Friday, December 17, 2021

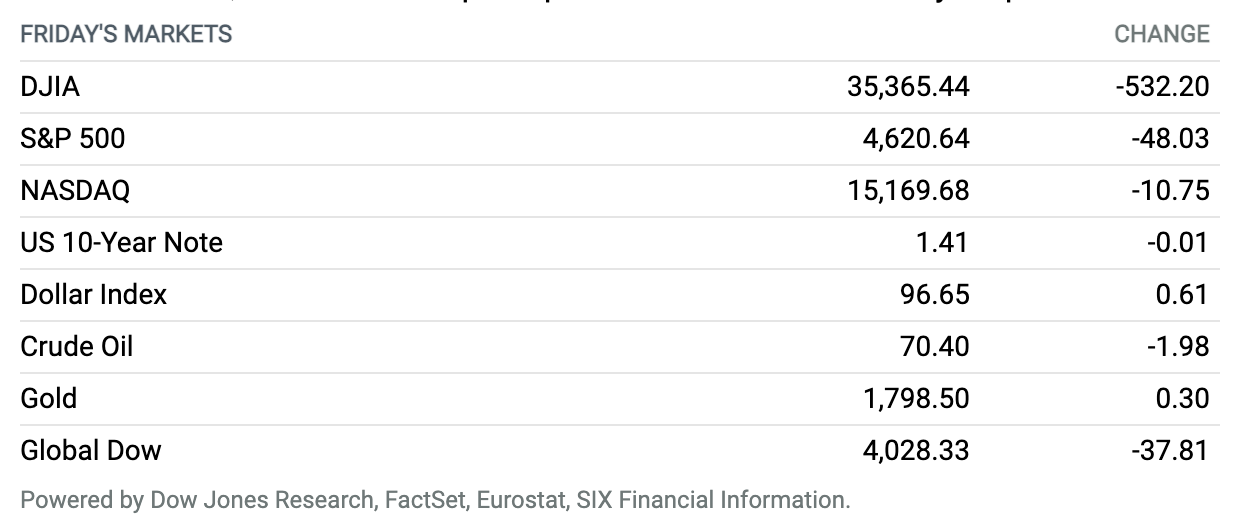

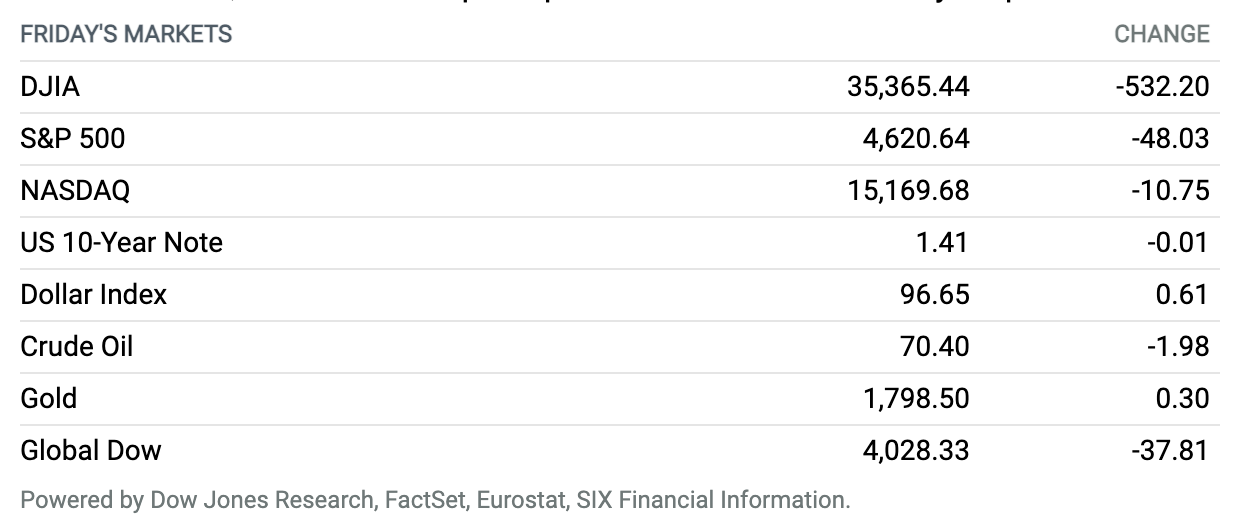

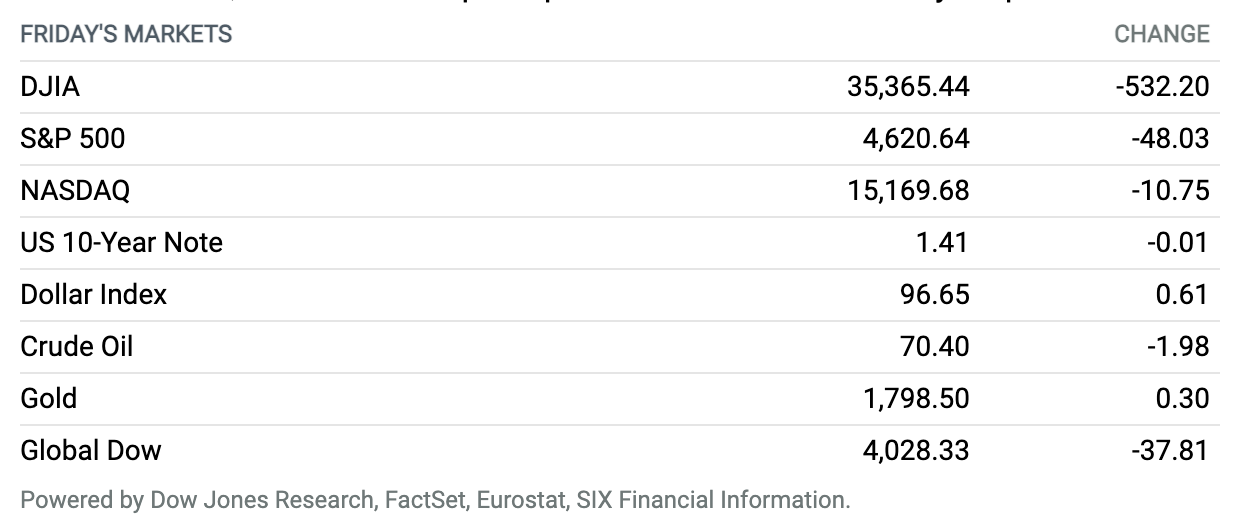

Stocks Lurch Lower to Conclude Ugly Fed Week. U.S. stocks closed solidly lower Friday and the Dow booked the worst decline of the month so far, as investors assessed the economic impact of the spread of the coronavirus Omicron variant and the most recent moves by central banks around the globe. The Dow Jones Industrial Average dropped 532 points, or 1.5%, to close at 35,365, marking the worst daily drop since Nov. 30. The S&P 500 index lost 48 points, or 1%, to reach 4621, and the Nasdaq Composite index retreated a more modest 11 points, less than 0.1%, to reach 15,170. For the week, the Dow booked a 1.7% decline, the S&P 500 lost 1.9%, and the Nasdaq Composite finished with a weekly drop of 3%.

Biden Says Unvaccinated Face ‘a Winter of Severe Illness and Death’

President Joe Biden said the unvaccinated in the U.S. face “a winter of severe illness and death” amid a resurgence of coronavirus cases and the emergence of the highly contagious Omicron variant.

“It’s here now and it’s spreading and it’s gonna increase,” the president said about the Omicron variant in a briefing Thursday at the White House. “We are looking at a winter of severe illness and death for the unvaccinated—for themselves, their families, and the hospitals they’ll soon overwhelm.”

But there’s good news: “If you’re vaccinated and you have your booster shot, you’re protected from severe illness and death,” the president added.

Continue reading

The Fed Plans Bigger Cuts to Bond Purchases in Move to Fight Inflation

The Federal Reserve will double the pace at which it is winding down its emergency asset-purchasing stimulus program, the central bank announced this week, clearing the way for an interest-rate increase in the first half of next year.

The move to accelerate the so-called taper, which was widely expected among economists, signals a shift from the Fed away from stimulating the economy and toward reining in rising inflation. Most Fed officials signaled they are prepared to raise interest rates three times next year.

Continue reading

Omicron and Delta Could Coexist. What That Would Look Like.

As Omicron spreads rapidly across the U.S., public-health experts and analysts have begun to question what that means for the Delta variant, which is the most prevalent strain of Covid-19 in the country.

Both variants are on the rise, with the total number of cases in the U.S. increasing by more than 30% over the last two weeks. Hospitalizations and deaths have been rising as well.

Continue reading

Jobless Claims Jump Back Above 200,000

The number of Americans filing for first-time unemployment benefits moved back above 200,000 last week, after dropping to 52-year lows the week earlier.

Initial seasonally adjusted jobless claims for the week ended Dec. 11 rose to 206,000, up 18,000 from the previous week’s revised level of 188,000, according to data released by the Labor Department this week.

Continue reading

Bank of England First Among Major Central Banks to Raise Rates

The Bank of England this week became the first major central bank to raise interest rates and tighten monetary policy, departing from the easing of the last two years in response to the Covid-19 pandemic.

It chose to focus on the fight against inflation over fears about the economic impact of the Omicron coronavirus variant.

Continue reading

Oracle Said to Be in Talks to Buy Medical-Records Company Cerner

Oracle is reportedly buying Cerner, the electronic-medical-records company, in a deal that could be worth around $30 billion. An agreement could be finalized soon, some of the people familiar with the matter told The Wall Street Journal. If the deal gets completed it would be Oracle’s biggest-ever acquisition, and rank as one of the largest takeovers of the year.

For Oracle, an acquisition of Cerner would help in its transition into a cloud-based software provider. The news comes a week after Oracle reported impressive fiscal second-quarter earnings.

Continue reading

Reddit, Home to WallStreetBets, Files to Go Public

Reddit, the social-media platform that is home to WallStreetBets and other forums, has confidentially filed for an initial public offering.

In a statement, Reddit said “the number of shares to be offered and the price range for the proposed offering have not yet been determined. The initial public offering is expected to occur after the [Securities and Exchange Commission] completes its review process, subject to market and other conditions.”

Continue reading

Busiest Shopping Day of the Holiday Season Is Coming

More than 148 million consumers are expected to hit stores in person and online this Saturday, making the last Saturday before Christmas the busiest shopping day of the season, according to a survey by the National Retail Federation and Prosper Insights & Analytics.

NRF says 27% of these consumers will shop exclusively in stores, and 32% will shop only online. The survey said 41% planned to do both.

Continue reading

FedEx Earnings Show Labor Inflation Can Be Managed

Shipping giant FedEx reported better-than-expected earnings and raised fiscal 2022 earnings guidance this week, suggesting that the worst fears about labor inflation and its impact on profit margin haven’t been realized.

The company earned $4.83 per share in its fiscal second quarter, ahead of the consensus estimate of about $4.27. What’s more, EPS guidance for the company’s full fiscal year went to a midpoint of $21, up from a prior midpoint of $20.38 provided in September.

Continue reading

AMC Says ‘Spider-Man’ Broke Opening Night Records

AMC Entertainment said 1.1 million people attended the premiere of Spider-Man: No Way Home on Thursday, breaking AMC box office records for December film releases.

The premiere was the highest December opening night ever at AMC theaters, and the second-highest opening night of all time, second only to Avengers: Endgame, which opened in 2019. The Spider-Man premiere also had the highest number of people watching one movie on a given day at AMC theaters during all of 2020 and 2021.

Continue reading

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.