Friday, April 30, 2021

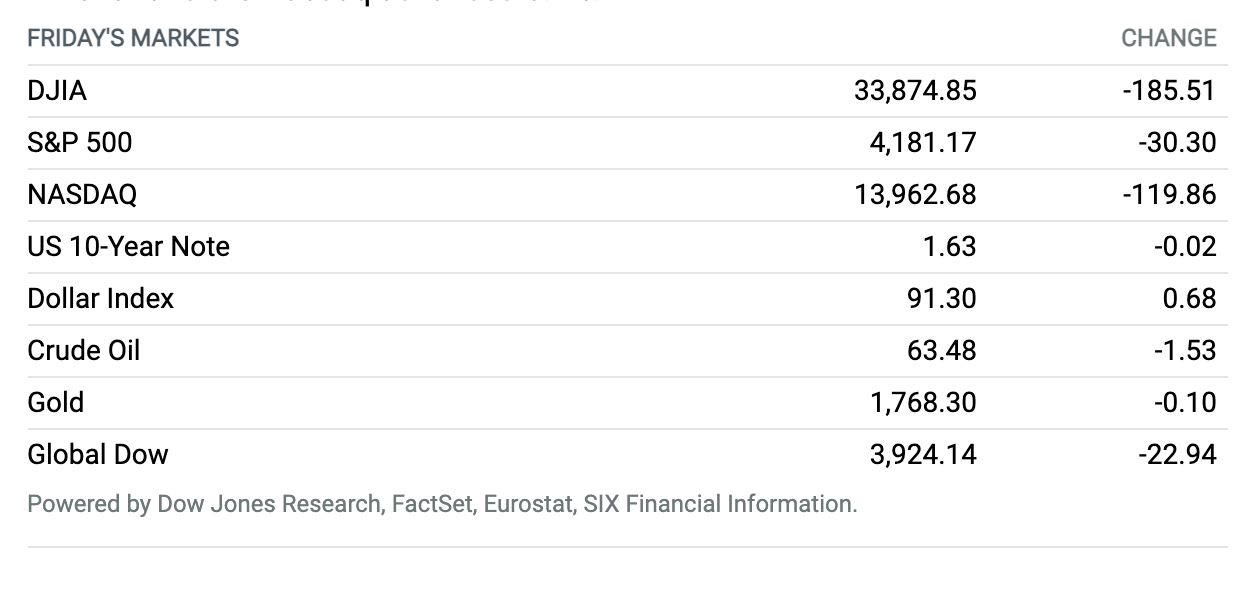

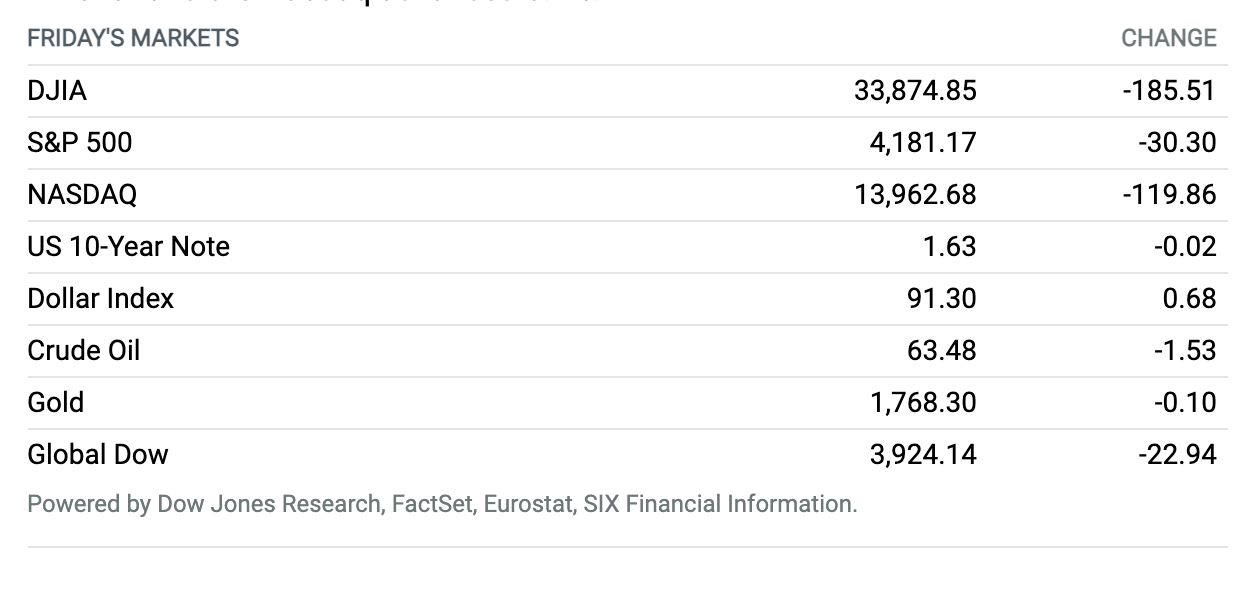

Stocks Slide Despite Mostly Bright Earnings. Stocks ended lower Friday as investors shrugged off largely strong earnings reports and U.S. economic data, dragging the Dow Jones Industrial Average and the Nasdaq Composite to weekly losses but leaving solid monthly gains intact. The Dow fell around 186 points, or 0.5%, to close near 33,875, while the S&P 500 fell around 30 points, or 0.7%, to end near 4181, and the Nasdaq Composite gave up around 120 points, or 0.9%, to finish near 13,963. Friday’s losses left the Dow down 0.5% for the week, while the S&P 500 clung to a gain of less than 0.1% and the Nasdaq Composite declined 0.4%. That left the Dow with a monthly gain of 2.7%, while the S&P 500 rose 5.2% for the month and the Nasdaq advanced 5.4%.

Apple Hit With Landmark Antitrust Charges in Europe Over App Store Practices

Apple has been charged with abusing its dominant position in the music-streaming market by imposing restrictive rules on the App Store, in a landmark move by European Union regulators.

The charges follow a 2019 complaint from music streaming platform Spotify, and carry a maximum penalty of up to 10% of Apple’s global annual turnover—what could amount to a multibillion-dollar fine.

This is the first time Apple has faced antitrust charges in the 27-member bloc, and the action represents one of a number of regulatory pressures on Apple globally that could lead to a change in the technology giant’s business model.

Continue reading ›

Cash-Rich Consumers Drive 6.4% Annualized Gain in GDP. And That’s Just a Start.

Gross domestic product grew at a robust 6.4% annualized rate in the first quarter, meaning the U.S. economy has nearly recouped the output lost to the pandemic.

The first-quarter GDP reported by the Bureau of Economic Analysis on Thursday was the advance estimate, or first of three prints, and it was a touch better than the 6.3% rate economists polled by FactSet predicted. In last year’s fourth quarter, GDP rose 4.3% after rising 33.4% in the third.

Continue reading ›

Europe Entered Recession in the First Quarter. Here’s Why It Won’t Last.

Europe’s economy slipped into recession in the first quarter of the year, which was widely expected after the third wave of the Covid-19 pandemic struck with a vengeance, although the drag of the German economy on the rest of the region’s growth was worse than forecast. The recovery should firm up in the coming months, but Europe will still be lagging far behind the U.S. and China until way into 2022.

European statistical office Eurostat said on Friday that the eurozone’s gross domestic product shrank by 0.6% compared with the previous quarter in the January to March period, which defines a technical recession after the 0.7% contraction recorded in the last quarter of 2020. GDP fell 0.4% in the larger European Union. By comparison, both the U.S. and China grew in the quarter, with GDP up 1.6% and 0.6%, respectively.

Continue reading ›

Amazon Made More Profit During Pandemic Than Previous 3 Years of Earnings in Total

The pandemic has been very profitable for Amazon.

Amazon reported first-quarter earnings of $8.11 billion Thursday afternoon, trouncing expectations yet again as it continues to provide services greatly needed during the Covid-19 pandemic, namely e-commerce and cloud computing. In the 12 months ending March 31, comprising most of the pandemic’s effects in the U.S. and areas other than China, Amazon collected net income of about $26.9 billion.

That is more than Amazon’s profits from the previous three full years, 2017 through 2019, which totaled roughly $24.7 billion.

Continue reading ›

Frontier Communications Is Emerging From Bankruptcy. Goodbye Copper, Hello Fiber.

Frontier Communications is set to emerge from Chapter 11 bankruptcy on Friday and return to public stock markets next week. The company has less debt, a new executive team, and a strategy focused on converting its slow and aging copper-based telecom network to a next-generation network built on fiber optic cable. That’s a path that cable giants like Charter Communications and Altice USA have delivered on over the past decade, with shareholders reaping the rewards.

But Frontier is still undoubtedly a fixer-upper, and management’s ability to execute on their targets will be the key to its future success or renewed failure. The new team hosted an event on Friday morning to discuss their future plans and release first-quarter results.

Continue reading ›

Here’s How Strong Apple’s Latest Quarter Was

Apple late Wednesday reported an insanely great March quarter, with revenues and profits far higher than expected. It exceeded expectations in every product line and in every geography. And to top things off, Apple raised its dividend by 7%, while increasing its stock repurchase plan by $90 billion.

Apple reported growth of 66% in iPhone sales, 70% for Macs, 79% for iPads, and 25% for Wearables, with 27% growth in Services. The company posted 56% growth in Europe, and a remarkable 88% in China.

Continue reading ›

Facebook Reports Big Jumps in Sales, Earnings From Advertising

After the bell Wednesday, Facebook announced better-than-expected first-quarter results.

The social-media giant said it earned $9.5 billion, or $3.30 a share, against expectations of $2.35 a share, according to analysts polled by FactSet. Facebook’s revenue improved 48% to $26.2 billion, beating estimates of $23.73 billion.

Continue reading ›

Microsoft Earnings Top Expectations Across the Board

Microsoft’s earnings easily surpassed estimates on Tuesday

Microsoft on Tuesday reported fiscal third-quarter earnings of $15.46 billion, or $2.03 a share, up from $1.40 a share a year ago, with profit buttressed by a $620 million net income-tax benefit. Without that tax gain, Microsoft would have reported earnings of $1.95 a share, still ahead of estimates. Revenue for the quarter was $41.7 billion, up from $33.06 billion in the same quarter last year.

Analysts on average expected earnings of $1.78 a share on sales of $41.04 billion, according to FactSet.

Continue reading ›

Nomura and UBS Report Archegos Losses

The tally from the wipeout of Archegos Capital Management to bank bottom lines keeps growing.

On Tuesday, Nomura Holdings said it recorded a 245.7 billion yen ($2.3 billion) loss from Archegos, slightly more than the $2 billion loss the Japanese bank initially estimated. That led the bank to record a 155.4 billion yen loss for its fiscal fourth quarter.

The real surprise came from UBS, which revealed a $774 million hit to its operating profit. The Swiss bank still managed to record a profit for the first quarter, of $1.82 billion, a gain of 14%.

Continue reading ›

Boeing Earnings Were Dreadful. That Isn’t the Point.

Boeing just might have posted the biggest earnings miss that doesn’t matter in Wall Street history. After problems with the 737 MAX jet and Covid-19, expectations for first-quarter earnings were low. Boeing‘s future is tied to its internal turnaround and the commercial aerospace recovery.

Boeing lost an adjusted $1.53 per share from $15.2 billion in sales. Wall Street was looking for a 90-cent loss from $15.1 billion in sales. That is a big miss, but Boeing has lost money for six consecutive quarters, for a total of almost $27 a share since the start of 2019. The Boeing 737 MAX jet was grounded worldwide that March following two deadly crashes inside of five months.

Continue reading ›