Friday, August 14, 2020

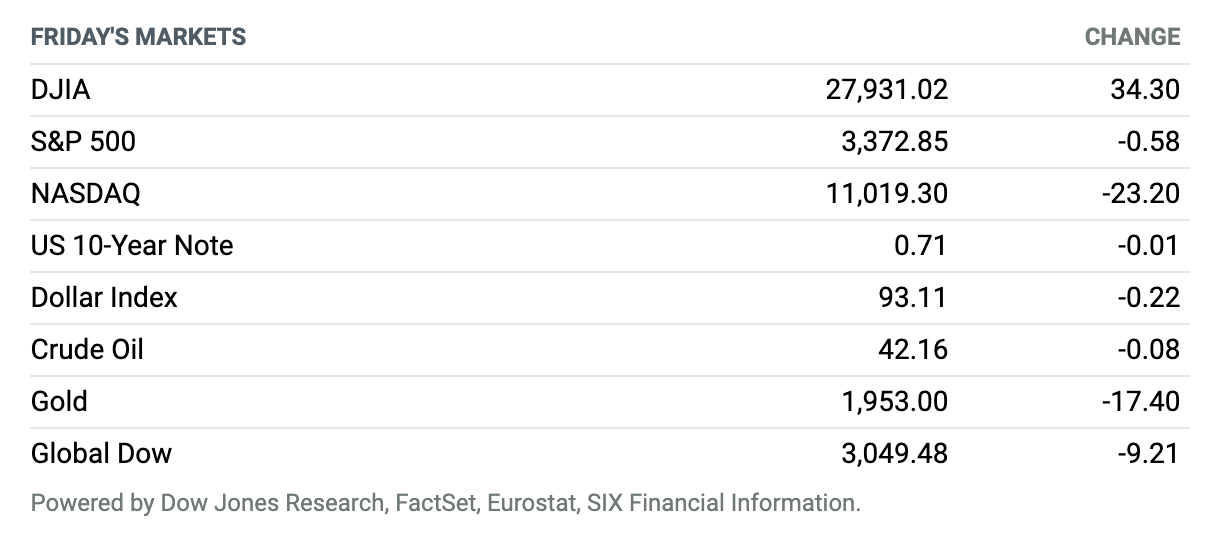

Recovery Worries. U.S. stocks closed lower Friday and booked weekly gains, but trading suggests that it may be tough sledding ahead for investors hoping to find further gains, as stimulus talks are all but dead and data point to a slow and fitful economic recovery from the Covid-19 pandemic. Economic reports, including unemployment claims and retail spending, continue to suggest the economy is recovering, but at an unsteady pace as the virus fails to submit efforts to quash it throughout the country. Retail sales in July rose 1.2%. Meanwhile, second-quarter productivity jumped 7.3%, while second-quarter unit labor costs surged by 12.2%. Separately, industrial production rose 3% in July for the third straight monthly gain after sharp declines in March and April, the Federal Reserve reported Friday. Investors continued to wait for developments on a coronavirus relief package from Congress, but lawmakers have broken for recess until Labor Day. The Dow Jones Industrial Average closed up 34 points, or 0.1%, at 27,931 and booked a weekly gain of 1.8%, while the S&P 500 index finished the day nearly unchanged around 3373 but notched a weekly gain of 0.6%, ending Friday’s trade about 14 points from a record close. Meanwhile, the Nasdaq Composite Index closed 0.2% lower at 11,019 and logged a weekly gain of less than 0.1%. Tech stocks have been at the vanguard of the current recovery for stocks but have seen gains peter out in recent trade.

Retail Sales Point to a Rocky Recovery

U.S. consumers sent retail sales higher for the third straight month in July, though investors should expect that spending has slowed since then because enhanced jobless benefits have dried up and the coronavirus is limiting reopenings.

Total retail sales rose a seasonally adjusted 1.2% last month from June, the Department of Commerce said Friday. That follows month-over-month gains of 8.4% and 18% in the preceding months, after retail sales plummeted 15% in April. The increase was short of the 2% rate economists surveyed by FactSet predicted.

U.S. Jobless Claims Drop Below 1 Million

The number of Americans filing for unemployment benefits fell below one million in the latest week, for the first time since the coronavirus pandemic took hold of the U.S. economy—an encouraging sign for the recovery even if layoffs remain extraordinarily high.

A seasonally adjusted 963,000 workers filed for first-time jobless benefits last week, the Labor Department said Thursday. That is down from a revised 1.19 million a week earlier and below the 1.15 million economists surveyed by FactSet had anticipated. Those continuing to claim jobless benefits fell to 15.5 million in the latest week, while those continuing to receive pandemic unemployment assistance, such as gig workers, fell to 10.7 million from 13 million.

What a Biden and Harris Administration Would Mean for the Economy

Former Vice President Joe Biden and Sen. Kamala Harris of California are set to be the Democratic presidential ticket. And though President Donald Trump’s campaign will look to paint them as a kind of trojan horse for far-left policies, many strategists see a moderate pairing.

RBC Capital Markets economists Tom Porcelli and Jacob Oubina believe the Harris pick was “far more neutral” than someone like Sen. Elizabeth Warren. Picking Warren, they wrote, “would have rendered useless any of his economic proposals. Kamala Harris seems a benign enough pick that it is unlikely to lead to any significant alterations to Biden’s economic plan.” In a note on Wednesday, they argued that if elected, Biden’s plan to raise revenue mostly includes “low-hanging fruit” like taxing the top 1% of earners and corporations.

Stagflation Looms Over This Market. Here’s What That Means.

It’s time to talk about stagflation, that double-barreled problem of flagging growth and rising prices last seen in the U.S. in the 1970s.

A trio of inflation numbers came in hotter than expected this past week, with consumer prices, producer prices, and import prices for July all rising at faster paces than economists anticipated. Notably, consumer prices—excluding the more-volatile food and energy categories—rose at the quickest clip since 1991. Of course, the increases come off low, pandemic-stricken bases, and compared with a year earlier, inflation is still tame. One month doesn’t make a trend, but this one should turn heads.

A King of Content, Sumner Redstone, Dies

Media mogul Sumner Redstone died Tuesday at the age of 97, his family’s holding company said on Wednesday. Redstone was a towering figure in the world of media and entertainment for several decades, and helped shape the company that is now ViacomCBS.

Redstone maintained control of the media company’s corporate parent, National Amusements, as chairman and CEO until his passing. The company holds close to 80% of ViacomCBS’s class A voting stock and a smaller stake in the nonvoting Class B shares. Redstone’s daughter, Shari Redstone, has been the public face of National Amusements in recent years, as her father battled health issues.

Airbnb May File This Month to Go Public

Airbnb’s long-awaited initial public offering may finally become reality. The home-sharing platform plans to file its IPO paperwork with the Securities and Exchange Commission later this month, The Wall Street Journal reported Tuesday.

Founded in 2008, Airbnb provides a marketplace that lets people list their homes for rent. If Airbnb files this month, its IPO could come before the end of 2020. The company is now valued at $18 billion, well below the $31 billion it had reached earlier. Airbnb had $4.8 billion revenue in 2019, the Journal said.

Epic Is Suing Apple and Google Over Fortnite and In-App Payments.

Epic Games filed lawsuits Thursday against Apple and Google after the tech titans removed its popular Fortnite title from their respective app stores because it violated their policies regarding in-app payments.

Earlier Thursday, Epic launched a payment system that bypasses the fees Apple and Google charge developers to place apps in their respective stores. It gives Fortnite players the option to buy digital goods for roughly 20% less than the tech titans charge.

McDonald’s Sues Former CEO, Alleging Inappropriate Employee Relationships

McDonald’s says it’s suing Stephen Easterbrook, the CEO it ousted last year over an inappropriate relationship with an employee, alleging Monday that he covered up relationships with other employees and destroyed evidence.

Easterbrook, according to a lawsuit, approved a special grant of restricted stock, worth hundreds of thousands of dollars, to one of those employees. The company now wants to reclaim hundreds of thousands of dollars in compensation paid to Easterbrook on his departure.

Uber Will Suspend Service in California Unless Court Stays Ruling on Drivers

Uber said it would temporarily shut down operations in California unless a court changes a ruling issued Monday that ordered both Uber and Lyft to classify drivers in the state as employees rather than contractors.

Superior Court Judge Ethan Schulman issued a preliminary injunction that orders the two ride-sharing companies to stop violating the provisions of a California law known as AB5 that sets strict rules on when companies can classify workers as contractors. The preliminary injunction comes in a case, filed in May by the city attorneys of Los Angeles, San Diego, and San Francisco on behalf of the state, asserting that both Uber and Lyft are violating AB5.

Tesla and Apple Are Splitting Their Stocks. Others Could Follow.

The recent stock splits announced by Apple and Tesla could prompt other companies with high-price shares to consider such a move.

Stock splits have been rare in recent years as many companies seem to view a high-price stock as a status symbol. Yet the splits announced by Apple and Tesla have played well with investors, and that might cause managements of companies with lofty share prices to reconsider. Tesla announced a 5-for-1 split after the bell on Tuesday. Apple announced a 4-for-1 split on July 30 in conjunction with its earnings report.