Friday, December 3, 2021

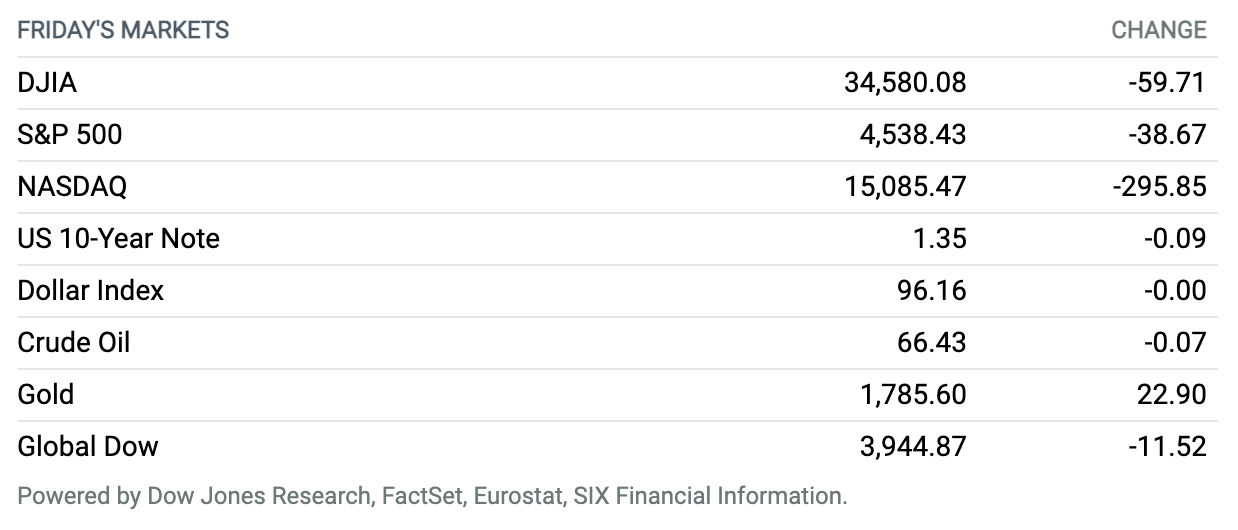

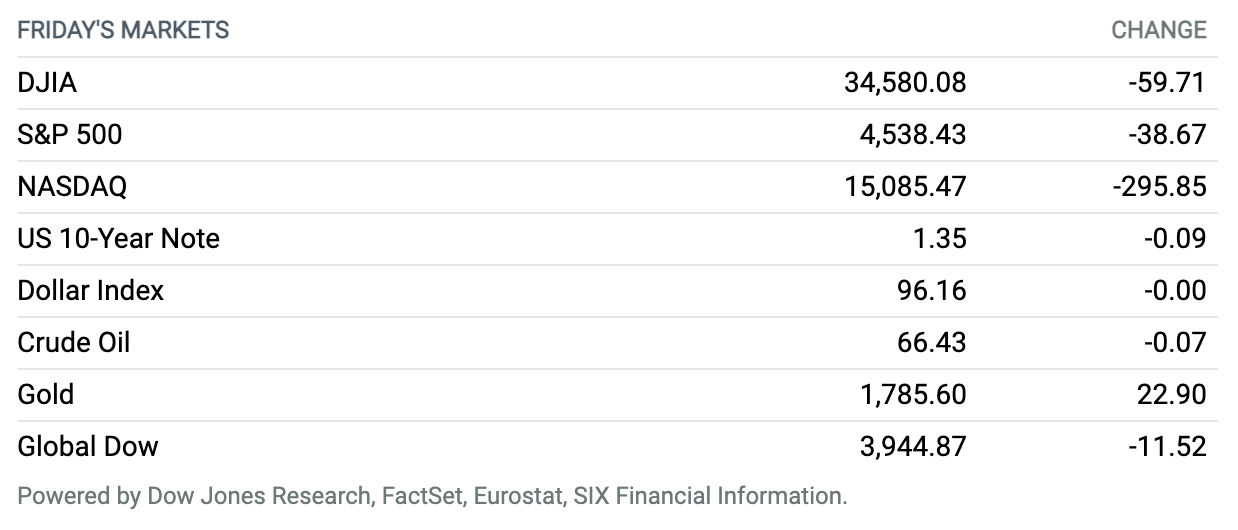

All 3 Major Stock-Market Indexes Post Losses to Cap a Wild Week. U.S. stock benchmarks closed lower Friday, but managed to finish off the day’s worst levels, as investors wrestled with a weaker-than-expected November jobs report. The Dow Jones Industrial Average closed down 60 points, or 0.2%, on Friday to reach 34,580. For the week, the index closed down 0.9% to mark the fourth straight weekly decline. The S&P 500 index closed the day down 39 points, or 0.8%, at 4538, while the Nasdaq Composite Index ended down 296 points, or 1.9%, at 15,085. For the week, the S&P 500 lost 1.2%, for its second straight weekly drop, while the Nasdaq Composite booked a 2.6% weekly skid.

Biden Signs Bill to Prevent Government Shutdown. Debt Ceiling Looms.

President Joe Biden signed a short-term bill Friday afternoon that funds the government through February, averting a shutdown.

The president’s signature came after Congress passed the legislation, called a continuing resolution, Thursday evening. The measure extends current funding approved during the Trump administration until Feb. 18, avoiding a partial shutdown that would include furloughs, as well as shuttered parks, monuments, and other federal institutions.

The Senate voted 69 to 28 Thursday night to approve the bill, with the House of Representatives voting 221 to 212 earlier in the evening. Attention now turns to the looming fight over raising the federal debt ceiling.

Continue reading

Look Past November’s Weak Hiring. The Jobs Report Was Good.

Hiring fell short of expectations in November, with 210,000 jobs added, but the labor force participation rate rose, suggesting some workers came off the sidelines and that the labor shortage may slowly begin to thaw.

Employers added 210,000 people to their payrolls last month, the lowest increase since hiring fell in December 2020 and below the 535,000 economists polled by FactSet predicted. But details of the report are much more positive than the headline nonfarm payrolls number would suggest.

Continue reading

Nvidia’s Purchase of Arm Looks Dead. What Comes Next?

Nvidia‘s $40 billion purchase of Arm—heralded as the biggest deal in the history of the semiconductor industry—looks dead in the water.

The Federal Trade Commission sued to block the deal this week, citing competition concerns and all but killing the prospect of Nvidia taking over control of the leading chip designer from SoftBank. And while Nvidia has vowed to press ahead, the transaction faces further scrutiny in Europe and China.

Continue reading

China Risks Covid Outbreak if It Relaxes Restrictions, Study Finds

International experts are questioning the validity of a Chinese study claiming that the country would experience a “colossal outbreak” of coronavirus cases if it abandoned its “zero-Covid” policy and relaxed restrictions as many advanced economies have done.

Researchers at China’s prestigious Peking University recently published a report in a Chinese CDC journal using mathematical models estimating the toll the country could face if it opened up to the same degree as five comparison countries—the U.S., the United Kingdom, Israel, Spain, and France.

Continue reading

Glaxo, Vir Antibody Drug Works Against Omicron, Tests Show

GlaxoSmithKline said this week that a preclinical analysis of its antibody-based Covid-19 therapy it is developing with U.S. partner Vir Biotechnology is likely to work against the new Omicron coronavirus variant.

GlaxoSmithKline, the U.K. drugmaker, said in a statement that early tests showed that the antibody treatment, called sotrovimab, was effective against the new strain, which was first identified in southern Africa.

Continue reading

Twitter’s New CEO Has a Tough Task Ahead

Twitter is betting its future on Parag Agrawal. He’s served as the company’s chief technology officer since 2017, so his ascension to CEO screams continuity. Some company watchers were looking for a cleaner break.

Agrawal just took over as CEO earlier this week and already faces a laundry list of concerns regarding the social-media giant. Twitter has stumbled in growing and monetizing its user base, all while the company deals with an ongoing political firestorm as it seeks to balance content moderation and free speech.

Continue reading

Andy Warhol Works Are Being Sold as NFTs. Crypto Is Colonizing the Art World.

Art works by Andy Warhol are being sold as nonfungible tokens, or NFTs, during the Art Basel Miami Beach fair this week. It’s the latest merger of crypto and art as dealers, artists, and collectors aim to monetize and trade works with blockchain technology.

NFTs are digital collectibles that can be traded like other cryptocurrencies. They confer some ownership rights to a work—whether it’s a song, video clip, tweet, piece of art, or gaming token. NFTs can also be auctioned and traded on blockchain-based platforms like OpenSea or Solana, using various cryptos as the currency.

Continue reading

Moderna CEO Says Current Vaccines Will Struggle Against Omicron

Moderna‘s CEO predicted a “material drop” in the effectiveness of current vaccines against the Omicron variant and warned it could take months for drug companies to manufacture the new jabs at scale.

Stéphane Bancel said the spread of the variant in South Africa, coupled with the high number of mutations, suggested existing vaccines may need to be modified next year.

Continue reading

China’s Didi to Delist From NYSE Months After Blockbuster IPO

Didi Global has announced plans to delist its shares from the New York Stock Exchange and prepare for a listing in Hong Kong just five months after the Chinese ride-hailing giant’s U.S. initial public offering.

Just days after the IPO, China’s cybersecurity watchdog launched a probe into Didi to protect national security and the public interest. The regulator also suspended new user registrations on the app in China.

Continue reading

The Chip Shortage Could Be Spreading to iPhones

The global semiconductor shortage has roiled automotive and appliance production all year long. Now a warning from Apple raises the possibility that the impact of the shortage is spreading and, more importantly, affecting consumer demand.

Apple reportedly told its suppliers this week to cut targeted production of the iPhone 13 to about 80 million units from 90 million units. Apple wasn’t immediately available to comment on the reports.

Continue reading

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.