Friday, October 8, 2021

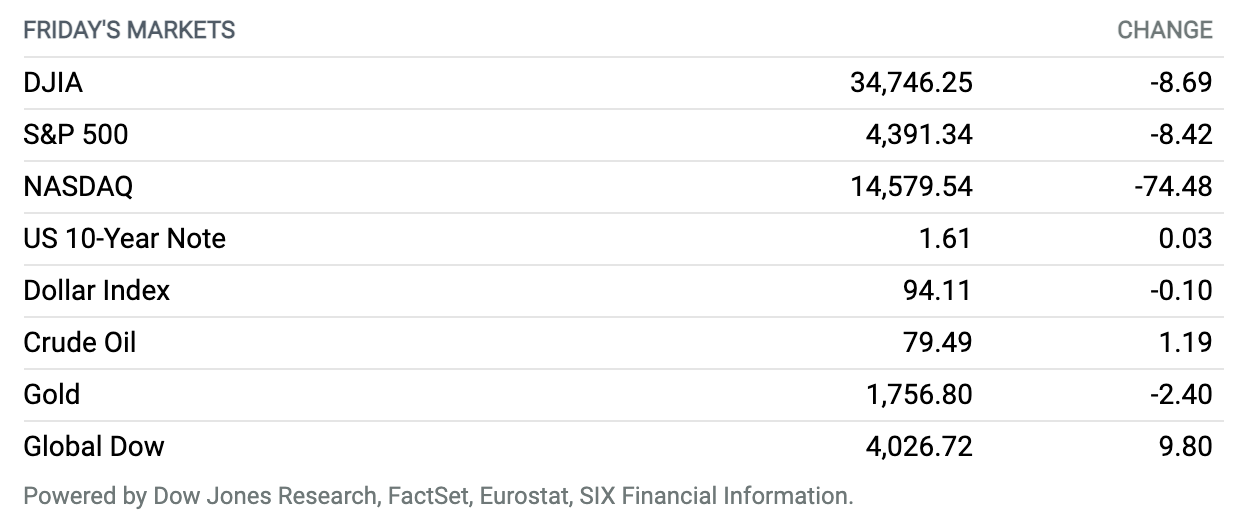

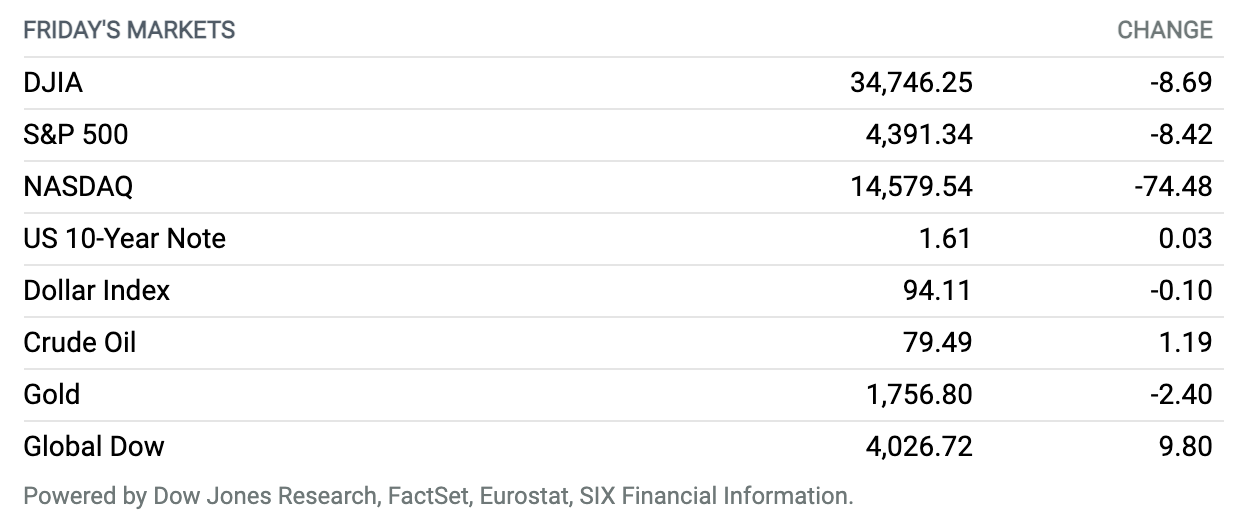

Stocks Sag on Disappointing Jobs Report but Post Winning Week. Stocks saw a slightly lower finish Friday after the government said the economy created just 194,000 jobs in September, well below economist expectations for a figure of 500,000. The Dow Jones Industrial Average fell 9 points to close at 34,746, while the S&P 500 shed 8 points, or 0.2%, to end at 4391. The Nasdaq Composite declined 74 points, or 0.5%, to finish around 14,580. Major indexes gained ground for the week, with the Dow rising 1.2%, the S&P 500 advancing 0.8%, and the Nasdaq eking out a 0.1% rise.

Weak September Jobs Gain Clouds Fed Outlook on Tapering

Hiring slowed further in September, with a paltry gain casting some doubt on the Federal Reserve’s plans to begin normalizing monetary policy.

Employers added 194,000 jobs in September, the Labor Department reported Friday, far below the 479,000 economists polled by FactSet predicted. It marks the softest pace of hiring since December, when employers shed workers. The far weaker-than-expected increase in hiring follows a disappointing reading in August, though that figure was revised higher to 366,000 from 235,000.

Economists say the result, when considering revisions and the private payroll portion, is probably enough for the Fed to still begin tapering in the coming months. But some Fed watchers cheered the miss in hopes that it dashes taper plans and emergency bond buying continues into next year.

Continue Reading

Republicans Criticize Fellow Party Members for Debt-Ceiling Shift

Senate Republicans are criticizing their fellow party members who allowed Democrats to advance a short-term debt-ceiling extension.

Eleven Republicans, including Senate Minority Leader Mitch McConnell, sided with the Democrats late Thursday to break the 60-vote filibuster, one vote more than needed. Then, Democrats raised the borrowing limit by $480 billion, enough to pay the country’s bills through early December and avoid a default. The measure passed, 50-48, on party lines.

Continue Reading

Pfizer and BioNTech Asked FDA to Authorize Vaccine for Children

Pfizer announced early Thursday that the company had officially submitted its request to the Food and Drug Administration to authorize its Covid-19 vaccine for children ages five through 11 years old.

The FDA is likely to move quickly on the request. Last week, prior to Pfizer’s filing, the agency scheduled a meeting of its vaccines advisory committee for Oct. 26 to consider the authorization.

Continue Reading

Tesla Is Moving to Texas, and 5 More Takeaways From Its Annual Meeting

Electric-vehicle pioneer Tesla is moving its headquarters to Austin, Texas, from Silicon Valley, saying that land prices in California limited its growth there.

The car maker hosted its annual meeting this week in Austin, at its new car-making facility. Attendees soon learned it wants to do more in Austin than just make cars.

Continue Reading

Biden Administration Wants IRS to Monitor People’s Bank Accounts More Closely

In the ongoing debate over tax hikes for the rich and multitrillion dollar government spending on the social safety net, a much smaller dollar amount is catching a lot of attention.

A Biden administration proposal calls for Internal Revenue Service monitoring of people’s bank accounts to kick in at the $600 mark.

Continue Reading

Covid-19 Vaccine Boosters Are Outpacing First Doses

Covid-19 vaccine-booster shots are getting more popular in the U.S., and now outpace the number of initial vaccine doses being administered, data from the Centers for Disease Control and Prevention (CDC) show.

A Barron’s analysis of CDC data shows that the number of people with at least one dose of a Covid-19 vaccine grew by nearly 1.4 million from Oct. 1 to Oct. 7. By comparison, more than two million people received a booster shot of a vaccine over that same period.

Continue Reading

Mark Zuckerberg Breaks Silence After Facebook Whistleblower’s Testimony

Facebook co-founder and CEO Mark Zuckerberg broke his silence this week on a reputational crisis facing the company. He pushed back on reports that have called into question the social media giant’s role in society and testimony given by a whistleblower in Congress on Tuesday.

“Many of the claims don’t make any sense,” Zuckerberg said, referring to the public debate over issues like safety, well-being, and mental health. “At the heart of these accusations is this idea that we prioritize profit over safety and well-being. That’s just not true.”

Continue Reading

A Lyme Disease Vaccine From Pfizer and Valneva Must Avoid the Pitfalls of the Past

In the northeastern U.S., where every summer seems to bring more ticks than the last, there may be no more anticipated pharmaceutical product than a vaccine for Lyme disease. The story of the lost Lyme vaccine, once approved for people and now available only for dogs, circulates like an urban legend; a parable of the absurdity of the healthcare system, or modern life, or perhaps existence itself.

The next Lyme vaccine may not be so far off. Pfizer and a small French biotech company, Valneva, are developing one that is expected to enter pivotal trials next year. If it works, it could be on the market by 2025.

Continue Reading

Why Merck’s Celebrated Covid Pill Could Be Riskier Than People Think

Merck’s announcement that its antiviral molnupiravir had halved hospitalizations in a trial of high-risk Covid-19 patients was met with enthusiasm last week, inspiring a vision of a world in which treating a Covid-19 infection could be as trivial as swallowing a few pills.

Some scientists who have studied the drug warn, however, that the method it uses to kill the virus that causes Covid-19 carries potential dangers that could limit the drug’s usefulness.

Continue Reading

New York City’s Office Buildings Lost 17% of Their Value in the Pandemic

New York City’s office buildings saw their first decline in property values in more than two decades as the pandemic shuttered businesses and sent thousands of workers home, raising serious questions about the health of the city’s finances.

The full market value of New York City office buildings was estimated at $172 billion in fiscal year 2021, according to a report out Thursday from New York State Comptroller Thomas DiNapoli. That was down 16.6% in the fiscal 2022 final assessment roll, which the report calls the first such decline “since at least fiscal year 2000.”

Continue Reading