Sep 29, 2025

The Markets

The economy is all right.

Last week, revised economic figures showed the United States economy grew faster from April through June than previously thought. The upward revision was primarily due to a revised estimate for consumer spending over the period, according to Connor Smith of Barron’s.

“American consumers, the engine of the world’s largest economy, have remained resilient in the face of tariffs and economic uncertainty…The continued strength in spending, which has defied worries about a slowdown, is in contrast to recent data showing a weakening labor market…But initial claims for unemployment insurance fell last week to their lowest level since July…in a sign that the jobs market might not be in as dire shape as other data have suggested,” reported Danielle Kay of the BBC.

The contrast between consumer spending and consumer sentiment was striking. Consumer sentiment moved lower again in September and is down more than 21 percent this year, according to the University of Michigan’s Consumer Sentiment Survey.

“Nationally, not only did macroeconomic expectations fall, particularly for labor markets and business conditions, but personal expectations did as well, with a softening outlook for [consumers’] own incomes and personal finances. Consumers continue to express frustration over the persistence of high prices, with 44 [percent] spontaneously mentioning that high prices are eroding their personal finances, the highest reading in a year,” wrote Surveys of Consumers Director Joanne Hsu.

The inflation picture did not improve in August. Prices, as measured by the personal consumption expenditures price index, were up 2.7 percent year over year. When volatile food and energy prices were excluded, prices rose 2.9 percent year over year. Both measures are well above the Federal Reserve’s two percent inflation target.

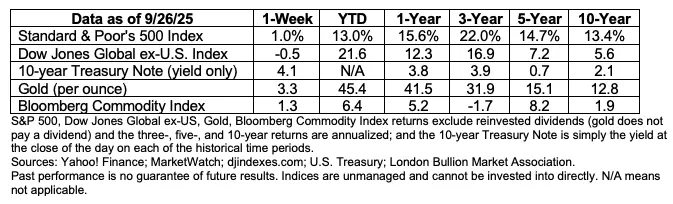

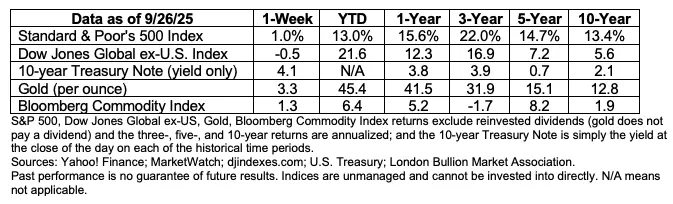

Last week, major U.S. stock indexes rallied on Friday, but were not able to recoup losses from earlier in the week, reported Sean Conlon of CNBC. Yields moved higher over the week for all but the longest maturities of U.S. Treasuries.

WEEKLY FOCUS – THINK ABOUT IT

“The ‘silly’ question is the first intimation of some totally new development.”

– Alfred Whitehead, Mathematician and philosopher

Disclosures and resources:

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.barrons.com/livecoverage/stock-market-news-today-092525/card/stocks-drop-for-third-straight-day-despite-upbeat-economic-data-7ZI68Vfc4Tr13YOsRiNH?mod=Searchresults or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/09-29-25-Barrons-Stock-Drop-For-Third-Straight-Day-1.pdf

https://www.bbc.com/news/articles/cjedze7e95lo

https://www.sca.isr.umich.edu

https://www.bea.gov/sites/default/files/2025-09/pi0825.pdf [Table 7]

https://www.federalreserve.gov/economy-at-a-glance-inflation-pce.htm

https://www.cnbc.com/2025/09/25/stock-market-today-live-updates.html#

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value=2025