recent months. That’s a good sign for the overall U.S. economy.

The Institute for Supply Management Manufacturing Purchasing Managers Index, or ISM PMI, registered a reading of 57.5 for November. Economists were looking for 58. Tuesday’s reading is a small miss, but 57.5 is higher than the average 56.9 reading of the past three months. A reading above 50 indicates growth. The higher the reading, the faster the growth.

Airbnb Seeks Valuation of Up to $35B in IPO

Airbnb has set the terms for its much-anticipated initial public offering. The San Francisco-based lodging upstart could raise as much as $2.6 billion if it prices on the high end of its expected price range.

Airbnb plans to sell 51,914,894 shares at $44 to $50 each, according to a regulatory filing on Tuesday. The company is expected to trade on the Nasdaq, under the ticker ABAB. Airbnb is going public next week and is expected to price its deal on Wednesday, Dec. 9 and trade on Dec. 10.