December 7, 2022

5 unique ways to give to your loved ones at Christmas

1. Give the gift of wealth. You can give money, but you can be extra intentional about the money you give by putting it into a retirement account. If you give $1000 to your grandchild or child and invest it in an IRA that averaged 8% in return for the next 55 years, it would be worth almost $64,000 when they are ready to retire. Yes, this is a very long-term-minded gift, but it would be very helpful in their future.

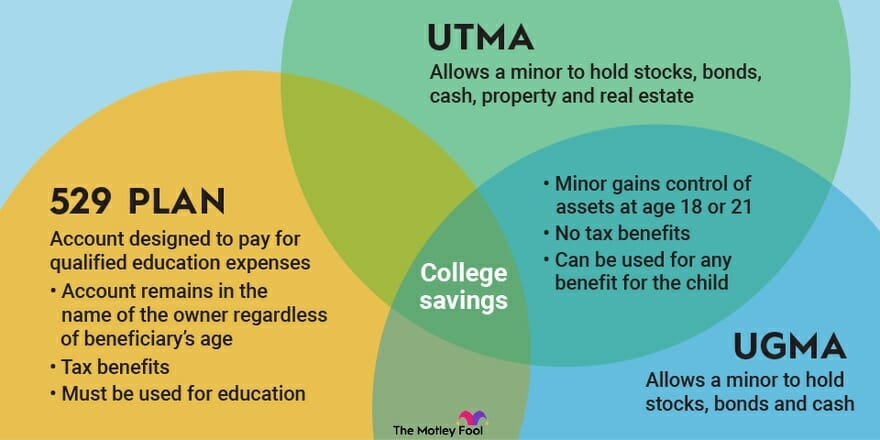

2. Give towards college. You could give your children or grandchildren the gift of helping them get a quality education by giving toward their college expenses through a 529 college savings plan. If this is something you are interested in, please reach out to your advisor or your tax advisor about whether to fund a 529 in your name or the parents of your grandkids’ names. Plus, it is always wise to talk to your advisor about any tax implications involved.

3. Open a brokerage account for your children. There are two types of custodial accounts or brokerage accounts for minors.

-

UTMA – The Uniform Transfers to Minors Act, or UTMA, is a law that allows minors to receive gifts such as stocks, bonds, cash, property, and real estate. A UTMA has an appointed adult custodian who oversees account transactions. UTMA accounts are helpful when trying to keep certain properties in a child’s name.

-

UGMA – The Uniform Gift to Minors Act, or UGMA, is a law established to provide a simple way for a minor to own securities without requiring the services of an attorney to prepare trust documents or the court appointment of a trustee. It is easier because the terms of the trust are established by a state statute, instead of a trust document. This allows a minor to receive stocks, bonds, and cash. A UGMA account has an appointed custodian who will oversee the transactions.

Here is a comparison of UTMA, UGMA, and 529 plans from The Motley Fool article titled, “What is the Uniform Transfer to Minors Act?”

*Source – The Motley Fool

*There are tax implications for these accounts as well, so make sure you talk to your financial advisor or CPA.

4. Give the gift of experience. You can think about experiences you want to cultivate and create memories around your children and grandchildren. Do you want them to experience travel and see the world? Do you want to take them to your hometown or alma mater? Do you want to teach them a skill that you have learned? Is there an experience you had as a child that you want your grandkids to experience with you? You have the ability to create beautiful memories that your family will never forget. This is part of your legacy. Have you read our blog about creating a legacy will? A character will, or legacy will is something that Tim Goodwin, Goodwin Investment Advisory’s President, and Founder, has been working on for years and highly recommends. In his character will, he has composed a comprehensive list of the things he wants to pass on and instill in those he loves. These include family recipes, quotes, favorite Bible verses to read when going through specific circumstances, and giving nicknames to people because it makes life more fun. He has a list of life principles such as, “experience trumps facts,” and concepts of goal setting which includes creating S.M.A.R.T. goals. Check out the rest of our blog titled, “Legacy vs Inheritance,” to learn more about a legacy will and how to create one.

5. Give the gift of financial peace. If you would like to have your kids or grandkids meet with one of our financial advisors, you could give a gift card to cover that time. Our advisors can help with debt elimination and planning, budgeting, saving, setting and reaching financial goals, and investing. A great place to begin is to send your family members our guide, “An Investor’s guide to your first $100,000.” This guide includes a map with a checklist and goals to help you or your friends and family reach their first $100,000 in investable assets.