Friday, April 29, 2022

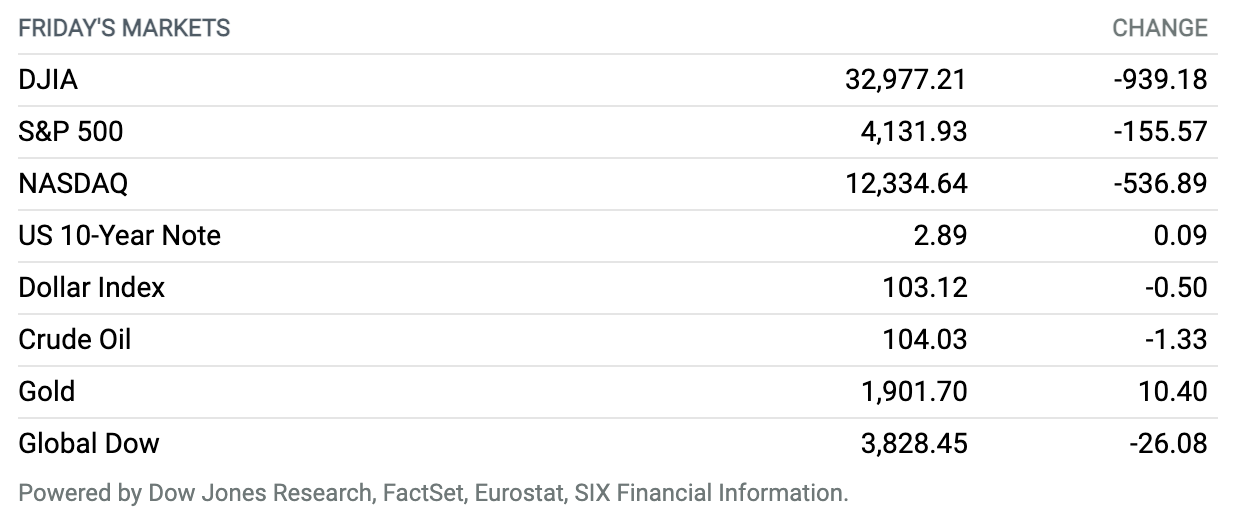

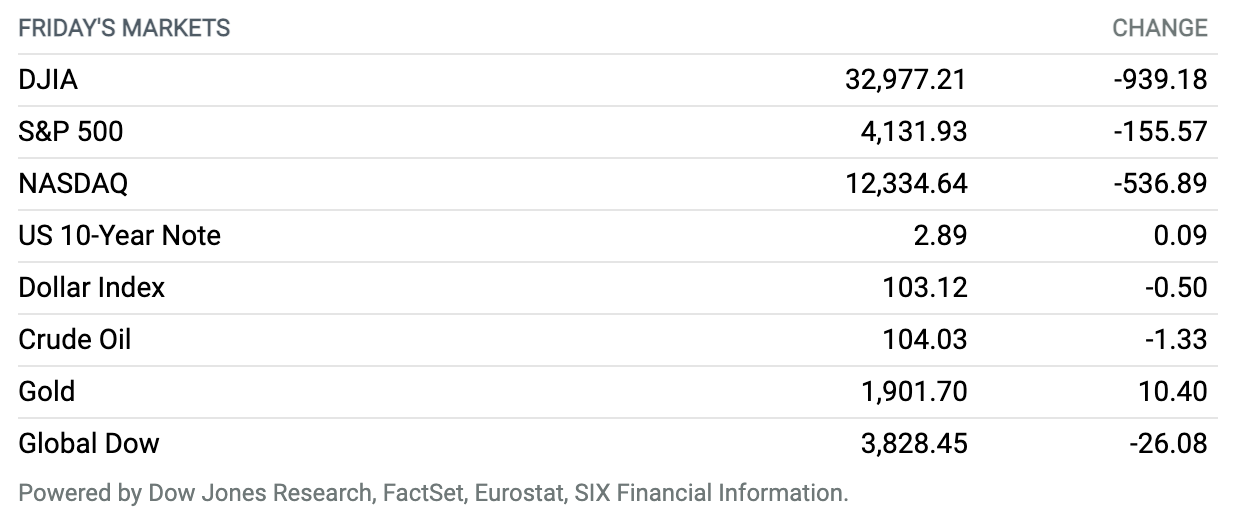

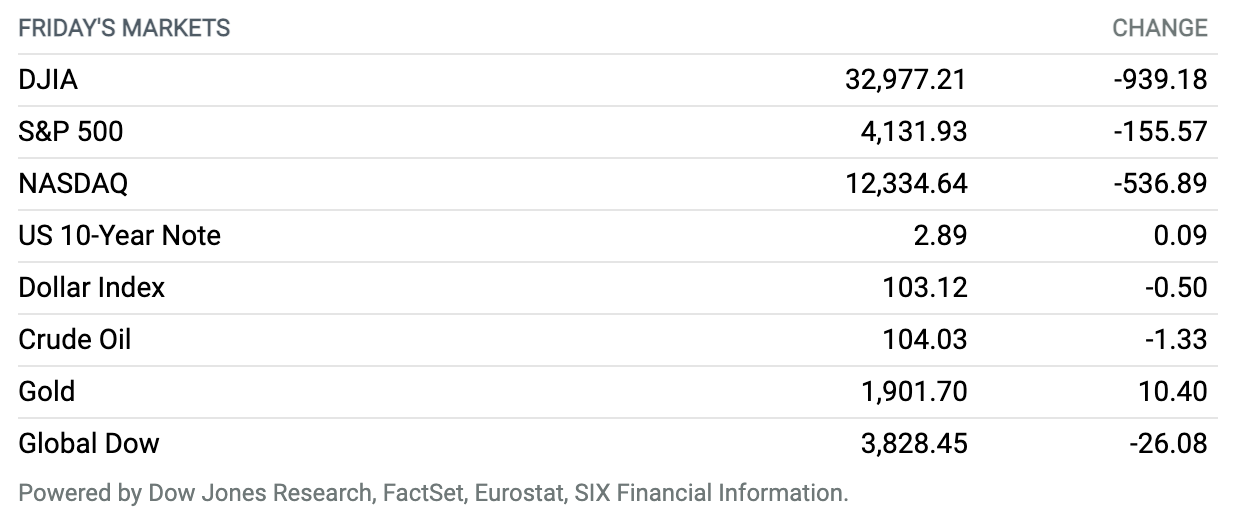

Dow Tumbles More Than 900 Points, Nasdaq Books Worst Month Since 2008 Crash. Stocks tumbled into the closing bell Friday, with all three major equity indexes shedding more than 2.7% to end an ugly week and month on Wall Street. The Dow Jones Industrial Average fell 939 points, or 2.8%, ending the session at 32,977. Continued carnage in technology-related stocks left the S&P 500 index down nearly 156 points, or 3.6%, on Friday, closing at 4132, while the Nasdaq Composite index dropped 537 points, or 4.2%, to finish near 12,335. It also marked the worst month for the Dow and S&P 500 since March 2020, but the 13.3% monthly skid for the Nasdaq was its biggest drop since October 2008. For the week, the Dow was off 2.5%, while the S&P dropped 3.3% and the Nasdaq shed 3.9%.

Europe Inches Closer to a Ban on Russian Oil. Here’s What That Would Mean.

Europe will continue debating a ban on imports of Russian oil over the weekend. While such a deal is far from certain, a report surfaced Friday that the European Union could approve a phased embargo on Russian oil as soon as next week.

Earlier this month, after reports of atrocities in Ukraine, the union has said it would ban Russian coal imports from August onward and is considering cutting imports of oil and natural gas as well. This week, Russia cut Poland and Bulgaria off from natural gas for refusing to pay in rubles and threatened to do the same to others.

Weaning Europe off Russian energy won’t be an easy task. Each EU nation is different when it comes to dependence on Russian fossil fuels.

Continue reading

Elon Musk’s Idea for ‘Open Source’ at Twitter Sounds Good. Here’s Why It Might Not Work.

Some Twitter users who think the site discriminates against their views have latched onto one of the geekier-sounding prescriptions that owner-in-waiting Elon Musk has for improving the platform: making the algorithms that govern the site’s behavior “open source.”

They may be disappointed.

The Next Move on Covid-19 Vaccines Is Up for Debate. The FDA Set a Key Date.

A late June meeting, announced Friday by the Food and Drug Administration, will likely see a clash over the future of the Covid-19 vaccine campaign, as experts hash out what should happen with the shots this fall.

The meeting date, June 28, comes at the tail end of the window within which the top FDA vaccines official has suggested that the strain for the fall booster might be selected. It would leave just a couple of months for Pfizer and Moderna to prepare updated versions of their vaccines for the fall.

Continue reading

Exxon Misses on Earnings, Books $3.4 Billion of Russia Charges

Exxon Mobil posted first-quarter adjusted financials that missed forecasts Friday, reporting adjusted earnings of $2.07 a share, below forecasts for $2.23 a share. The quarter included charges of $3.4 billion, or 79 cents a share, from the company’s exit of Russia.

Net earnings in the period were $5.5 billion, or $1.28 a share. Revenue in the period was $90.5 billion, higher than analysts’ forecasts of $82.8 billion, according to FactSet. Year-earlier revenue was almost $59.2 billion.

Continue reading

The Pandemic’s Impact on Merck Is Lessening, CFO Says

Despite some clear signs of eroding confidence in the biotechnology sector, potential acquisitions aren’t any cheaper for big pharma buyers yet, according to Merck’s chief financial officer.

“We’ve yet to see the seller change their mindset on what the value of their company is,” CFO Caroline Litchfield told Barron’s. This week, Merck reported first-quarter earnings that beat expectations and were 84% higher than the same quarter in 2021.

Continue reading

Bitcoin Is Now Legal Tender in Central African Republic. It Could Cause Problems.

Central African Republic became the second country to adopt Bitcoin as legal tender, following El Salvador in putting the largest digital asset on the same level as its official currency.

CAR’s parliament unanimously adopted a bill governing the use of crypto, according to a report citing a statement from President Faustin-Archange Touadera’s chief of staff, who said the move would “improve the conditions of … citizens.”

Continue reading

Beijing Lockdowns Stoke Fears of Continuing Hit to China’s Economy

The massive Covid-19 lockdowns in Shanghai have shaken China, provoking rare public outcries and causing Beijing residents to wonder if they are next.

Even with fewer than 100 cases officially reported, Beijing has started citywide testing, and the lockdown of some neighborhoods has prompted panic-buying that has emptied many grocery and supply stores across the city.

Continue reading

Twitter Misses Revenue Estimates. It Will No Longer Be Providing Guidance.

Twitter posted a first-quarter earnings beat this week, but revenue came in under expectations.

Twitter reported adjusted earnings of 90 cents a share on $1.2 billion in revenue. Analysts polled by FactSet forecast the company would report adjusted earnings per share of 5 cents on sales of $1.23 billion. The company’s prior outlook from February called for sales of $1.17 billion.

Continue reading

Pfizer, BioNTech Seek Emergency Authorization for Covid Booster in Children 5 to 11

Pfizer and BioNTech are seeking emergency use authorization for Covid-19 booster shots for use in five- to 11-year-olds, the companies said.

The request included data from Phase 2 and 3 trials, data which “demonstrated a strong immune response in this age group following a booster dose of the Pfizer-BioNTech COVID-19 vaccine with no new safety signals.” Some 4,500 children between the ages of six months and under 12 years have been enrolled in Phase 1, 2, and 3 trials, the companies said.

Continue reading

Home Prices Climbed 20% in February—Faster Than Expected

Home prices in February rose faster than expected, according to Case Shiller data released this week.

In the report’s 20-city index, home prices gained 20.2% year over year, up from a revised 18.9% gain in January and beating consensus estimates that called for a 19% gain. Of the 20 metropolitan areas evaluated, Phoenix, Tampa, and Miami saw the greatest price increases. Home prices in these cities rose 32.9%, 32.6%, and 29.7% compared to the same month last year, respectively.

Continue reading

Disclosure – All investment carries risk, and we cannot guarantee performance or results. Past performance does not guarantee future results. GIA does not earn any compensation from any of the non-GIA links provided in these resources. The market insights, podcast, blogs, book recommendations, self improvement thoughts, food recipes and activities are based on our perspectives and experience, and may not apply to your unique situation or be appropriate for your health and wellness. We are not aware of any conflicts of interest relating to any testimonials or endorsements. Please contact us for any questions relating to the content above, or to discuss how we can support you in your specific situation, and help you to reach your financial and personal goals.